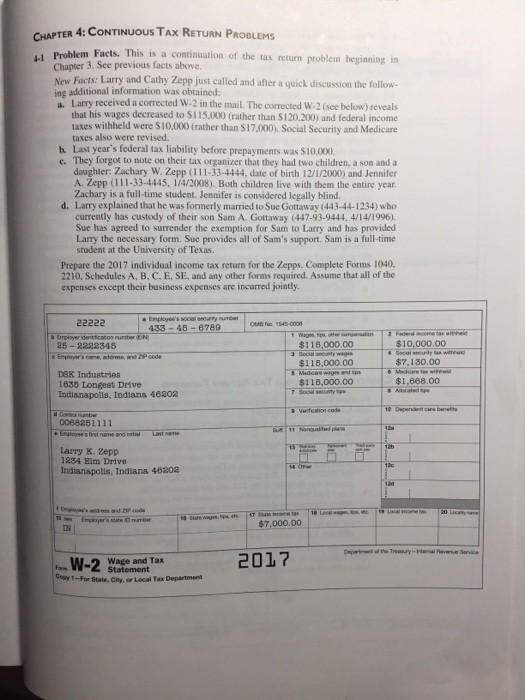

CHAPTER 4: CONTINUOUS TAx RETURN PROBLEMS 4-1 Proble m Facts. This is a continuation of the tax return problem beginning in Chapter 3. See previous facts above. New Facts: Larry and Cathy Zepp just called and after a quick discussion the fol ing additional information was obtained: lonw-. a. Larry received a corrected W-2 in the mail. The corrected W-2 (see below) reveals that his wages decreased to $115,000 (rather than $120.200) and federal income taxes withheld were $10,.000 (rather than $17,000) Social Security and Medicare taxes also were revised. Last year's federal tax liability before prepayments was $10,000. b. c. They forgot to note on their tax organizer that they had two children, a son and a daughter: Zachary W. Zepp (i11-33-4444, date of birth 12/1/2000) and Jennifer A. Zepp (111-33-4445, 1/4/2008). Both children live with them the entire year Zachary is a full-time student. Jennifer is considered legally blind. d. Larry explained that he was formerly married to Sue Gottaway (443-44-1234) who currently has custody of their son Sam A. Gottaway (447-93-9444, 4/14/1996). Sue has agreed to surrender the exemption for Sam to Larry and has provided Larry the necessary form. Sue provides all of Sam's support. Sam is a full-time student at the University of Texas. Prepare the 2017 individual income tax return for the Zepps. Complete Forms 1040. 2210, Schedules A, B, C. E, SE, and any other forms required. Assume that all of the expenses except their business expenses are incurred jointly Employeer's social seourty rumber 433-45-6789 Na. 1548-000S $115,000.00 $116,000.00 $118,000.00 $10,000.00 $7.130.00 $1,668.00 26-2222345 DSK Industries 1638 Longest Drive Indianapolls, Indiana 48202 0068251111 Larry K. Zepp 1234 Elm Drive Indianapolis, Indiana 46202 Employers scate Dmr IN I $7,000.00 W-2 Wage and Tax 2017 Copy 1-For State, City, or Local Tax Department CHAPTER 4: CONTINUOUS TAx RETURN PROBLEMS 4-1 Proble m Facts. This is a continuation of the tax return problem beginning in Chapter 3. See previous facts above. New Facts: Larry and Cathy Zepp just called and after a quick discussion the fol ing additional information was obtained: lonw-. a. Larry received a corrected W-2 in the mail. The corrected W-2 (see below) reveals that his wages decreased to $115,000 (rather than $120.200) and federal income taxes withheld were $10,.000 (rather than $17,000) Social Security and Medicare taxes also were revised. Last year's federal tax liability before prepayments was $10,000. b. c. They forgot to note on their tax organizer that they had two children, a son and a daughter: Zachary W. Zepp (i11-33-4444, date of birth 12/1/2000) and Jennifer A. Zepp (111-33-4445, 1/4/2008). Both children live with them the entire year Zachary is a full-time student. Jennifer is considered legally blind. d. Larry explained that he was formerly married to Sue Gottaway (443-44-1234) who currently has custody of their son Sam A. Gottaway (447-93-9444, 4/14/1996). Sue has agreed to surrender the exemption for Sam to Larry and has provided Larry the necessary form. Sue provides all of Sam's support. Sam is a full-time student at the University of Texas. Prepare the 2017 individual income tax return for the Zepps. Complete Forms 1040. 2210, Schedules A, B, C. E, SE, and any other forms required. Assume that all of the expenses except their business expenses are incurred jointly Employeer's social seourty rumber 433-45-6789 Na. 1548-000S $115,000.00 $116,000.00 $118,000.00 $10,000.00 $7.130.00 $1,668.00 26-2222345 DSK Industries 1638 Longest Drive Indianapolls, Indiana 48202 0068251111 Larry K. Zepp 1234 Elm Drive Indianapolis, Indiana 46202 Employers scate Dmr IN I $7,000.00 W-2 Wage and Tax 2017 Copy 1-For State, City, or Local Tax Department