Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 5, Bucket 1 Problem 12 You are considering making an investment which requires you to pay $1,996 today. In return you expect to

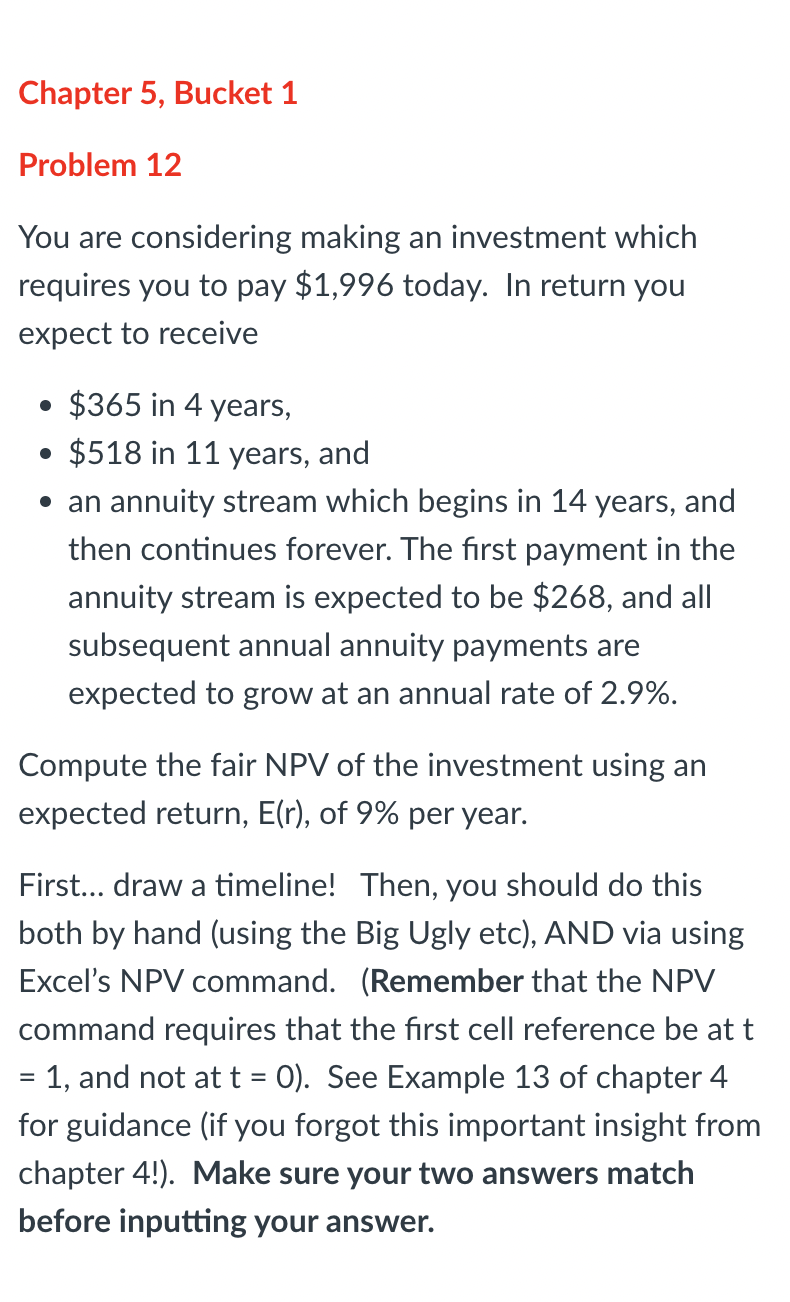

Chapter 5, Bucket 1 Problem 12 You are considering making an investment which requires you to pay $1,996 today. In return you expect to receive $365 in 4 years, $518 in 11 years, and an annuity stream which begins in 14 years, and then continues forever. The first payment in the annuity stream is expected to be $268, and all subsequent annual annuity payments are expected to grow at an annual rate of 2.9%. Compute the fair NPV of the investment using an expected return, E(r), of 9% per year. First... draw a timeline! Then, you should do this both by hand (using the Big Ugly etc), AND via using Excel's NPV command. (Remember that the NPV command requires that the first cell reference be at t = 1, and not at t = 0). See Example 13 of chapter 4 for guidance (if you forgot this important insight from chapter 4!). Make sure your two answers match before inputting your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started