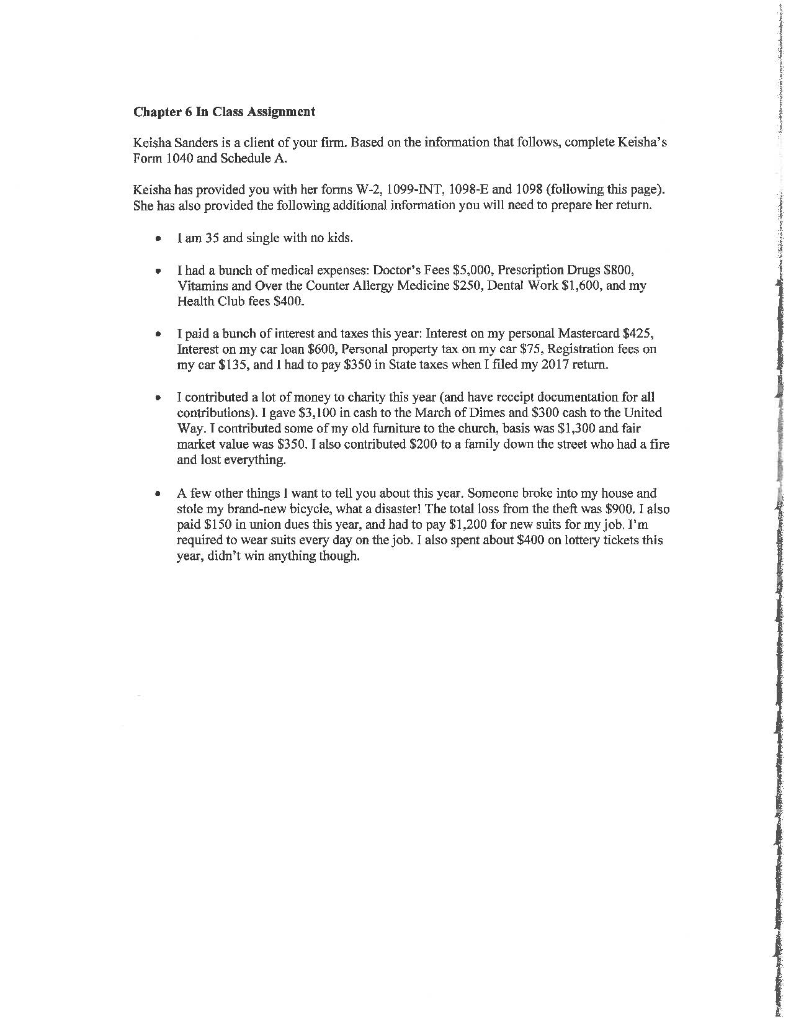

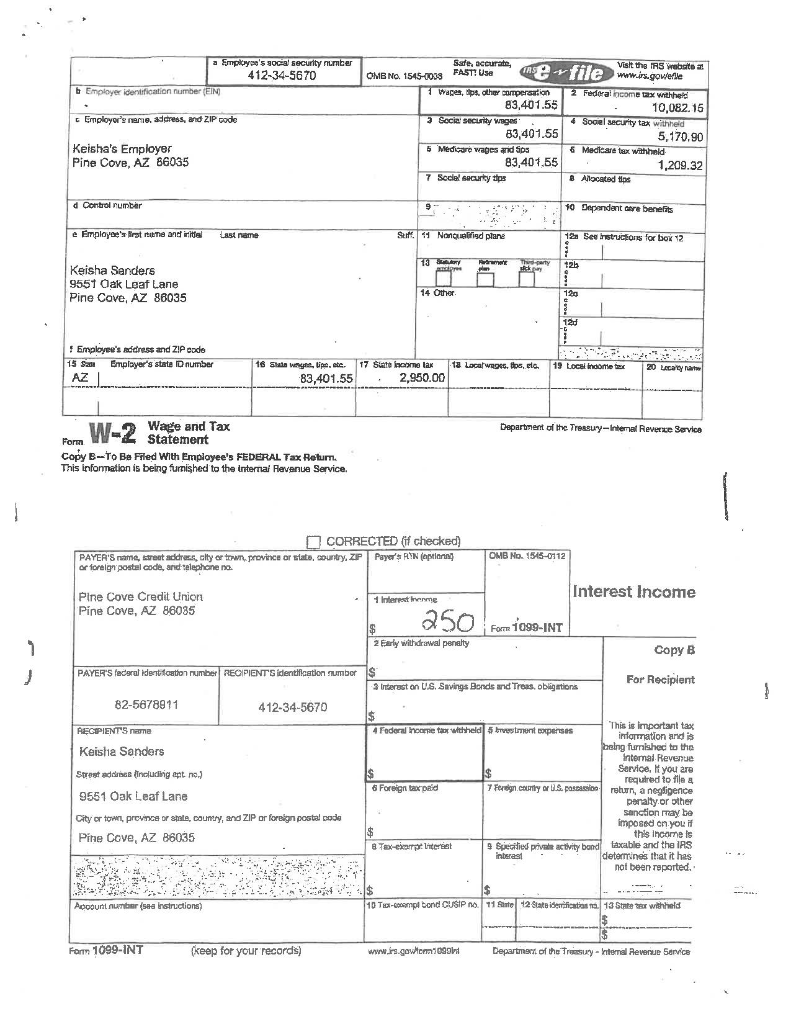

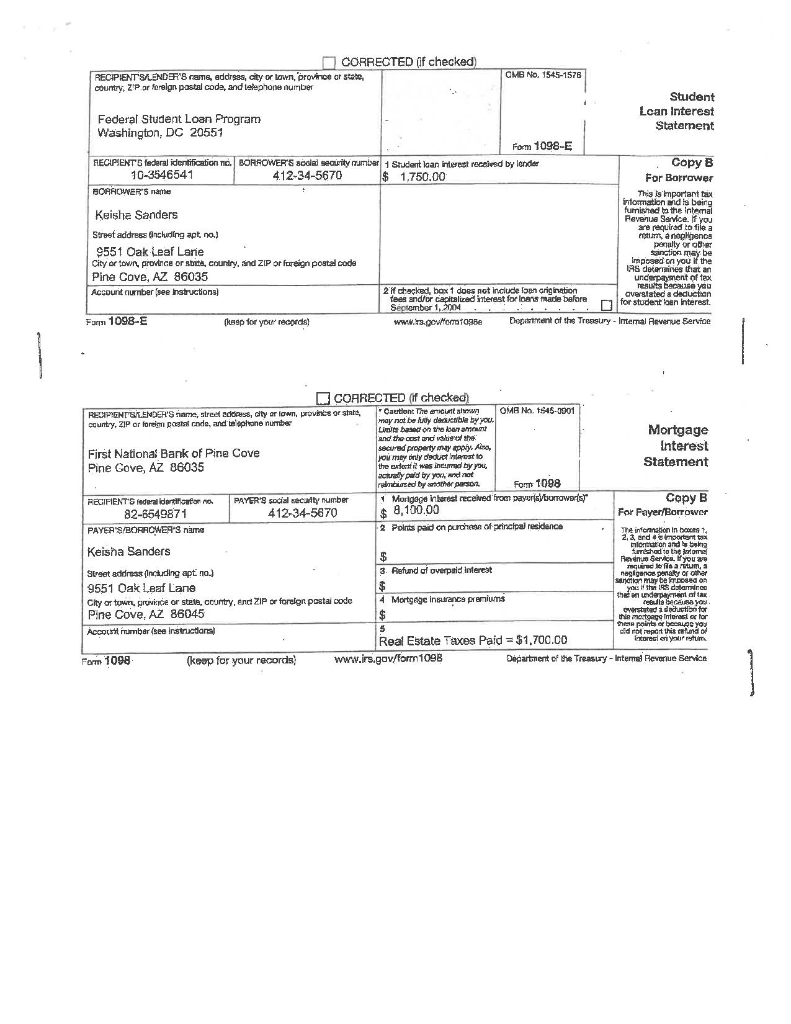

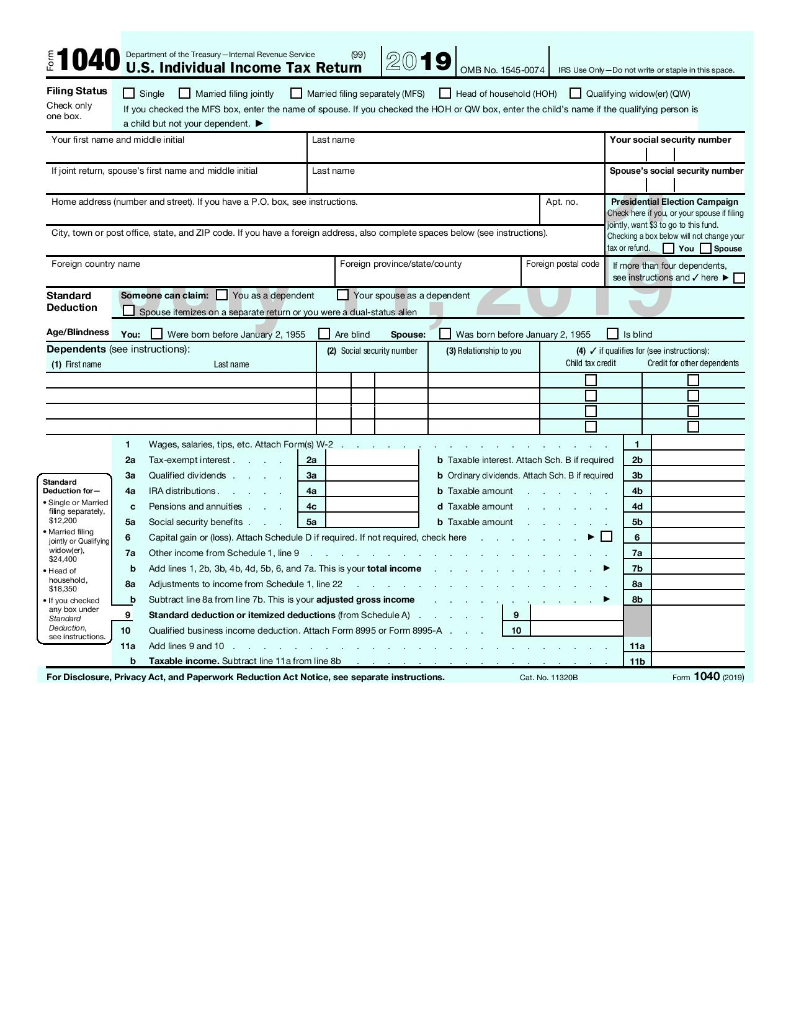

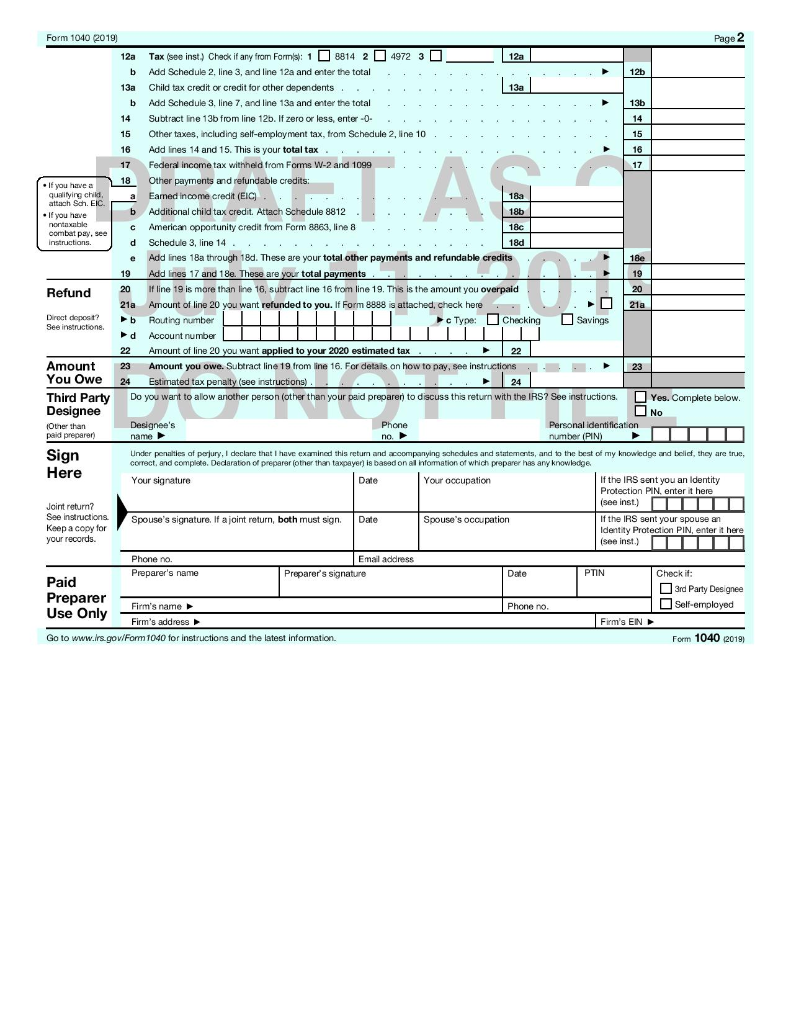

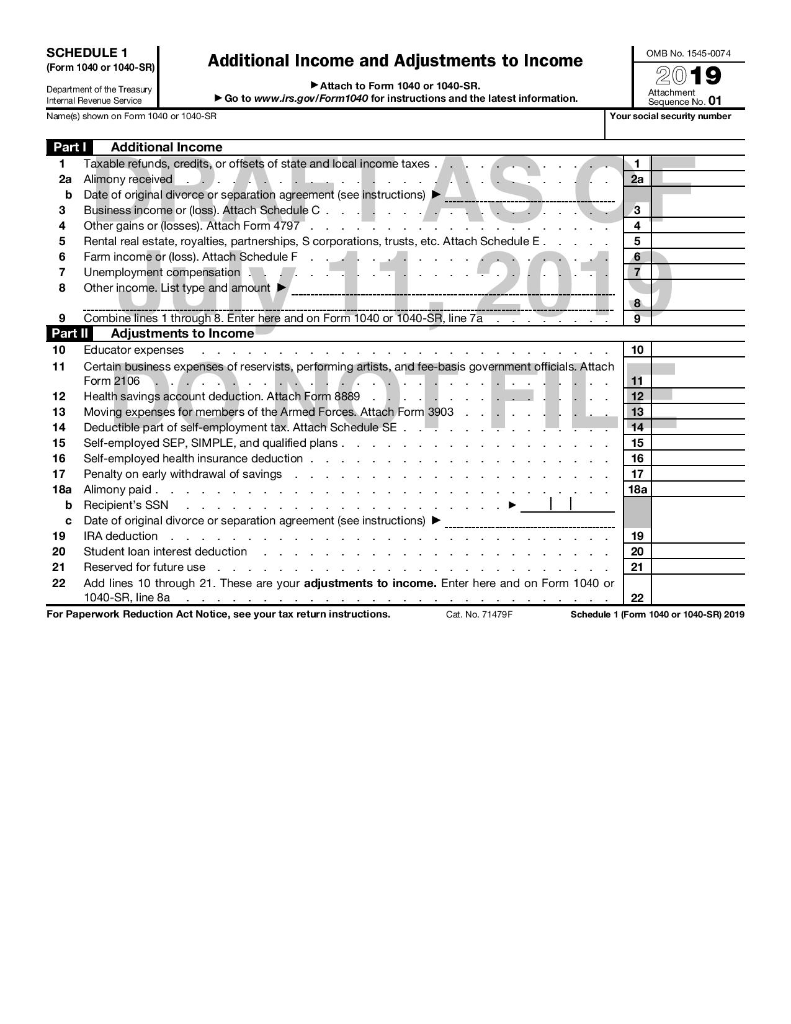

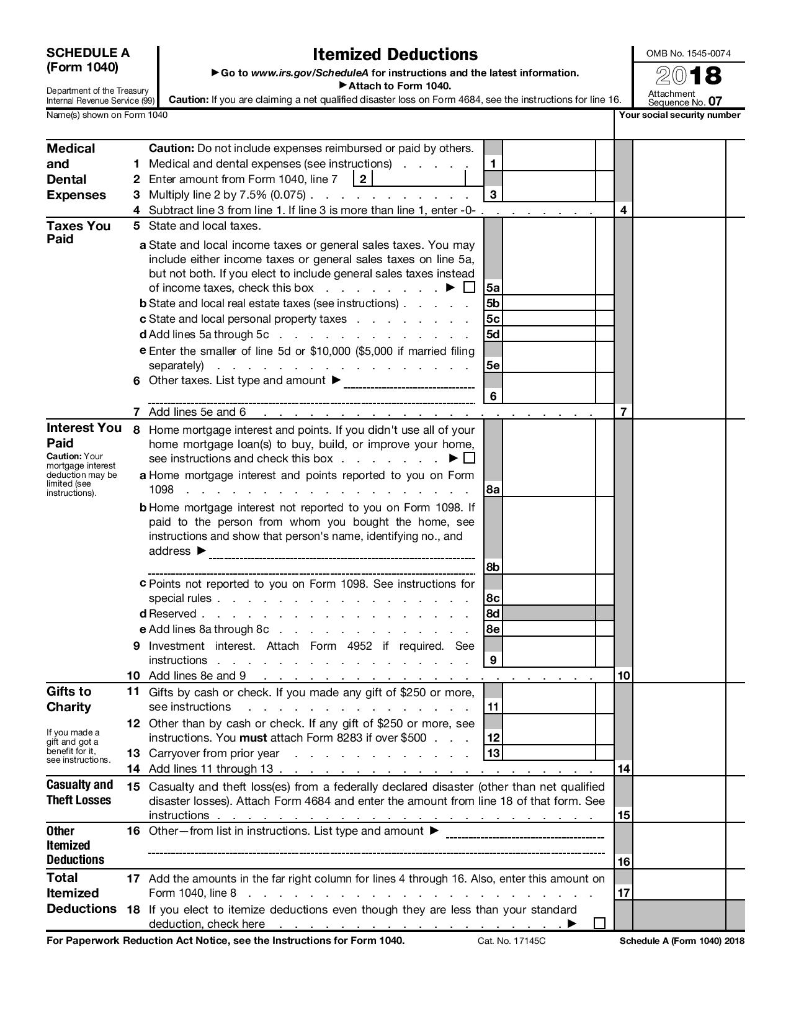

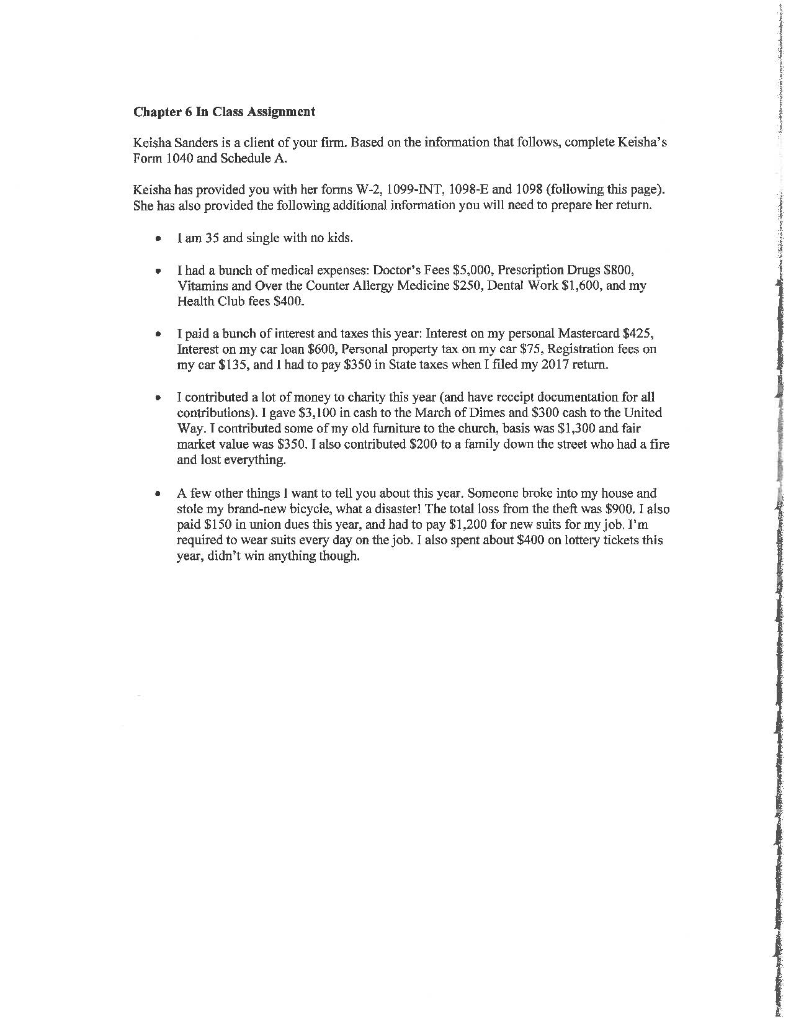

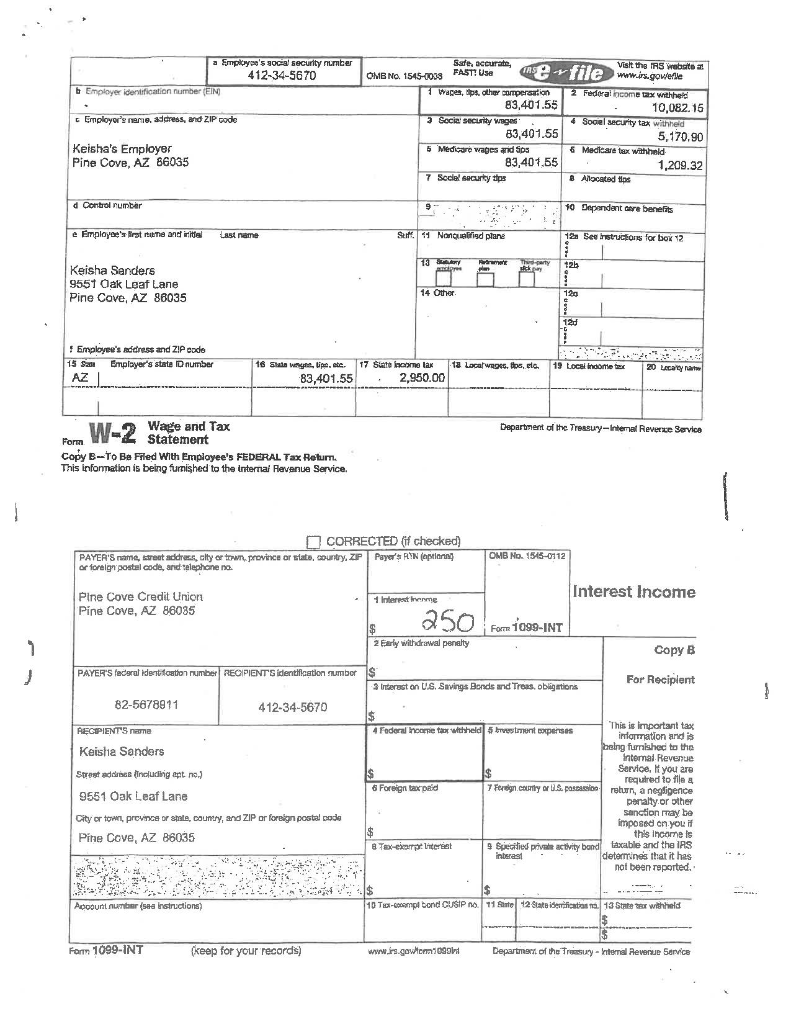

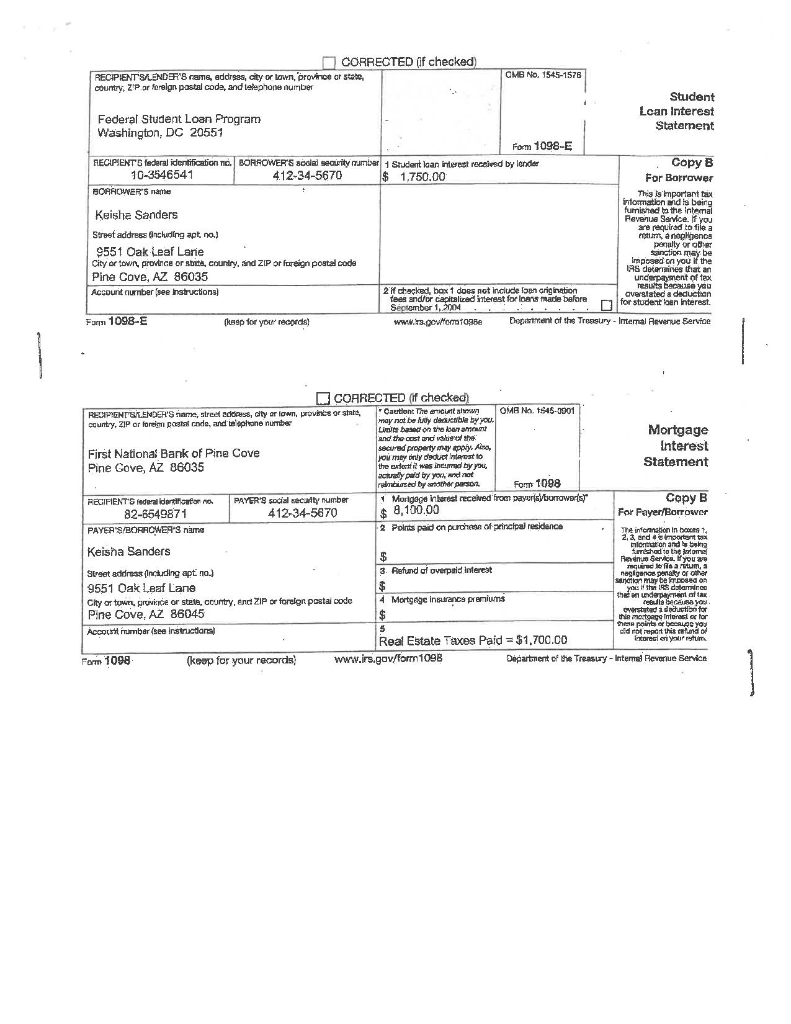

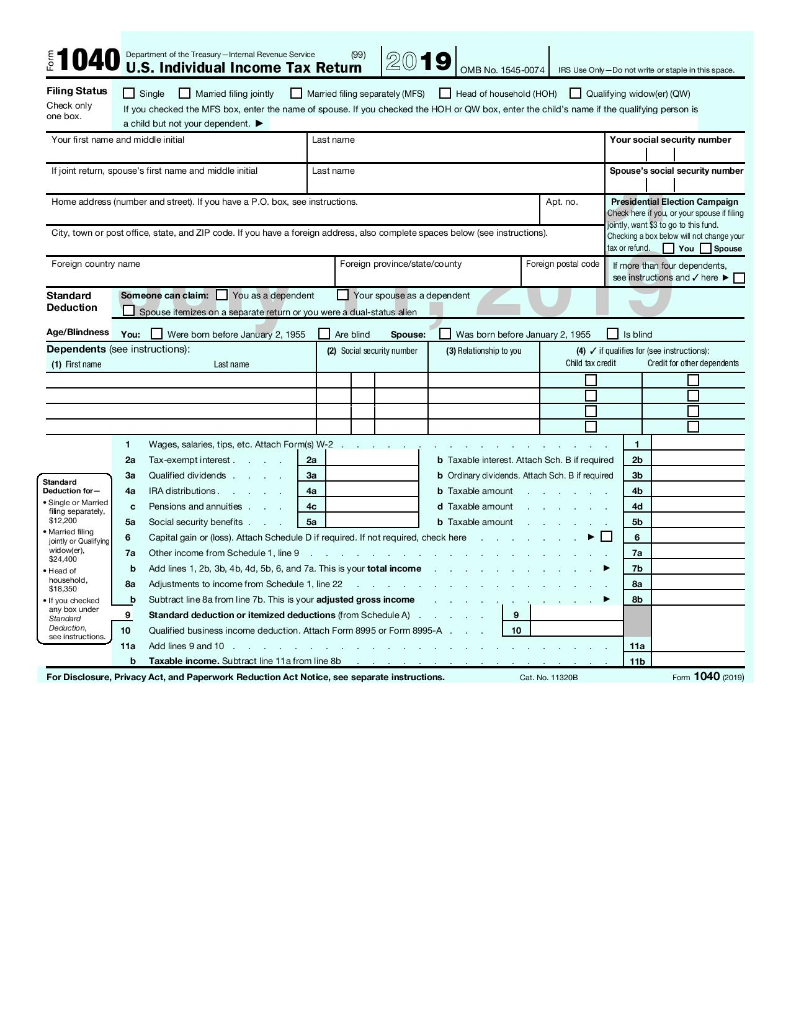

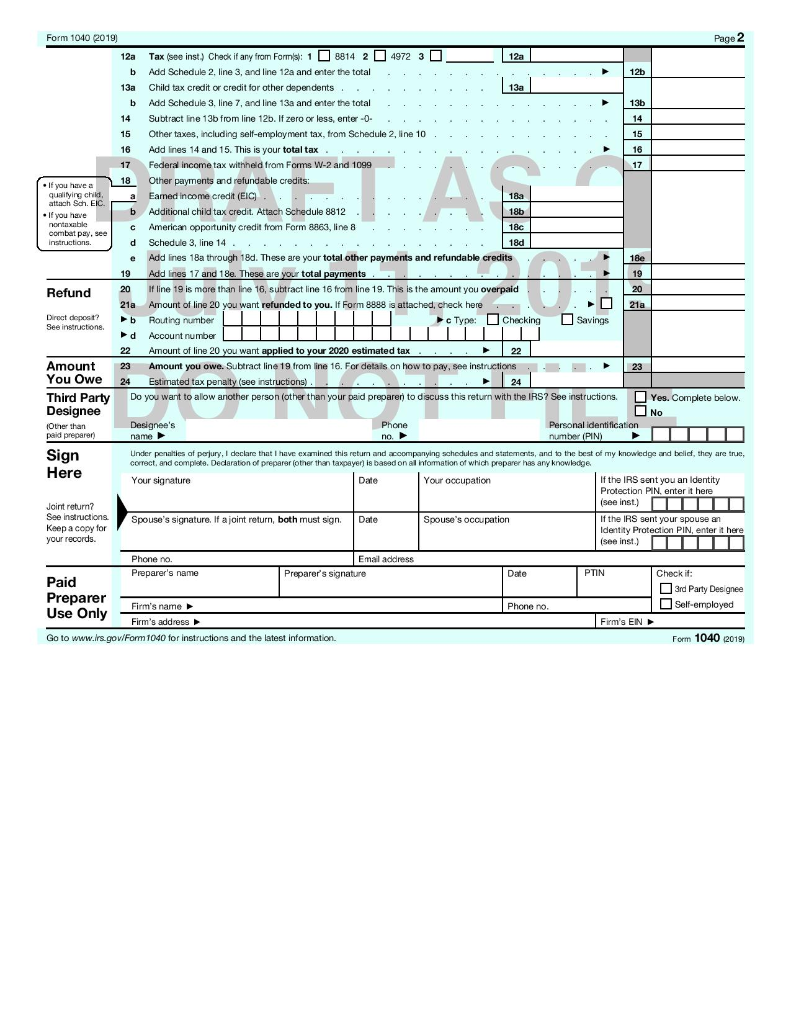

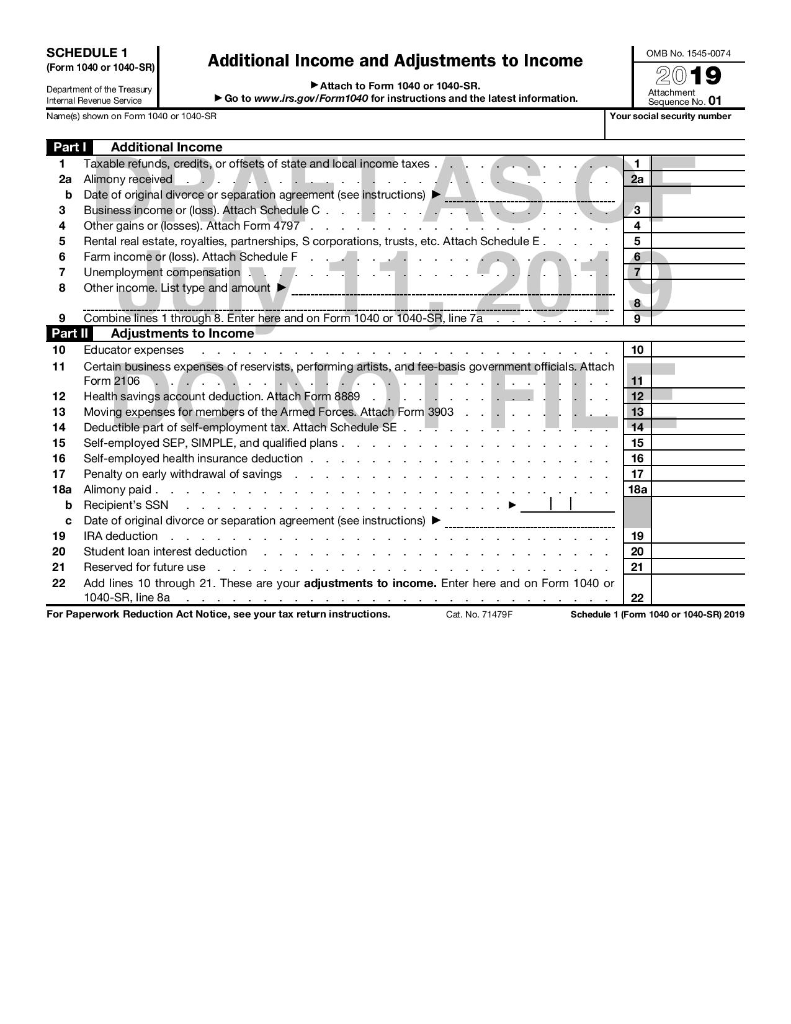

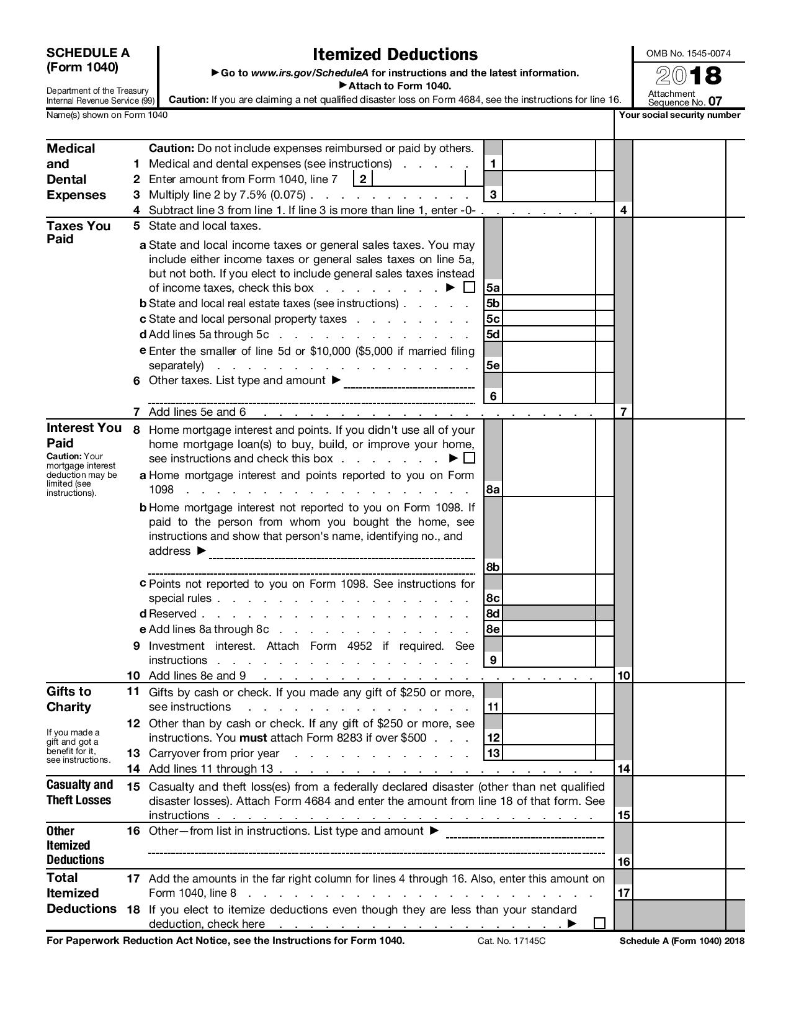

Chapter 6 In Class Assignment Keisha Sanders is a client of your firm. Based on the information that follows, complete Keisha's Form 1040 and Schedule A. Keisha has provided you with her forns W-2, 1099-INT, 1098-E and 1098 (following this page). She has also provided the following additional information you will need to prepare her return. . I am 35 and single with no kids. I had a bunch of medical expenses: Doctor's Fees $5,000. Prescription Drugs $800, Vitamins and Over the Counter Allergy Medicine $250, Dental Work $1,600, and my Health Club fees $400. I paid a bunch of interest and taxes this year: Interest on my personal Mastercard $425, Interest on my car loan $600, Personal property tax on my car $75. Registration fees on my car $135, and I had to pay $350 in State taxes when I filed my 2017 return I contributed a lot of money to charity this year (and have receipt documentation for all contributions). I gave $3,100 in cash to the March of Dimes and $300 cash to the United Way. I contributed some of my old furniture to the church, basis was $1,300 and fair market value was $350. I also contributed $200 to a farnily down the street who had a fire and lost everything. A few other things I want to tell you about this year. Someone broke into my house and stole my brand-new bicycle, what a disaster! The total loss from the theft was $900. I also paid $150 in union dues this year, and had to pay $1,200 for new suits for my job. I'm required to wear suits every day on the job. I also spent about $400 on lottery tickets this year, didn't win anything though. a Employee's Toca security Filmber 412-34-5670 t Employer identification number (EIN e Visit the IRS Wabato www.is.gowelle Employer's name, address, and ZIP code Sare accurate, OMB No 1545-1003 FAST! Use A v Waper, ps. other operation 83,401.55 Social SecSy wages 83,401.55 5 Medicare wages arid Sips 83,407,55 7 Social security to 2 Federal income tax withheld . 10,082.15 4 Sooel security tax withheld 5,170,90 & Medicare tax watthild 1,209.32 & Allocated tips Keisha's Employer Pine Cove, AZ 66035 d Control rumber 5 : 10 Dependant Gere benefits e Employee's Brote and intel last name Suite Nogueired plane 12 See store for bok 12 Keisha Senders 9551 Oak Leaf Lane Pine Cove, AZ 86035 14 Other Employee's address and ZIP code 15 Saal Employer's state number AZ ta Local was belo. 19 Local Indore ter 20 Locacy na 16 Slaw , Upate 83,401.55 17 Sunteiname lak 2 ,950.00 TALL, Wage and Tax Department of the Treasury-Intemal Reverice Service W-2 Statement Copy B-To Be Fried With Employee's FEDERAL Tax Retum. This information is being furnished to the internal Revenue Service O CORRECTED (f checked) PAYER' S t reet address, city or town, province or stato, country, Zip Puyer's RYN (option or foreign postal code, and telephone na OMB No. 1515-0112 Interest Income Pine Cove Credit Union Pine Cove, AZ 86035 - 1 Interest reme 250! 0 Form 1099-INT 2 Early withdrawal penalty Copy B PAYER'S federal identication number RECIPIENTS identification sumber $ For Recipient Interest on U.S. Savings Bonds and Treas, obligations 82-5678911 412-34-5670 $ RECIPIENT'S name Federal noore to withheld Keisha Sonders Street addice Including ent no 6 Foreign tax paid 9551 Oak Leaf Lane City or town, province or country, and ZIP or foreign postal code Pine Cove, AZ 86035 "This is important tax brivestimento perses inlaration and is being furnished to the Internal Revenue Service. If you are required to file 7 Fereign country or U.S. POSAO retur, a negligence penalty or other Sanction may be imposed on you if this income is 9 Suecidis private activity bondaxable and