Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 4 - Homework to complete and bring to class. The following information is available for Bean McKean Tour Company. The company adjusts its accounts

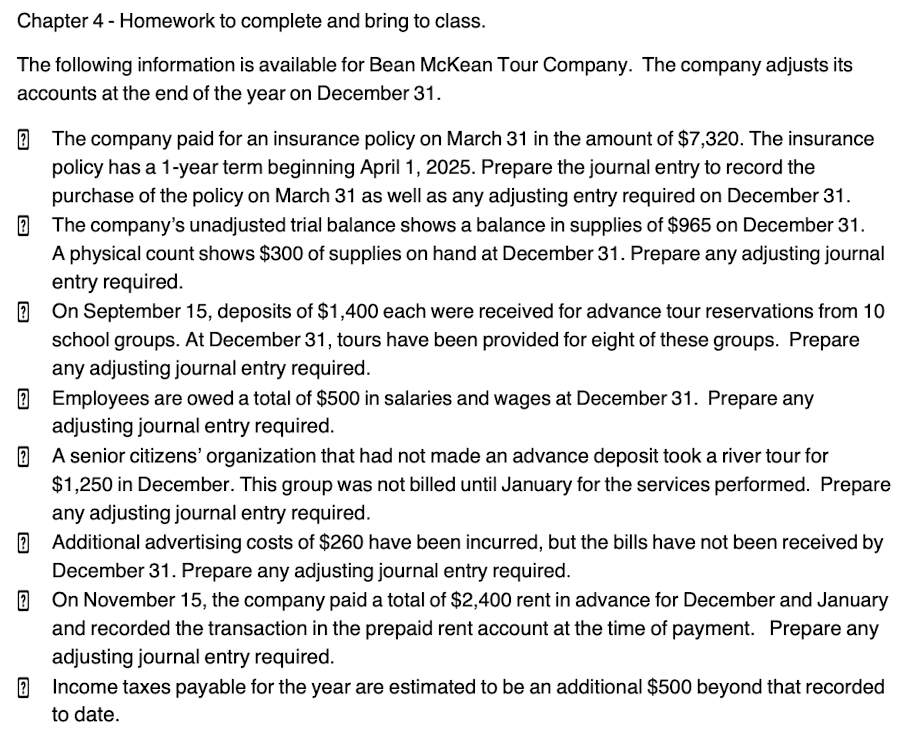

Chapter 4 - Homework to complete and bring to class. The following information is available for Bean McKean Tour Company. The company adjusts its accounts at the end of the year on December 31 . ?] The company paid for an insurance policy on March 31 in the amount of $7,320. The insurance policy has a 1-year term beginning April 1, 2025. Prepare the journal entry to record the purchase of the policy on March 31 as well as any adjusting entry required on December 31. [? The company's unadjusted trial balance shows a balance in supplies of $965 on December 31. A physical count shows $300 of supplies on hand at December 31. Prepare any adjusting journal entry required. ? On September 15, deposits of $1,400 each were received for advance tour reservations from 10 school groups. At December 31, tours have been provided for eight of these groups. Prepare any adjusting journal entry required. ?] Employees are owed a total of $500 in salaries and wages at December 31. Prepare any adjusting journal entry required. [? A senior citizens' organization that had not made an advance deposit took a river tour for $1,250 in December. This group was not billed until January for the services performed. Prepare any adjusting journal entry required. ? Additional advertising costs of $260 have been incurred, but the bills have not been received by December 31. Prepare any adjusting journal entry required. (3) On November 15 , the company paid a total of $2,400 rent in advance for December and January and recorded the transaction in the prepaid rent account at the time of payment. Prepare any adjusting journal entry required. ? Income taxes payable for the year are estimated to be an additional $500 beyond that recorded to date. Chapter 4 - Homework to complete and bring to class. The following information is available for Bean McKean Tour Company. The company adjusts its accounts at the end of the year on December 31 . ?] The company paid for an insurance policy on March 31 in the amount of $7,320. The insurance policy has a 1-year term beginning April 1, 2025. Prepare the journal entry to record the purchase of the policy on March 31 as well as any adjusting entry required on December 31. [? The company's unadjusted trial balance shows a balance in supplies of $965 on December 31. A physical count shows $300 of supplies on hand at December 31. Prepare any adjusting journal entry required. ? On September 15, deposits of $1,400 each were received for advance tour reservations from 10 school groups. At December 31, tours have been provided for eight of these groups. Prepare any adjusting journal entry required. ?] Employees are owed a total of $500 in salaries and wages at December 31. Prepare any adjusting journal entry required. [? A senior citizens' organization that had not made an advance deposit took a river tour for $1,250 in December. This group was not billed until January for the services performed. Prepare any adjusting journal entry required. ? Additional advertising costs of $260 have been incurred, but the bills have not been received by December 31. Prepare any adjusting journal entry required. (3) On November 15 , the company paid a total of $2,400 rent in advance for December and January and recorded the transaction in the prepaid rent account at the time of payment. Prepare any adjusting journal entry required. ? Income taxes payable for the year are estimated to be an additional $500 beyond that recorded to date

