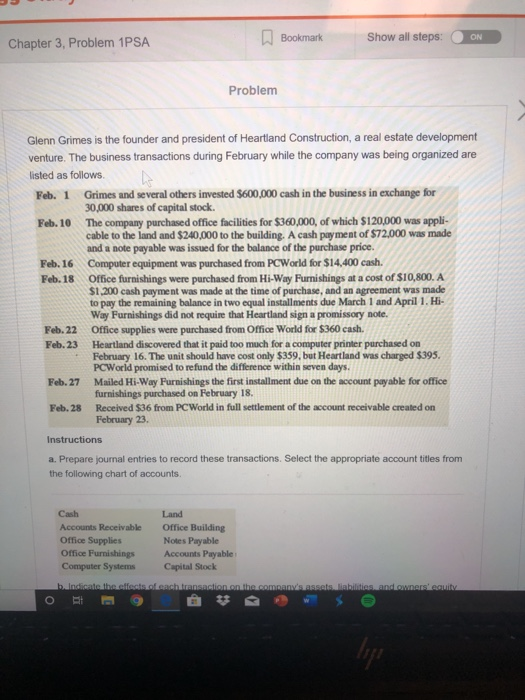

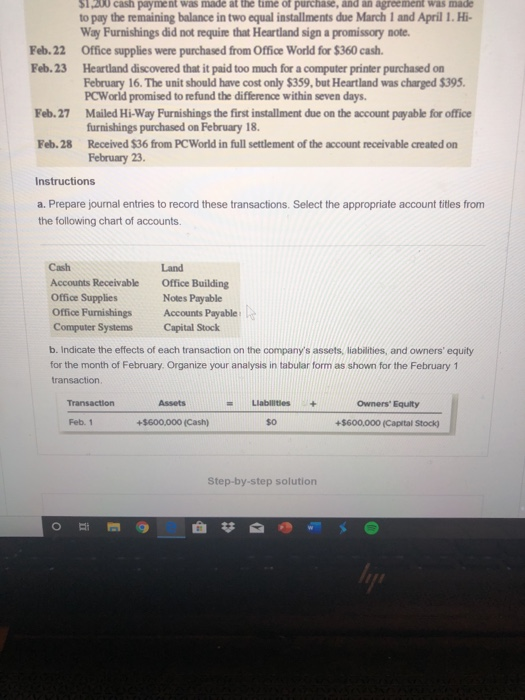

Chapter 3. Problem 1PSA Bookmark Show all steps: ON Problem Glenn Grimes is the founder and president of Heartland Construction, a real estate development venture. The business transactions during February while the company was being organized are listed as follows Feb. 1 Grimes and several others invested $600,000 cash in the business in exchange for 30,000 shares of capital stock. Feb. 10 The company purchased office facilities for $360,000, of which $120,000 was appli cable to the land and $240,000 to the building. A cash payment of $72,000 was made and a note payable was issued for the balance of the purchase price Feb. 16 Computer equipment was purchased from PCWorld for $14,400 cash. Feb. 18 Office furnishings were purchased from Hi-Way Furnishings at a cost of $10,800. A $1.200 cash payment was made at the time of purchase, and an agreement was made to pay the remaining balance in two equal installments due March 1 and April 1. Hi- Way Furnishings did not require that Heartland sign a promissory note. Feb. 22 Office supplies were purchased from Office World for $360 cash. Feb. 23 Heartland discovered that it paid too much for a computer printer purchased on February 16. The unit should have cost only $359, but Heartland was charged $395. PCWorld promised to refund the difference within seven days. Feb. 27 Mailed Hi-Way Furnishings the first installment due on the account payable for office furnishings purchased on February 18. Feb. 28 Received $36 from PC World in full settlement of the account receivable created on February 23. Instructions a. Prepare journal entries to record these transactions. Select the appropriate account titles from the following chart of accounts. Cash Accounts Receivable Office Supplies Office Furnishings Computer Systems a Land Office Building Notes Payable Accounts Payable Capital Stock chmann.comans assets B and owners.com 31 Jan cash payment was made at the time of purchase, and an agreement was made to pay the remaining balance in two equal installments due March 1 and April 1. Hi- Way Furnishings did not require that Heartland sign a promissory note. Feb. 22 Office supplies were purchased from Office World for $360 cash. Feb. 23 Heartland discovered that it paid too much for a computer printer purchased on February 16. The unit should have cost only $359, but Heartland was charged $395. PCWorld promised to refund the difference within seven days. Feb. 27 Mailed Hi-Way Furnishings the first installment due on the account payable for office furnishings purchased on February 18. Feb. 28 Received $36 from PCWorld in full settlement of the account receiv February 23 Instructions a. Prepare journal entries to record these transactions. Select the appropriate account titles from the following chart of accounts Cash Land Accounts Receivable Office Building Office Supplies Notes Payable Office Furnishings Accounts Payable Computer Systems Capital Stock b. Indicate the effects of each transaction on the company's assets, liabilities, and owners' equity for the month of February. Organize your analysis in tabular form as shown for the February 1 transaction Transaction Assets Liabilities + Owners' Equity +$600,000 (Capital Stock) Feb. 1 +5600,000 (Cash) Step-by-step solution