Answered step by step

Verified Expert Solution

Question

1 Approved Answer

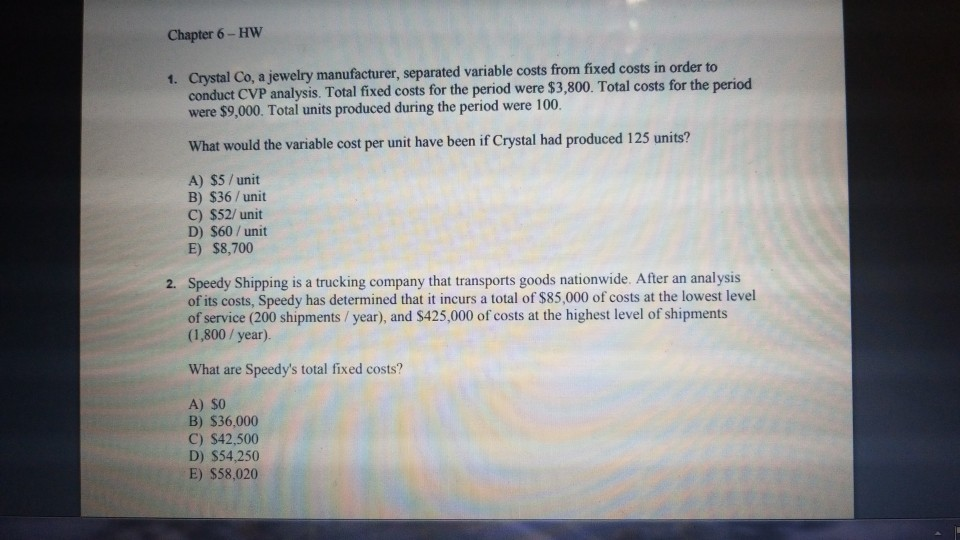

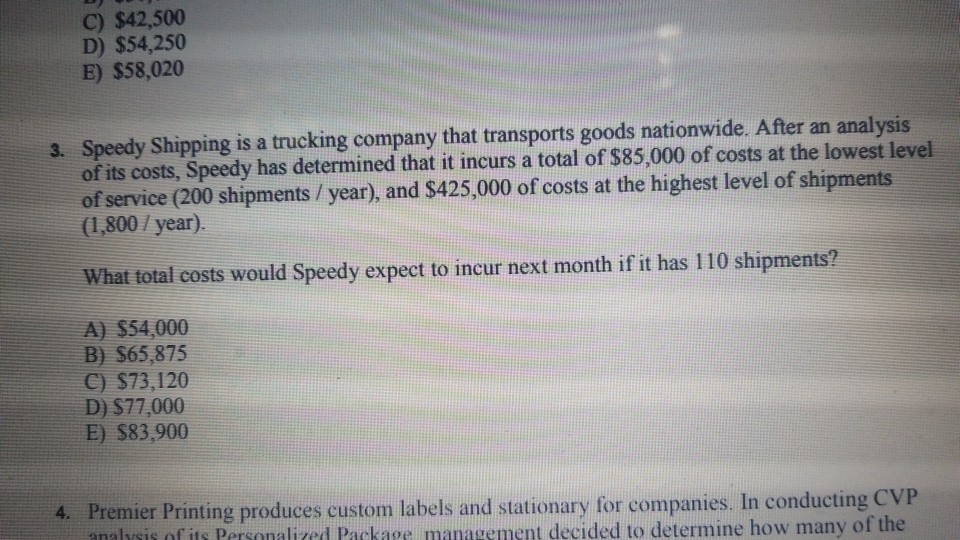

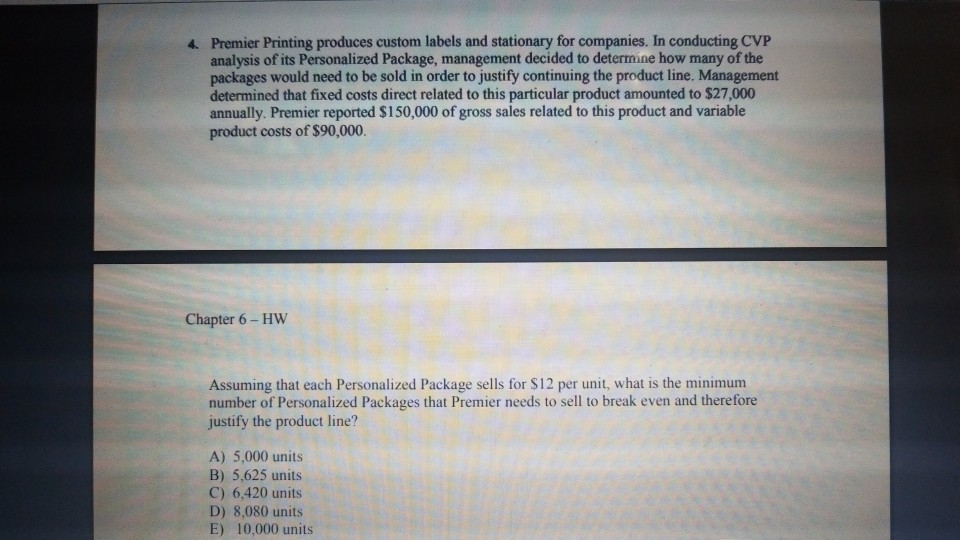

