Chapter 5

FORECASTING FINANCIAL STATEMENTS

Homework Assignment: THE CORTINO CORPORATION

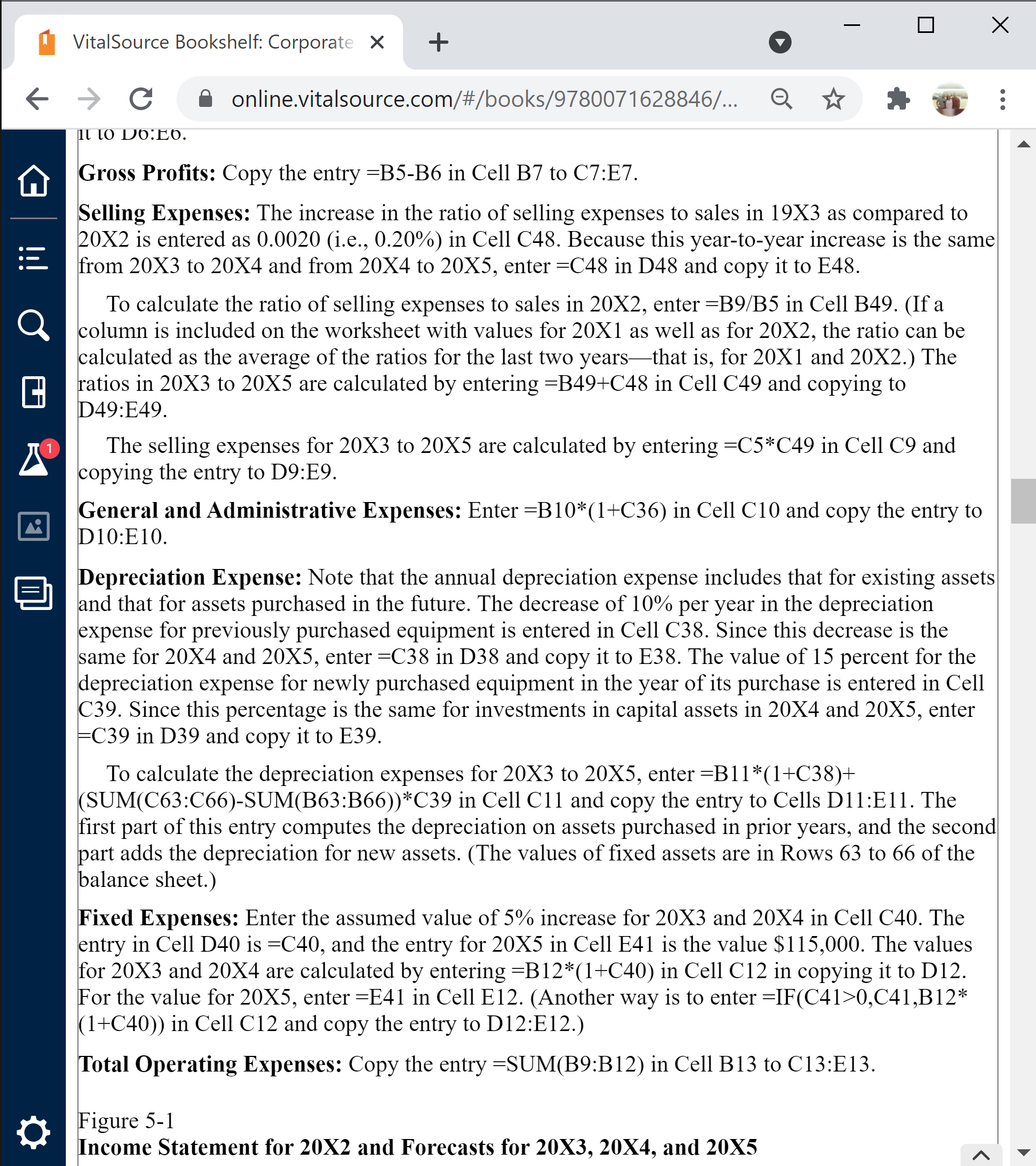

Forecast the income statement and balance sheet for 20X2 based on the following data for 20X1 and expectations or assumptions for 20X2. Your answer should be formatted similarly to Figures 5-1 and 5-2 on pages 174 and 176 of the Financial Analysis textbook.

