Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 6 - OPJ Mini Project Solid Footing 14e Account # 225 Interest Payable - Little Bank Account #300 Common Stock begin{tabular}{|c|c|c|c|c|c|c|} hline 2023Month-Day &

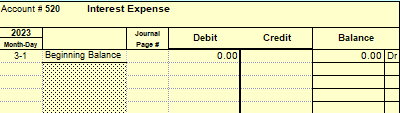

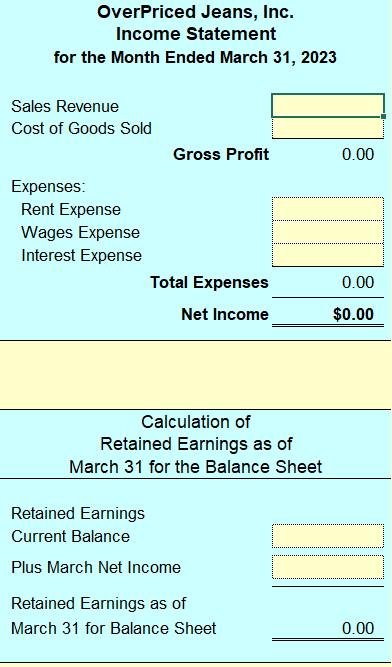

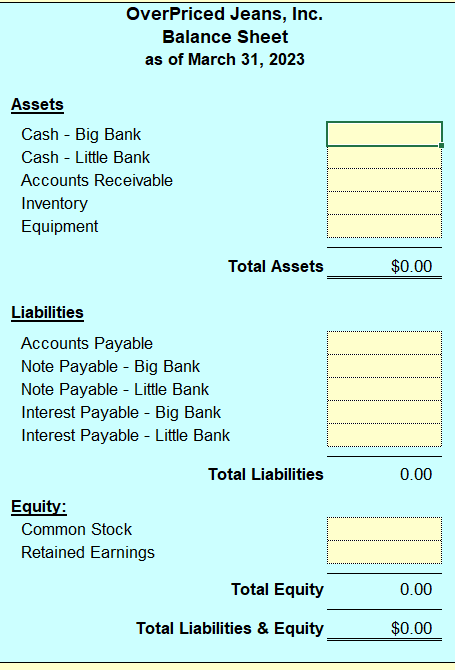

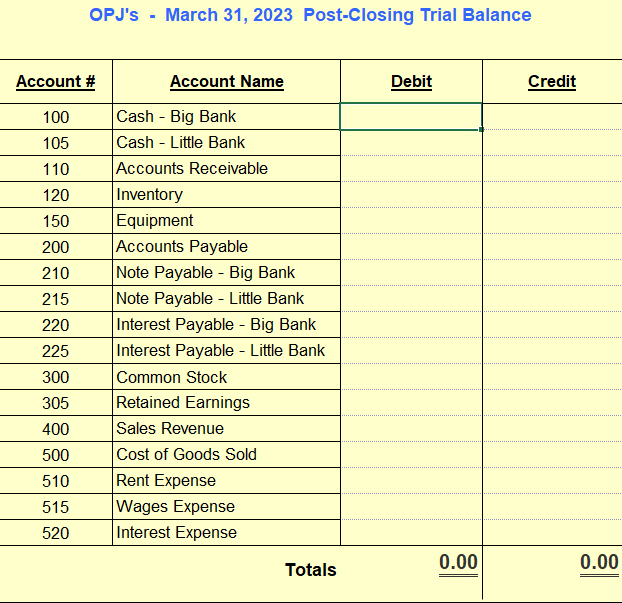

Chapter 6 - OPJ Mini Project Solid Footing 14e

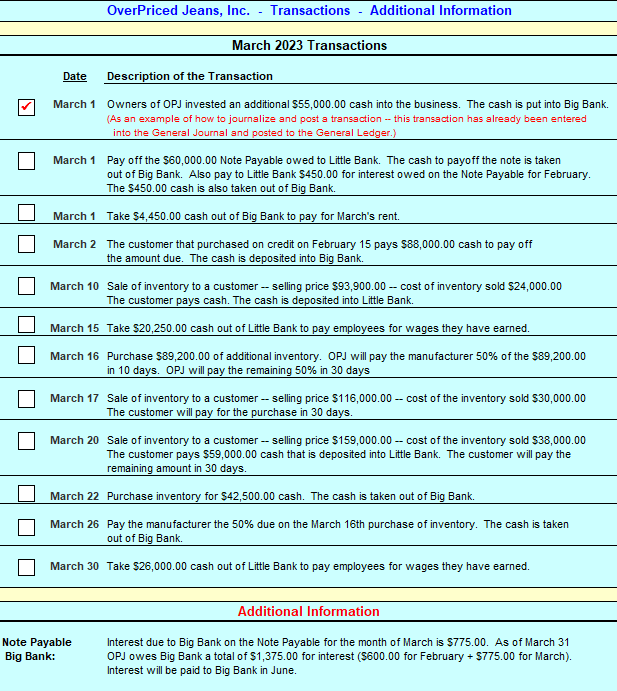

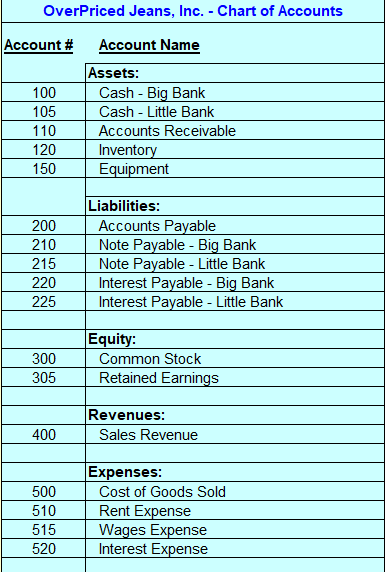

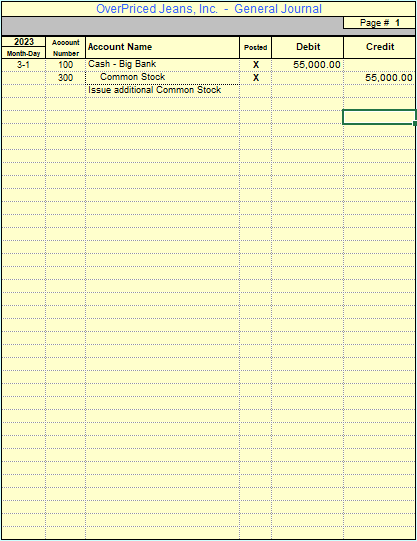

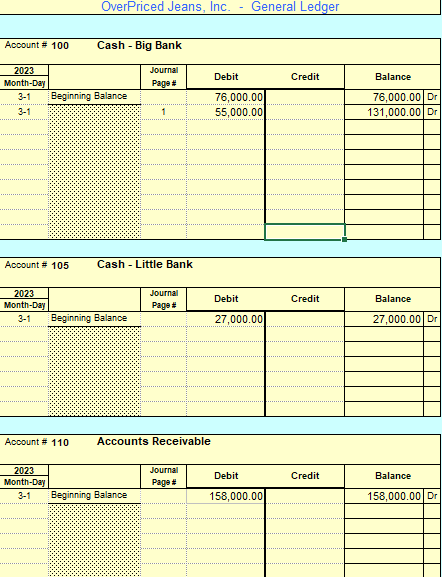

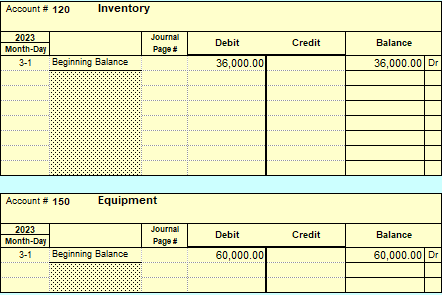

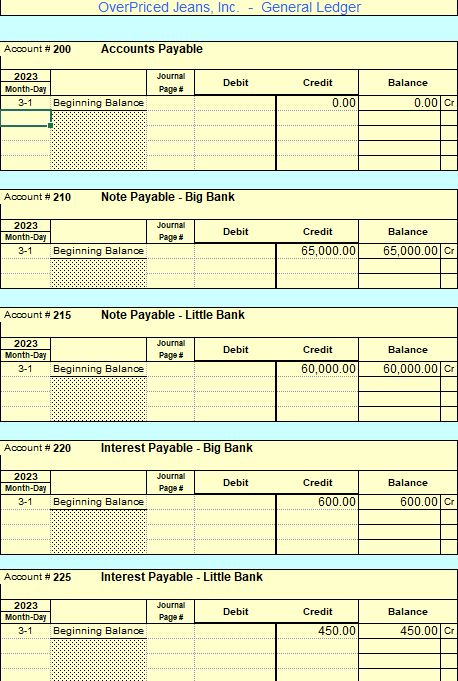

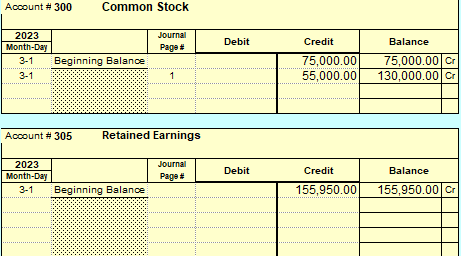

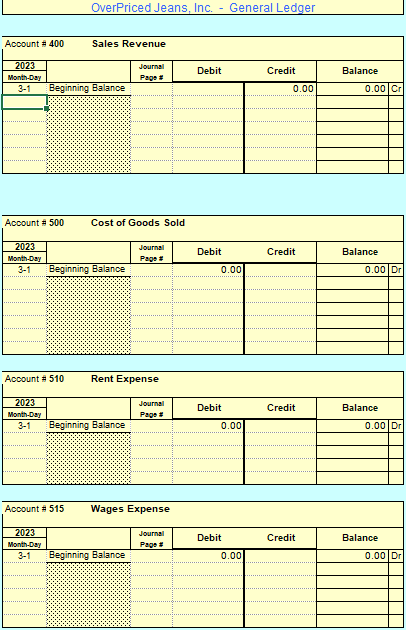

Account \# 225 Interest Payable - Little Bank Account #300 Common Stock \begin{tabular}{|c|c|c|c|c|c|c|} \hline 2023Month-Day & & JournalPage# & Debit & Credit & Balance & \\ \hline 31 & Beginning Balance & & & 75,000.00 & 75,000.00 & Cr \\ \hline 31 & - & 1 & & 55,000.00 & 130,000.00 & Cr \\ \hline & & & & & & \\ \hline \end{tabular} Account #305 Retained Earnings \begin{tabular}{|c|c|c|c|c|c|c|} \hline \begin{tabular}{|c|} 2023 \\ Month-Day \\ \end{tabular} & & JournalPage# & Debit & Credit & Balance & \\ \hline 31 & Beginning Balance & & & 155,950.00 & 155,950.00 & Cr \\ \hline & - & & & & & \\ \hline & - & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} Account #120 Inventory \begin{tabular}{|c|c|c|c|c|c|c|} \hline \begin{tabular}{c|} 2023 \\ Month-Day \end{tabular} & & JournalPage# & Debit & Credit & \multicolumn{2}{|l|}{ Balance } \\ \hline 31 & Beginning Balance & & 36,000.00 & & 36,000.00 & Dr \\ \hline & - & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} Account #150 Equipment \begin{tabular}{|c|c|c|c|c|c|c|} \hline \begin{tabular}{|c|} 2023 \\ Month-Day \\ \end{tabular} & & JournalPage# & Debit & Credit & \multicolumn{2}{|l|}{ Balance } \\ \hline 31 & Beginning Balance & & 60,000.00 & & 60,000.00 & Dr \\ \hline & - & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} OverPriced Jeans. Inc. Account $520 Interest Expense \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{2023Month-Dey} & & \multirow{2}{*}{JournalPape:} & \multirow{2}{*}{ Debit } & \multirow{2}{*}{ Credit } & \multirow{2}{*}{\multicolumn{2}{|c|}{ Balance }} \\ \hline & & & & & & \\ \hline 31 & Beginning Balance & & 0.00 & & 0.00 & Dr \\ \hline & & & & & & \\ \hline & - & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|l|}{OverPricedJeans,Inc.BalanceSheetasofMarch31,2023} \\ \hline \multicolumn{2}{|l|}{ Assets } \\ \hline \multicolumn{2}{|l|}{ Cash - Big Bank } \\ \hline \multicolumn{2}{|l|}{ Cash - Little Bank } \\ \hline \multicolumn{2}{|l|}{ Accounts Receivable } \\ \hline \multicolumn{2}{|l|}{ Inventory } \\ \hline \multicolumn{2}{|l|}{ Equipment } \\ \hline Total Assets & $0.00 \\ \hline \multicolumn{2}{|l|}{ Liabilities } \\ \hline \multicolumn{2}{|l|}{ Accounts Payable } \\ \hline \multicolumn{2}{|l|}{ Note Payable - Big Bank } \\ \hline \multicolumn{2}{|l|}{ Note Payable - Little Bank } \\ \hline \multicolumn{2}{|l|}{ Interest Payable - Big Bank } \\ \hline \multicolumn{2}{|l|}{ Interest Payable - Little Bank } \\ \hline Total Liabilities & 0.00 \\ \hline \multicolumn{2}{|l|}{ Equity: } \\ \hline \multicolumn{2}{|l|}{ Common Stock } \\ \hline \multicolumn{2}{|l|}{ Retained Earnings } \\ \hline Total Equity & 