Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CHAPTER 6 Time Value of Money Concepts 339 BE 6-4 Present value: single amount John has an investment opportunity that promises to pay him $16,000

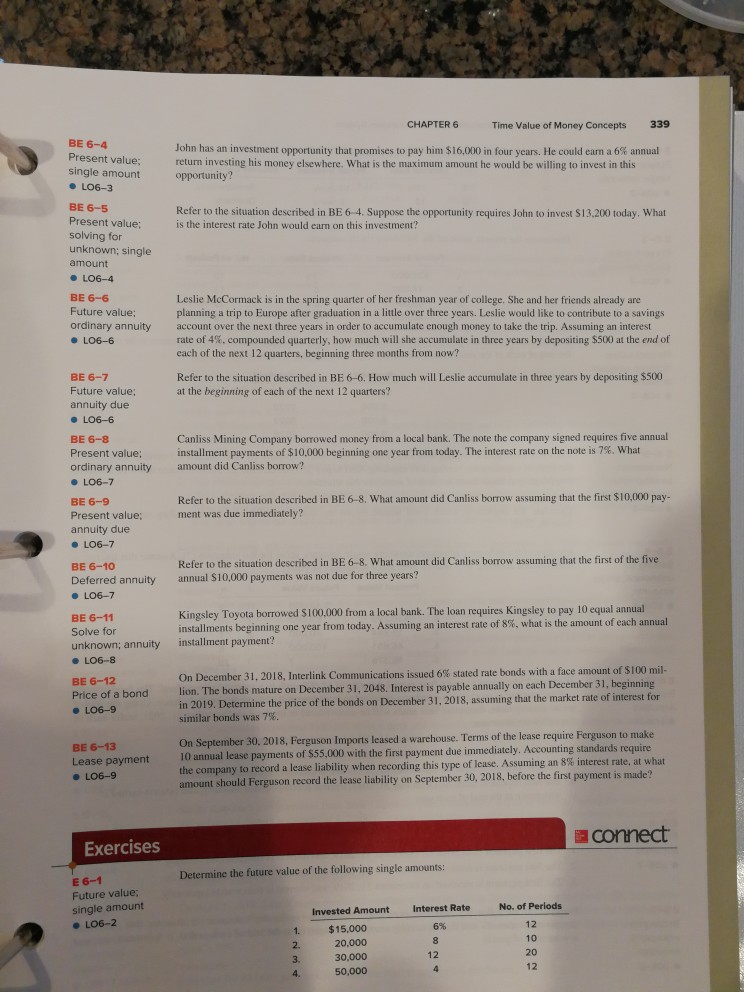

CHAPTER 6 Time Value of Money Concepts 339 BE 6-4 Present value: single amount John has an investment opportunity that promises to pay him $16,000 in four years. He could earn a 6% annual return investing his money elsewhere. What is the maximum amount he would be willing to invest in this opportunity? LO6-3 BE 6-5 Present value solving for unknown; single amount Refer to the situation described in BE 6-4. Suppose the opportunity requires John to invest S13.200 today. What is the interest rate John would eam on this investment? L06-4 BE 6-6 Future value; ordinary annuity L06-6 Leslie McCormack is in the spring quarter of her freshman year of college. She and her friends already are planning a trip to Europe after graduation in a little over three years. Leslie would like to contribute to a savings account over the next three years in order to accumulate enough money to take the trip. Assuming an interest rate of 4%, compounded quarterly, how much will he accumulate in three years by depositing $500 at the end of cach of the next 12 quarters, beginning three months from now? Refer to the situation described in BE 6-6. How much will Leslie accumulate in three years by depositing $500 at the beginning of each of the next 12 quarters? BE 6-7 Future value; annuity due L06-6 BE 6-8 Present value; ordinary annuity Canliss Mining Company borrowed money from a local bank. The note the company signed requires five annual nstall ment payments of $10,000 beginning 0ne year from today. The interest rate on the note is 7%, what amount did Canliss borrow? L06-7 BE 6-9 Present value annuity due L06-7 Refer to the situation described in BE 6-8. What amount did Canliss borrow assuming that the first $10,000 pay ment was due immediately? BE 6-10 Deferred annuity Refer to the situation described in BE 6-8. What amount did Canliss borrow assuming that the first of the five annual $10,000 payments was not due for three years? LO6-7 BE 6-11 Solve for unknown; annuity Kingsley Toyota borrowed S100,000 from a local bank. The loan requires Kingsley to pay 10 equal annual installments beginning one year from today. Assuming an interest rate of 8%, what is the amount of each annual installment payment? BE 6-12 Price of a bond L06-9 On December 31, 2018, Interlink Communications issued 6% stated rate bonds with a face amount of SI 00 mil lion. The bonds mature on December 31, 2048. Interest is payable annually on each December 31, beginning in 2019. Determine the price of the bonds on December 31, 2018, assuming that the market rate of interest for similar bonds was 7% 30. 2018, Ferguson Imports leased a warehouse. Terms of the lease require Ferguson to make On September 10 annual lease payments of $55,000 first paym the company to amount should Ferguson record the lease liability on September 30, 2018, before the first payment is made? BE 6-13 Lease payment 00 with the first payment due immediately. Accounting standards re record a lease liability when recording this type of lease. Assuming an 8% interest rate, at what a connect Exercises Determine the future value of the following single amounts: E 6-1 Future value single amount L06-2 No. of Periods 12 10 20 12 Interest Rate 6% Invested Amount 1. 2. 3. $15,000 20,000 30,000 50,000 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started