Answered step by step

Verified Expert Solution

Question

1 Approved Answer

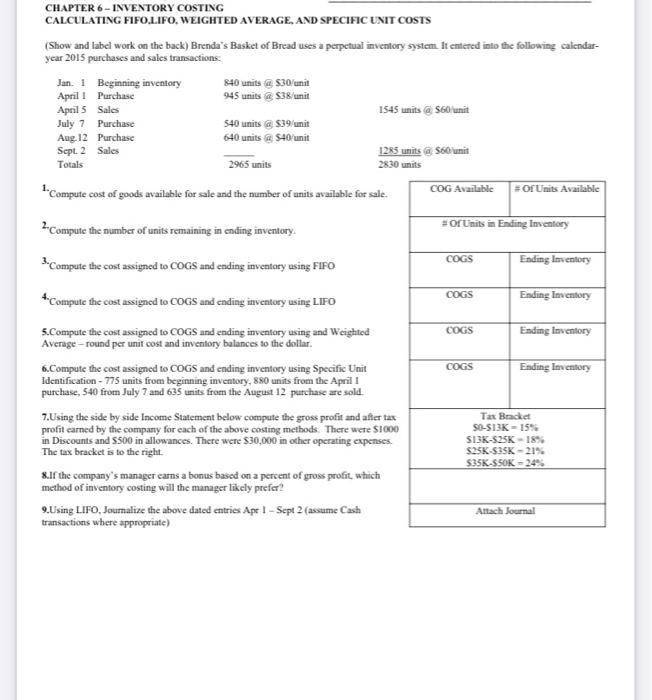

CHAPTER 6-INVENTORY COSTING CALCULATING FIFO.LIFO, WEIGHTED AVERAGE, AND SPECIFIC UNIT COSTS (Show and label work on the back) Brenda's Basket of Bread uses a

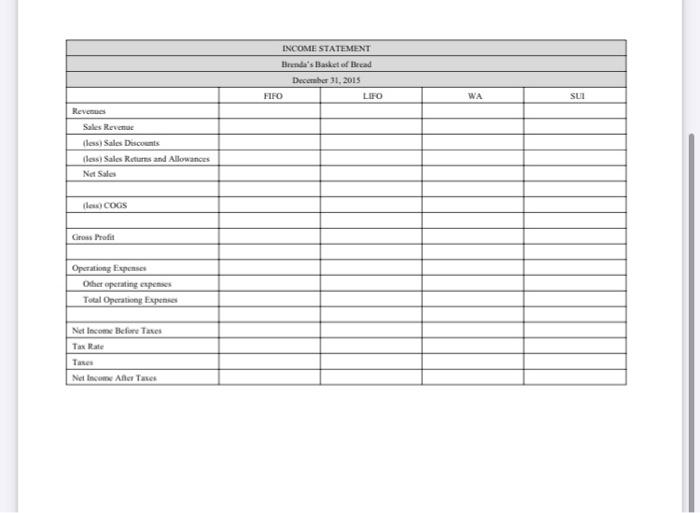

CHAPTER 6-INVENTORY COSTING CALCULATING FIFO.LIFO, WEIGHTED AVERAGE, AND SPECIFIC UNIT COSTS (Show and label work on the back) Brenda's Basket of Bread uses a perpetual inventory system. It entered into the following calendar- year 2015 purchases and sales transactions: Jan. 1 Beginning inventory April 1 Purchase April 5 Sales July 7 Purchase Aug. 12 Purchase Sept. 2 Sales Totals 840 units @$30/unit 945 units @$38/unit 1545 units @$60 unit 540 units @$39/unit 640 units @ $40/unit 2965 units 1285 units @$60 unit 2830 units COG Available #Of Units Available Compute cost of goods available for sale and the number of units available for sale. Compute the number of units remaining in ending inventory. 3-Compute the cost assigned to COGS and ending inventory using FIFO 4-Compute the cost assigned to COGS and ending inventory using LIFO 5.Compute the cost assigned to COGS and ending inventory using and Weighted Average -round per unit cost and inventory balances to the dollar. 6.Compute the cost assigned to COGS and ending inventory using Specific Unit Identification-775 units from beginning inventory, 880 units from the April 1 purchase, 540 from July 7 and 635 units from the August 12 purchase are sold. 7.Using the side by side Income Statement below compute the gross profit and after tax profit earned by the company for each of the above costing methods. There were $1000 in Discounts and $500 in allowances. There were $30,000 in other operating expenses. The tax bracket is to the right. 8.If the company's manager earns a bonus based on a percent of gross profit, which method of inventory costing will the manager likely prefer? 9.Using LIFO, Journalize the above dated entries Apr 1-Sept 2 (assume Cash transactions where appropriate) COGS #Of Units in Ending Inventory Ending Inventory COGS Ending Inventory COGS Ending Inventory COGS Ending Inventory Tax Bracket S0-$13K-15% $13K-$25K 18% $25k-$35K-21% $35K-$50K-24% Attach Journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started