chapter 4

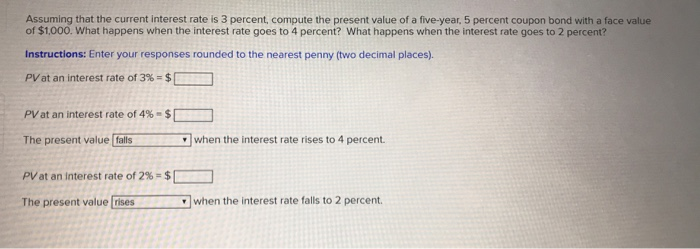

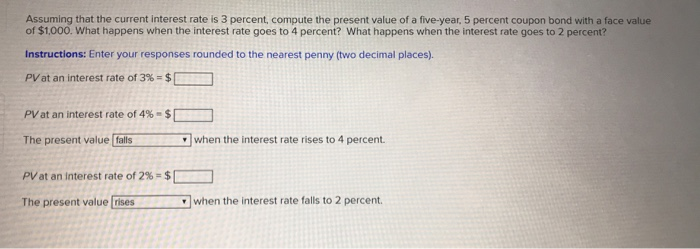

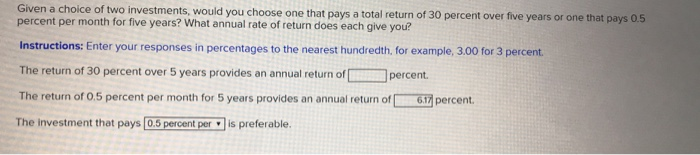

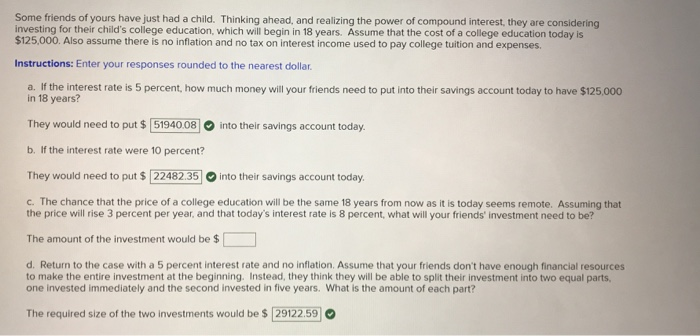

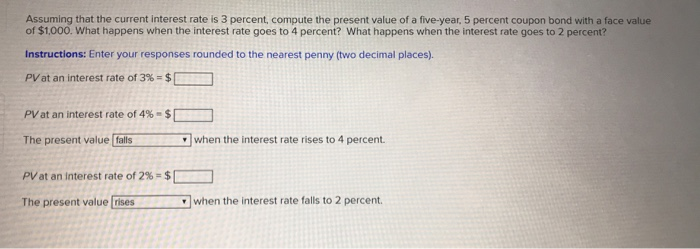

Assuming that the current interest rate is 3 percent, compute the present value of a five-year, 5 percent coupon bond with a face value of $1,000. What happens when the interest rate goes to 4 percent? What happens when the interest rate goes to 2 percent? Instructions: Enter your responses rounded to the nearest penny (two decimal places). PV at an interest rate of 3% = $ PV at an interest rate of 4 % - $ when the interest rate rises to 4 percent The present value falls PV at an Interest rate of 2% - $ The present value rises when the interes t rate falls to 2 percent. Given a choice of two investments, would you choose one that pays a total return of 30 percent over five years or one that pays 0.5 percent per month for five years? What annual rate of return does each give you? Instructions: Enter your responses in percentages to the nearest hundredth, for example, 3.00 for 3 percent. The return of 30 percent over 5 years provides an annual return of percent. The return of 0.5 percent per month for 5 years provides an annual return of 6.17 percent The investment that pays 0.5 percent per is preferable. Most businesses replace their computers every two to three years. Assume that a computer costs $2,000 and that it fully depreciates in 3 years, at which point it has no resale value and is thrown away Instructions: Enter your responses rounded to the nearest dollar a. If the interest rate for financing the equipment is 10 percent, what is the minimum annual cash flow that a computer must generate to be worth the purchase? The minimum annual cash flow must be at least $ b. Suppose the computer did not fully depreciate but still had a $250 value at the time it was replaced. What is the minimum annual cash flow that a computer must generate to be worth the purchase? The minimum annual cash flow must be at least $ Some friends of yours have just had a child. Thinking ahead, and realizing the power of compound interest, they are considering investing for their child's college education, which will begin in 18 years. Assume that the cost of a college education today is $125,000. Also assume there is no inflation and no tax on interest income used to pay college tuition and expenses. Instructions: Enter your responses rounded to the nearest dollar. a. If the interest rate is 5 percent, how much money will your friends need to put into their savings account today to have $125,000 in 18 years? They would need to put $ 51940.08 into their savings account today b. If the interest rate were 10 percent? They would need to put $ [22482.35 into their savings account today. c. The chance that the price of a college education will be the same 18 years from now as it is today seems remote. Assuming that the price will rise 3 percent per year, and that today's interest rate is 8 percent, what will your friends' investment need to be? The amount of the investment would be $ d. Return to the case with a 5 percent interest rate and no inflation. Assume that your friends don't have enough financial resources to make the entire investment at the beginning. Instead, they think they will be able to split their investment into two equal parts, one invested immediately and the second invested in five years. What is the amount of each part? The required size of the two investments would be $ 29122.59