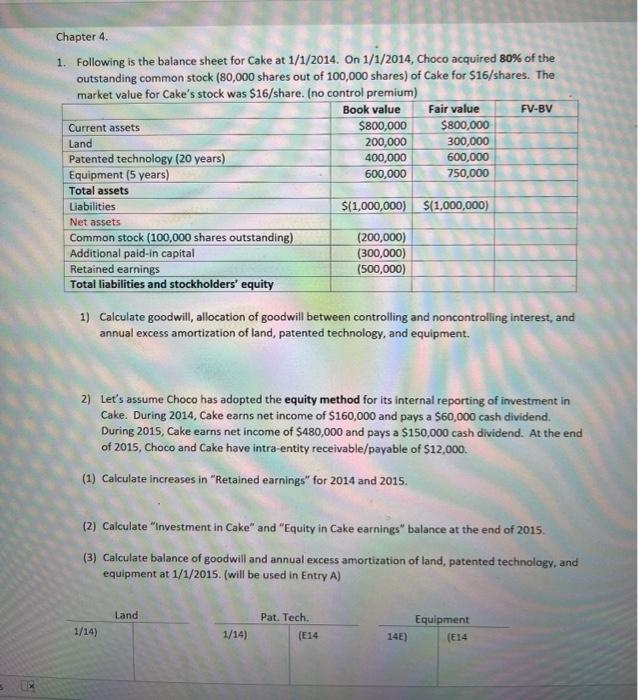

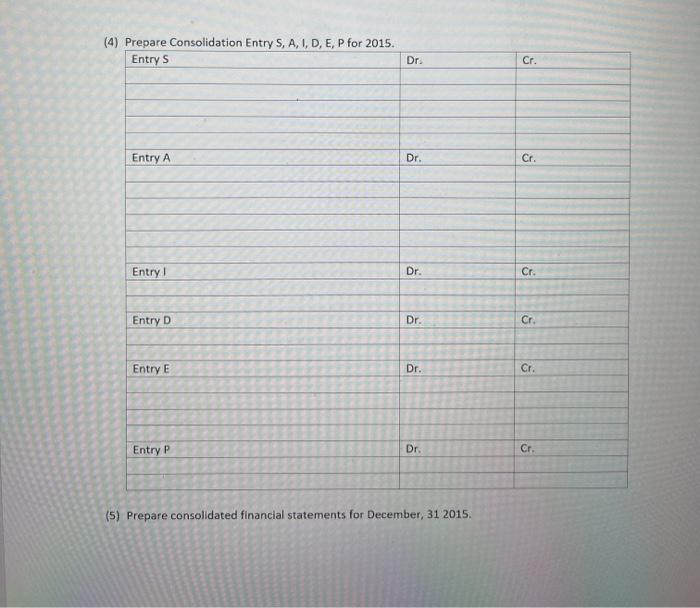

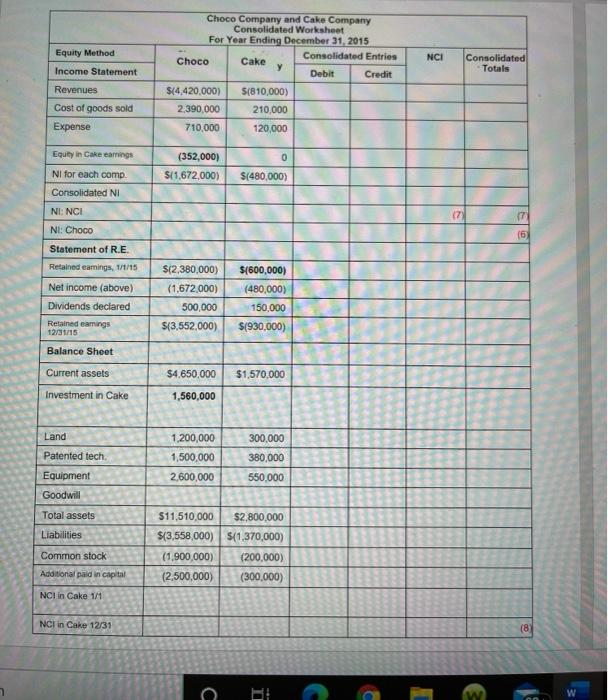

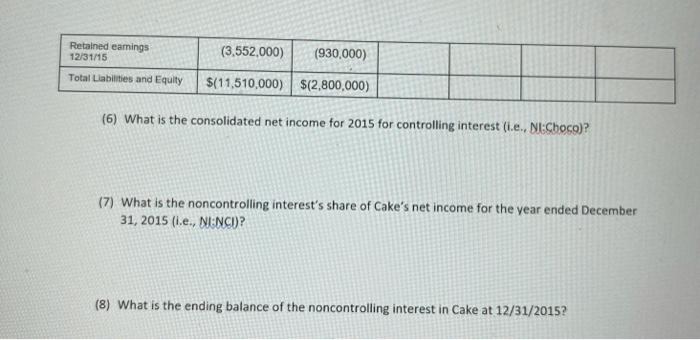

Chapter 4. 1. Following is the balance sheet for Cake at 1/1/2014. On 1/1/2014, Choco acquired 80% of the outstanding common stock (80,000 shares out of 100,000 shares) of Cake for $16/shares. The market value for Cake's stock was $16/share. (no control premium) Book value Fair value FV-BV Current assets $800,000 $800,000 Land 200,000 300,000 Patented technology (20 years) 400,000 600,000 Equipment (5 years) 600,000 750,000 Total assets Liabilities $(1,000,000) $(1,000,000) Net assets Common stock (100,000 shares outstanding) (200,000) Additional paid-in capital (300,000) Retained earnings (500,000) Total liabilities and stockholders' equity 1) Calculate goodwill, allocation of goodwill between controlling and noncontrolling interest, and annual excess amortization of land, patented technology, and equipment. 2) Let's assume Choco has adopted the equity method for its internal reporting of investment in Cake. During 2014, Cake earns net income of $160,000 and pays a $60,000 cash dividend. During 2015, Cake earns net income of $480,000 and pays a $150,000 cash dividend. At the end of 2015, Choco and Cake have intra-entity receivable/payable of $12,000. (1) Calculate increases in "Retained earnings" for 2014 and 2015. (2) Calculate Investment in Cake" and "Equity in Cake earnings" balance at the end of 2015. (3) Calculate balance of goodwill and annual excess amortization of land, patented technology, and equipment at 1/1/2015. (will be used in Entry