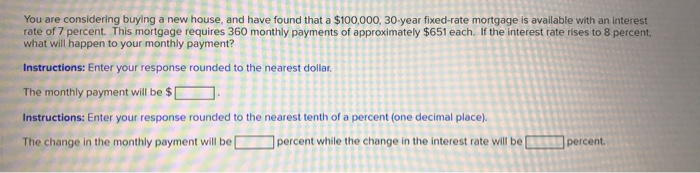

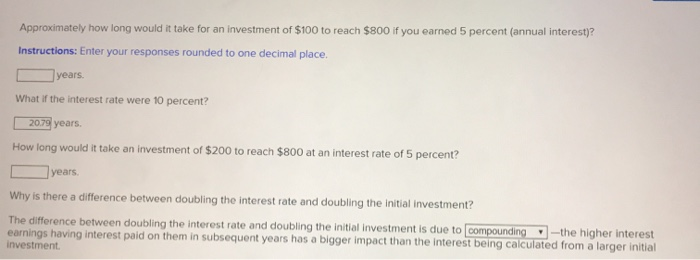

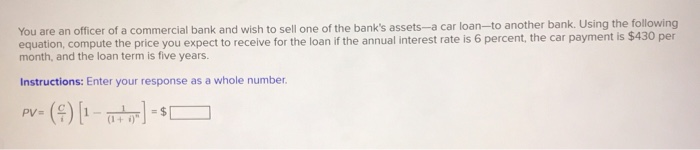

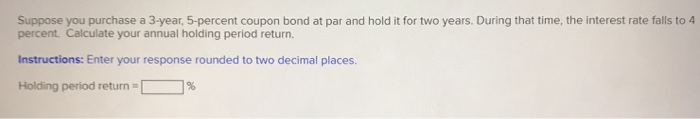

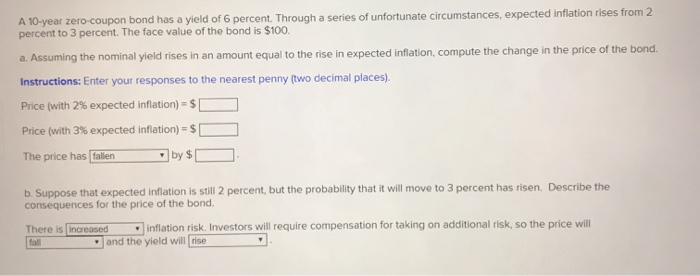

You are considering buying a new house, and have found that a $100,000, 30-year fixed-rate mortgage is available with an interest rate of 7 percent. This mortgage requires 360 monthly payments of approximately $651 each. If the interest rate rises to 8 percent, what will happen to your monthly payment? Instructions: Enter your response rounded to the nearest dollar The monthly payment will be $ Instructions: Enter your response rounded to the nearest tenth of a percent (one decimal place). percent while the change in the interest rate will be The change in the monthly payment will be percent Approximately how long would it take for an investment of $100 to reach $800 if you earned 5 percent (annual interest)? Instructions: Enter your responses rounded to one decimal place. years What if the interest rate were 10 percent? 2079 years. How long would it take an investment of $200 to reach $800 at an interest rate of 5 percent? years. Why is there a difference between doubling the interest rate and doubling the initial investment? The difference between doubling the interest rate and doubling the initial investment is due to compounding -the higher interest earnings having interest paid on them in subsequent years has a bigger impact than the interest being calculated from a larger initial investment You are an officer of a commercial bank and wish to sell one of the bank's assets-a car loan-to another bank. Using the following equation, compute the price you expect to receive for the loan if the annual interest rate is 6 percent, the car payment is $430 per month, and the loan term is five years. Instructions: Enter your response as a whole number PV (1+ - () Suppose you purchase a 3-year, 5-percent coupon bond at par and hold it for two years. During that time, the interest rate falls to 4 percent. Calculate your annual holding period return. Instructions: Enter your response rounded to two decimal places. Holding period return A 10-year zero-coupon bond has a yield of 6 percent. Through a series of unfortunate circumstances, expected inflation rises from 2 percent to 3 percent. The face value of the bond is $100. a. Assuming the nominal yield rises in an amount equal to the rise in expected inflation, compute the change in the price of the bond. Instructions: Enter your responses to the nearest penny (two decimal places). Price (with 2% expected inflation) $ Price (with 3% expected inflation) = $ by $ The price has fallen b. Suppose that expected inflation is still 2 percent, but the probability that it will move to 3 percent has risen. Describe the consequences for the price of the bond. inflation risk., Investors will require compensation for taking on additional risk, so the price will There is increased fall and the yield will rise