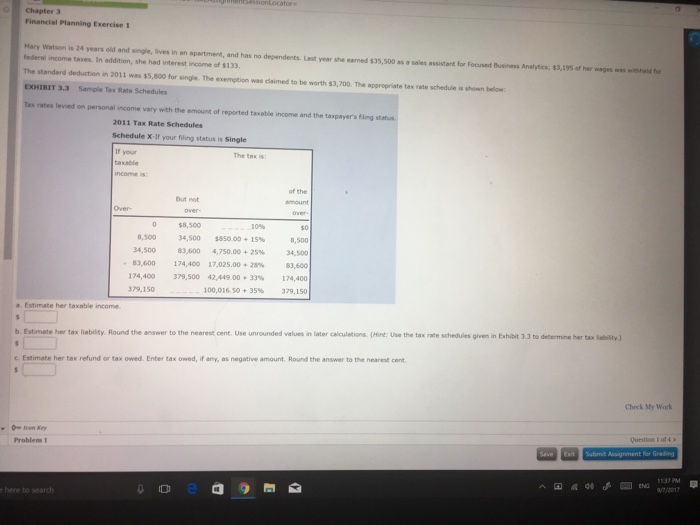

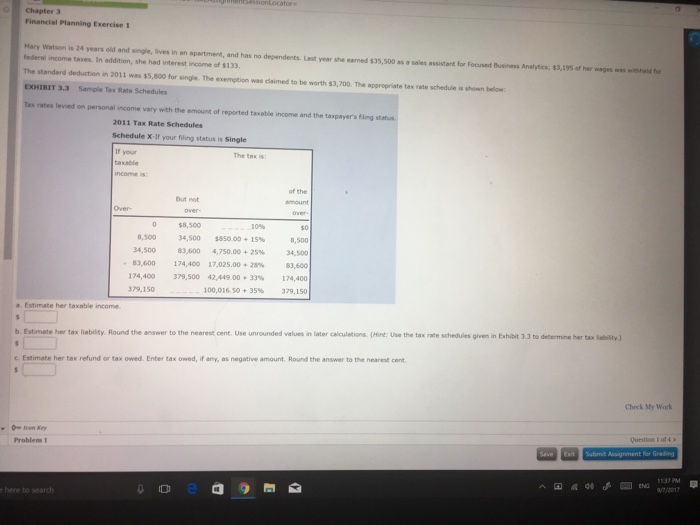

Chapter 3 Financial Planning Exercise 1 Mary Watson is 24 years old and single, lives in an apartment, and has no dependents. Lest year she earned $35,500 as a sales assistant for Focused Business Analytics; $3,195 of her mages wss eltshelfor federal income taves. In addition, she had interest income of $133 The standard deduction in 2011 was $5,800 for single The exemption was claimed to be worth $3,700. The appropriate tax rate schedule is shown below EXHIBIT 3.3 Sample Tax Rate Schedules rates levied on personal income vary with the amount of reported taxable income and the taxpayer's fling stsbus 2011 Tax Rate Schedules Schedule X-If your filing status is Single The tax is taxable of the But not so $8,500 34,500 8,500 34,500 .83,600 174,400 379,150 S850 00 + S% 83,600 4,750.00 + 25% 174,400 17,02S.00 + 2S% 379,500 42,449.00 + 33% 100,016.50 + 35% 34,500 83,600| 174,400 379,150 a. Estimate her taxable income b Estimate her tax liability. Round the answer to the nearest cent. Use unrounded values in later calculetions. (Hint: Use the tax rate schedules given in Eshibit 33 to determine her tax lability,) c. Estimate her tax refund or tax owed. Enter tax owed, if any, as negative amount. Round the answer to the nearest cent Check My Work Question 1 of 4 Problem 1137pM here to search Chapter 3 Financial Planning Exercise 1 Mary Watson is 24 years old and single, lives in an apartment, and has no dependents. Lest year she earned $35,500 as a sales assistant for Focused Business Analytics; $3,195 of her mages wss eltshelfor federal income taves. In addition, she had interest income of $133 The standard deduction in 2011 was $5,800 for single The exemption was claimed to be worth $3,700. The appropriate tax rate schedule is shown below EXHIBIT 3.3 Sample Tax Rate Schedules rates levied on personal income vary with the amount of reported taxable income and the taxpayer's fling stsbus 2011 Tax Rate Schedules Schedule X-If your filing status is Single The tax is taxable of the But not so $8,500 34,500 8,500 34,500 .83,600 174,400 379,150 S850 00 + S% 83,600 4,750.00 + 25% 174,400 17,02S.00 + 2S% 379,500 42,449.00 + 33% 100,016.50 + 35% 34,500 83,600| 174,400 379,150 a. Estimate her taxable income b Estimate her tax liability. Round the answer to the nearest cent. Use unrounded values in later calculetions. (Hint: Use the tax rate schedules given in Eshibit 33 to determine her tax lability,) c. Estimate her tax refund or tax owed. Enter tax owed, if any, as negative amount. Round the answer to the nearest cent Check My Work Question 1 of 4 Problem 1137pM here to search