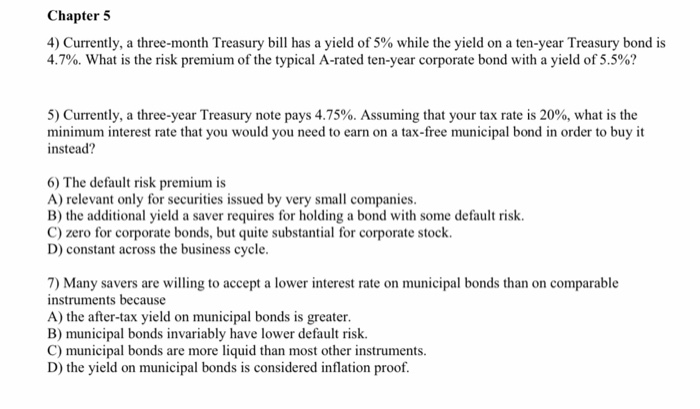

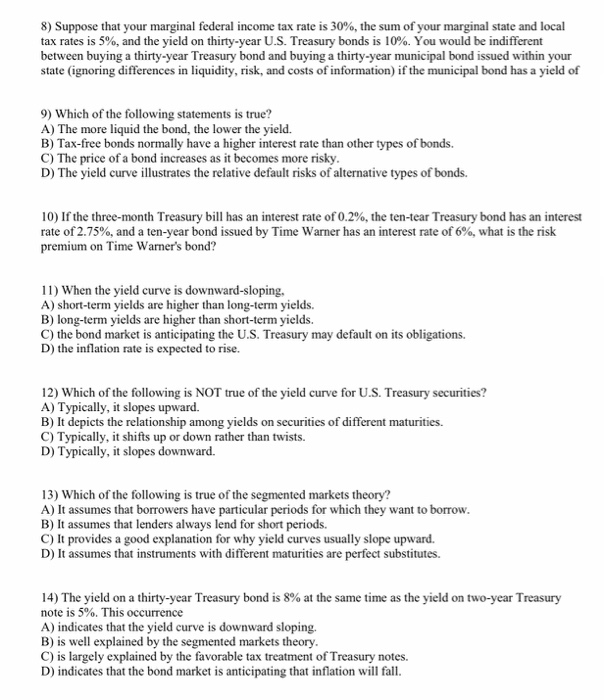

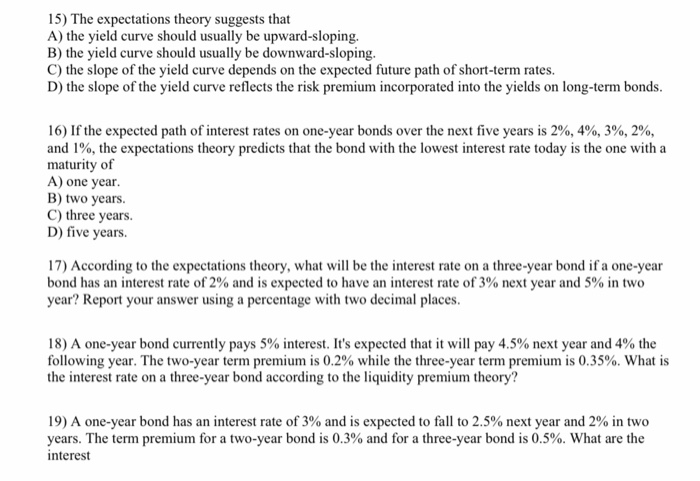

Chapter 5 4) Currently, a three-month Treasury bill has a yield of 5% while the yield on a ten-year Treasury bond is 4.7%. What is the risk premium of the typical A-rated ten-year corporate bond with a yield of 5.5%? 5) Currently, a three-year Treasury note pays 4.75%. Assuming that your tax rate is 20%, what is the minimum interest rate that you would you need to earn on a tax-free municipal bond in order to buy it instead? 6) The default risk premium is A) relevant only for securities issued by very small companies. B) the additional yield a saver requires for holding a bond with some default risk. C) zero for corporate bonds, but quite substantial for corporate stock, D) constant across the business cycle. 7) Many savers are willing to accept a lower interest rate on municipal bonds than on comparable instruments because A) the after-tax yield on municipal bonds is greater B) municipal bonds invariably have lower default risk. C) municipal bonds are more liquid than most other instruments. D) the yield on municipal bonds is considered inflation proof. 8) Suppose that your marginal federal income tax rate is 30%, the sum of your marginal state and local tax rates is 5%, and the yield on thirty-year U.S. Treasury bonds is 10%. You would be indifferent between buying a thirty-year Treasury bond and buying a thirty-year municipal bond issued within your state (ignoring differences in liquidity, risk, and costs of information) if the municipal bond has a yield of 9) Which of the following statements is true? A) The more liquid the bond, the lower the yield. B) Tax-free bonds normally have a higher interest rate than other types of bonds. C) The price of a bond increases as it becomes more risky. D) The yield curve illustrates the relative default risks of alternative types of bonds. 10) If the three-month Treasury bill has an interest rate of 0.2%, the ten-tear Treasury bond has an interest rate of 2.75%, and a ten-year bond issued by Time Warner has an interest rate of 6%, what is the risk premium on Time Warner's bond? 11) When the yield curve is downward-sloping, A) short-term yields are higher than long-term yields. B) long-term yields are higher than short-term yields. C) the bond market is anticipating the U.S. Treasury may default on its obligations D) the inflation rate is expected to rise. 12) Which of the following is NOT true of the yield curve for U.S. Treasury securities? A) Typically, it slopes upward. B) It depicts the relationship among yields on securities of different maturities C) Typically, it shifts up or down rather than twists. D) Typically, it slopes downward. 13) Which of the following is true of the segmented markets theory? A) It assumes that borrowers have particular periods for which they want to borrow. B) It assumes that lenders always lend for short periods. C) It provides a good explanation for why yield curves usually slope upward. D) It assumes that instruments with different maturities are perfect substitutes. 14) The yield on a thirty-year Treasury bond is 8% at the same time as the yield on two-year Treasury note is 5%. This occurrence A) indicates that the yield curve is downward sloping, B) is well explained by the segmented markets theory. C) is largely explained by the favorable tax treatment of Treasury notes D) indicates that the bond market is anticipating that inflation will fall. 15) The expectations theory suggests that A) the yield curve should usually be upward-sloping. B) the yield curve should usually be downward-sloping. C) the slope of the yield curve depends on the expected future path of short-term rates. D) the slope of the yield curve reflects the risk premium incorporated into the yields on long-term bonds. 16) If the expected path of interest rates on one-year bonds over the next five years is 2%, 4%, 3%, 2%, and 1%, the expectations theory predicts that the bond with the lowest interest rate today is the one with a maturity of A) one year. B) two years. C) three years. D) five years. 17) According to the expectations theory, what will be the interest rate on a three-year bond if a one-year bond has an interest rate of 2% and is expected to have an interest rate of 3% next year and 5% in two year? Report your answer using a percentage with two decimal places. 18) A one-year bond currently pays 5% interest. It's expected that it will pay 4.5% next year and 4% the following year. The two-year term premium is 0.2% while the three-year term premium is 0.35%. What is the interest rate on a three-year bond according to the liquidity premium theory? 19) A one-year bond has an interest rate of 3% and is expected to fall to 2.5% next year and 2% in two years. The term premium for a two-year bond is 0.3% and for a three-year bond is 0.5%. What are the interest