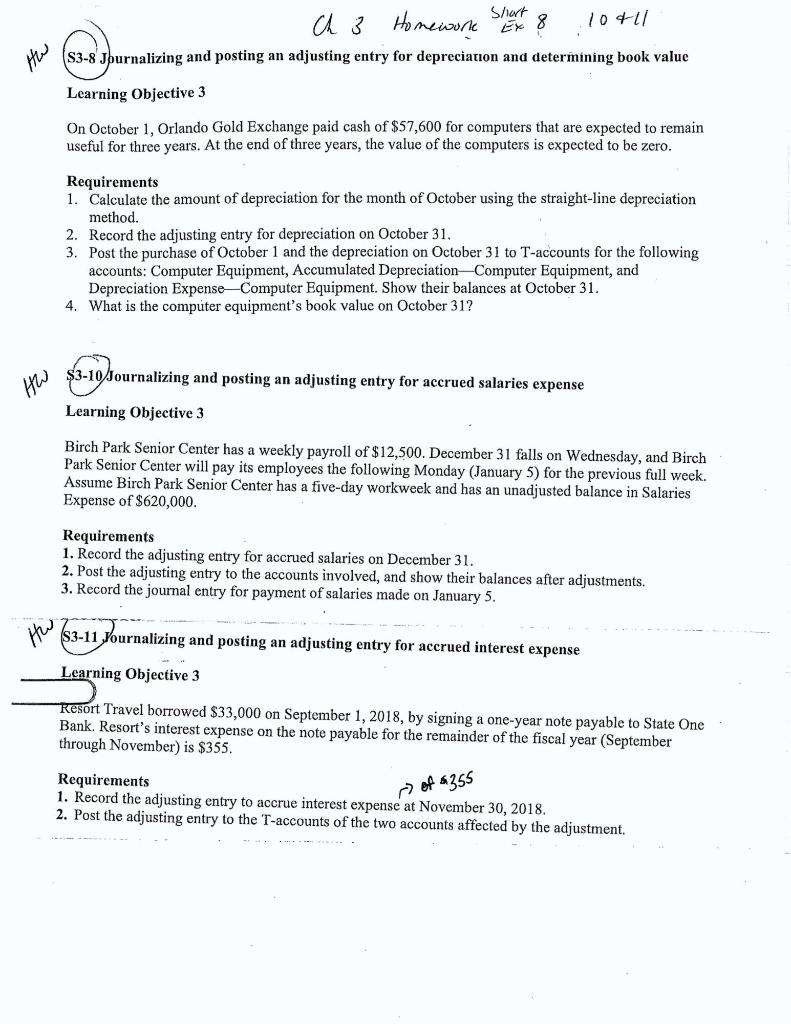

Chapter 3: Short Exercises 8, 10 & 11

Hw Ch 3 Homework 10811 S3-8 Journalizing and posting an adjusting entry for depreciation and determining book value Learning Objective 3 On October 1, Orlando Gold Exchange paid cash of $57,600 for computers that are expected to remain useful for three years. At the end of three years, the value of the computers is expected to be zero. Requirements 1. Calculate the amount of depreciation for the month of October using the straight-line depreciation method. 2. Record the adjusting entry for depreciation on October 31 3. Post the purchase of October 1 and the depreciation on October 31 to T-accounts for the following accounts: Computer Equipment, Accumulated Depreciation Computer Equipment, and Depreciation Expense Computer Equipment. Show their balances at October 31. 4. What is the computer equipment's book value on October 31? How $3-10 Journalizing and posting an adjusting entry for accrued salaries expense Learning Objective 3 Birch Park Senior Center has a weekly payroll of $12,500. December 31 falls on Wednesday, and Birch Park Senior Center will pay its employees the following Monday (January 5) for the previous full week. Assume Birch Park Senior Center has a five-day workweek and has an unadjusted balance in Salaries Expense of $620,000. Requirements 1. Record the adjusting entry for accrued salaries on December 31. 2. Post the adjusting entry to the accounts involved, and show their balances after adjustments. 3. Record the journal entry for payment of salaries made on January 5. z $3-11 Journalizing and posting an adjusting entry for accrued interest expense Learning Objective 3 Resort Travel borrowed $33,000 on September 1, 2018, by signing a one-year note payable to State One Bank, Resort's interest expense on the note payable for the remainder of the fiscal year (September through November) is $355. of 4355 Requirements 1. Record the adjusting entry to accrue interest expense at November 30, 2018. 2. Post the adjusting entry to the T-accounts of the two accounts affected by the adjustment. Ch 3 Homework Str8 106/ s3-8 Journalizing and posting an adjusting entry for depreciation and determining book value Learning Objective 3 On October 1, Orlando Gold Exchange paid cash of $57,600 for computers that are expected to remain useful for three years. At the end of three years, the value of the computers is expected to be zero. Requirements 1. Calculate the amount of depreciation for the month of October using the straight-line depreciation method. 2. Record the adjusting entry for depreciation on October 31, 3. Post the purchase of October 1 and the depreciation on October 31 to T-accounts for the following accounts: Computer Equipment, Accumulated Depreciation Computer Equipment, and Depreciation Expense Computer Equipment. Show their balances at October 31. 4. What is the computer equipment's book value on October 31? $3-10 Journalizing and posting an adjusting entry for accrued salaries expense How Learning Objective 3 Birch Park Senior Center has a weekly payroll of $12,500. December 31 falls on Wednesday, and Birch Park Senior Center will pay its employees the following Monday (January 5) for the previous full week. Assume Birch Park Senior Center has a five-day workweek and has an unadjusted balance in Salaries Expense of $620,000. Requirements 1. Record the adjusting entry for accrued salaries on December 31. 2. Post the adjusting entry to the accounts involved, and show their balances after adjustments. 3. Record the journal entry for payment of salaries made on January 5. HW 53-11 Journali $3-11 Journalizing and posting an adjusting entry for accrued interest expense Learning Objective 3 Resort Travel borrowed $33,000 on September 1, 2018, by signing a one-year note payable to State One Bank. Resort's interest expense on the note payable for the remainder of the fiscal year (September through November) is $355. of 4355 Requirements 1. Record the adjusting entry to accrue interest expense at November 30, 2018. 2. Post the adjusting entry to the T-accounts of the two accounts affected by the adjustment