Answered step by step

Verified Expert Solution

Question

1 Approved Answer

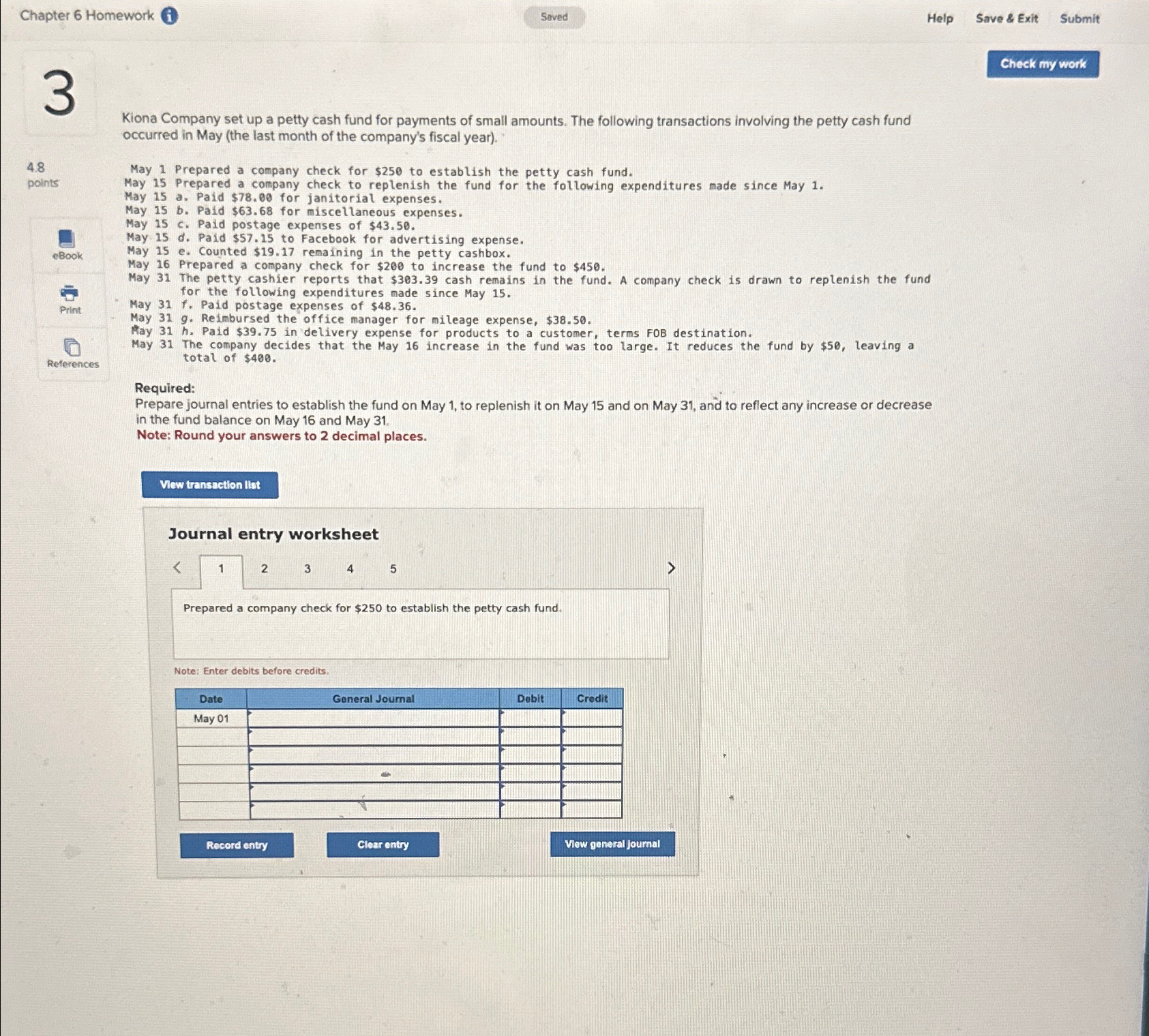

Chapter 6 Homework i Help Save & Exit Submit Kiona Company set up a petty cash fund for payments of small amounts. The following transactions

Chapter Homework

Help

Save & Exit

Submit

Kiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May the last month of the company's fiscal year

points

References

May Prepared a company check for $ to establish the petty cash fund.

May Prepared a company check to replenish the fund for the following expenditures made since May

May a Paid $ for janitorial expenses.

May b Paid $ for miscellaneous expenses.

May Paid postage expenses of $

May d Paid $ to Facebook for advertising expense.

May e Counted $ remaining in the petty cashbox.

May Prepared a company check for $ to increase the fund to $

May The petty cashier reports that $ cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May

May Paid postage expenses of $

May Reimbursed the office manager for mileage expense, $

Ray h Paid $ in delivery expense for products to a customer, terms FOB destination.

May The company decides that the May increase in the fund was too large. It reduces the fund by $ leaving a total of $

Required:

Prepare journal entries to establish the fund on May to replenish it on May and on May and to reflect any increase or decrease in the fund balance on May and May

Note: Round your answers to decimal places.

Journal entry worksheet

Prepared a company check for $ to establish the petty cash fund.

Note: Enter debits before credits.

tableDateGeneral Journal,Dobit,CreditMay T

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started