Income Statement

Annual sales for 20X1 were $4,500,000.The marketing organization has reviewed its annual sales for the last five years and made a statistical projection of annual sales for 20X2.Following this, the firm's planning staff reviewed the growth of worldwide competition and markets, as well as changes in other socioeconomic conditions, and analyzed how they might affect the statistical projections of past trends.As a result of their analyses, they concluded that the firm's annual sales revenues will increase 15% in 20X2 over its value for 20X1.Cortino has no other sources of income.

The cost of goods sold in 20X1 was $2,812,500.Discussions between the marketing and manufacturing organizations indicate that although production costs are expected to drop, selling prices will also drop in parallel.As a result, the cost of goods sold in 20X2 will remain at the same percentage of sales as in 20X1.

Selling expenses were $265,000 in 20X1.The marketing organization expects that because of increasing competition, selling expenses, as a percentage of sales, will increase 0.30% next year.This means, for example, if the selling expenses were 5.00% of sales in 20X1, the selling expenses would be 5.30% of sales in 20X2.

General and Administrative (G&A) expenses were $250,000 in 20X1.Discussions between the CFO's office and the managers of the various divisions indicate that in order to improve the company's financial well being, general and administrative expenses will be held to an increase of only 10% in 20X2 over the value in 20X1.

Fixed expenses were $325,000 in 20X1.They are expected to increase 10% in 20X2 over the value for 20X1.

Depreciation expenses were $80,000 in 20X1.They are expected to increase 8% in 20X2 over the value for 20X1.

Interest paid on short-term notes was $8,500 in 20X1, and interest on long-term debt was $22,000 in 20X1.Both of these are expected to increase 5% in 20X2 from their values in 20X1.

The tax rate will remain at 40%.Cortino has not deferred paying taxes in the past, nor does it plan to do so in the future.

There will be no change in the dividends paid to holders of preferred stock, which were $100,000 in 20X1. Dividends paid to holders of common stock amounted to $300,000 in 20X1 and are planned to increase by 10% in 20X2 over the value in 20X1.

Balance Sheet

Cash and equivalents at the end of 20X1 amounted to $1,100,000 and are expected to increase in 20X2 by the same percentage rate as sales.

Accounts receivable was $885,600 at the end of 20X1, and accounts payable was $410,000 at the end of 20X1.Both of these are expected to keep pace with sales.That is, the percentage increases in accounts receivable and accounts payable in 20X2 will be the same as the percentage increase in sales in 20X2.

Inventory was $750,000 at the end of 20X1.Because of improvements in logistics management, the value of inventory at the end of 20X2 will be reduced by 5% from its value at the end of 20X1.

The value of other current assets was $10,000 at the end of 20X1 and is expected to increase by 20% by the end of 20X2.

The company's investment in plant and equipment was $1,428,000 at the end of 20X1.The company expects to invest $100,000 in plant and equipment in 20X2.The accumulated depreciation for the company's plant and equipment at the end of 20X1 was $750,000.

Short-term notes payable was $135,000 at the end of 20X1.It's expected to increase in 20X2 at the same percentage rate as sales.

Other current liabilities amounted to $35,000 at the end of 20X1 and are expected to increase by 20% by the end of 20X2.

The company's long-term debt was $378,600 at the end of 20X1 and is expected to increase to $458,000 by the end of 20X2.

The equity of holders of preferred stock will remain constant at $250,000.The par value of Cortino's common stock is $1/share, and the number of outstanding shares will remain at 1 million.Paid-in capital in excess of par on common stock was $1,150,000 at the end of 20X1 and will remain at that value in 20X2.

Accumulated retained earnings amounted to $65,000 at the end of 20X1.