A) Land Pat. Tech. 1/14) 1/14) Equipment 14E) (E14 (E14 (4) Prepare Consolidation Entry S, A, I, D, E, P for 2015. Entry s Dr Cr. Entry A Dr. Cr. Entry Dr. Cr. Entry D Dr. Cr. Entry E Dr. Cr. Entry P Dr. Cr. (5) Prepare consolidated financial statements for December, 31 2015. Equity Method NCI Choco Company and Cake Company Consolidated Worksheet For Year Ending December 31, 2015 Consolidated Entries Choco Cake y Debit Credit ${4.420,000) 5(810,000) 2,390,000 210,000 710,000 120,000 Consolidated Totals Income Statement Revenues Cost of goods sold Expense Equity in Cake earings 0 (352,000) $(1,672,000) $(480,000) NI for each comp. Consolidated NI NI: NCI (7 17 NI: Choco (67 Statement of R.E. Retained earnings, 1/1/15 $(2,380,000) Net income (above) Dividends declared Retained earings 12/31/15 (1.672 000) 500,000 S(3,552,000) $(600,000) (480,000) 150,000 S(930,000) Balance Sheet Current assets $4.650,000 $1,570,000 Investment in Cake 1,560,000 Land 1.200,000 1,500,000 Patented tech Equipment 300,000 380,000 550.000 2,600,000 Goodwill Total assets Liabilities $11,510,000 $2,800,000 $(3,558,000) $(1,370,000) (1,900,000) (200,000) (2,500,000) (300,000) Common stock Additional paid in capital NCI in Cake 1/1 NCI in Cake 12/31 (8 C (3.552,000) Retained earings 12/31/15 Total Liabilities and Equity (930,000) $(11,510,000) $(2,800,000) (6) What is the consolidated net income for 2015 for controlling interest (i.e., NCChoco)? (7) What is the noncontrolling interest's share of Cake's net income for the year ended December 31, 2015 (1.e., NI:NCI? (8) What is the ending balance of the noncontrolling interest in Cake at 12/31/2015