Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 3 Problems 1.2.4.7.16, 22-24, 28, 35 Sved 10 8.5 points 2018 Skipped Some recent financial statements for Smolira Golf, Inc., follow. SMOLIRA GOLF, INC

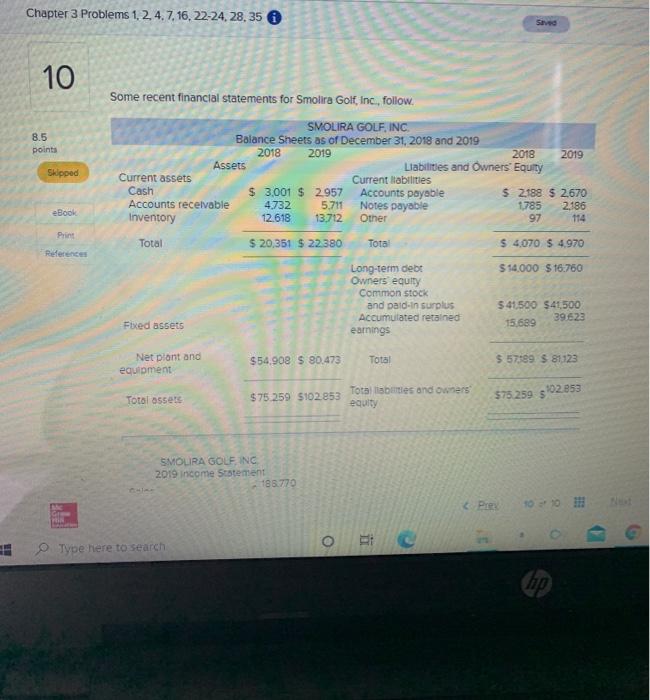

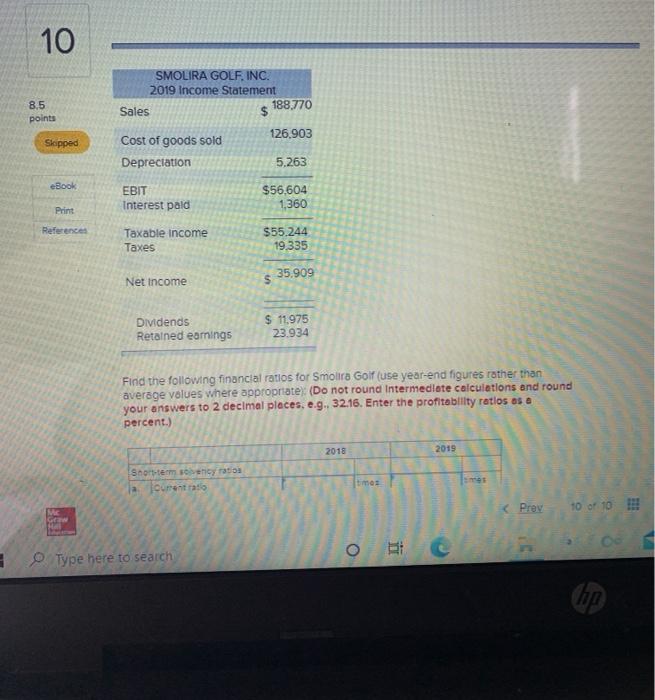

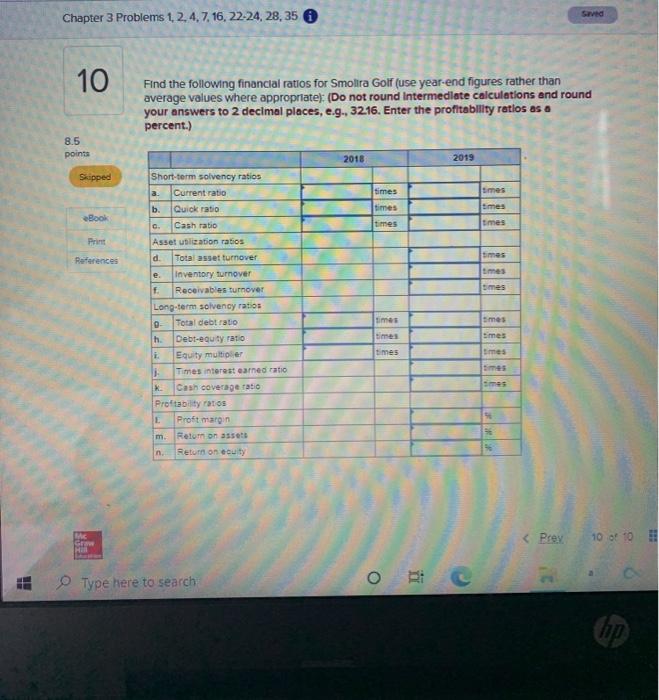

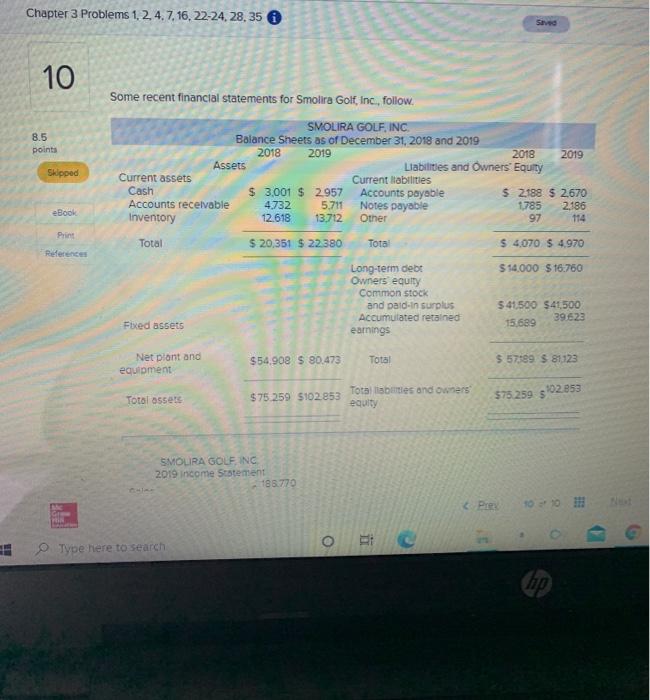

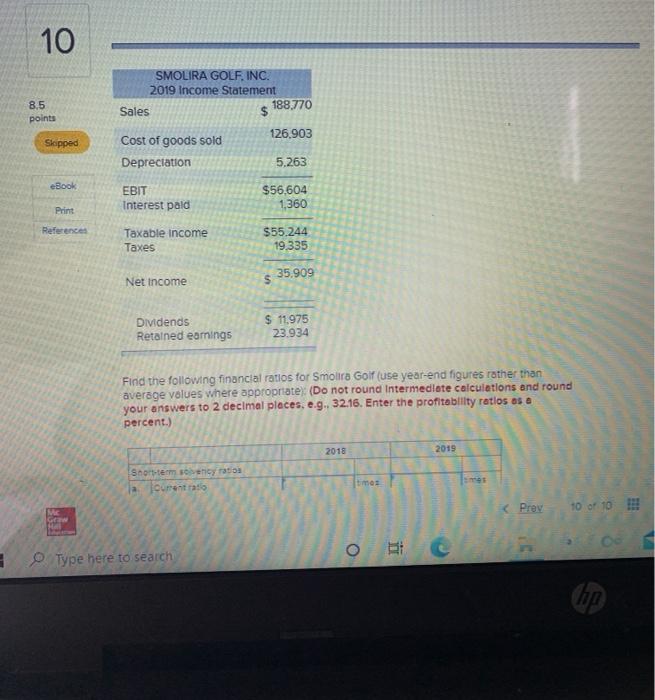

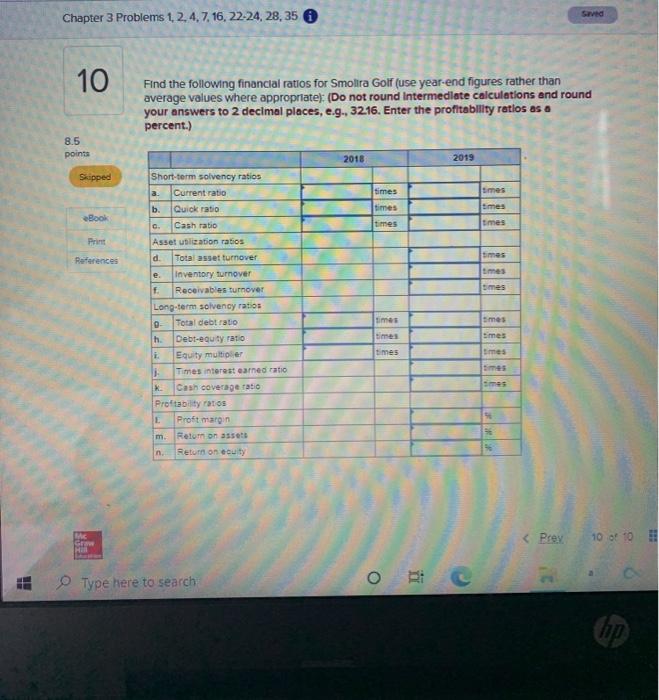

Chapter 3 Problems 1.2.4.7.16, 22-24, 28, 35 Sved 10 8.5 points 2018 Skipped Some recent financial statements for Smolira Golf, Inc., follow. SMOLIRA GOLF, INC Balance Sheets as of December 31, 2018 and 2019 2018 2019 2019 Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 3,001 $ 2957 Accounts payable $ 2.188 $ 2.670 Accounts receivable 4732 5.711 Notes payable 1785 2.186 Inventory 12.618 13.712 Other 97 114 Total $ 20,351 $ 22.380 Total $ 4,070 $ 4.970 eBook Print References $ 14,000 $16.760 Long-term debt Owners equity Common stock and paid in surplus Accumulated retained earnings $41.500 $41500 15.689 39.623 Fixed assets Net plant and