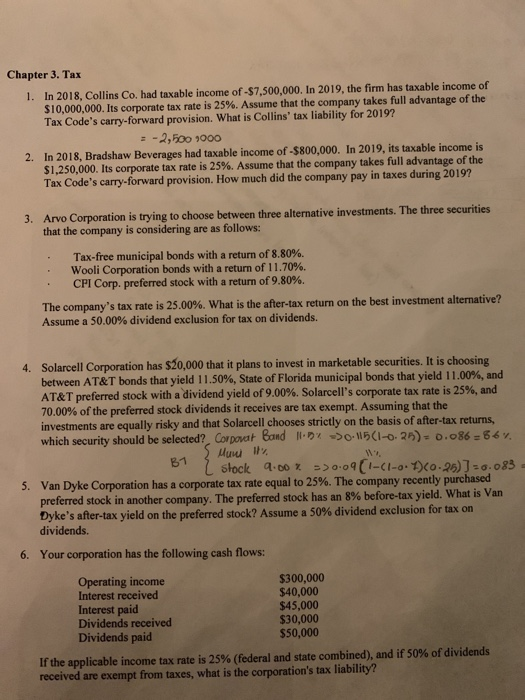

Chapter 3. Tax 1. In 2018, Collins Co. had taxable income of -$7,500,000. In 2019, the firm has taxable income of $10,000,000. Its corporate tax rate is 25%. Assume that the company takes full advantage of the Tax Code's carry-forward provision. What is Collins' tax liability for 2019? = -2,500 1000 2. In 2018, Bradshaw Beverages had taxable income of $800,000. In 2019, its taxable income is $1,250,000. Its corporate tax rate is 25%. Assume that the company takes full advantage of the Tax Code's carry-forward provision. How much did the company pay in taxes during 2019? 3. Arvo Corporation is trying to choose between three alternative investments. The three securities that the company is considering are as follows: Tax-free municipal bonds with a return of 8.80%. Wooli Corporation bonds with a return of 11.70%. CPI Corp. preferred stock with a return of 9.80%. The company's tax rate is 25.00%. What is the after-tax return on the best investment alternative? Assume a 50.00% dividend exclusion for tax on dividends. 4. Solarcell Corporation has $20,000 that it plans to invest in marketable securities. It is choosing between AT&T bonds that yield 11.50%, State of Florida municipal bonds that yield 11.00%, and AT&T preferred stock with a dividend yield of 9.00%. Solarcell's corporate tax rate is 25%, and 70.00% of the preferred stock dividends it receives are tax exempt. Assuming that the investments are equally risky and that Solarcell chooses strictly on the basis of after-tax returns, which security should be selected? Corporat Band 0:15(1-0. 21) - 0.086 86 Huu W. B L Stock 9.00 x = 0.09(1-C1-o.1) (0.25)] = 0.083 5. Van Dyke Corporation has a corporate tax rate equal to 25%. The company recently purchased preferred stock in another company. The preferred stock has an 8% before-tax yield. What is Van Dyke's after-tax yield on the preferred stock? Assume a 50% dividend exclusion for tax on dividends. 6. Your corporation has the following cash flows: Operating income $300,000 Interest received $40,000 Interest paid $45,000 Dividends received $30,000 Dividends paid $50,000 If the applicable income tax rate is 25% (federal and state combined), and if 50% of dividends received are exempt from taxes, what is the corporation's tax liability? Chapter 3. Tax 1. In 2018, Collins Co. had taxable income of -$7,500,000. In 2019, the firm has taxable income of $10,000,000. Its corporate tax rate is 25%. Assume that the company takes full advantage of the Tax Code's carry-forward provision. What is Collins' tax liability for 2019? = -2,500 1000 2. In 2018, Bradshaw Beverages had taxable income of $800,000. In 2019, its taxable income is $1,250,000. Its corporate tax rate is 25%. Assume that the company takes full advantage of the Tax Code's carry-forward provision. How much did the company pay in taxes during 2019? 3. Arvo Corporation is trying to choose between three alternative investments. The three securities that the company is considering are as follows: Tax-free municipal bonds with a return of 8.80%. Wooli Corporation bonds with a return of 11.70%. CPI Corp. preferred stock with a return of 9.80%. The company's tax rate is 25.00%. What is the after-tax return on the best investment alternative? Assume a 50.00% dividend exclusion for tax on dividends. 4. Solarcell Corporation has $20,000 that it plans to invest in marketable securities. It is choosing between AT&T bonds that yield 11.50%, State of Florida municipal bonds that yield 11.00%, and AT&T preferred stock with a dividend yield of 9.00%. Solarcell's corporate tax rate is 25%, and 70.00% of the preferred stock dividends it receives are tax exempt. Assuming that the investments are equally risky and that Solarcell chooses strictly on the basis of after-tax returns, which security should be selected? Corporat Band 0:15(1-0. 21) - 0.086 86 Huu W. B L Stock 9.00 x = 0.09(1-C1-o.1) (0.25)] = 0.083 5. Van Dyke Corporation has a corporate tax rate equal to 25%. The company recently purchased preferred stock in another company. The preferred stock has an 8% before-tax yield. What is Van Dyke's after-tax yield on the preferred stock? Assume a 50% dividend exclusion for tax on dividends. 6. Your corporation has the following cash flows: Operating income $300,000 Interest received $40,000 Interest paid $45,000 Dividends received $30,000 Dividends paid $50,000 If the applicable income tax rate is 25% (federal and state combined), and if 50% of dividends received are exempt from taxes, what is the corporation's tax liability