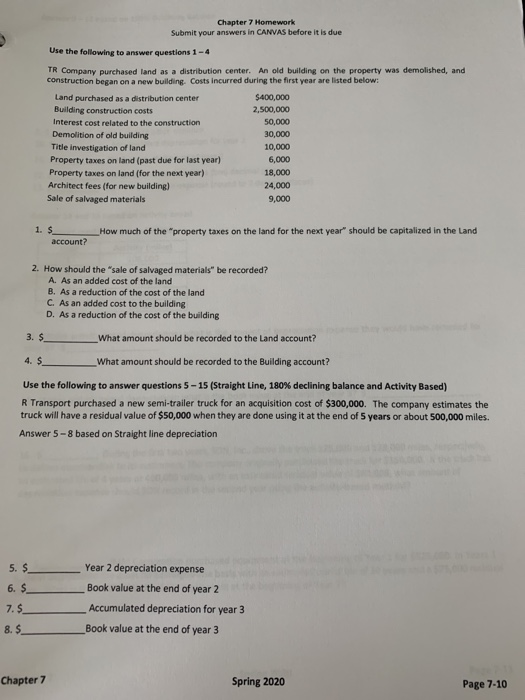

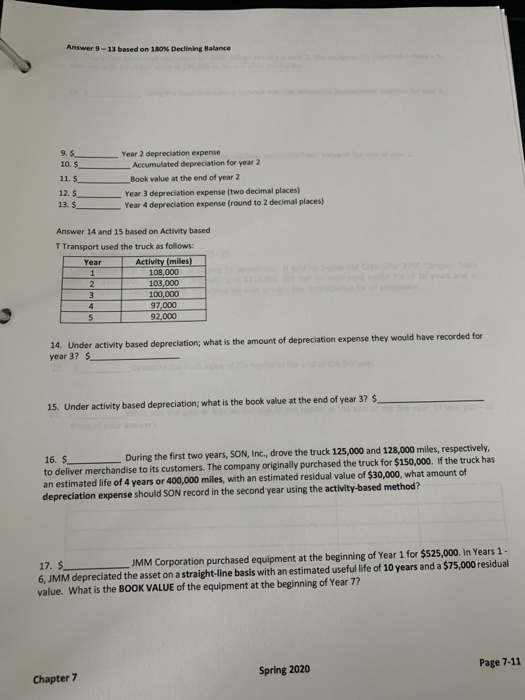

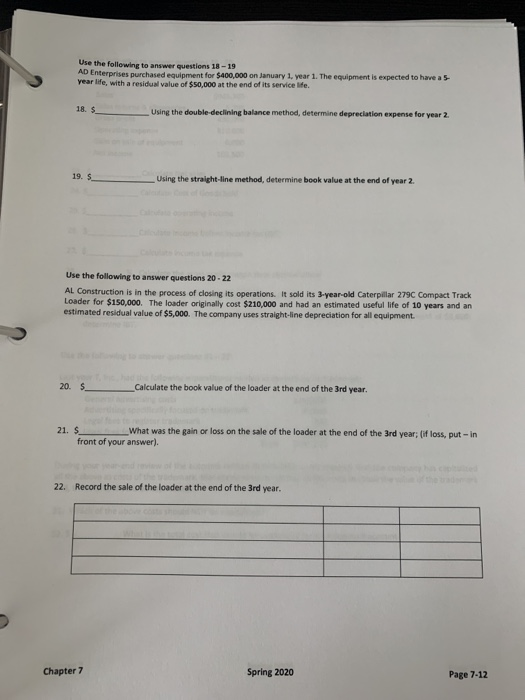

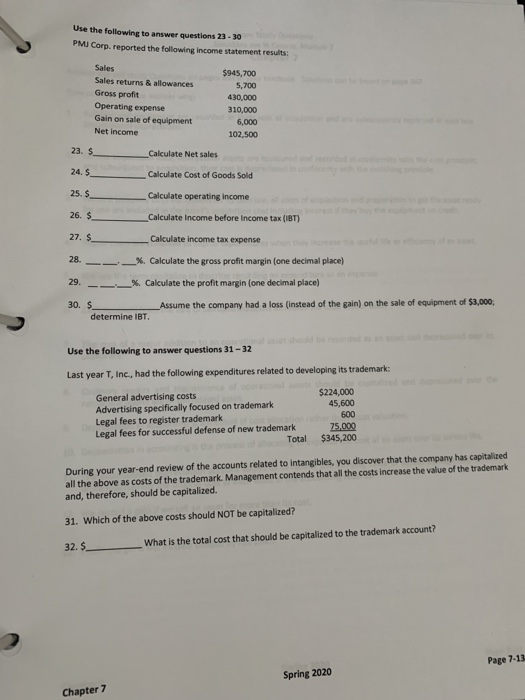

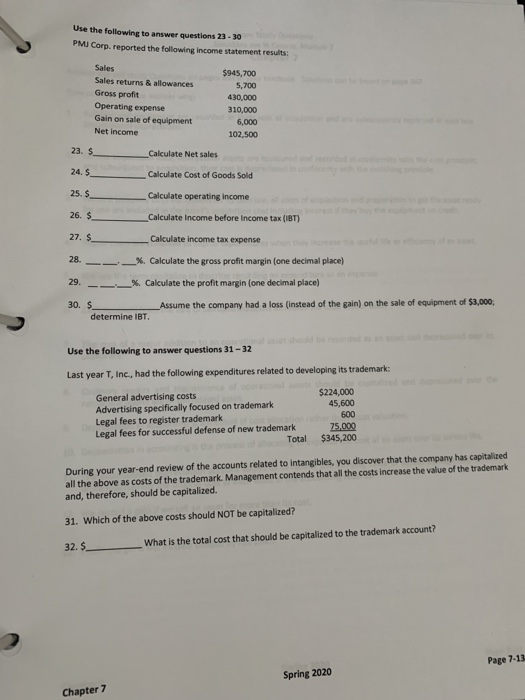

Chapter 7 Homework Submit your answers in CANVAS before it is due Use the following to answer questions 1-4 TR Company purchased land as a distribution center. An old building on the property was demolished, and construction began on a new building Costs incurred during the first year are listed below: Land purchased as a distribution center Building construction costs Interest cost related to the construction Demolition of old building Title investigation of land Property taxes on land (past due for last year) Property taxes on land (for the next year) Architect fees (for new building) Sale of salvaged materials $400,000 2,500,000 50,000 30,000 10,000 6,000 18,000 24,000 9,000 1. $ account? How much of the property taxes on the land for the next year should be capitalized in the Land 2. How should the sale of salvaged materials" be recorded? A. As an added cost of the land B. As a reduction of the cost of the land C. As an added cost to the building D. As a reduction of the cost of the building 3. $ _What amount should be recorded to the Land account? 4.$_ What amount should be recorded to the Building account? Use the following to answer questions 5-15 (Straight Line, 180% declining balance and Activity Based) R Transport purchased a new semi-trailer truck for an acquisition cost of $300,000. The company estimates the truck will have a residual value of $50,000 when they are done using it at the end of 5 years or about 500,000 miles. Answer 5-8 based on Straight line depreciation 5. $ 6. $ Year 2 depreciation expense Book value at the end of year 2 Accumulated depreciation for year 3 _Book value at the end of year 3 7.$_ 8.$__ Chapter 7 Spring 2020 Page 7-10 9-13 based on 10 Declining Balance 9. $ 10. $ 11.52 12. $ 13. S Year 2 depreciation expense Accumulated depreciation for year 2 _Book value at the end of year 2 -Year 3 depreciation expense (two decimal places) Year 4 depreciation expense round to 2 decimal places) Answer 14 and 15 based on Activity based T Transport used the truck as follows: Activity (miles) 108 000 103,000 100.000 97,000 92,000 14. Under activity based depreciation; what is the amount of depreciation expense they would have recorded for Year 3?$ 15. Under activity based depreciation; what is the book value at the end of year 3? 16. $_ During the first two years, SON, Inc., drove the truck 125,000 and 128,000 miles, respectively. to deliver merchandise to its customers. The company originally purchased the truck for $150,000. If the truck has an estimated life of 4 years or 400,000 miles, with an estimated residual value of $30,000, what amount of depreciation expense should SON record in the second year using the activity-based method? 