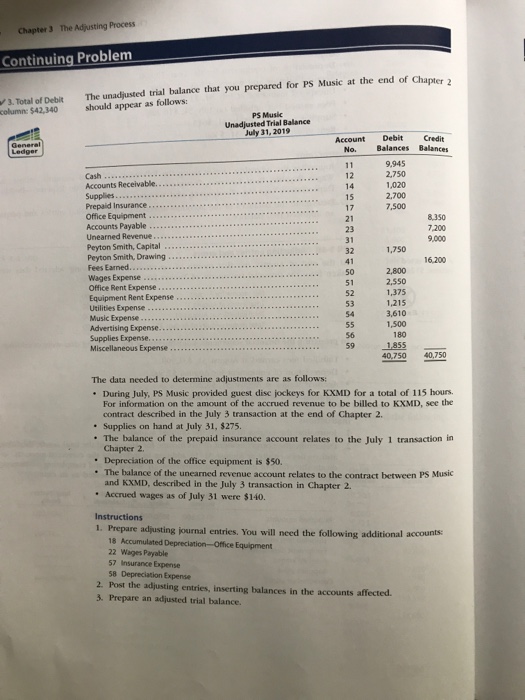

Chapter 3 The Adjusting Process Continuing Problem The unad usted trial balance that you prepared for PS Music at the end of Chapter ) Total of Debit column: $42,340 i should appear as follows PS Music Unadjusted Trial Balance July 31, 2019 AccountDebit Credit No. Balances Balances Ledger 9,945 2,750 1,020 2.700 7,500 12 Cash Accounts Receivable. Supplies Prepaid Insurance. Office Equipment Accounts Payable Unearned Revenue Peyton Smith, Capital Peyton Smith, Drawing 15 17 8,350 7.200 9,000 31 32 41 50 1,750 Wages Expense Office Rent Expense Equipment Rent Expense . Utilities Expense Music Expense Advertising Expense. Supplies Expense. 51 200 16200 52 53 34 2,550 1,375 1,215 3,610 1,500 180 59 1855 40,750 40,750 The data needed to determine adjustments are as follows: During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3 transaction at the end of Chapter 2 Supplies on hand at July 31, $275. The balance of the prepaid insurance account relates to the July 1 transaction in Chapter 2. Depreciation of the office equipment is $50. The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3 transaction in Chapter 2. Accrued wages as of July 31 were $140. Instructions 1. Prepare adjusting journal entries. You will need the following additional accounts: 18 Accumulated Depreciation Office Equipment 22 Wages Payable 57 Insurance Expense 58 Depreciation Expense 2. Post the adjusting entries, inserting balances in the accounts affected. 3. Prepare an adjusted trial balance Chapter 3 The Adjusting Process Continuing Problem The unad usted trial balance that you prepared for PS Music at the end of Chapter ) Total of Debit column: $42,340 i should appear as follows PS Music Unadjusted Trial Balance July 31, 2019 AccountDebit Credit No. Balances Balances Ledger 9,945 2,750 1,020 2.700 7,500 12 Cash Accounts Receivable. Supplies Prepaid Insurance. Office Equipment Accounts Payable Unearned Revenue Peyton Smith, Capital Peyton Smith, Drawing 15 17 8,350 7.200 9,000 31 32 41 50 1,750 Wages Expense Office Rent Expense Equipment Rent Expense . Utilities Expense Music Expense Advertising Expense. Supplies Expense. 51 200 16200 52 53 34 2,550 1,375 1,215 3,610 1,500 180 59 1855 40,750 40,750 The data needed to determine adjustments are as follows: During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3 transaction at the end of Chapter 2 Supplies on hand at July 31, $275. The balance of the prepaid insurance account relates to the July 1 transaction in Chapter 2. Depreciation of the office equipment is $50. The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3 transaction in Chapter 2. Accrued wages as of July 31 were $140. Instructions 1. Prepare adjusting journal entries. You will need the following additional accounts: 18 Accumulated Depreciation Office Equipment 22 Wages Payable 57 Insurance Expense 58 Depreciation Expense 2. Post the adjusting entries, inserting balances in the accounts affected. 3. Prepare an adjusted trial balance