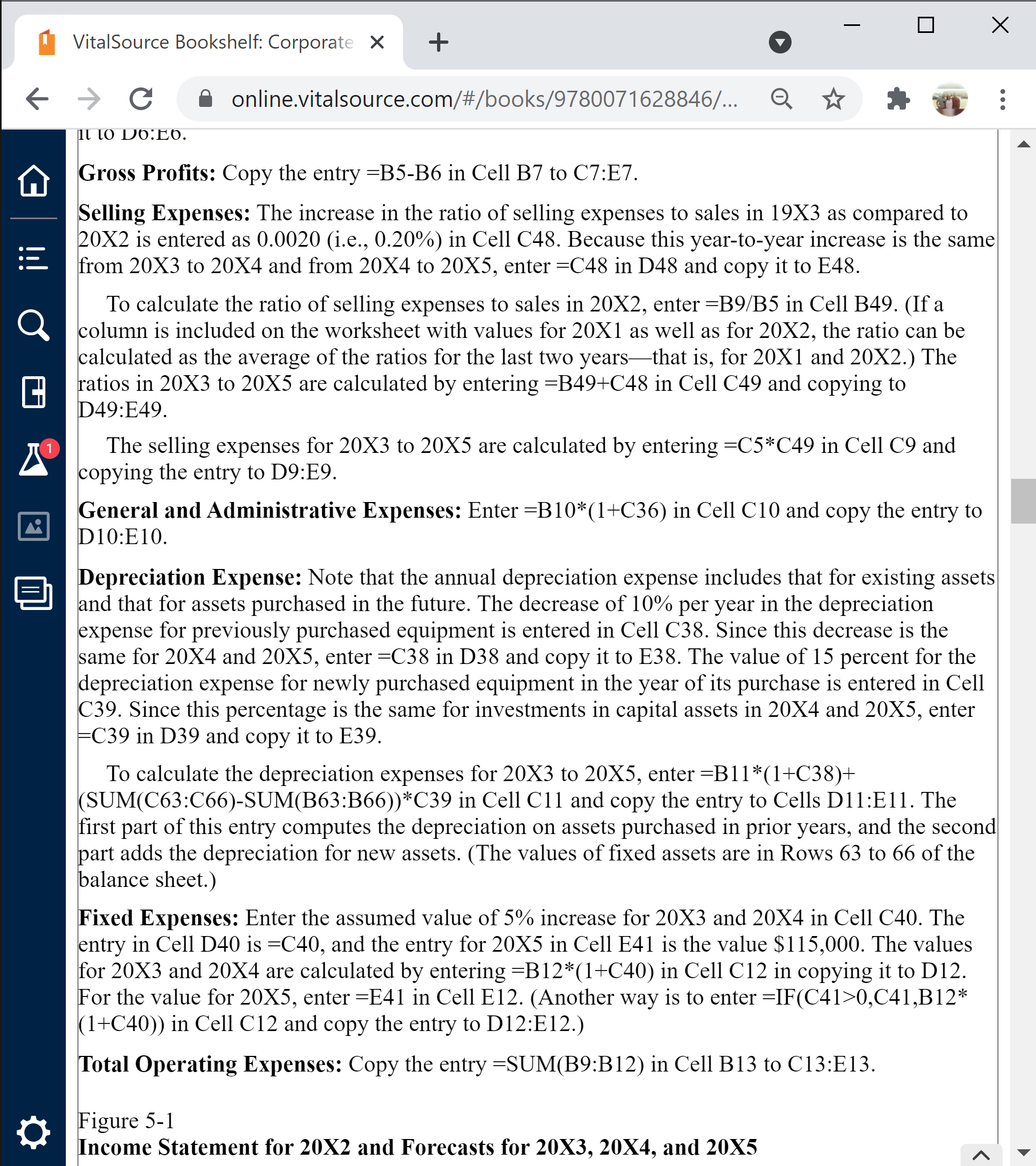

Figures 5-1 ( follow figure 5-1) (course hero couldn't allow my send more pictures )

