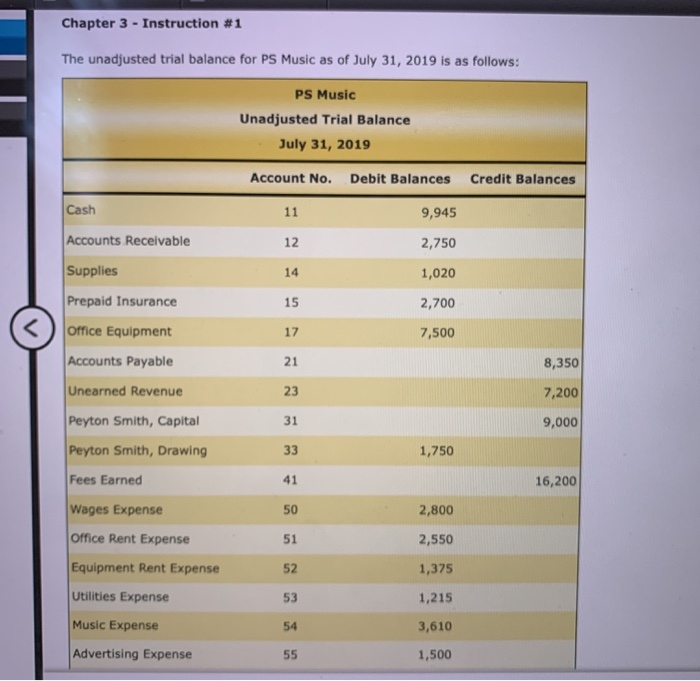

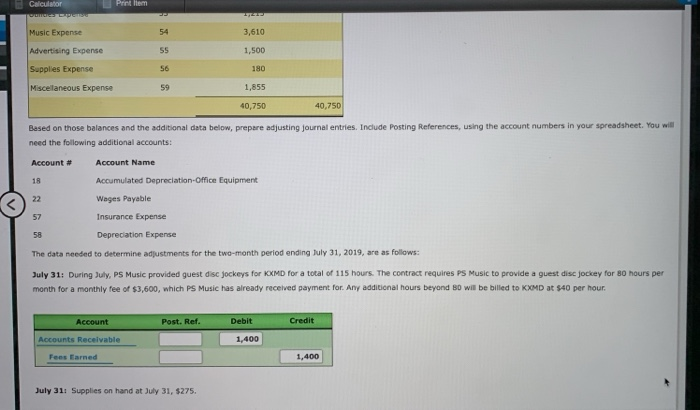

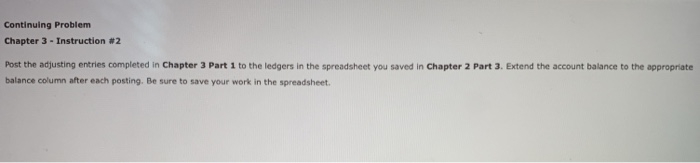

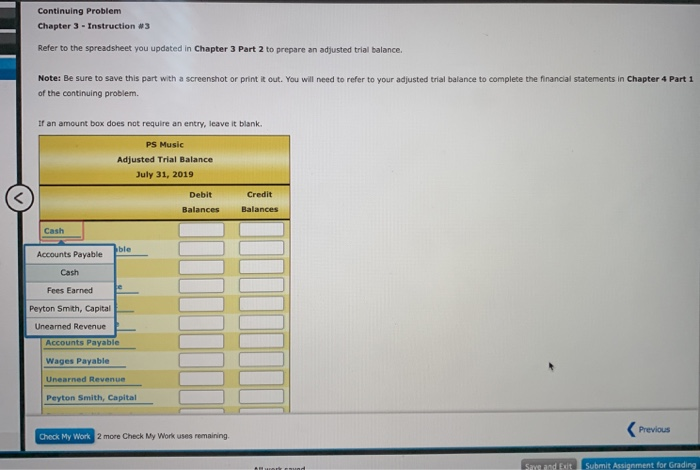

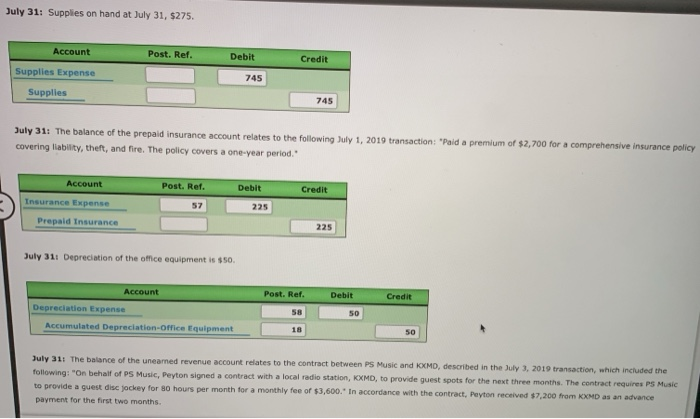

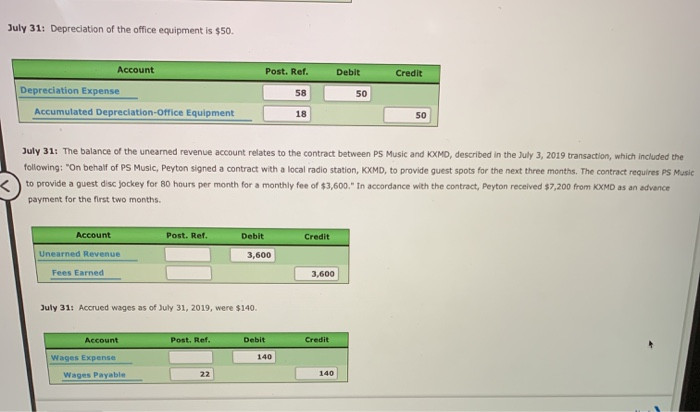

Chapter 3 - Instruction #1 The unadjusted trial balance for PS Music as of July 31, 2019 is as follows: PS Music Unadjusted Trial Balance July 31, 2019 Account No. Debit Balances Credit Balances Cash 119 12 ,945 2,750 Accounts Receivable Supplies Prepaid Insurance 1,020 15 2,700 Office Equipment 17 7,500 Accounts Payable Unearned Revenue 23 8,350 7,200 9,000 Peyton Smith, Capital Peyton Smith, Drawing 1,750 Fees Earned 41 16,200 Wages Expense 2,800 51 2,550 Office Rent Expense Equipment Rent Expense 1,375 Utilities Expense 1,215 Music Expense 3,610 Advertising Expense 1,500 Calculator Music Expense 3,610 Advertising Expense 1,500 Supplies Expense 180 Miscellaneous Expense 59 1,855 40,750 40,750 Based on those balances and the additional data below, prepare adjusting journal entries. Include Posting References, using the account numbers in your spreadsheet. You will need the following additional accounts: Account Account Name Accumulated Depreciation Office Equipment Wages Payable Insurance Expense Depreciation Expense The data needed to determine adjustments for the two-month period ending July 31, 2019, are as follows: July 31: During July, PS Music provided quest disc jockeys for KMD for a total of 115 hours. The contract requires PS Music to provide a quest disc jockey for 80 hours per month for a monthly fee of $3,600, which PS Music has already received payment for. Any additional hours beyond Bo will be billed to KMD at $40 per hour. Account Post. Ref. Debit Credit Accounts Receivable 1.400 Fees Earned 1,400 July 31. Supplies on hand at July 31, $275. Continuing Problem Chapter 3 - Instruction #2 Post the adjusting entries completed in Chapter 3 Part 1 to the ledgers in the spreadsheet you saved in Chapter 2 Part 3. Extend the account balance to the appropriate balance column after each posting. Be sure to save your work in the spreadsheet. Continuing Problem Chapter 3 - Instruction #3 Refer to the spreadsheet you updated in Chapter 3 Part 2 to