Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 3 Homework 1 Question 2, E3-31 (book/static) Part 8 of 9 HW Score: 82.45%, 16.49 of 20 points Points: 4.74 of 8 Save

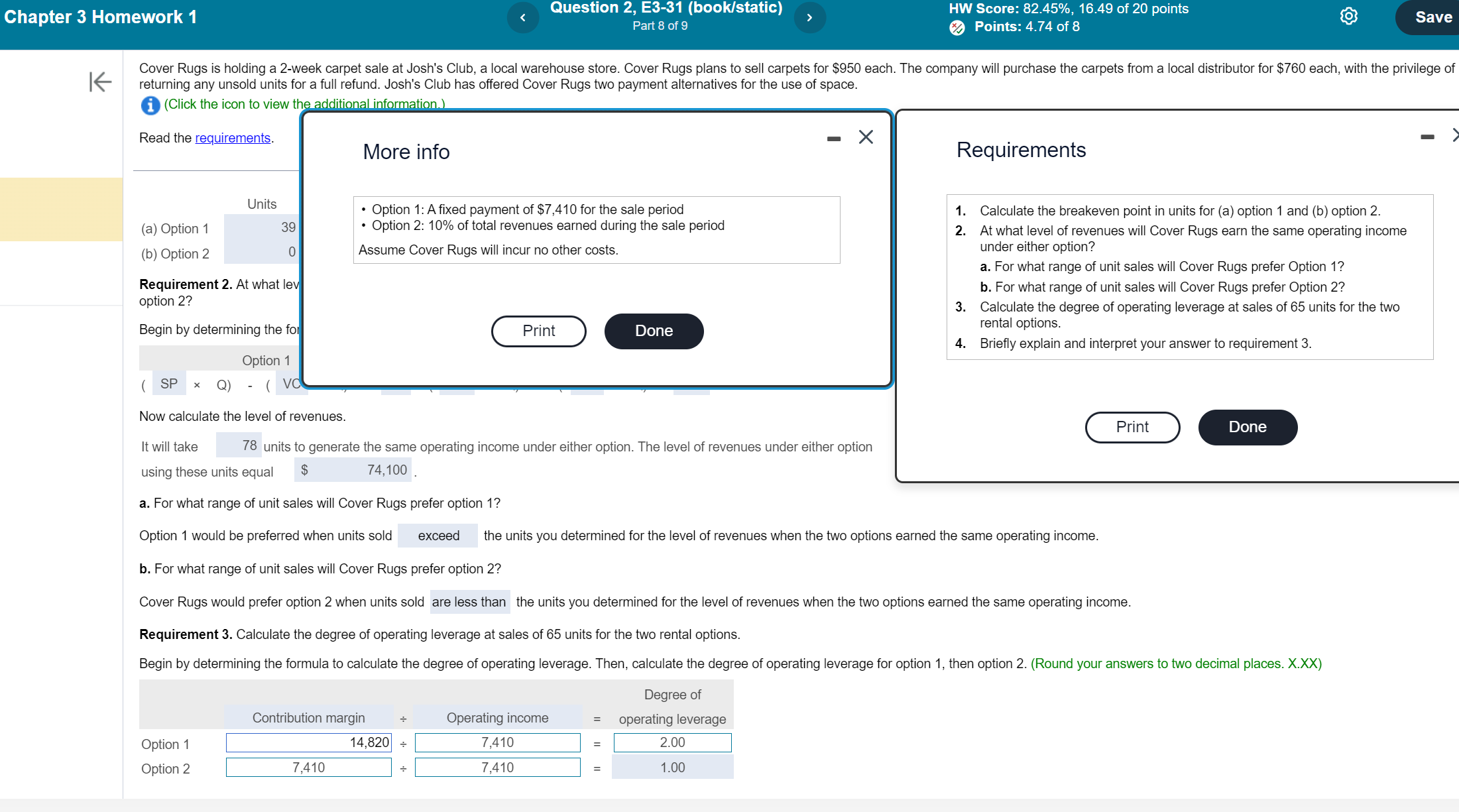

Chapter 3 Homework 1 Question 2, E3-31 (book/static) Part 8 of 9 HW Score: 82.45%, 16.49 of 20 points Points: 4.74 of 8 Save Cover Rugs is holding a 2-week carpet sale at Josh's Club, a local warehouse store. Cover Rugs plans to sell carpets for $950 each. The company will purchase the carpets from a local distributor for $760 each, with the privilege of returning any unsold units for a full refund. Josh's Club has offered Cover Rugs two payment alternatives for the use of space. (Click the icon to view the additional information.) Read the requirements. More info Requirements Units Option 1: A fixed payment of $7,410 for the sale period 1. Calculate the breakeven point in units for (a) option 1 and (b) option 2. (a) Option 1 (b) Option 2 39 0 Option 2: 10% of total revenues earned during the sale period Assume Cover Rugs will incur no other costs. 2. At what level of revenues will Cover Rugs earn the same operating income under either option? Requirement 2. At what lev option 2? Begin by determining the for Option 1 ( SP x Q) - (VO Print Done Now calculate the level of revenues. It will take 78 units to generate the same operating income under either option. The level of revenues under either option using these units equal $ 74,100 a. For what range of unit sales will Cover Rugs prefer option 1? a. For what range of unit sales will Cover Rugs prefer Option 1? b. For what range of unit sales will Cover Rugs prefer Option 2? 3. Calculate the degree of operating leverage at sales of 65 units for the two rental options. 4. Briefly explain and interpret your answer to requirement 3. Option 1 would be preferred when units sold exceed the units you determined for the level of revenues when the two options earned the same operating income. Print Done b. For what range of unit sales will Cover Rugs prefer option 2? Cover Rugs would prefer option 2 when units sold are less than the units you determined for the level of revenues when the two options earned the same operating income. Requirement 3. Calculate the degree of operating leverage at sales of 65 units for the two rental options. Begin by determining the formula to calculate the degree of operating leverage. Then, calculate the degree of operating leverage for option 1, then option 2. (Round your answers to two decimal places. X.XX) Degree of Contribution margin Operating income = operating leverage Option 1 14,820 7,410 = 2.00 Option 2 7,410 7,410 1.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure I can help you solve this problem Option 1 Contribution Margin per unit 950 selling price 760 variable cost per unit 190 per unit Breakeven Point in Units 7410 fixed cost 190 contribution margin ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started