the IAS interest determines that it has not been reported. Tex-earp: terest 4 $ 10 T Account number (sea instructions) acomal bond CUSIP n. 71 Ste 12 Stateider fantasma 13 Statex withhold Form 1099-INT (keep for your recordis) www.rs.gowlermo nt Department of the Trosu - temal Revenue Service CORRECTED (f checked) RECIPIENTS/LEND'Srame, address, city or own, province of state, CMS No. 1545-1578 country ZP or foreign postal code, and telephone number Student Lean Interest Federal Student Loan Program Staternent Washington, DC 20551 Form 1098-E FECUPENT S federal identification no. BORROWERS scoled security rumber 1 Student loan interest received by lender Copy B 10-3546541 412-34-5670 $ 1.750.00 For Borrower BORROWER snarte This is important tax information wid is being fumishad bathe inhemal Keisha Sanders Revenue Service. f You are required to file a Street address including apt no.) metanoghnencs ully or Die 9551 Oak Leaf Lane Scination may be Iradieses you if the City or town, province or sout, country, and ZIP or foreign postal code 115 decertaines that an Pine Cove, AZ 86035 urdeptent of leo regids because you Account number see Instructions) 2 if chakad, box 1 does not include loon Grigination oversiated a deduction Tees and/or capitalized interest for Ipans made before for student loan interest. September 1, 2004 . , Fann 1098-E toge t her flasp for your records of the Treasury - Internal Revenue Service CORRECTED (if checked REPONTUENDER' Shame, street edes, aty or own, province or state. Caution The amount T O MB No 1946-9001 country, ZIP or lorem pasticnde, and taleplane number may not be My deable by you Limta based on the bar Mortgage and the cast and the First National Bank of Pine Cove Seevad property owy pay. Ale Interest You may buy doctor interest to Pine Gove, AZ 86035 the surtout esined by you Statement pt by yme reducirsed by other person Form 1098 RECIFIENT'S federal dortfoutor no PAYER'social security number Mortgage interest received from payur(5ErroWorl" Copy B 82-6549871 412-34-5670 $ 8,100.00 For Payer/Borrower PAYERS/BORACWEA'S nams 2 Points paid on purchase of principal residence The internation in b e 2. 3 rd be mootorttu mortion and ana Keisha Sanders um had to the come Rasun Service. If you are Street address Including apti no.) 3. Refund of overpaid interest Tagurd Roarium, a nag gange penalty or other sancion Maybe IT POSSO 9551 Oak Leaf Lane you this datamine the moderpa Tip of tax City or town, provide or stet, country, End ZIP or foreign postal code 4 Mortgage insurance praniwns COLIS GAY Pine Cove, AZ 86045 warstad adnutter this postage interest of lor me points or b e you Acco umber (see Instructions! cd rot report this cound Real Estate Taxes Paid = $1,700.CO Encorel on your retum Form 1098 (koop for your records) www.irs.gov/formn 1098 Department of the Treasury - Intermed Revenue Service ol A n Department of the Treasury - Internal Revenue Service 99 TU U.S. Individual Income Tax Return OMB No 1545-0074 IRS Use Only-Do not write or staple in this space. Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widower) (QW) Check only if you checked the MFS box, enter the name of spouse. If you checked the HOH or GW box, enter the child's name if the qualifying person is one bax. a child but not your dependent Your first name and midde initial Last name Your social security number If joint return, spouse's first name and middle initial Last name Spouse's social security number county Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Presidential Election Campaign Check here if you or your spouse if filing jointly, want $3 to go to this fund. City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions) Checking a box belon will not change your tax or refund. You Spouse Foreign country name Foreign province/state/county Foreign postal code more than four depende see instructions and here Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction D Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were bom before January 2, 1955 Are blind Spouse: Was born before January 2, 1955 is blind Dependents (see instructions): (2) Social security number (3) Relationship to you (4) il qualifies for see instructions: (1) First name Last name Child tax credit Credit for other dependents 2b 40 1 Wages, salaries, tips, etc. Attach Formis) W-2. 