0.00 \\ \hline Total Liabilities \& Equity & $0.00 \\ \hline \end{tabular} Account \# 105 Cash - Little Bank OPJ's - March 31, 2023 Post-Closing Trial Balance \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ OverPriced Jeans, Inc. - Chart of Accounts } \\ \hline \multirow{2}{*}{ Account \# } & Account Name \\ \cline { 2 - 2 } & Assets: \\ \hline 100 & Cash - Big Bank \\ \hline 105 & Cash - Little Bank \\ \hline 110 & Accounts Receivable \\ \hline 120 & Inventory \\ \hline 150 & Equipment \\ \hline & \\ \cline { 2 - 2 } & Liabilities: \\ \hline 200 & Accounts Payable \\ \hline 210 & Note Payable - Big Bank \\ \hline 215 & Note Payable - Little Bank \\ \hline 220 & Interest Payable - Big Bank \\ \hline 225 & Interest Payable - Little Bank \\ \hline & \\ \hline & Equity: \\ \hline 300 & Common Stock \\ \hline 305 & Retained Earnings \\ \hline & \\ \hline & Revenues: \\ \hline 400 & Sales Revenue \\ \hline & \\ \hline & Expenses: \\ \hline 500 & Cost of Goods Sold \\ \hline 510 & Rent Expense \\ \hline 515 & Wages Expense \\ \hline 520 & Interest Expense \\ \hline & \\ \hline & \end{tabular} OverPriced Jeans, Inc. - General Ledger \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account & Sales Re & venue & & & & \\ \hline \begin{tabular}{|c|} 2023 \\ Month-Day \\ \end{tabular} & & JournalPage & Debit & Credit & Balance & \\ \hline 31 & Beginning Balance & & & 0.00 & 0.00 & Cr \\ \hline & - & & & & & \\ \hline & - & & & & & \\ \hline & a & & & & & \\ \hline & - & & & & & \\ \hline & a & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account : & Cost of G & ioods S & & & & \\ \hline \begin{tabular}{|c|} 2023 \\ Month-Dyy \\ \end{tabular} & & JournalPape: & Debit & Credit & Balance & \\ \hline 31 & Beginning Balance & & 0.00 & & 0.00 & Dr \\ \hline & & & & & & \\ \hline & - & & & & & \\ \hline & - & & & & & \\ \hline & S & & & & & \\ \hline & - & & & & & \\ \hline & - & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account & Rent Exp & ense & & & & \\ \hline 2023Month-Dsy & & JournalPapo: & Debit & Credit & Balance & \\ \hline 31 & Beginning Balance & & 0.00 & & 0.00 & Dr \\ \hline & - & & & & & \\ \hline & - & & & & & \\ \hline & - & & & & & \\ \hline & - & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account & Wages E & xpense & & & & \\ \hline \begin{tabular}{|c|} 2023 \\ Month-Dey \\ \end{tabular} & & JournalPapo: & Debit & Credit & Balance & \\ \hline 31 & Beginning Balance & & 0.00 & & 0.00 & Dr \\ \hline & - & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & a & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ OverPriced Jeans, Inc. - General Journal } \\ \hline 2023 & \multirow{2}{*}{AocountNumber} & \multirow{2}{*}{ Account Name } & \multirow{2}{*}{ Poctsd } & \multirow{2}{*}{ Debit } & \multirow{2}{*}{ Credit } \\ \hline Month-Dosy & & & & & \\ \hline \multirow[t]{3}{*}{31} & 100 & Cash - Big Bank & X & 55,000.00 & \\ \hline & 300 & Common Stock & x & & 55,000.00 \\ \hline & & Issue additional Common Stock & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|r|}{ March 2023 Transactions } \\ \hline Date & Description of the Transaction \\ \hline March 1 & OwnersofOPJinvestedanadditional$55,000.00cashintothebusiness.ThecashisputintoBigBank.