Question

CHAPTER 4 MINI-CASE: SALLY AND DAVES CONDOFINANCING WITH A MORTGAGE* This version: April 2011 Overview This mini-case takes us back to b-school grads Sally and

CHAPTER 4 MINI-CASE: SALLY AND DAVES CONDOFINANCING WITH A MORTGAGE* This version: April 2011

Overview

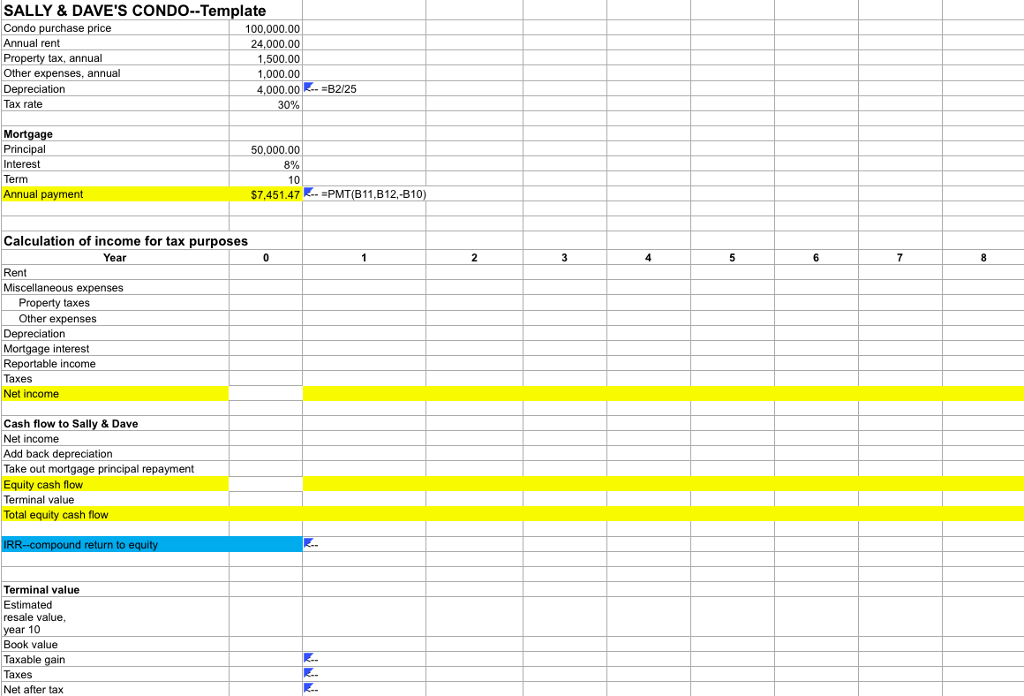

This mini-case takes us back to b-school grads Sally and Dave. Youll perhaps recall from PFE Chapter 4 that theyre thinking of buying a condo which will cost $100,000. In Chapter 4, Sally and Dave were planning to finance the condo purchase without borrowing. In this case we consider the case where they take out a mortgage to finance the investment.

The point of this case is to get you to think about the effect of financing on returns. It should also lead to a discussion of the relation between financing and risk.

Case facts

Here are the facts:

? Sally and Dave intend to take a 10-year mortgage for $50,000. The mortgage has interest rate of 8%, compounded annually. Repayment of the mortgage is in equal annual payments of interest and principal.

? Sally and Dave can rent out the condo for $2,000 per month. Theyll have to pay property taxes of $1,500 annually and theyre figuring on additional miscellaneous expenses of $1,000 per year.

? All the income from the condo has to be reported on their annual tax return. Currently Sally & Dave have a tax rate of 30%, and they think this rate will continue for the foreseeable future.

? The full cost of the condo can be depreciated over 25 years on a straight-line basis.

? To calculate the return from owning the condo, Sally and Dave assume that they will sell the condo at the end of 10 years for $100,000. Any gain over book value on the sale is, of course, taxable.

Assignment

1. Use the template for this case to calculate Sally and Daves IRR on their equity investment. (Terminology: Since the cost of the condo is $100,000 and since theyre borrowing $50,000, the equity investment is $50,000.) Remember that for income tax purposes depreciation and interest on the mortgage are expenses, but that repayment of mortgage principal is not an expense. Use Excels IPMT and PPMT functions (see explanation below).

2. Show (in a data table) the effect on the equity IRR when the mortgage goes from $0, $10,000, $20,000, ... , $90,000 . Explain your results.

3. Show (in a data table) the effect on the equity IRR when the tax rate varies from 0% to 40% (in steps of 5%).

4. Suppose that Sally and Dave take a $50,000 mortgage with a 25-year term. They still plan to sell the apartment at the end of year 10. At this date they will repay the remaining mortgage principal with a 2% penalty for early repayment. Calculate the equity IRR.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started