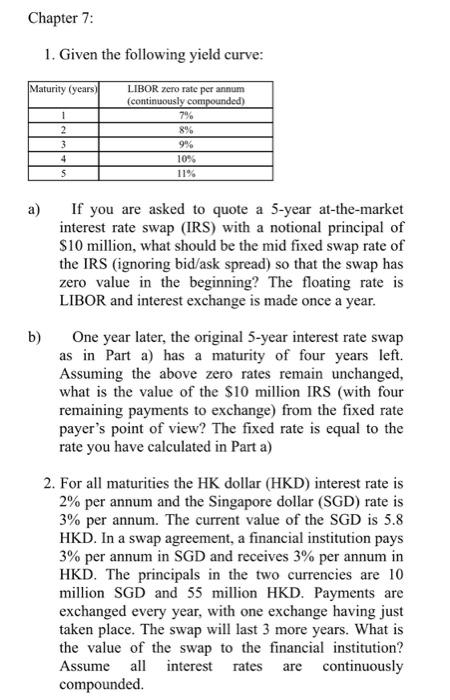

Chapter 7: 1. Given the following yield curve: Maturity (years) LIBOR zero rate per annum (continuously compounded) 8% 9% 4 10% 11% a) If you are asked to quote a 5-year at-the-market interest rate swap (IRS) with a notional principal of s10 million, what should be the mid fixed swap rate of the IRS (ignoring bid/ask spread) so that the swap has zero value in the beginning? The floating rate is LIBOR and interest exchange is made once a year. b) One year later, the original 5-year interest rate swap as in Part a) has a maturity of four years left. Assuming the above zero rates remain unchanged, what is the value of the $10 million IRS (with four remaining payments to exchange) from the fixed rate payer's point of view? The fixed rate is equal to the rate you have calculated in Part a) 2. For all maturities the HK dollar (HKD) interest rate is 2% per annum and the Singapore dollar (SGD) rate is 3% per annum. The current value of the SGD is 5.8 HKD. In a swap agreement, a financial institution pays 3% per annum in SGD and receives 3% per annum in HKD. The principals in the two currencies are 10 million SGD and 55 million HKD. Payments are exchanged every year, with one exchange having just taken place. The swap will last 3 more years. What is the value of the swap to the financial institution? continuously Assume all interest rates are compounded. Chapter 7: 1. Given the following yield curve: Maturity (years) LIBOR zero rate per annum (continuously compounded) 8% 9% 4 10% 11% a) If you are asked to quote a 5-year at-the-market interest rate swap (IRS) with a notional principal of s10 million, what should be the mid fixed swap rate of the IRS (ignoring bid/ask spread) so that the swap has zero value in the beginning? The floating rate is LIBOR and interest exchange is made once a year. b) One year later, the original 5-year interest rate swap as in Part a) has a maturity of four years left. Assuming the above zero rates remain unchanged, what is the value of the $10 million IRS (with four remaining payments to exchange) from the fixed rate payer's point of view? The fixed rate is equal to the rate you have calculated in Part a) 2. For all maturities the HK dollar (HKD) interest rate is 2% per annum and the Singapore dollar (SGD) rate is 3% per annum. The current value of the SGD is 5.8 HKD. In a swap agreement, a financial institution pays 3% per annum in SGD and receives 3% per annum in HKD. The principals in the two currencies are 10 million SGD and 55 million HKD. Payments are exchanged every year, with one exchange having just taken place. The swap will last 3 more years. What is the value of the swap to the financial institution? continuously Assume all interest rates are compounded