prepare an adjusted trial balance. Note: Be sure to save this part with a screenshot or print it out. You will need to refer to your adjusted trial balance to complete the financial statements in Chapter 4 Part 1 of the continuing problem. If an amount box does not require an entry, leave it blank. PS Music Adjusted Trial Balance July 31, 2019 Debit Credit Balances Balances Cash Accounts Payable Cash Fees Earned Peyton Smith, Capital Unearned Revenue Accounts Payable Wages Payable Unearned Revenue Peyton Smith, Capital Check My Work 2 more Check My Work uses remaining. Previous Submit Assignment for Grading July 31: Supplies on hand at July 31, $275. Account Post. Ref. Debit Credit Supplies Expense 745 Supplies July 31: The balance of the prepaid insurance account relates to the following July 1, 2019 transaction: "Paid a premium of $2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period." Post. Ref. Debit Credit Account Insurance Expense 225 Prepaid Insurance 225 July 311 Depreciation of the office equipment is $50 Post. Ref. Debit Credit Account Depreciation Expense Accumulated Depreciation Office Equipment 50 18 July 31: The balance of the uneared revenue account relates to the contract between PS Music and KXMD, described in the July 3, 2019 transaction, which included the following: "On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 30 hours per month for a monthly fee of $3,600." In accordance with the contract, Peyton received $7,200 from HD as an advance payment for the first two months. July 31: Depreciation of the office equipment is $50. Account Credit Depreciation Expense Post. Ref. Debit 5850 18 Accumulated Depreciation Office Equipment 50 July 31: The balance of the unearned revenue account relates to the contract between PS Music and KMD, described in the July 3, 2019 transaction, which included the following: "On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of $3,600." In accordance with the contract, Peyton received $7,200 from KXMD as an advance payment for the first two months. Post. Ref. Credit Account Unearned Revenue Debit 3,600 Fees Earned 3.600 July 311 Accrued wages as of July 31, 2019, were $140. Post. Ref. Credit Account Wages Expense Wages Payable Debit 140