Answered step by step

Verified Expert Solution

Question

1 Approved Answer

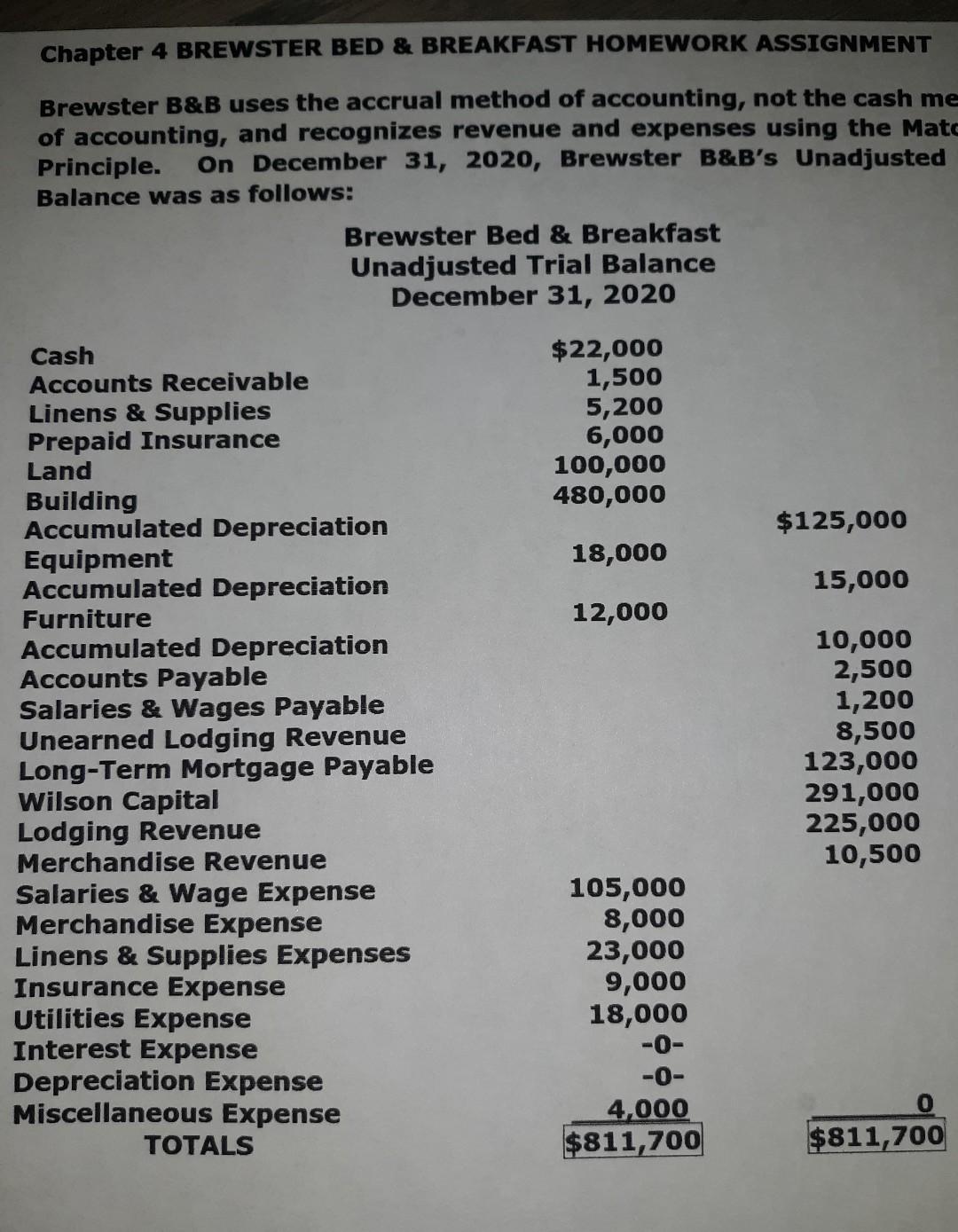