(Asanexampleofhowtojournalizeandpostatransaction-thistransactionhasalreadybeenenteredintotheGeneralJournalandpostedtotheGeneralLedger.) \\ \hline March 1 & Payoffthe$60,000.00NotePayableowedtoLittleBank.ThecashtopayoffthenoteistakenoutofBigBank.AlsopaytoLittleBank$450.00forinterestowedontheNotePayableforFebruary.The$450.00cashisalsotakenoutofBigBank. \\ \hline March 1 & Take $4,450.00 cash out of Big Bank to pay for March's rent. \\ \hline March 2 & ThecustomerthatpurchasedoncreditonFebruary15pays$88,000.00cashtopayofftheamountdue.ThecashisdepositedintoBigBank. \\ \hline March 10 & Saleofinventorytoacustomer-sellingprice$93,900.00-costofinventorysold$24,000.00Thecustomerpayscash.ThecashisdepositedintoLittleBank. \\ \hline March 15 & Take $20,250.00 cash out of Little Bank to pay employees for wages they have earned. \\ \hline March 16 & Purchase$89,200.00ofadditionalinventory.OPJwillpaythemanufacturer50%ofthe$89,200.00in10days.OPJwillpaytheremaining50%in30days \\ \hline March 17 & Saleofinventorytoacustomer-sellingprice$116,000.00-costoftheinventorysold$30,000.00Thecustomerwillpayforthepurchasein30days. \\ \hline March 20 & Saleofinventorytoacustomer-sellingprice$159,000.00-costoftheinventorysold$38,000.00Thecustomerpays$59,000.00cashthatisdepositedintoLittleBank.Thecustomerwillpaytheremainingamountin30days. \\ \hline March 22 & Purchase inventory for $42,500.00 cash. The cash is taken out of Big Bank. \\ \hline March 26 & Paythemanufacturerthe50%dueontheMarch16thpurchaseofinventory.ThecashistakenoutofBigBank. \\ \hline March 30 & Take $26,000.00 cash out of Little Bank to pay employees for wages they have earned. \\ \hline & Additional Information \\ \hline yablek: & InterestduetoBigBankontheNotePayableforthemonthofMarchis$775.00.AsofMarch31OPJowesBigBankatotalof$1,375.00forinterest($600.00forFebruary+$775.00forMarch).InterestwillbepaidtoBigBankinJune. \\ \hline \end{tabular}