2a Tax-exempt interest. . . 2a b Taxable interest. Attach Sch. B if required 3a Qualified dividends. . . , 3a b Ordinary dividends. Attach Sch. B if required Standard Deduction for 4a IRA distributions. . . . . 4a b Taxable amount . . . . . . Sincle ar Married c Pensions and annuities. . d Taxable amount . . . filing separately. $12.200 5a Social security benefits . . . 5a b Taxable amount . . Married filing 6 Capital gain or loss), Attach Schedule Dif required. If not required, check here . . jointly or Qualifying . . widower 7a Other income from Schedule 1, line 9 . . . . . . . . . . . . . . . $24.400 Head of b Add lines 1, 2, 3, 45, 4d, 5b, 6, and 7a. This is your total income . . . . . . . .: household, Ba Adjustments to income from Schedule 1. line 22 . . . . . . . . $16.350 If you checked b Subtract line Ba from line 7b. This is your adjusted gross income . any box under 9 Standard deduction or itemized deductions from Schedule A). . Standard . . Deduction, 10 Qualified business income deduction. Attach Form 8995 or Form 8995-A. . 10 sce instructions 11a Add lines 9 and 10 . . . . . . . . . . . . . . . . . . . . . . . . b Taxable income. Subtract line 11a from line 8b . . . For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat No. 11320B Form 1040 (2019) Form 1040 2019) Page 2 12a Tax (see inst.) Check if any from Formis: 1 9914 2 4972 30 _ 12a b Add Schedule 2, line 3, and line 12a and enter the total . . . . . . . . . . . . 12b 13a Child tax credit or credit for other dependents . 13a b Add Schedule 3. line 7, and line 13a and enter the total . . . 13b 14 Subtract line 13b from line 12b. If zero or less, enter- 15 Other taxes, including self-employment tax, from Schedule 2, line 10. . . . 16 Add lines 14 and 15. This is your total tax . . . . . . Federal income tax withheld from Forms W-2 and 1099 18 Other payments and refundable credits: . If you have a qualifying child, Earned income credit (EIC) . . . . . 189 attach Sch. EiC . If you we b Additional child tax credit. Attach Schedule 8812 . . . . . . nontaxable C American opportunity credit from Form 8863, line 8 . . . . . . combat puy, see . . Instructions. d Schedule 3, line 14. . . . . . . . . . . . . . . 18d Add ines 18a through 18d. These are your total other payments and refundable credits 19 Add lines 17 and 18e. These are your total payments. . Refund 20 f line 19 is more than line 16, subtract line 16 from line 19. This is the amount you overpaid . 210 Amount of line 20 you want refunded to you. If Form 8888 is attached, check here Direct deposit? b Routing number 1 c Type: Checking O Savings See instructions. d Account number 22 Amount of line 20 you want applied to your 2020 estimated tax. . . . 22 | Amount 23 Amount you owe. Subtract line 19 from line 16. For details on how to pay, see instructions. . . You Owe 24 Estimated tax penalty (see instructions) 24 Third Party Do you want to allow another person (other than your paid preparer to discuss this return with the IRS? See instructions. Yes. Complete below. Designee O No Other than Designee's Phone Personal identification paid preparer) name number (PIN) Sign Under penalties of perjury, I declare that I have examined this retum and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Dedaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge Here Your signature Your occupation If the IRS sent you an Identity Protection PIN, enter it here Joint return? (see Inst.) D T I See instructions. Spouse's signature. If a joint return, both must sign. Date Spouse's occupation If the IRS sent your spouse an Keep a cogy for Identity Protection PIN, enter it here your records. (see inst.) Phone no. Email address Preparer's name Preparer's signature Date Check it: Paid 3rd Party Designee Preparer Firm's name Phone no. Self-employed Firm's EIN Go to www.lrs.gov/Form 1040 for instructions and the latest Information Form 1040 (2019) Use Only Firm's address SCHEDULE 1 (Form 1040 or 1040-SR) Additional Income and Adjustments to Income Department of the Treasury Internal Revenue Service Name(s) shown on Form 1040 or 1040-SR Attach to Form 1040 or 1040-SR. Go to www.lrs.gov/Form 1040 for instructions and the latest information. OMB No. 1545-0074 2019 Attachment Sequence No. 01 Your social security number Part Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes.. . 