u Homev X I E Center X I E Discus: X I G Popula X I Q Speed X I Q Public X I G Hypoti X n VitalSr X W Typel X I WordC X I + o X 6 ) C i on|ine.vitaIsource.com/#/books/9780071628846/cfi/6/24l/4/118/2/2/2/2/4@0:0 Q *' t i Example 5.1: ABC's income statement and balance sheet for the years 20Xl and 20x2 are given in C_hapter 1. Using the nancial statements for 20X2 as a starting point and the assumptions given below, forecast ABC's income statement and balance sheet for the next three yearsfrom 20x3 to 20X5. Assumptions for the Income Statement The marketing organization has reviewed its annual sales for the last ve years and made a statistical projection of their trend to the next year. Following this, the firm's planning staff reviewed the growth of worldwide competition and markets, as well as changes in other socioeconomic conditions, and analyzed how they might affect the statistical projections of past trends. As a result of their analyses, they concluded that the nn's annual sales revenues will increase 11.5 percent each year from its value of $2,575,000 for the year just completed. Discussions between the marketing and manufacturing organizations indicate that, although production costs are expected to drop, selling prices will also drop in parallel. As a result, the cost of goods sold will remain at the same percentage of sales as in 20X2. The marketing organization expects that because of increasing competition, selling expenses, as a percentage of sales, will increase 0.20 percent each year for the next three, This means, for example, that if the selling expenses were 15.00 percent of sales the rst year, the selling expenses would be 15.20 percent of sales the second year, 15.40 percent of sales the third year, and so forth. Discussions between the CFO's ofce and the managers of the various divisions indicate that in order to improve the company's nancial well-being, general and administrative expenses will be held to an increase of only 8 percent each year from the value $225,000 in 20x2. The annual depreciation on the rm's existing capital assets is expected to decline 10 percent each year. The annual depreciation on new capital assets is expected to average 15 percent in the year of their purchase and then decline 10 percent each year thereafter. The annual xed expenses, which are currently $75,000, are expected to increase 5 percent for the next two years. They will jump to $115,000 for the third year, when the company's current building lease expires and a new one will be negotiated for a larger building. Income from other sources will increase at one-half the rate of increase for sales. Interest paid on short-term and long-term borrowing will increase 6 percent each year from their current values of $10,000 and $50,000, The tax rate will remain at 40 percent, and the ratio of current taxes to deferred taxes will remain the same for the next three years, There will be no change in the dividends paid to holders of preferred stock. The number of outstanding shares of common stock will remain at 100,000, and the dividends paid to holders of common stock will increase 10 percent each year for the next three. Assumptions for the Balance Sheet Cash and equivalents will increase 3 percent per yeariapproximately at the rate of ination. Accounts receivable and accounts payable are expected to keep pace with sales. That is, the year-toyear percentage increases in accounts receivable and accounts payable will be the same as the corresponding year-to-year percentage increases in sales. The value of inventories will increase at the same percentage rate as sales. The value of other current assets will increase 5 percent per year. In order to handle the increased customer demand and sales for the next three years, the company will need to invest in additional capital assets, such as buildings ----- 4- - r - - '- -- - - - -'- - - es, End vehicles, The company expects that its total investment in new xed assets each year will equal 5 percent of its net xed assets (i,e., assets at purchase price less r We've updated our read aloud feature! Give It a try here eceding year and that its mix of assets (i.e., the ratio of the cost of each type of asset to the total cost) will remain constant, (Accumulated depreciation will increas statement.) VitalSource Bookshelf: Corporate X + o 6 9 C i onIine.vitaIsource.com/#/boo|