Account \# 225 Interest Payable - Little Bank Account #300 Common Stock \begin{tabular}{|c|c|c|c|c|c|c|} \hline 2023Month-Day & & JournalPage# & Debit & Credit & Balance & \\ \hline 31 & Beginning Balance & & & 75,000.00 & 75,000.00 & Cr \\ \hline 31 & - & 1 & & 55,000.00 & 130,000.00 & Cr \\ \hline & & & & & & \\ \hline \end{tabular} Account #305 Retained Earnings \begin{tabular}{|c|c|c|c|c|c|c|} \hline \begin{tabular}{|c|} 2023 \\ Month-Day \\ \end{tabular} & & JournalPage# & Debit & Credit & Balance & \\ \hline 31 & Beginning Balance & & & 155,950.00 & 155,950.00 & Cr \\ \hline & - & & & & & \\ \hline & - & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} Account #120 Inventory \begin{tabular}{|c|c|c|c|c|c|c|} \hline \begin{tabular}{c|} 2023 \\ Month-Day \end{tabular} & & JournalPage# & Debit & Credit & \multicolumn{2}{|l|}{ Balance } \\ \hline 31 & Beginning Balance & & 36,000.00 & & 36,000.00 & Dr \\ \hline & - & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} Account #150 Equipment \begin{tabular}{|c|c|c|c|c|c|c|} \hline \begin{tabular}{|c|} 2023 \\ Month-Day \\ \end{tabular} & & JournalPage# & Debit & Credit & \multicolumn{2}{|l|}{ Balance } \\ \hline 31 & Beginning Balance & & 60,000.00 & & 60,000.00 & Dr \\ \hline & - & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} OverPriced Jeans. Inc. Account $520 Interest Expense \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{2023Month-Dey} & & \multirow{2}{*}{JournalPape:} & \multirow{2}{*}{ Debit } & \multirow{2}{*}{ Credit } & \multirow{2}{*}{\multicolumn{2}{|c|}{ Balance }} \\ \hline & & & & & & \\ \hline 31 & Beginning Balance & & 0.00 & & 0.00 & Dr \\ \hline & & & & & & \\ \hline & - & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|l|}{OverPricedJeans,Inc.BalanceSheetasofMarch31,2023} \\ \hline \multicolumn{2}{|l|}{ Assets } \\ \hline \multicolumn{2}{|l|}{ Cash - Big Bank } \\ \hline \multicolumn{2}{|l|}{ Cash - Little Bank } \\ \hline \multicolumn{2}{|l|}{ Accounts Receivable } \\ \hline \multicolumn{2}{|l|}{ Inventory } \\ \hline \multicolumn{2}{|l|}{ Equipment } \\ \hline Total Assets & $0.00 \\ \hline \multicolumn{2}{|l|}{ Liabilities } \\ \hline \multicolumn{2}{|l|}{ Accounts Payable } \\ \hline \multicolumn{2}{|l|}{ Note Payable - Big Bank } \\ \hline \multicolumn{2}{|l|}{ Note Payable - Little Bank } \\ \hline \multicolumn{2}{|l|}{ Interest Payable - Big Bank } \\ \hline \multicolumn{2}{|l|}{ Interest Payable - Little Bank } \\ \hline Total Liabilities & 0.00 \\ \hline \multicolumn{2}{|l|}{ Equity: } \\ \hline \multicolumn{2}{|l|}{ Common Stock } \\ \hline \multicolumn{2}{|l|}{ Retained Earnings } \\ \hline Total Equity & 0.00 \\ \hline Total Liabilities \& Equity & $0.00 \\ \hline \end{tabular} Account \# 105 Cash - Little Bank OPJ's - March 31, 2023 Post-Closing Trial Balance \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ OverPriced Jeans, Inc. - Chart of Accounts } \\ \hline \multirow{2}{*}{ Account \# } & Account Name \\ \cline { 2 - 2 } & Assets: \\ \hline 100 & Cash - Big Bank \\ \hline 105 & Cash - Little Bank \\ \hline 110 & Accounts Receivable \\ \hline 120 & Inventory \\ \hline 150 & Equipment \\ \hline & \\ \cline { 2 - 2 } & Liabilities: \\ \hline 200 & Accounts Payable \\ \hline 210 & Note Payable - Big Bank \\ \hline 215 & Note Payable - Little Bank \\ \hline 220 & Interest Payable - Big Bank \\ \hline 225 & Interest Payable - Little Bank \\ \hline & \\ \hline & Equity: \\ \hline 300 & Common Stock \\ \hline 305 & Retained Earnings \\ \hline & \\ \hline & Revenues: \\ \hline 400 & Sales Revenue \\ \hline & \\ \hline & Expenses: \\ \hline 500 & Cost of Goods Sold \\ \hline 510 & Rent Expense \\ \hline 515 & Wages Expense \\ \hline 520 & Interest Expense \\ \hline & \\ \hline & \end{tabular} OverPriced Jeans, Inc. - General Ledger \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account & Sales Re & venue & & & & \\ \hline \begin{tabular}{|c|} 