Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 5: The Time Value of Money. 1) First City Bank pays 9% simple interest on its savings account balances, whereas Second City Bank pays

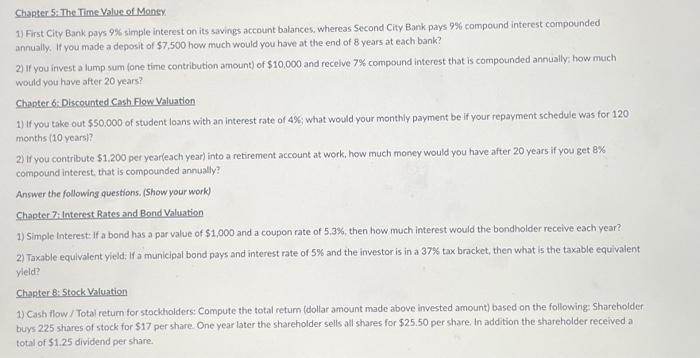

Chapter 5: The Time Value of Money. 1) First City Bank pays 9% simple interest on its savings account balances, whereas Second City Bank pays 9% compound interest compounded annually. If you made a deposit of $7,500 how much would you have at the end of 8 years at each bank? 2) If you invest a lump sum (one time contribution amount) of $10,000 and receive 7% compound interest that is compounded annually; how much would you have after 20 years? Chapter 6: Discounted Cash Flow Valuation 1) If you take out $50,000 of student loans with an interest rate of 4%; what would your monthly payment be if your repayment schedule was for 120 months (10 years)? 2) If you contribute $1,200 per year(each year) into a retirement account at work, how much money would you have after 20 years if you get 8% compound interest, that is compounded annually? Answer the following questions. (Show your work) Chapter 7: Interest Rates and Bond Valuation 1) Simple Interest: If a bond has a par value of $1,000 and a coupon rate of 5.3%, then how much interest would the bondholder receive each year? 2) Taxable equivalent yield: If a municipal bond pays and interest rate of 5% and the investor is in a 37% tax bracket, then what is the taxable equivalent yield? Chapter 8: Stock Valuation 1) Cash flow/Total return for stockholders: Compute the total return (dollar amount made above invested amount) based on the following: Shareholder buys 225 shares of stock for $17 per share. One year later the shareholder sells all shares for $25.50 per share. In addition the shareholder received a total of $1.25 dividend per share.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started