2a Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . b Date of original divorce or separation agreement (see instructions) 3 Business income or (oss). Attach Schedule ........ 4 Other gains or losses). Attach Form 4797 .. 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E.. 6 Farm income or loss). Attach Schedule F .. 7 Unemployment compensation. .. 8 Other income. List type and amount en 2 BILDE 9 Combine lines 1 through 8. Enter here and on Form 1040 or 1040-SR, line 7a. . Part II Adjustments to Income 10 Educator expenses . . . . . . . . . . . . . . . . . . . . . . 11 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 . 12 Health savings account deduction. Attach Form 8889 ...... 13 Moving expenses for members of the Armed Forces. Attach Form 3903 14 Deductible part of self-employment tax. Attach Schedule SE.......... 15 Self-employed SEP, SIMPLE, and qualified plans 16 Self-employed health insurance deduction . . . . . . . . . . . . . . 17 Penalty on early withdrawal of savings . . . . . . . . . . . . . . . . 18a Alimony paid. . . . . . . . . . . . . . . . . . . . . . . b Recipient's SSN . . . Date of original divorce or separation agreement (see instructions) 19 IRA deduction . . . . . . 20 Student loan interest deduction . . . . . . . . . . . . . . . . . . . . . . . 20 21 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . 21 22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040 or 1040-SR, line Ba ..... For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F Schedule 1 (Form 1040 or 1040-SR) 2019 reuse es 10th 1040 22 SCHEDULE A Itemized Deductions OMB No. 1545-0074 (Form 1040) Go to www.irs.gov/ScheduleA for instructions and the latest information. 2018 Department of the Treasury Attach to Form 1040. Internal Revenue Service 10 Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16 Sequence No. 07 Name(s) shown on Form 1040 Your social security number Altachment 07 Medical and Dental Expenses Taxes You Paid Caution: Do not include expenses reimbursed or paid by others. 1 Medical and dental expenses (see instructions).... 2 Enter amount from Form 1040, line 7 2 3 Multiply line 2 by 7.5% (0.075) . . . . . . . . . . . 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter-O- 5 State and local taxes. a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box.... .. O 5a b State and local real estate taxes (see instructions) . . . . . 5b_ c State and local personal property taxes . . . . . . . . 5c d Add lines 5a through 50 . . . . . . . . . . . 150 e Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) . . . 6 Other taxes. List type and amount 7 Add lines 5e and 6 . . . Interest You 8 Home mortgage interest and points. If you didn't use all of your Paid home mortgage loan(s) to buy, build, or improve your home, Caution: Your see instructions and check this box. . . . . . . U mortgage interest deduction may be a Home mortgage interest and points reported to you on Form limited see instructions). b Home mortgage interest not reported to you on Form 1098. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address c Points not reported to you on Form 1098. See instructions for special rules. . . d Reserved. . . . . . . e Add lines Ba through 8c ..... 9 Investment interest. Attach Form 4952 if required. See instructions . . . . . . . . . . . . . . 9 10 Add lines 8e and 9 . . Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, Charity see instructions . . . . . . . . . . . . . . . 12 Other than by cash or check. If any gift of $250 or more, see If you made a 112 gift and got a instructions. You must attach Form 8283 it over $500... benefit for it. 13 Carryover from prior year 13 . . . . . . . . . . see instructions . . 14 Add lines 11 through 13. . Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions . . . . . . . . . . . . . . . . . . . . . . Other 16 Other-from list in instructions. List type and amount Itemized Deductions Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040, line 8 . . . . . . . . . . . . . . . . . . . . . Deductions 18 If you elect to itemize deductions even though they are less than your standard deduction, check here . . . . . . . . . . . . . . . For Paperwork Reduction Act Notice, see the Instructions for Form 1040. Cat. No. 171450 Schedule A (Form 1040) 2018 Chapter 6 In Class Assignment Keisha Sanders is a client of your firm. Based on the information that follows, complete Keisha's Form 1040 and Schedule A. Keisha has provided you with her forns W-2, 1099-INT, 1098-E and 1098 (following this page). She has also provided the following additional information you will need to prepare her return. . I am 35 and single with no kids. I had a bunch of medical expenses: Doctor's Fees $5,000. Prescription Drugs $800, Vitamins and Over the Counter Allergy Medicine $250, Dental Work $1,600, and my Health Club fees $400. I paid a bunch of interest and taxes this year: Interest on my personal Mastercard $425, Interest on my car loan $600, Personal property tax on my car $75. Registration fees on my car $135, and I had to pay $350 in State taxes when I filed my 2017 return I contributed a lot of money to charity this year (and have receipt documentation for all contributions). I gave $3,100 in cash to the March of Dimes and $300 cash to the United Way. I contributed some of my old furniture to the church, basis was $1,300 and fair market value was $350. I also contributed $200 to a farnily down the street who had a fire and lost everything. A few other things I want to tell you about this year. Someone broke into my house and stole my brand-new bicycle, what a disaster! The total loss from the theft was $900. I also paid $150 in union dues this year, and had to pay $1,200 for new suits for my job. I'm required to wear suits every day on the job. I also spent about $400 on lottery tickets this year, didn't win anything though. a Employee's Toca security Filmber 412-34-5670 t Employer identification number (EIN e Visit the IRS Wabato www.is.gowelle Employer's name, address, and ZIP code Sare accurate, OMB No 1545-1003 FAST! Use A v Waper, ps. other operation 83,401.55 Social SecSy wages 83,401.55 5 Medicare wages arid Sips 83,407,55 7 Social security to 2 Federal income tax withheld . 10,082.15 4 Sooel security tax withheld 5,170,90 & Medicare tax watthild 1,209.32 & Allocated tips Keisha's Employer Pine Cove, AZ 66035 d Control rumber 5 : 10 Dependant Gere benefits e Employee's Brote and intel last name Suite Nogueired plane 12 See store for bok 12 Keisha Senders 9551 Oak Leaf Lane Pine Cove, AZ 86035 14 Other Employee's address and ZIP code 15 Saal Employer's state number AZ ta Local was belo. 19 Local Indore ter 20 Locacy na 16 Slaw , Upate 83,401.55 17 Sunteiname lak 2 ,950.00 TALL, Wage and Tax Department of the Treasury-Intemal Reverice Service W-2 Statement Copy B-To Be Fried With Employee's FEDERAL Tax Retum. This information is being furnished to the internal Revenue Service O CORRECTED (f checked) PAYER' S t reet address, city or town, province or stato, country, Zip Puyer's RYN (option or foreign postal code, and telephone na OMB No. 1515-0112 Interest Income Pine Cove Credit Union Pine Cove, AZ 86035 - 1 Interest reme 250! 0 Form 1099-INT 2 Early withdrawal penalty Copy B PAYER'S federal identication number RECIPIENTS identification sumber $ For Recipient Interest on U.S. Savings Bonds and Treas, obligations 82-5678911 412-34-5670 $ RECIPIENT'S name Federal noore to withheld Keisha Sonders Street addice Including ent no 6 Foreign tax paid 9551 Oak Leaf Lane City or town, province or country, and ZIP or foreign postal code Pine Cove, AZ 86035 "This is important tax brivestimento perses inlaration and is being furnished to the Internal Revenue Service. If you are required to file 7 Fereign country or U.S. POSAO retur, a negligence penalty or other Sanction may be imposed on you if this income is 9 Suecidis private activity bondaxable and the IAS interest determines that it has not been reported. Tex-earp: terest 4 $ 10 T Account number (sea instructions) acomal bond CUSIP n. 71 Ste 12 Stateider fantasma 13 Statex withhold Form 1099-INT (keep for your recordis) www.rs.gowlermo nt Department of the Trosu - temal Revenue Service