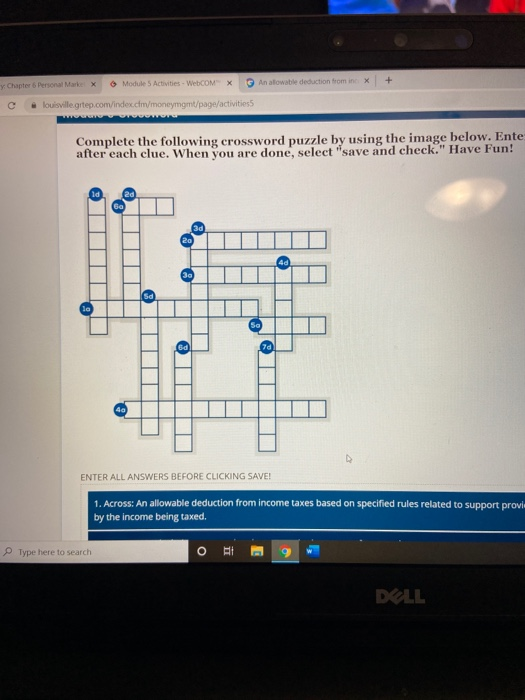

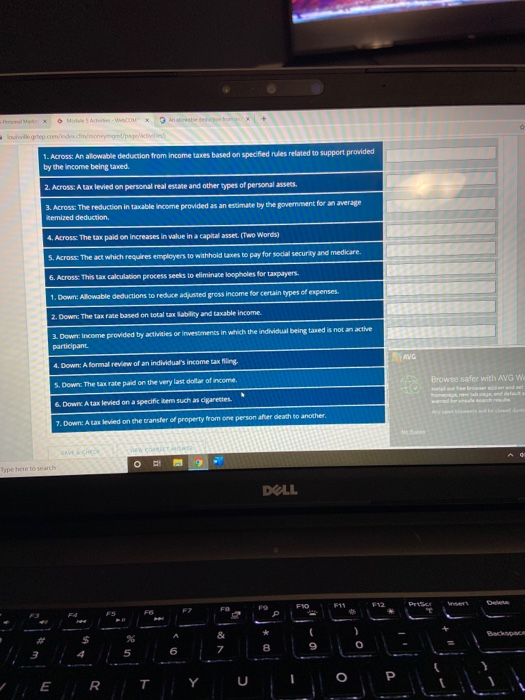

- Chapter 6 Personal Marke X Module & Activities - Webcom x Anatowable deduction from in x + c l ouisville grep.com/index.com/moneymgmt/page/activities Complete the following crossword puzzle by using the image below. Ente after each clue. When you are done, select "save and check." Have Fun! ENTER ALL ANSWERS BEFORE CLICKING SAVE! 1. Across: An allowable deduction from income taxes based on specified rules related to support prov by the income being taxed. Type here to search OHH9 DELL wiertop.codex.moneygulaci 1.Across An allowable deduction from income taxes based on specified rules related to support provided by the income being taked. 2. Across A tax levied on personal real estate and other types of personal assets. 3. Across: The reduction in taxable income provided as an estimate by the government for an average itemized deduction. 4. Across: The tax paid on increases in value in a capital asset. (Two Words) 5. Across: The act which requires employers to withhold takes to pay for social security and medicare. 6. Across This tax calculation process seeks to eliminate loopholes for taxpayers. 1. Downs Allowable deductions to reduce adjusted gross income for certain types of expenses. 2. Down: The tax rate based on total tax ability and taxable income 3. Down Income provided by activities or investments in which the individual being tawed is not an active participant 4. Down: A formal review of an individual's income tax filling, 5. Down: The tax rate paid on the very last dollar of income. Browse safer with AVG W 6. Down Atax levied on a specific em such as cigarettes. 7. Down: A tax kvied on the transfer of property from one person after death to another Type here to search DELL - Chapter 6 Personal Marke X Module & Activities - Webcom x Anatowable deduction from in x + c l ouisville grep.com/index.com/moneymgmt/page/activities Complete the following crossword puzzle by using the image below. Ente after each clue. When you are done, select "save and check." Have Fun! ENTER ALL ANSWERS BEFORE CLICKING SAVE! 1. Across: An allowable deduction from income taxes based on specified rules related to support prov by the income being taxed. Type here to search OHH9 DELL wiertop.codex.moneygulaci 1.Across An allowable deduction from income taxes based on specified rules related to support provided by the income being taked. 2. Across A tax levied on personal real estate and other types of personal assets. 3. Across: The reduction in taxable income provided as an estimate by the government for an average itemized deduction. 4. Across: The tax paid on increases in value in a capital asset. (Two Words) 5. Across: The act which requires employers to withhold takes to pay for social security and medicare. 6. Across This tax calculation process seeks to eliminate loopholes for taxpayers. 1. Downs Allowable deductions to reduce adjusted gross income for certain types of expenses. 2. Down: The tax rate based on total tax ability and taxable income 3. Down Income provided by activities or investments in which the individual being tawed is not an active participant 4. Down: A formal review of an individual's income tax filling, 5. Down: The tax rate paid on the very last dollar of income. Browse safer with AVG W 6. Down Atax levied on a specific em such as cigarettes. 7. Down: A tax kvied on the transfer of property from one person after death to another Type here to search DELL