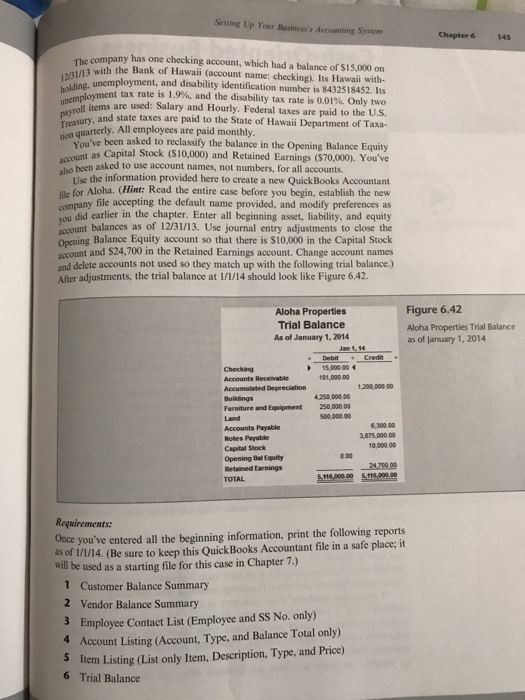

Chapter 6 Case3 ALOHA PROPERTIES Aloha Properties is located at 4-356 Kuhio Highway, Suite A-1, Kapaa Kauai, HI 96746. Its phone number is 808-823-8375, and the corporation specializes in Hawaii Vacation Rentals. Its federal tax ID number is 72-6914707, and it plans to start using QuickBooks Accountant as its accounting program on January 1 2014. It has been in business for two years using a manual accounti Aloha hopes that you can help it migrate to Quick Books Accountant. It is a property rental firm, files Form 1 120 each year, and collects a 4% general excise tax (Tax name: HI Sales Tax, Description: Sales Tax) on all rental income, which must be paid to the State of Hawaii Department of Taxation located at P.O. Box 1425, Honolulu, HI 96806-1425. It has chosen to use sales receipts for its cash sales and invoices and statements for its credit sales. The firm would like to use QuickBooks Accountant to keep track of bills it owes but will continue service to handwrite checks. It accepts credit and debit cards. Aloha plans to use QuickBooks Accountant's service invoice format but not use progress invoicing. It also plans to use QuickBooks Accountant's payroll features but to continue calculating payroll manually, because it currently has only two W-2 employees. The firm doesn't prepare estimates and does not track employee time or segments. It does, however, plan to enter bills as received and then enter payments later. Reports are to be accrual based, and Aloha plans to use the income and expense accounts created in Quick Books Accountant for a Chapter 6 Case3 ALOHA PROPERTIES Aloha Properties is located at 4-356 Kuhio Highway, Suite A-1, Kapaa Kauai, HI 96746. Its phone number is 808-823-8375, and the corporation specializes in Hawaii Vacation Rentals. Its federal tax ID number is 72-6914707, and it plans to start using QuickBooks Accountant as its accounting program on January 1 2014. It has been in business for two years using a manual accounti Aloha hopes that you can help it migrate to Quick Books Accountant. It is a property rental firm, files Form 1 120 each year, and collects a 4% general excise tax (Tax name: HI Sales Tax, Description: Sales Tax) on all rental income, which must be paid to the State of Hawaii Department of Taxation located at P.O. Box 1425, Honolulu, HI 96806-1425. It has chosen to use sales receipts for its cash sales and invoices and statements for its credit sales. The firm would like to use QuickBooks Accountant to keep track of bills it owes but will continue service to handwrite checks. It accepts credit and debit cards. Aloha plans to use QuickBooks Accountant's service invoice format but not use progress invoicing. It also plans to use QuickBooks Accountant's payroll features but to continue calculating payroll manually, because it currently has only two W-2 employees. The firm doesn't prepare estimates and does not track employee time or segments. It does, however, plan to enter bills as received and then enter payments later. Reports are to be accrual based, and Aloha plans to use the income and expense accounts created in Quick Books Accountant for a