Chapter 4 - Homework to complete and bring to class. The following information is available for Bean McKean Tour Company. The company adjusts its accounts at the end of the year on December 31 . ?] The company paid for an insurance policy on March 31 in the amount of $7,320. The insurance policy has a 1-year term beginning April 1, 2025. Prepare the journal entry to record the purchase of the policy on March 31 as well as any adjusting entry required on December 31. [? The company's unadjusted trial balance shows a balance in supplies of $965 on December 31. A physical count shows $300 of supplies on hand at December 31. Prepare any adjusting journal entry required. ? On September 15, deposits of $1,400 each were received for advance tour reservations from 10 school groups. At December 31, tours have been provided for eight of these groups. Prepare any adjusting journal entry required. ?] Employees are owed a total of $500 in salaries and wages at December 31. Prepare any adjusting journal entry required. [? A senior citizens' organization that had not made an advance deposit took a river tour for $1,250 in December. This group was not billed until January for the services performed. Prepare any adjusting journal entry required. ? Additional advertising costs of $260 have been incurred, but the bills have not been received by December 31. Prepare any adjusting journal entry required. (3) On November 15 , the company paid a total of $2,400 rent in advance for December and January and recorded the transaction in the prepaid rent account at the time of payment. Prepare any adjusting journal entry required. ? Income taxes payable for the year are estimated to be an additional $500 beyond that recorded to date. Chapter 4 - Homework to complete and bring to class. The following information is available for Bean McKean Tour Company. The company adjusts its accounts at the end of the year on December 31 . ?] The company paid for an insurance policy on March 31 in the amount of $7,320. The insurance policy has a 1-year term beginning April 1, 2025. Prepare the journal entry to record the purchase of the policy on March 31 as well as any adjusting entry required on December 31. [? The company's unadjusted trial balance shows a balance in supplies of $965 on December 31. A physical count shows $300 of supplies on hand at December 31. Prepare any adjusting journal entry required. ? On September 15, deposits of $1,400 each were received for advance tour reservations from 10 school groups. At December 31, tours have been provided for eight of these groups. Prepare any adjusting journal entry required. ?] Employees are owed a total of $500 in salaries and wages at December 31. Prepare any adjusting journal entry required. [? A senior citizens' organization that had not made an advance deposit took a river tour for $1,250 in December. This group was not billed until January for the services performed. Prepare any adjusting journal entry required. ? Additional advertising costs of $260 have been incurred, but the bills have not been received by December 31. Prepare any adjusting journal entry required. (3) On November 15 , the company paid a total of $2,400 rent in advance for December and January and recorded the transaction in the prepaid rent account at the time of payment. Prepare any adjusting journal entry required. ? Income taxes payable for the year are estimated to be an additional $500 beyond that recorded to date Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started