Answered step by step

Verified Expert Solution

Question

1 Approved Answer

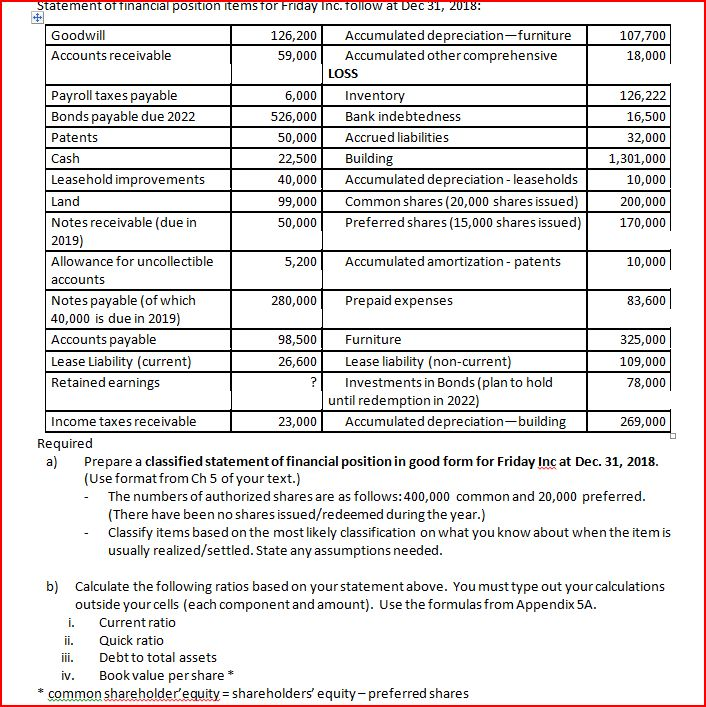

Chapter 5 format: Statement of financial position itemS for Friday Tnc. follow at Dec 31, 2018: Accumulated depreciation-furniture Accumulated other comprehensive Goodwill 126,200 107,700 Accounts

Chapter 5 format:

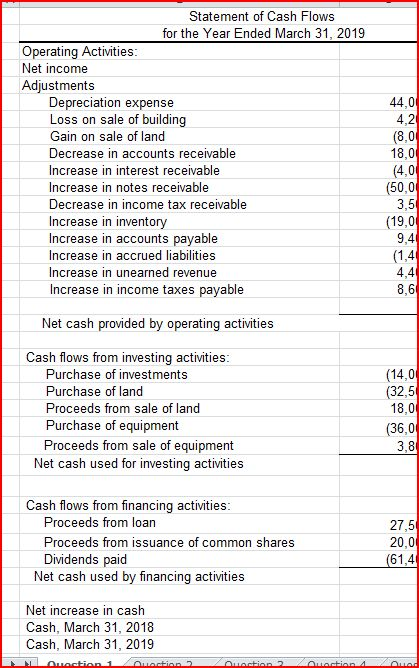

Statement of financial position itemS for Friday Tnc. follow at Dec 31, 2018: Accumulated depreciation-furniture Accumulated other comprehensive Goodwill 126,200 107,700 Accounts receivable 59,000 18,000 LOSS Payroll taxes payable 6,000 126,222 Inventory Bonds payable due 2022 Bank indebtedness 526,000 16,500 Accrued liabilities Patents 50,000 32,000 Cash Building 22,500 1,301,000 Leasehold improvements Accumulated depreciation- leaseholds 10,000 40,000 Land Common shares (20,000 shares issued) 200,000 99,000 Preferred shares (15,000 shares issued) Notes receivable (due in 2019) 50,000 170,000 Accumulated amortization - patents Allowance for uncollectible 5,200 10,000 accounts Notes payable (of which 40,000 is due in 2019) Prepaid expenses 280,000 83,600 Accounts payable 98,500 Furniture 325,000 Lease Liability (current) Lease liability (non-current) 26,600 109,000 Retained earnings ? Investments in Bonds (plan to hold until redemption in 2022) Accumulated depreciation-building 78,000 Income taxes receivable 23,000 269,000 Required a) Prepare a classified statement of financial position in good form for Friday Inc at Dec. 31, 2018. (Use format from Ch 5 of your text.) The numbers of authorized shares are as follows: 400,000 common and 20,000 preferred (There have been no shares issued/redeemed during the year.) Classify items based on the most likely classification on what you know about when the item is usually realized/settled.State any assumptions needed b) Calculate the following ratios based on your statement above. You must type out your calculations outside your cells (each component and amount). Use the formulas from Appendix 5A i. Current ratio Quick ratio Debt to total assets ii. iii. Book value per share iv common shareholder'equity - shareholders equity-preferred shares Statement of Cash Flows for the Year Ended March 31, 2019 Operating Activities Net income Adjustments Depreciation expense Loss on sale of building 44,0 4.2 (8,0 18,0 (4,0 (50,0 Gain on sale of land Decrease in accounts receivable Increase in interest receivable Increase in notes receivable Decrease in income tax receivable 3,5 (19,0 9,4 (1,4 4,4 Increase in inventory Increase in accounts payable Increase in accrued liabilities Increase in unearned revenue Increase in income taxes payable 8,6 Net cash provided by operating activities Cash flows from investing activities: Purchase of investments (14,0 (32,5 18,0 Purchase of land Proceeds from sale of land Purchase of equipment (36,0 Proceeds from sale of equipment Net cash used for investing activities 3,8 Cash flows from financing activities: Proceeds from loan 27,5 20,0 (61,4 Proceeds from issuance of common shares Dividends paid Net cash used by financing activities Net increase in cash Cash, March 31, 2018 Cash, March 31, 2019 Ouaction 1 Ouoction 2 Ouoction 4 Ouoc Ouoction co Statement of financial position itemS for Friday Tnc. follow at Dec 31, 2018: Accumulated depreciation-furniture Accumulated other comprehensive Goodwill 126,200 107,700 Accounts receivable 59,000 18,000 LOSS Payroll taxes payable 6,000 126,222 Inventory Bonds payable due 2022 Bank indebtedness 526,000 16,500 Accrued liabilities Patents 50,000 32,000 Cash Building 22,500 1,301,000 Leasehold improvements Accumulated depreciation- leaseholds 10,000 40,000 Land Common shares (20,000 shares issued) 200,000 99,000 Preferred shares (15,000 shares issued) Notes receivable (due in 2019) 50,000 170,000 Accumulated amortization - patents Allowance for uncollectible 5,200 10,000 accounts Notes payable (of which 40,000 is due in 2019) Prepaid expenses 280,000 83,600 Accounts payable 98,500 Furniture 325,000 Lease Liability (current) Lease liability (non-current) 26,600 109,000 Retained earnings ? Investments in Bonds (plan to hold until redemption in 2022) Accumulated depreciation-building 78,000 Income taxes receivable 23,000 269,000 Required a) Prepare a classified statement of financial position in good form for Friday Inc at Dec. 31, 2018. (Use format from Ch 5 of your text.) The numbers of authorized shares are as follows: 400,000 common and 20,000 preferred (There have been no shares issued/redeemed during the year.) Classify items based on the most likely classification on what you know about when the item is usually realized/settled.State any assumptions needed b) Calculate the following ratios based on your statement above. You must type out your calculations outside your cells (each component and amount). Use the formulas from Appendix 5A i. Current ratio Quick ratio Debt to total assets ii. iii. Book value per share iv common shareholder'equity - shareholders equity-preferred shares Statement of Cash Flows for the Year Ended March 31, 2019 Operating Activities Net income Adjustments Depreciation expense Loss on sale of building 44,0 4.2 (8,0 18,0 (4,0 (50,0 Gain on sale of land Decrease in accounts receivable Increase in interest receivable Increase in notes receivable Decrease in income tax receivable 3,5 (19,0 9,4 (1,4 4,4 Increase in inventory Increase in accounts payable Increase in accrued liabilities Increase in unearned revenue Increase in income taxes payable 8,6 Net cash provided by operating activities Cash flows from investing activities: Purchase of investments (14,0 (32,5 18,0 Purchase of land Proceeds from sale of land Purchase of equipment (36,0 Proceeds from sale of equipment Net cash used for investing activities 3,8 Cash flows from financing activities: Proceeds from loan 27,5 20,0 (61,4 Proceeds from issuance of common shares Dividends paid Net cash used by financing activities Net increase in cash Cash, March 31, 2018 Cash, March 31, 2019 Ouaction 1 Ouoction 2 Ouoction 4 Ouoc Ouoction co

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started