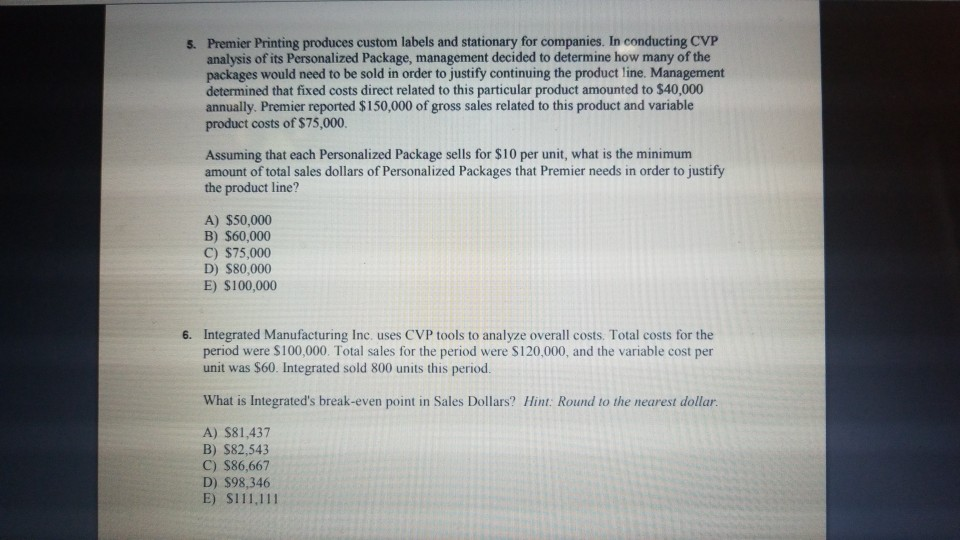

Chapter 6- HW 1. Crystal Co, a jewelry manufacturer, separated variable costs from fixed costs in order to conduct CVP analysis. Total fixed costs for