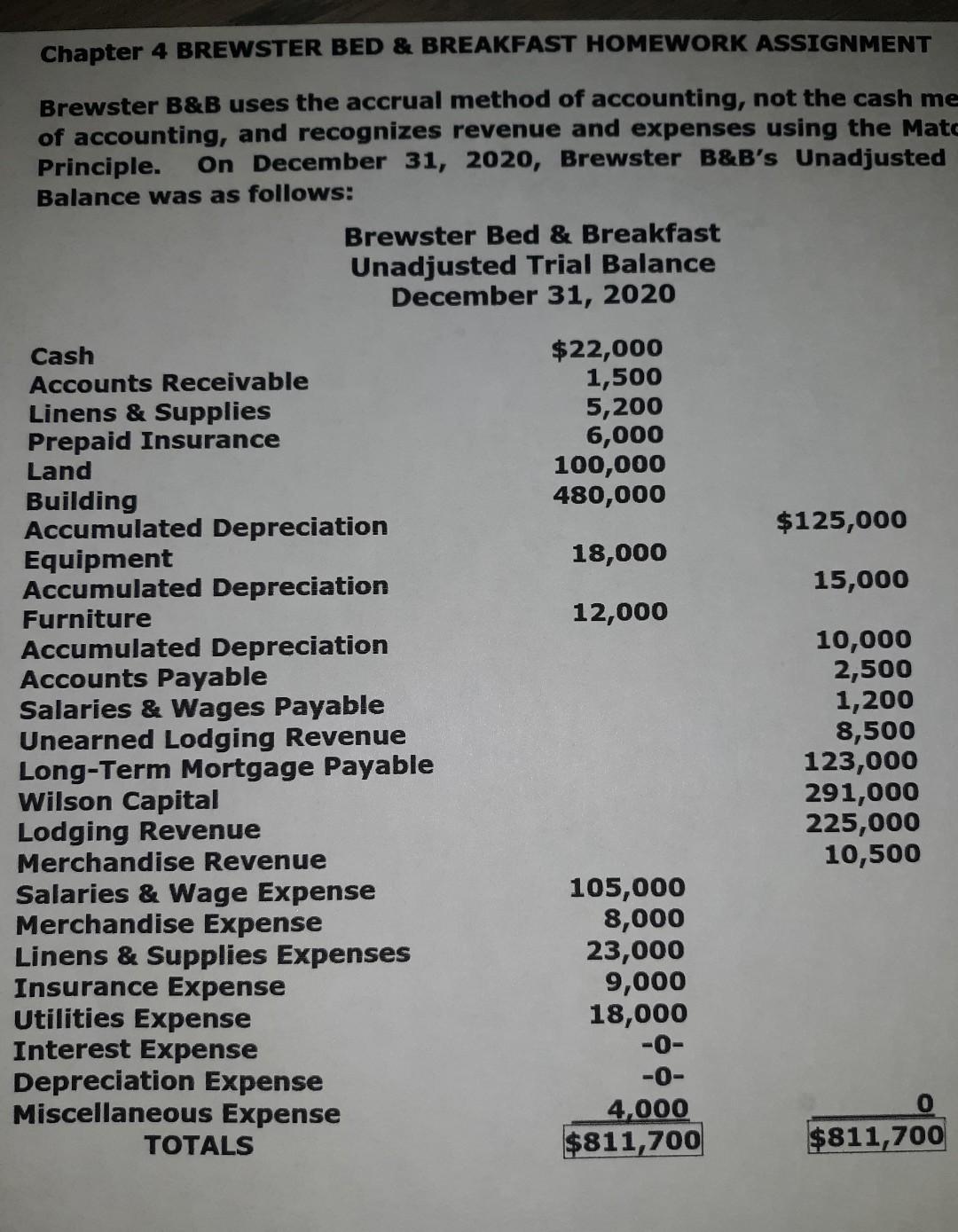

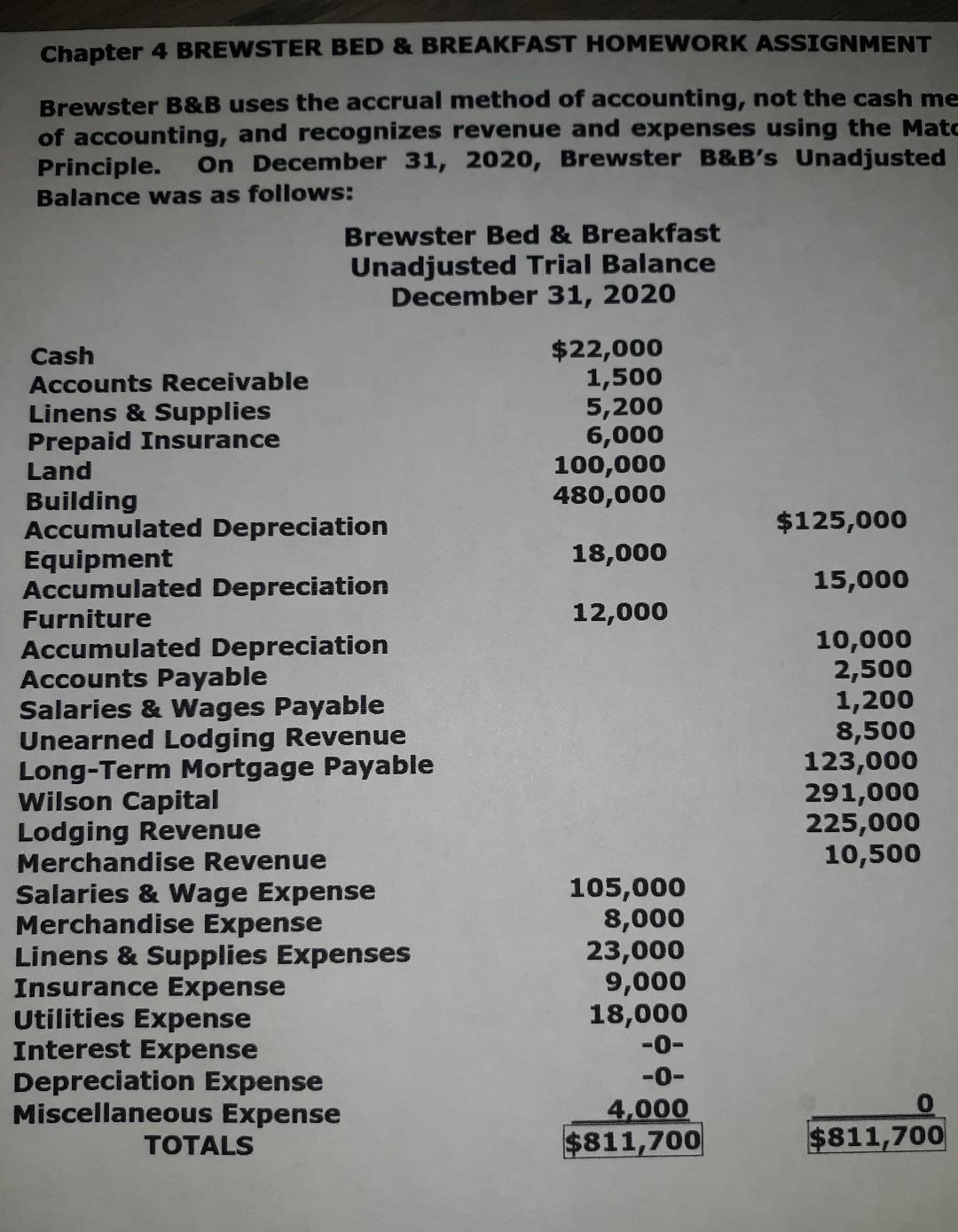

Chapter 4 BREWSTER BED & BREAKFAST HOMEWORK ASSIGNMENT Brewster B&B uses the accrual method of accounting, not the cash me of accounting, and recognizes revenue