CORRECTED (f checked) RECIPIENTS/LEND'Srame, address, city or own, province of state, CMS No. 1545-1578 country ZP or foreign postal code, and telephone number Student Lean Interest Federal Student Loan Program Staternent Washington, DC 20551 Form 1098-E FECUPENT S federal identification no. BORROWERS scoled security rumber 1 Student loan interest received by lender Copy B 10-3546541 412-34-5670 $ 1.750.00 For Borrower BORROWER snarte This is important tax information wid is being fumishad bathe inhemal Keisha Sanders Revenue Service. f You are required to file a Street address including apt no.) metanoghnencs ully or Die 9551 Oak Leaf Lane Scination may be Iradieses you if the City or town, province or sout, country, and ZIP or foreign postal code 115 decertaines that an Pine Cove, AZ 86035 urdeptent of leo regids because you Account number see Instructions) 2 if chakad, box 1 does not include loon Grigination oversiated a deduction Tees and/or capitalized interest for Ipans made before for student loan interest. September 1, 2004 . , Fann 1098-E toge t her flasp for your records of the Treasury - Internal Revenue Service CORRECTED (if checked REPONTUENDER' Shame, street edes, aty or own, province or state. Caution The amount T O MB No 1946-9001 country, ZIP or lorem pasticnde, and taleplane number may not be My deable by you Limta based on the bar Mortgage and the cast and the First National Bank of Pine Cove Seevad property owy pay. Ale Interest You may buy doctor interest to Pine Gove, AZ 86035 the surtout esined by you Statement pt by yme reducirsed by other person Form 1098 RECIFIENT'S federal dortfoutor no PAYER'social security number Mortgage interest received from payur(5ErroWorl" Copy B 82-6549871 412-34-5670 $ 8,100.00 For Payer/Borrower PAYERS/BORACWEA'S nams 2 Points paid on purchase of principal residence The internation in b e 2. 3 rd be mootorttu mortion and ana Keisha Sanders um had to the come Rasun Service. If you are Street address Including apti no.) 3. Refund of overpaid interest Tagurd Roarium, a nag gange penalty or other sancion Maybe IT POSSO 9551 Oak Leaf Lane you this datamine the moderpa Tip of tax City or town, provide or stet, country, End ZIP or foreign postal code 4 Mortgage insurance praniwns COLIS GAY Pine Cove, AZ 86045 warstad adnutter this postage interest of lor me points or b e you Acco umber (see Instructions! cd rot report this cound Real Estate Taxes Paid = $1,700.CO Encorel on your retum Form 1098 (koop for your records) www.irs.gov/formn 1098 Department of the Treasury - Intermed Revenue Service ol A n Department of the Treasury - Internal Revenue Service 99 TU U.S. Individual Income Tax Return OMB No 1545-0074 IRS Use Only-Do not write or staple in this space. Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widower) (QW) Check only if you checked the MFS box, enter the name of spouse. If you checked the HOH or GW box, enter the child's name if the qualifying person is one bax. a child but not your dependent Your first name and midde initial Last name Your social security number If joint return, spouse's first name and middle initial Last name Spouse's social security number county Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Presidential Election Campaign Check here if you or your spouse if filing jointly, want $3 to go to this fund. City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions) Checking a box belon will not change your tax or refund. You Spouse Foreign country name Foreign province/state/county Foreign postal code more than four depende see instructions and here Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction D Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were bom before January 2, 1955 Are blind Spouse: Was born before January 2, 1955 is blind Dependents (see instructions): (2) Social security number (3) Relationship to you (4) il qualifies for see instructions: (1) First name Last name Child tax credit Credit for other dependents 2b 40 1 Wages, salaries, tips, etc. Attach Formis) W-2. 2a Tax-exempt interest. . . 2a b Taxable interest. Attach Sch. B if required 3a Qualified dividends. . . , 3a b Ordinary dividends. Attach Sch. B if required Standard Deduction for 4a IRA distributions. . . . . 