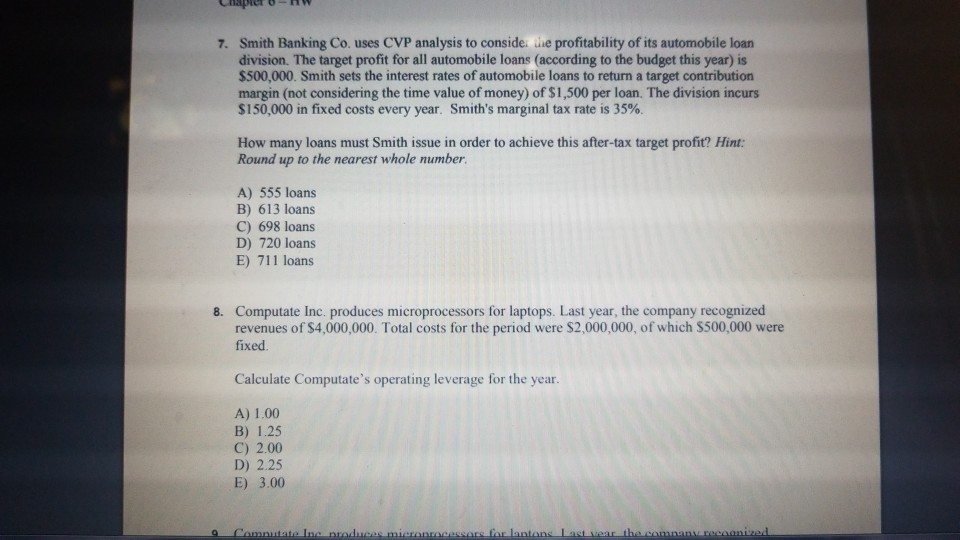

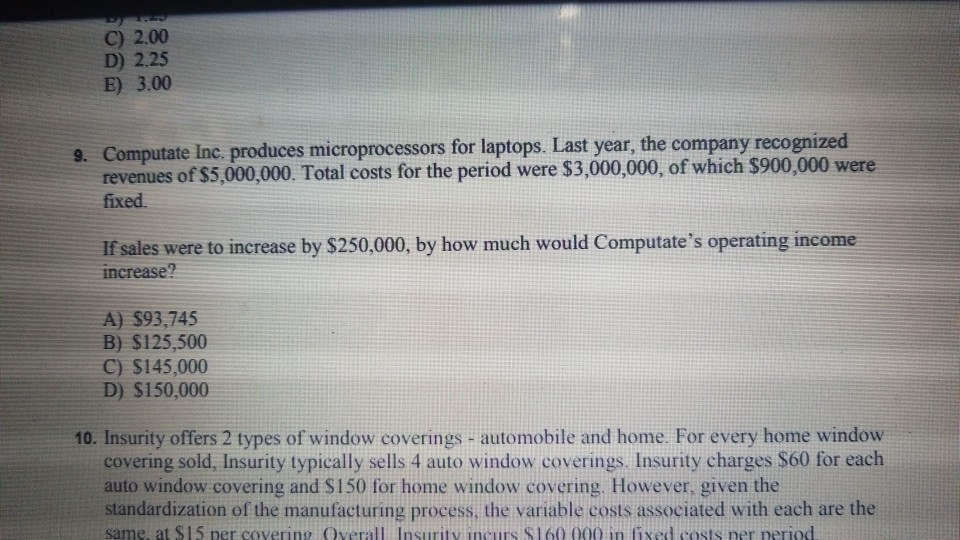

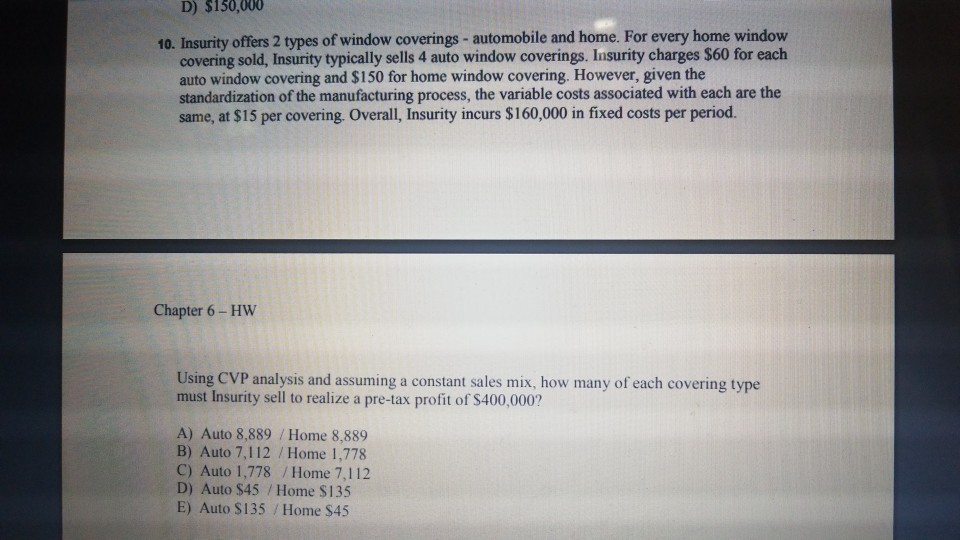

Chapter 6- HW 1. Crystal Co, a jewelry manufacturer, separated variable costs from fixed costs in order to conduct CVP analysis. Total fixed costs for the period were $3,800. Total costs for the period were $9,000. Total units produced during the period were 100. What would the variable cost per unit have been if Crystal had produced 125 units? A) S5/unit B) $36/unit C) $52/ unit D) $60/unit E) $8,700 2. Speedy Shipping is a trucking company that transports goods nationwide. After an analysis of its costs, Speedy has determined that it incurs a total of $85,000 of costs at the lowest level of service (200 shipments / year), and $425,000 of costs at the highest level of shipment:s (1,800/year). What are Speedy's total fixed costs? A) SO B) S36,000 C) S42,500 D) $54,250 E) $58,020 C) $42,500 D) $54,250 E) $58,020 Speedy Shipping is a trucking company that transports goods nationwide. After an analysis of its costs, Speedy has determined that it incurs a total of $85,000 of costs at the lowest level of service (200 shipments / year), and $425,000 of costs at the highest level of shipments (1,800/ year) 3. What total costs would Speedy expect to incur next month if it has 110 shipments? A) $54,000 B) $65,875 C) $73,120 D) $77,000 E) $83,900 4. Premier Printing produces custom labels and stationary for companies. In conducting CVP analysis of its Personalied Package management decided to determine how many of the Premier Printing produces custom labels and stationary for companies. In conducting CVP analysis of its Personalized Package, management decided to determine how many of the packages would need to be sold in order to justify continuing the product line. Management determined that fixed costs direct related to this particular product amounted to $27,000 annually. Premier reported $150,000 of gross sales related to this product and variable product costs of $90,000. 4. Chapter 6- Hw Assuming that each Personalized Package sells for $12 per unit, what is the minimum number of Personalized Packages that Premier needs to sell to break even and therefore justify the product line? A) 5,000 units B) 5,625 units C) 6,420 units D) 8,080 units E) 10,000 units s. Premier Printing produces custom labels and stationary for companies. In conducting CVP analysis of its Personalized Package, management decided to determine how many of the packages would need to be sold in order to justify continuing the product line. Management determined that fixed costs direct related to this particular product amounted to $40,000 annually. Premier reported $150,000 of gross sales related to this product and variable product costs of $75,000 Assuming that each Personalized Package sells for $10 per unit, what is the minimum amount of total sales dollars of Personalized Packages that Premier needs in order to