2023 \\ Month-Day \\ \end{tabular} & & JournalPage & Debit & Credit & Balance & \\ \hline 31 & Beginning Balance & & & 0.00 & 0.00 & Cr \\ \hline & - & & & & & \\ \hline & - & & & & & \\ \hline & a & & & & & \\ \hline & - & & & & & \\ \hline & a & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account : & Cost of G & ioods S & & & & \\ \hline \begin{tabular}{|c|} 2023 \\ Month-Dyy \\ \end{tabular} & & JournalPape: & Debit & Credit & Balance & \\ \hline 31 & Beginning Balance & & 0.00 & & 0.00 & Dr \\ \hline & & & & & & \\ \hline & - & & & & & \\ \hline & - & & & & & \\ \hline & S & & & & & \\ \hline & - & & & & & \\ \hline & - & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account & Rent Exp & ense & & & & \\ \hline 2023Month-Dsy & & JournalPapo: & Debit & Credit & Balance & \\ \hline 31 & Beginning Balance & & 0.00 & & 0.00 & Dr \\ \hline & - & & & & & \\ \hline & - & & & & & \\ \hline & - & & & & & \\ \hline & - & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account & Wages E & xpense & & & & \\ \hline \begin{tabular}{|c|} 2023 \\ Month-Dey \\ \end{tabular} & & JournalPapo: & Debit & Credit & Balance & \\ \hline 31 & Beginning Balance & & 0.00 & & 0.00 & Dr \\ \hline & - & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & a & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ OverPriced Jeans, Inc. - General Journal } \\ \hline 2023 & \multirow{2}{*}{AocountNumber} & \multirow{2}{*}{ Account Name } & \multirow{2}{*}{ Poctsd } & \multirow{2}{*}{ Debit } & \multirow{2}{*}{ Credit } \\ \hline Month-Dosy & & & & & \\ \hline \multirow[t]{3}{*}{31} & 100 & Cash - Big Bank & X & 55,000.00 & \\ \hline & 300 & Common Stock & x & & 55,000.00 \\ \hline & & Issue additional Common Stock & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|r|}{ March 2023 Transactions } \\ \hline Date & Description of the Transaction \\ \hline March 1 & OwnersofOPJinvestedanadditional$55,000.00cashintothebusiness.ThecashisputintoBigBank.(Asanexampleofhowtojournalizeandpostatransaction-thistransactionhasalreadybeenenteredintotheGeneralJournalandpostedtotheGeneralLedger.) \\ \hline March 1 & Payoffthe$60,000.00NotePayableowedtoLittleBank.ThecashtopayoffthenoteistakenoutofBigBank.AlsopaytoLittleBank$450.00forinterestowedontheNotePayableforFebruary.The$450.00cashisalsotakenoutofBigBank. \\ \hline March 1 & Take $4,450.00 cash out of Big Bank to pay for March's rent. \\ \hline March 2 & ThecustomerthatpurchasedoncreditonFebruary15pays$88,000.00cashtopayofftheamountdue.ThecashisdepositedintoBigBank. \\ \hline March 10 & Saleofinventorytoacustomer-sellingprice$93,900.00-costofinventorysold$24,000.00Thecustomerpayscash.ThecashisdepositedintoLittleBank. \\ \hline March 15 & Take $20,250.00 cash out of Little Bank to pay employees for wages they have earned. \\ \hline March 16 & Purchase$89,200.00ofadditionalinventory.OPJwillpaythemanufacturer50%ofthe$89,200.00in10days.OPJwillpaytheremaining50%in30days \\ \hline March 17 & Saleofinventorytoacustomer-sellingprice$116,000.00-costoftheinventorysold$30,000.00Thecustomerwillpayforthepurchasein30days. \\ \hline March 20 & Saleofinventorytoacustomer-sellingprice$159,000.00-costoftheinventorysold$38,000.00Thecustomerpays$59,000.00cashthatisdepositedintoLittleBank.Thecustomerwillpaytheremainingamountin30days. \\ \hline March 22 & Purchase inventory for $42,500.00 cash. The cash is taken out of Big Bank. \\ \hline March 26 & Paythemanufacturerthe50%dueontheMarch16thpurchaseofinventory.ThecashistakenoutofBigBank. \\ \hline March 30 & Take $26,000.00 cash out of Little Bank to pay employees for wages they have earned. \\ \hline & Additional Information \\ \hline yablek: & InterestduetoBigBankontheNotePayableforthemonthofMarchis$775.00.AsofMarch31OPJowesBigBankatotalof$1,375.00forinterest($600.00forFebruary+$775.00forMarch).InterestwillbepaidtoBigBankinJune. \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started