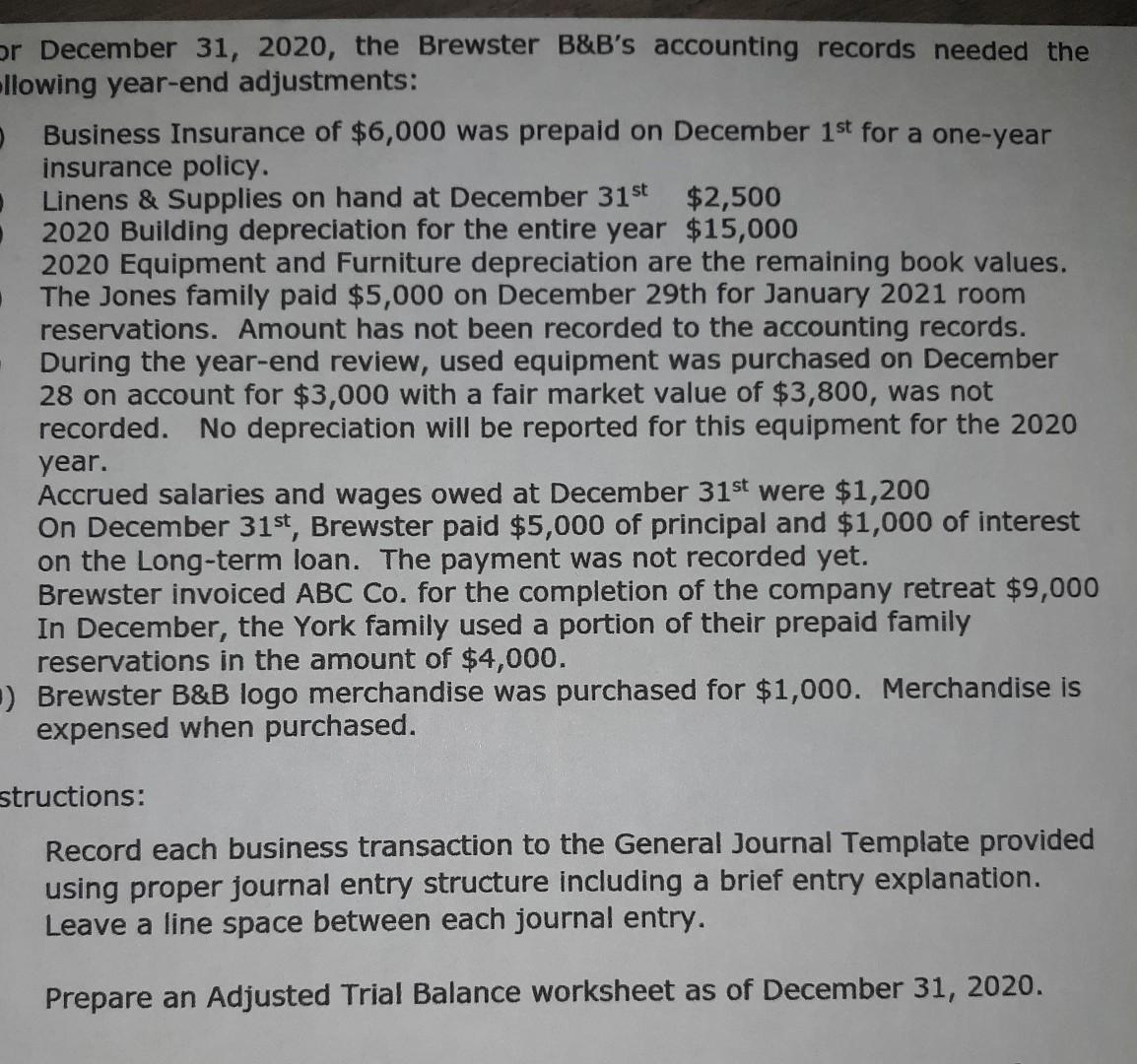

Chapter 4 BREWSTER BED & BREAKFAST HOMEWORK ASSIGNMENT Brewster B&B uses the accrual method of accounting, not the cash me of accounting, and recognizes revenue and expenses using the Matc Principle. On December 31, 2020, Brewster B&B's Unadjusted Balance was as follows: Brewster Bed & Breakfast Unadjusted Trial Balance December 31, 2020 $22,000 1,500 5,200 6,000 100,000 480,000 $125,000 18,000 15,000 12,000 Cash Accounts Receivable Linens & Supplies Prepaid Insurance Land Building Accumulated Depreciation Equipment Accumulated Depreciation Furniture Accumulated Depreciation Accounts Payable Salaries & Wages Payable Unearned Lodging Revenue Long-Term Mortgage Payable Wilson Capital Lodging Revenue Merchandise Revenue Salaries & Wage Expense Merchandise Expense Linens & Supplies Expenses Insurance Expense Utilities Expense Interest Expense Depreciation Expense Miscellaneous Expense TOTALS 10,000 2,500 1,200 8,500 123,000 291,000 225,000 10,500 105,000 8,000 23,000 9,000 18,000 -0- -0- 4,000 $811,700 $811,700 or December 31, 2020, the Brewster B&B's accounting records needed the llowing year-end adjustments: Business Insurance of $6,000 was prepaid on December 1st for a one-year insurance policy. Linens & Supplies on hand at December 31st $2,500 2020 Building depreciation for the entire year $15,000 2020 Equipment and Furniture depreciation are the remaining book values. The Jones family paid $5,000 on December 29th for January 2021 room reservations. Amount has not been recorded to the accounting records. During the year-end review, used equipment was purchased on December 28 on account for $3,000 with a fair market value of $3,800, was not recorded. No depreciation will be reported for this equipment for the 2020 year. Accrued salaries and wages owed at December 31st were $1,200 On December 31st, Brewster paid $5,000 of principal and $1,000 of interest on the Long-term loan. The payment was not recorded yet. Brewster invoiced ABC Co. for the completion of the company retreat $9,000 In December, the York family used a portion of their prepaid family reservations in the amount of $4,000. Brewster B&B logo merchandise was purchased for $1,000. Merchandise is expensed when purchased. structions: Record each business transaction to the General Journal Template provided using proper journal entry structure including a brief entry explanation. Leave a line space between each journal entry. Prepare an Adjusted Trial Balance worksheet as of December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started