justify the product line? A) $50,000 B) S60,000 C) $75,000 D) $80,000 E) $100,000 6. Integrated Manufacturing Inc uses CVP tools to analyze overall costs. Total costs for the period were S100,000. Total sales for the period were S120,000, and the variable cost per unit was $60. Integrated sold 800 units this period. What is Integrated's break-even point in Sales Dollars? Hint: Round to the nearest dollar A) $81,437 B) S82,543 C) $86,667 D) $98,346 E) S111.111 7. Smith Banking Co. uses CVP analysis to conside. he profitability of its automobile loan division. The target profit for all automobile loans (according to the budget this year) is $500,000. Smith sets the interest rates of automobile loans to return a target contribution margin (not considering the time value of money) of $1,500 per loan. The division incurs $150,000 in fixed costs every year. Smith's marginal tax rate is 35%. How many loans must Smith issue in order to achieve this after-tax target profit? Hint: Round up to the nearest whole number A) 555 loans B) 613 loans C) 698 loans D) 720 loans E) 711 loans Computate Inc. produces microprocessors for laptops. Last year, the company recognized revenues of $4,000,000. Total costs for the period were S2,000,000, of which S500,000 were fixed 8. Calculate Computate's operating leverage for the year. A) 1.00 B) 1.25 C) 2.00 D) 2.25 E) 3.00 C) 2.00 D) 2.25 E 3.00 Computate Inc. produces microprocessors for laptops. Last year, the company recognized revenues of $5,000,000. Total costs for the period were $3,000,000, of which $900,000 were fixed 9. If sales were to increase by $250,000, by how much would Computate's operating income increase? A) $93,745 B) $125,500 C) $145,000 D) $150,000 10. Insurity offers 2 types of window coverings - automobile and home. For every home window covering sold, Insurity typically sells 4 auto window coverings. Insurity charges $60 for each auto window covering and S150 for home window covering. However, given the standardization of the manufacturing process, the variable costs associated with each are the same, at $15 per coverin? Overall Insurity incurs $160 000 in fixed costs ner period D) $150,000 10. Insurity offers 2 types of window coverings- automobile and home. For every home window covering sold, Insurity typically sells 4 auto window coverings. Insurity charges $60 for each auto window covering and $150 for home window covering. However, given the standardization of the manufacturing process, the variable costs associated with each are the same, at $15 per covering. Overall, Insurity incurs $160,000 in fixed costs per period. Chapter 6- Hw Using CVP analysis and assuming a constant sales mix, how many of each covering type must Insurity sell to realize a pre-tax profit of $400,000? A) Auto 8,889 Home 8,889 B) Auto 7,112 Home 1,778 C) Auto 1,778 /Home 7,112 D) Auto $45 /Home S135 E) Auto $135 Home $45

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started