Answered step by step

Verified Expert Solution

Question

1 Approved Answer

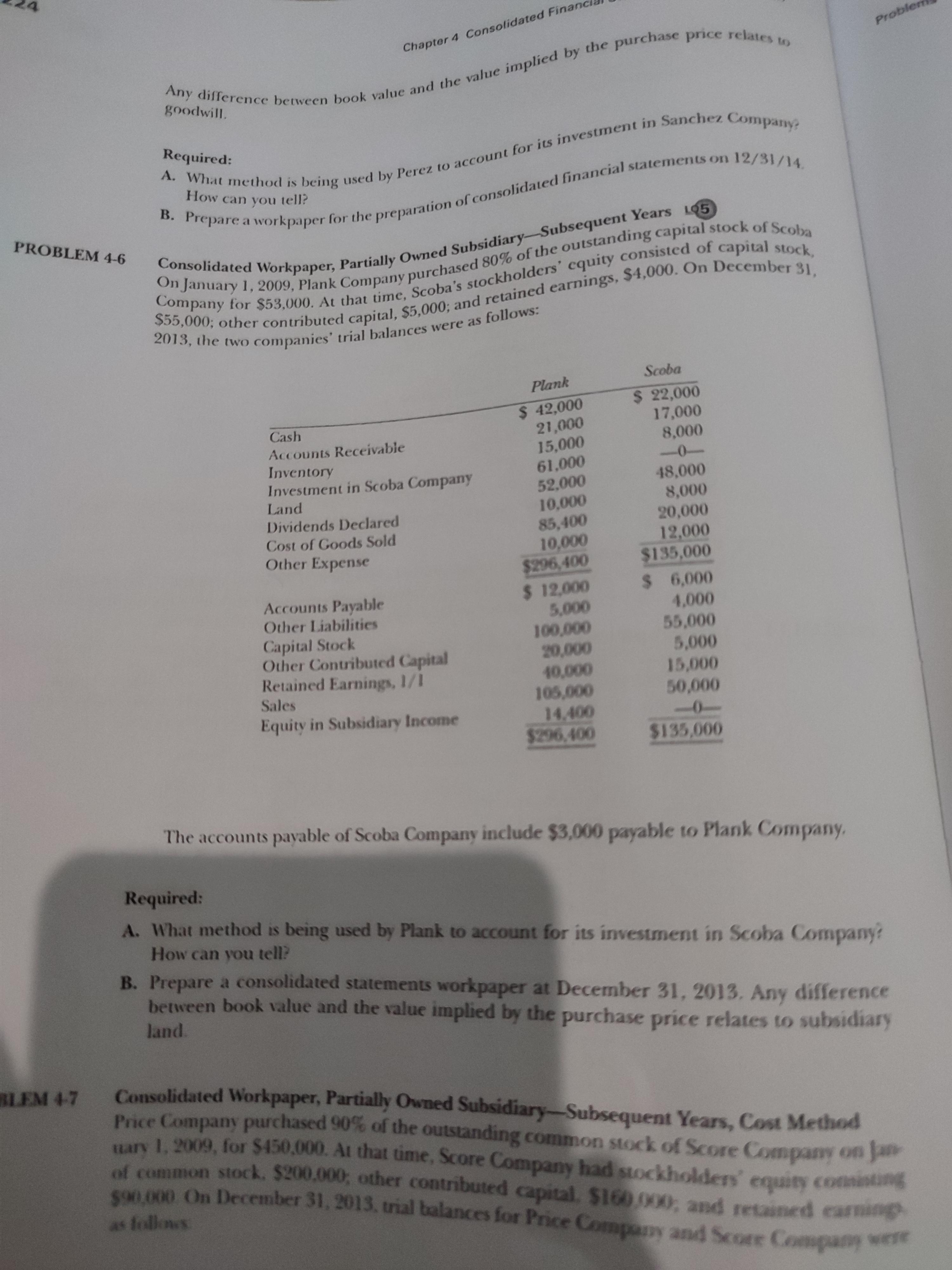

Chapter 4 Consolidated Financa Probler goodwill. Required: How can you tell? PROBLEM 4-6 Consolidated Workpaper, Partially Owned Subsidiary-Subsequent Years LO5 Scoba Plank $ 22,000

Chapter 4 Consolidated Financa Probler goodwill. Required: How can you tell? PROBLEM 4-6 Consolidated Workpaper, Partially Owned Subsidiary-Subsequent Years LO5 Scoba Plank $ 22,000 17,000 8,000 $ 42,000 21,000 15,000 61,000 52,000 10,000 85,400 10,000 $296,400 $ 12,000 5,000 100,000 20,000 40,000 105,000 14,400 $296,400 Cash Accounts Receivable Inventory -0- Investment in Scoba Company Land 48,000 8,000 Dividends Declared Cost of Goods Sold Other Expense 20,000 12,000 $135,000 $ 6,000 4,000 Accounts Payable Other Liabilities Capital Stock Other Contributed Capital Retained Earnings, 1/1 55,000 5,000 15,000 50,000 Sales Equity in Subsidiary Income $135,000 The accounts payable of Scoba Company include $3,000 payable to Plank Company. Required: A. What method is being used by Plank to account for its investment in Scoba Company? How can you tell? B. Prepare a consolidated statements workpaper at December 31, 2013. Any difference between book value and the value implied by the purchase price relates to subsidiary land. Consolidated Workpaper, Partially Owned Subsidiary-Subsequent Years, Cost Method Price Company purchased 90% of the outstanding common stock of Score Company on Ja Hary 1.2009, for $450,000. At that time, Score Company had stockholders' equity consinting of common stock. $200.000; other contributed capital. $160 000, and retained earning son.000 On December 31, 2013. trial balances for Price Company and Score Company wee BLEM 4-7 as follows

Step by Step Solution

★★★★★

3.34 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

3 What method is being used ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started