0,C41,B12* (1+C40)) in Cell C12 and copy the entry to D12:E12.) Total Operating Expenses: Copy the entry =SUM(B9:B 12) in Cell B13 to C132E13. Figure 51 Income Statement for 20X2 and Forecasts for 20X3, 20X4, and 20X5 A 0 X VitalSource Bookshelf: Corporate X + -> C a online.vitalsource.com/#/books/9780071628846/... . . Figure 5-1 A Income Statement for 20X2 and Forecasts for 20X3, 20X4, and 20X5 B C D E ABC COMPANY Income Statement for Year Ended December 31, 20X2 and Forecast for Next 3 Years Values in $ thousand, except EPS Q 20X2 20X3 20X4 20X5 Total Operating Revenues (or Total Sales Revenues) $2.575.0 $2.871.1 $3,201.3 $3.569.5 6 Less: Cost of Goods Sold (COGS $1 150.0 $1,282.3 $1,429.7 $1.594.1 7 Gross Profits $1.425.0 $1.588.9 $1,771.6 $1.975.3 8 Less: Operating Expenses 1 9 Selling Expenses $275.0 $312.4 $354.7 $402.6 10 General and Administrative Expenses (G&A) $225.0 $243.0 $262.4 $283.4 Depreciation Expense $100.0 $1 18.9 $136.4 $152.6 Fixed Expenses $75.0 $78.8 $82.7 $115.0 13 Total Operating Expenses $675.0 $753.0 $836.2 $953.7 14 Net Operating Income $750.0 $835.9 $935.4 $1.021.6 15 |Other Income $20.0 $21.2 $22.4 $23.7 16 Earnings before Interest and Taxes (EBIT) $770.0 $857.0 $957.7 $1.045.3 Less: Interest Expense 18 Interest on Short-Term Notes $10.0 $10.6 $11.2 $11.9 19 Interest on Long-Term Borrowing $50.0 $53.0 $56.2 $59.6 20 Total Interest Expense $60.0 $63.6 $67.4 $71.5 21 Earnings before Taxes (EBT) $710.0 $793.4 $890.3 $973.8 22 Less: Taxes (rate = 40%) 23 Current $160.0 $178.8 $200.6 $219.5 24 Deferred $124.0 $138.6 $155.5 $170.1 25 Total taxes (rate = 40%) $284.0 $317.4 $356.1 $389.5 26 Earnings after Taxes (EAT) $426.0 $476.1 $534.2 $584.3 27 Less: Preferred Stock Dividends $95.0 $95.0 $95.0 $95.0 28 Net Earnings Available for Common Stockholders $331.0 $381.1 $439.2 $489.3 29 Earnings per Share (EPS), 100,000 shares outstanding S 3.31 $ 3.81 $ 4.39 S 4.89 30 Retained Earnings $220.0 $259.0 $304.9 $341.5 31 Dividends Paid to Holders of Common Stock $111.0 $122.1 $134.3 $147.7 32 Assumptions for 3-Year Projections on Income Statement 33 20X2 20X3 20X4 20X5 34 Projected Annual Growth from Year Before 35 Total Sales Revenues 11.50% 11.50% 11.50% 36 General and Administrative Expenses 8.00% 8.00% 8.00% Depreciation Expense0 X VitalSource Bookshelf: Corporate X + V online.vitalsource.com/#/books/9780071628846/... . . 13 Total Operating Expenses $675.0 $753.0 $836.2 $953.7 14 Net Operating Income $750.0 $835.9 $935.4 $1.021.6 15 Other Income $20.0 $21.2 $22.4 $23.7 16 Earnings before Interest and Taxes (EBIT) $770.0 $857.0 $957.7 $1.045.3 Less: Interest Expense Interest on Short-Term Notes $10.0 $10.6 $11.2 $11.9 19 Interest on Long-Term Borrowing $50.0 $53.0 $56.2 $59.6 20 Total Interest Expense $60.0 $63.6 $67.4 $71.5 Q 21 Earnings before Taxes (EBT) $710.0 $793.4 $890.3 $973.8 22 Less: Taxes (rate = 40%) 23 Current $160.0 $178.8 $200.6 $219.5 24 Deferred $124.0 $138.6 $155.5 $170.1 25 Total taxes (rate = 40%) $284.0 $317.4 $356.1 $389.5 1 26 Earnings after Taxes (EAT) $426.0 $476.1 $534.2 $584.3 27 Less: Preferred Stock Dividends $95.0 $95.0 $95.0 $95.0 28 Net Earnings Available for Common Stockholders $331.0 $381.1 $439.2 $489.3 29 Earnings per Share (EPS), 100,000 shares outstanding S 3.31 $ 3.81 $ 4.39 S 4.89 30 Retained Earnings $220.0 $259.0 $304.9 $341.5 31 Dividends Paid to Holders of Common Stock $111.0 $122.1 $134.3 $147.7 32 Assumptions for 3-Year Projections on Income Statement 33 20X2 20X3 20X4 20X5 34 Projected Annual Growth from Year Before Total Sales Revenues 11.50% 11.50% 11.50% General and Administrative Expenses 8.00% 8.00% 8.00% Depreciation Expense 38 Existing Capital Assets -10.00% -10.00% -10.00% 39 New Capital Assets in Year of Purchase 15.00% 15.00% 15.00% 40 Fixed Expenses 5.00% 5.00% 41 Fixed Expenses, value for 20X5 ($ thousand) $115.0 42 Other Income 5.75% 5.75% 5,75% Interest on Short-Term Notes 6.00% 6.00% 6.00% Interest on Long-Term Borrowing 6.00% 6.00% 6.00% 45 Dividends Paid to Holders of Common Stock 10.00% 10 00% 10.00% 46 Projected Ratios 47 COGS to Sales 44.66% 44.66% 44.66% 48 Annual Increase in Ratio of Selling Expenses to Sales 0.20% 0.20% 0.20% 49 Selling Expenses to Sales 10.68% 10.88% 11.08% 11.28% 50 Projected Tax Rate 40% 40% 40% 40% Net Operating Income: Copy the entry =B7-B13 in Cell B14 to C14:E14. Other Income: The percentage increase in Other Income is assumed to be one-half the percentage Sales Revenue. Therefore, e -C35/2 in Cell C42 and copy it to D42:E42. The6 9 C i onIine.vitaIsource.com/#/boo|