Chapter 7: Decision Case 7.3/ Chipotle and Panera (the assignment says use Under Armour and Columbia Sportswear: do not use those companies.answer the questions for Chipotle and Panera) - AR Turnover Ratio: Calculate the accounts receivable turnover ratios for both companies for the most recent year. Assume all sales are on credit. AR Turnover Ratio = Net Credit Sales/Average Accounts Receivable (AR) Net Credit Sales = Revenue Average AR = Balance AR 2015+Balance 2014/2 - AR Days: Calculate the average length of time it takes each company to collect its accounts receivable. # Days Sales in AR = Number of Days in Year (360)/AR Turnover Ratio - COMPARE: Compare the two companies on the basis of your calculations in parts (1) and (2).

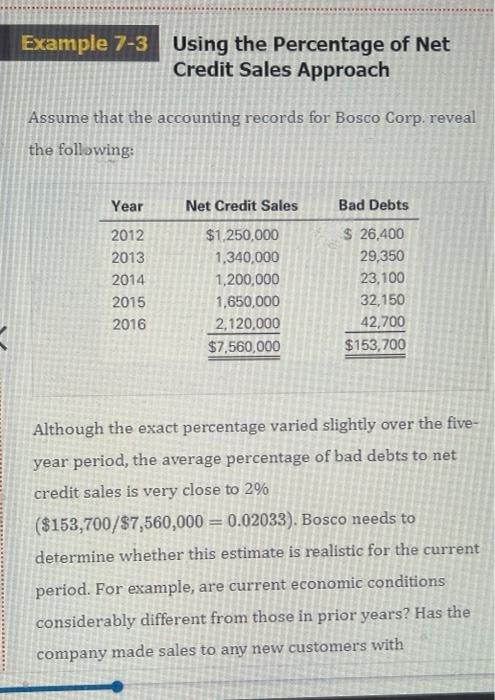

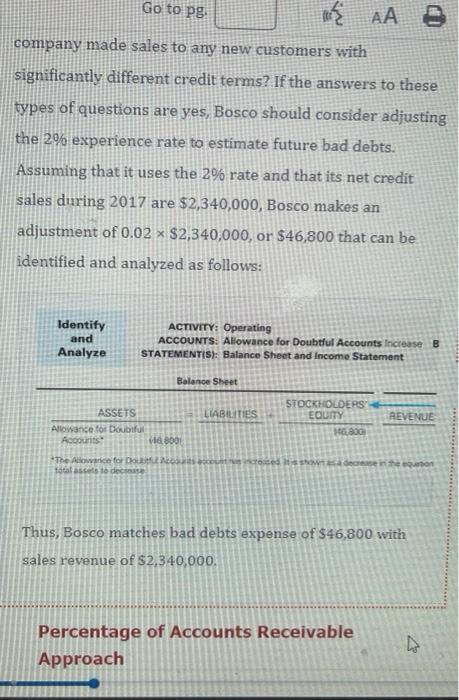

Example 7-3 Using the Percentage of Net Credit Sales Approach Assume that the accounting records for Bosco Corp. reveal the following: Year Net Credit Sales Bad Debts 2012 2013 2014 2015 2016 $1,250,000 1,340,000 1,200,000 1,650,000 2,120,000 $7,560,000 $ 26,400 29,350 23,100 32,150 42,700 $153,700 Although the exact percentage varied slightly over the five- year period, the average percentage of bad debts to net credit sales is very close to 2% ($153,700/$7,560,000 = 0.02033). Bosco needs to determine whether this estimate is realistic for the current period. For example, are current economic conditions considerably different from those in prior years? Has the company made sales to any new customers with Go to Pg. he AA company made sales to any new customers with significantly different credit terms? If the answers to these types of questions are yes, Bosco should consider adjusting the 296 experience rate to estimate future bad debts. Assuming that it uses the 2% rate and that its net credit sales during 2017 are $2,340,000, Bosco makes an adjustment of 0.02 * $2,340,000, or $46,800 that can be identified and analyzed as follows: Identify and Analyze ACTIVITY: Operating ACCOUNTS: Allowance for Doubtful Accounts increase B STATEMENT(S): Balance Sheet and Income Statement Balance Sheet LIABILITIES STOCKHOLDERS EQUITY H6800 ASSETS Allowance for Doubtful Accounts M 800 REVENUE The Allowance for Douto show the equation total costo de Thus, Bosco matches bad debts expense of $46,800 with sales revenue of S2,340,000. Percentage of Accounts Receivable Approach D identified and analyzed as follows: Identify and Analyze ACTIVITY: Operating ACCOUNTS: Allowance for Doubtful Accounts Increaso B STATEMENT(S): Balance Sheet and Income Statement Balance Sheet LIABILITIES STOCKHOLDERS EQUITY H6.2001 ASSETS Allowance for Doubtful Accounts 146,8001 REVENUE -The lawance for Accounts account created to shown as a decenthtu total assets to desse Thus, Bosco matches bad debts expense of $46,800 with sales revenue of $2,340,000. > Percentage of Accounts Receivable Approach A Some companies believe that they can more accurately estimate bad debts by relating them to the balance in the Accounts Receivable account at the end of the period rather than to the sales of the period. Example 7-4 Using the Percentage of Accounts Receivable Approach Example 7-3 Using the Percentage of Net Credit Sales Approach Assume that the accounting records for Bosco Corp. reveal the following: Year Net Credit Sales Bad Debts 2012 2013 2014 2015 2016 $1,250,000 1,340,000 1,200,000 1,650,000 2,120,000 $7,560,000 $ 26,400 29,350 23,100 32,150 42,700 $153,700 Although the exact percentage varied slightly over the five- year period, the average percentage of bad debts to net credit sales is very close to 2% ($153,700/$7,560,000 = 0.02033). Bosco needs to determine whether this estimate is realistic for the current period. For example, are current economic conditions considerably different from those in prior years? Has the company made sales to any new customers with Go to Pg. he AA company made sales to any new customers with significantly different credit terms? If the answers to these types of questions are yes, Bosco should consider adjusting the 296 experience rate to estimate future bad debts. Assuming that it uses the 2% rate and that its net credit sales during 2017 are $2,340,000, Bosco makes an adjustment of 0.02 * $2,340,000, or $46,800 that can be identified and analyzed as follows: Identify and Analyze ACTIVITY: Operating ACCOUNTS: Allowance for Doubtful Accounts increase B STATEMENT(S): Balance Sheet and Income Statement Balance Sheet LIABILITIES STOCKHOLDERS EQUITY H6800 ASSETS Allowance for Doubtful Accounts M 800 REVENUE The Allowance for Douto show the equation total costo de Thus, Bosco matches bad debts expense of $46,800 with sales revenue of S2,340,000. Percentage of Accounts Receivable Approach D identified and analyzed as follows: Identify and Analyze ACTIVITY: Operating ACCOUNTS: Allowance for Doubtful Accounts Increaso B STATEMENT(S): Balance Sheet and Income Statement Balance Sheet LIABILITIES STOCKHOLDERS EQUITY H6.2001 ASSETS Allowance for Doubtful Accounts 146,8001 REVENUE -The lawance for Accounts account created to shown as a decenthtu total assets to desse Thus, Bosco matches bad debts expense of $46,800 with sales revenue of $2,340,000. > Percentage of Accounts Receivable Approach A Some companies believe that they can more accurately estimate bad debts by relating them to the balance in the Accounts Receivable account at the end of the period rather than to the sales of the period. Example 7-4 Using the Percentage of Accounts Receivable Approach