17. S JMM Corporation purchased equipment at the beginning of Year 1 for $525,000. In Years 1 - 6, JMM depreciated the asset on a straight-line basis with an estimated useful life of 10 years and a $75,000 residual value. What is the BOOK VALUE of the equipment at the beginning of Year 7? Chapter 7 Spring 2020 Page 7-11 Use the following to answer questions 18-19 AD Enterprises purchased equipment for $400,000 on January 1 year 1. The equipment is expected to have a 5 year life, with a residual value of $50,000 at the end of its service life. 18. Using the double declining balance method, determine depreciation expense for year 2 19. $ Using the straight-line method, determine book value at the end of year 2 Use the following to answer questions 20-22 AL Construction is in the process of closing its operations. It sold its 3-year-old Caterpillar 279C Compact Track Loader for $150,000. The loader originally cost $210,000 and had an estimated useful life of 10 years and an estimated residual value of $5,000. The company uses straight-line depreciation for all equipment 20.$_ Calculate the book value of the loader at the end of the 3rd year. 21. $ _What was the gain or loss on the sale of the loader at the end of the 3rd year; ifloss, put-in front of your answer) 22. Record the sale of the loader at the end of the 3rd year. Chapter 7 Spring 2020 Page 7-12 Use the following to answer questions 23 - 30 PMI Corp. reported the following income statement results: Sales Sales returns & allowances Gross profit Operating expense Gain on sale of equipment Net income $945,700 5,700 430,000 310,000 6,000 102,500 23. $ Calculate Net sales Calculate Cost of Goods Sold Calculate operating income Calculate Income before income tax (IBT) Calculate income tax expense %. Calculate the gross profit margin (one decimal place) - - > % Calculate the profit margin (one decimal place) Assume the company had a loss (instead of the gain) on the sale of equipment of $3,000 determine IBT. Use the following to answer questions 31 - 32 Last year T, Inc., had the following expenditures related to developing its trademark: General advertising costs Advertising specifically focused on trademark Legal fees to register trademark Legal fees for successful defense of new trademark Total $224,000 45,600 600 75.000 $345,200 During your year-end review of the accounts related to intangibles, you discover that the company has capitalized all the above as costs of the trademark. Management contends that all the costs increase the value of the trademark and, therefore, should be capitalized. 31. Which of the above costs should NOT be capitalized? 32. $ What is the total cost that should be capitalized to the trademark account? Page 7-13 Spring 2020 Chapter 7