4a b Taxable amount . . . . . . Sincle ar Married c Pensions and annuities. . d Taxable amount . . . filing separately. $12.200 5a Social security benefits . . . 5a b Taxable amount . . Married filing 6 Capital gain or loss), Attach Schedule Dif required. If not required, check here . . jointly or Qualifying . . widower 7a Other income from Schedule 1, line 9 . . . . . . . . . . . . . . . $24.400 Head of b Add lines 1, 2, 3, 45, 4d, 5b, 6, and 7a. This is your total income . . . . . . . .: household, Ba Adjustments to income from Schedule 1. line 22 . . . . . . . . $16.350 If you checked b Subtract line Ba from line 7b. This is your adjusted gross income . any box under 9 Standard deduction or itemized deductions from Schedule A). . Standard . . Deduction, 10 Qualified business income deduction. Attach Form 8995 or Form 8995-A. . 10 sce instructions 11a Add lines 9 and 10 . . . . . . . . . . . . . . . . . . . . . . . . b Taxable income. Subtract line 11a from line 8b . . . For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat No. 11320B Form 1040 (2019) Form 1040 2019) Page 2 12a Tax (see inst.) Check if any from Formis: 1 9914 2 4972 30 _ 12a b Add Schedule 2, line 3, and line 12a and enter the total . . . . . . . . . . . . 12b 13a Child tax credit or credit for other dependents . 13a b Add Schedule 3. line 7, and line 13a and enter the total . . . 13b 14 Subtract line 13b from line 12b. If zero or less, enter- 15 Other taxes, including self-employment tax, from Schedule 2, line 10. . . . 16 Add lines 14 and 15. This is your total tax . . . . . . Federal income tax withheld from Forms W-2 and 1099 18 Other payments and refundable credits: . If you have a qualifying child, Earned income credit (EIC) . . . . . 189 attach Sch. EiC . If you we b Additional child tax credit. Attach Schedule 8812 . . . . . . nontaxable C American opportunity credit from Form 8863, line 8 . . . . . . combat puy, see . . Instructions. d Schedule 3, line 14. . . . . . . . . . . . . . . 18d Add ines 18a through 18d. These are your total other payments and refundable credits 19 Add lines 17 and 18e. These are your total payments. . Refund 20 f line 19 is more than line 16, subtract line 16 from line 19. This is the amount you overpaid . 210 Amount of line 20 you want refunded to you. If Form 8888 is attached, check here Direct deposit? b Routing number 1 c Type: Checking O Savings See instructions. d Account number 22 Amount of line 20 you want applied to your 2020 estimated tax. . . . 22 | Amount 23 Amount you owe. Subtract line 19 from line 16. For details on how to pay, see instructions. . . You Owe 24 Estimated tax penalty (see instructions) 24 Third Party Do you want to allow another person (other than your paid preparer to discuss this return with the IRS? See instructions. Yes. Complete below. Designee O No Other than Designee's Phone Personal identification paid preparer) name number (PIN) Sign Under penalties of perjury, I declare that I have examined this retum and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Dedaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge Here Your signature Your occupation If the IRS sent you an Identity Protection PIN, enter it here Joint return? (see Inst.) D T I See instructions. Spouse's signature. If a joint return, both must sign. Date Spouse's occupation If the IRS sent your spouse an Keep a cogy for Identity Protection PIN, enter it here your records. (see inst.) Phone no. Email address Preparer's name Preparer's signature Date Check it: Paid 3rd Party Designee Preparer Firm's name Phone no. Self-employed Firm's EIN Go to www.lrs.gov/Form 1040 for instructions and the latest Information Form 1040 (2019) Use Only Firm's address SCHEDULE 1 (Form 1040 or 1040-SR) Additional Income and Adjustments to Income Department of the Treasury Internal Revenue Service Name(s) shown on Form 1040 or 1040-SR Attach to Form 1040 or 1040-SR. Go to www.lrs.gov/Form 1040 for instructions and the latest information. OMB No. 1545-0074 2019 Attachment Sequence No. 01 Your social security number Part Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes.. . 