equipment $54,908 S 80.473 Total $ 57189 $ 81,123 Total assets $75 259 $102.853 Totalemes and owners equity $75 2595 102.853 SMOURA GOLF, NC 2019 income Statement 85.770 o Type here to search hp 10 8,5 points SMOLIRA GOLF, INC. 2019 Income Statement 188,770 Sales $ 126,903 Cost of goods sold Depreciation 5.263 Skipped eBook EBIT Interest pald $56,604 1,360 Print Reference Taxable income Taxes $55,244 19,335 35.909 Net Income Dividends Retained earnings $ 11.975 23.934 Find the following financial ratlos for Smolira Golf (use year-end figures rather than average values where appropriate (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g. 32.16. Enter the profitability ratios as o percent.) 2018 2019 Short-term stato la jouentrato mos ME

Chapter 3 Problems 1.2.4.7.16, 22-24, 28, 35 Sved 10 8.5 points 2018 Skipped Some recent financial statements for Smolira Golf, Inc., follow. SMOLIRA GOLF, INC Balance Sheets as of December 31, 2018 and 2019 2018 2019 2019 Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 3,001 $ 2957 Accounts payable $ 2.188 $ 2.670 Accounts receivable 4732 5.711 Notes payable 1785 2.186 Inventory 12.618 13.712 Other 97 114 Total $ 20,351 $ 22.380 Total $ 4,070 $ 4.970 eBook Print References $ 14,000 $16.760 Long-term debt Owners equity Common stock and paid in surplus Accumulated retained earnings $41.500 $41500 15.689 39.623 Fixed assets Net plant and equipment $54,908 S 80.473 Total $ 57189 $ 81,123 Total assets $75 259 $102.853 Totalemes and owners equity $75 2595 102.853 SMOURA GOLF, NC 2019 income Statement 85.770 o Type here to search hp 10 8,5 points SMOLIRA GOLF, INC. 2019 Income Statement 188,770 Sales $ 126,903 Cost of goods sold Depreciation 5.263 Skipped eBook EBIT Interest pald $56,604 1,360 Print Reference Taxable income Taxes $55,244 19,335 35.909 Net Income Dividends Retained earnings $ 11.975 23.934 Find the following financial ratlos for Smolira Golf (use year-end figures rather than average values where appropriate (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g. 32.16. Enter the profitability ratios as o percent.) 2018 2019 Short-term stato la jouentrato mos ME

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started