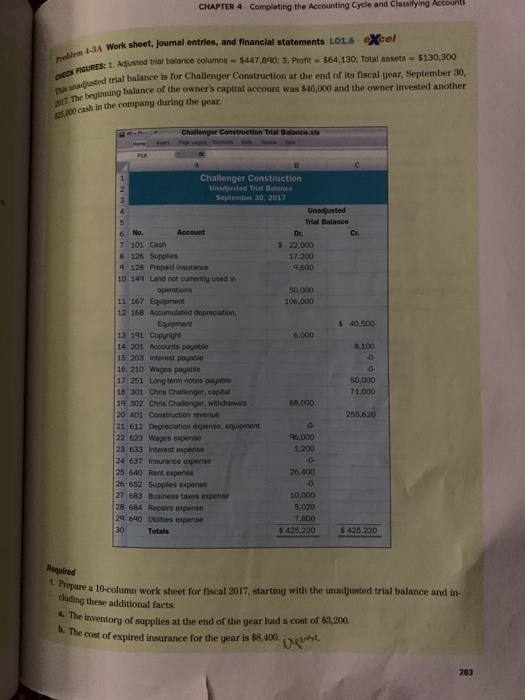

CHAPTER 4 Completing the Accounting Cycle and Classifying Accounts the trial balance because the bill arrived equity, and a classified balance sheet. c. Annual depreciation of the equipment is $17,600. d. The September utilities expense was not included in the trial balan after it was prepared. Its $750 amount needs to be recorded. e. The company's employees have earned $4,200 of accrued wages. The interest expense of $120 for September has not yet been paid or recorded 2. Use the work sheet to prepare the adjusting and closing entries. 3. Prepare an income statement, a statement of changes in equity, and a classified $16,000 of the long-term note payable is to be paid by September 30, 2018. Analysis Component: Analyze the following potential errors and describe how each 10-column work sheet. Explain whether the error is likely to be discovered in completing the and, if not, the effect of the error on the financial statements. a. The adjustment to record used supplies was credited to Supplies for $3,200 and debited the same amount to Supplies Expense. b. When completing the adjusted trial balance in the work sheet, the $22,000 cash balance was incorrectly entered in the Credit column. describe how each would affect the ed in completing the work sheet CHAPTER 4 Completing the Accounting Cycle and Classiying Account Problem 4-34 Word CHECK FROURES: 1 mis nadjusted trial Work sheet. Journal entries, and financial statements 101.6 excel Adjusted trial balance columns - $447.890: 3. Profit $64,130: Total assets $130,300 ed trial balance is for Challenger Construction at the end of its fiscal year, September 30, ning balance of the owner's capital account was $16,000 and the owner invested another cash in the company during the year. The beginning bala Challenger Construction Thal Balance.xls Challenger Construction Unadjusted Trial Balance September 30, 2017 Unadjusted Trin Balance $ 22.000 17200 4,600 50.000 106.000 $ 40,500 6.000 8.100 6 No. Account 7 101 Cash 8 126 Supplies 9 128 Prepaid insurance 10 149 Land not currently used in operations 11 167 Equipment 12 168 Accumulated depreciation, Equipment 13 191 Copyright 14 201 Accounts payable 15 203 Interest payable 16 210 Wages payable 17 251 Long term notes payable 18 301 Chris Challenger, capital 19 302 Chris Challenger, withdrawals 20 401 Construction revenue 21 612 Depreciation expense, equipment 22 623 Wages expense 23 633 Interest expense 24 637 Insurance expense 25 640 Rent expense 26 652 Supplies expense 27 683 Business taxes expense 28 684 Repairs expense 29 640 Utilities expense 30 Totals 50.000 71.000 68,000 255,620 46,000 1.200 26.400 10.000 5,020 7,800 $ 425,220 $425.220 Required Pare a 10-column work sheet for fiscal 2017, starting with the unadjusted trial balance and in cluding these additional facts The inventory of supplies at the end of the gear had a cost of $3,200. The cost of expired insurance for the year is $8,400. c h e