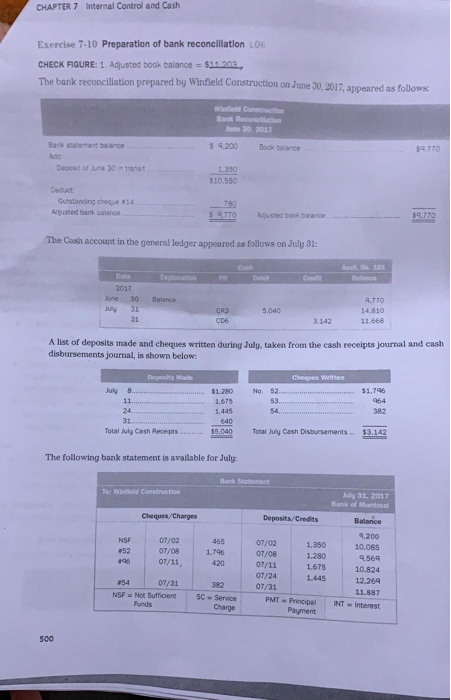

CHAPTER 7 Internal Control and Cash Exercise 7-10 Preparation of bank reconciliation L06 CHECK FIGURE: 1. Adjusted book balance = $11.203 The bank reconciliation prepared by Winfield Construction on June 30, 2017, appeared as follows Wind Construction 30 2017 Bank Statement balance $ 4.200 Book balance 34770 Deposit of June 30 ntrast $10.550 Deduct: Outstanding cheque #14 Austed bank bance... $ 4,770 Adjusted book balance The Cash account in the general ledger appeared as follows on July 31: Date Balance June July 30 31 CR3 5.040 2.770 14,810 11668 3.142 A list of deposits made and cheques written during July, taken from the cash receipts journal and cash disbursements journal, is shown below: Deposits Made Che Written July No. 52 $1,796 8. 11... 1675 1.445 382 Totally Cash Receipts ............ $5.040 Total July Cash Disbursements... $3.142 The following bank statement is available for July: To: Wind Construction July 31, 2007 Bank of Montreal Cheques/Charges Deposits/Credits NSF #52 196 07/02 07/08 07/11 1.746 420 1.350 1.280 07/02 07/08 07/11 1.675 07/24 1.445 07/31 PMT Principal Payment Balance 9.200 10.085 9.569 10.824 12.264 11.887 Interest #54 NSF 07/31 Not Sufficient Funds 382 Service SC Charge INT 500 Some of Fannin Co.'s cash receipts from customers are sent to the company in the mail. Fannin's book- keeper opens the letters and deposits the cash received each day. What internal control problem do you see in this arrangement? What changes would you recommend? Exercise 7-5 Petty cash fund L04 Cameron Co. established a $150 petty cash fund on January 1, 2017. One week later, on January 8, the fund contained $29.25 in cash and receipts for these expenditures: postage, $42.00; transportation-in, $27.00; store supplies, $32.75; and a withdrawal of $19.00 by Jim Cameron, the owner. Cameron uses the perpetual method to account for merchandise inventory a. Prepare the journal entry to establish the fund on January 1. b. Prepare a summary of the petty cash payments similar to Exhibit 7.3 and record the entry to reimburse the fund on January 8. Analysis Component: If the January 8 entry to reimburse the fund were not recorded and financial state- ments were prepared for the month of January, would profit be over or understated? 498