2a Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . b Date of original divorce or separation agreement (see instructions) 3 Business income or (oss). Attach Schedule ........ 4 Other gains or losses). Attach Form 4797 .. 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E.. 6 Farm income or loss). Attach Schedule F .. 7 Unemployment compensation. .. 8 Other income. List type and amount en 2 BILDE 9 Combine lines 1 through 8. Enter here and on Form 1040 or 1040-SR, line 7a. . Part II Adjustments to Income 10 Educator expenses . . . . . . . . . . . . . . . . . . . . . . 11 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 . 12 Health savings account deduction. Attach Form 8889 ...... 13 Moving expenses for members of the Armed Forces. Attach Form 3903 14 Deductible part of self-employment tax. Attach Schedule SE.......... 15 Self-employed SEP, SIMPLE, and qualified plans 16 Self-employed health insurance deduction . . . . . . . . . . . . . . 17 Penalty on early withdrawal of savings . . . . . . . . . . . . . . . . 18a Alimony paid. . . . . . . . . . . . . . . . . . . . . . . b Recipient's SSN . . . Date of original divorce or separation agreement (see instructions) 19 IRA deduction . . . . . . 20 Student loan interest deduction . . . . . . . . . . . . . . . . . . . . . . . 20 21 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . 21 22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040 or 1040-SR, line Ba ..... For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F Schedule 1 (Form 1040 or 1040-SR) 2019 reuse es 10th 1040 22 SCHEDULE A Itemized Deductions OMB No. 1545-0074 (Form 1040) Go to www.irs.gov/ScheduleA for instructions and the latest information. 2018 Department of the Treasury Attach to Form 1040. Internal Revenue Service 10 Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16 Sequence No. 07 Name(s) shown on Form 1040 Your social security number Altachment 07 Medical and Dental Expenses Taxes You Paid Caution: Do not include expenses reimbursed or paid by others. 1 Medical and dental expenses (see instructions).... 2 Enter amount from Form 1040, line 7 2 3 Multiply line 2 by 7.5% (0.075) . . . . . . . . . . . 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter-O- 5 State and local taxes. a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box.... .. O 5a b State and local real estate taxes (see instructions) . . . . . 5b_ c State and local personal property taxes . . . . . . . . 5c d Add lines 5a through 50 . . . . . . . . . . . 150 e Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) . . . 6 Other taxes. List type and amount 7 Add lines 5e and 6 . . . Interest You 8 Home mortgage interest and points. If you didn't use all of your Paid home mortgage loan(s) to buy, build, or improve your home, Caution: Your see instructions and check this box. . . . . . . U mortgage interest deduction may be a Home mortgage interest and points reported to you on Form limited see instructions). b Home mortgage interest not reported to you on Form 1098. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address c Points not reported to you on Form 1098. See instructions for special rules. . . d Reserved. . . . . . . e Add lines Ba through 8c ..... 9 Investment interest. Attach Form 4952 if required. See instructions . . . . . . . . . . . . . . 9 10 Add lines 8e and 9 . . Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, Charity see instructions . . . . . . . . . . . . . . . 12 Other than by cash or check. If any gift of $250 or more, see If you made a 112 gift and got a instructions. You must attach Form 8283 it over $500... benefit for it. 13 Carryover from prior year 13 . . . . . . . . . . see instructions . . 14 Add lines 11 through 13. . Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions . . . . . . . . . . . . . . . . . . . . . . Other 16 Other-from list in instructions. List type and amount Itemized Deductions Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040, line 8 . . . . . . . . . . . . . . . . . . . . . Deductions 18 If you elect to itemize deductions even though they are less than your standard deduction, check here . . . . . . . . . . . . . . . For Paperwork Reduction Act Notice, see the Instructions for Form 1040. Cat. No. 171450 Schedule A (Form 1040) 2018