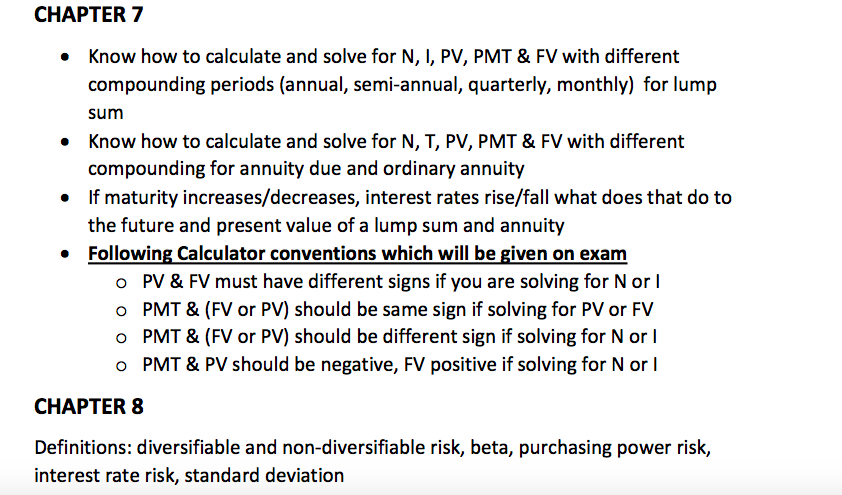

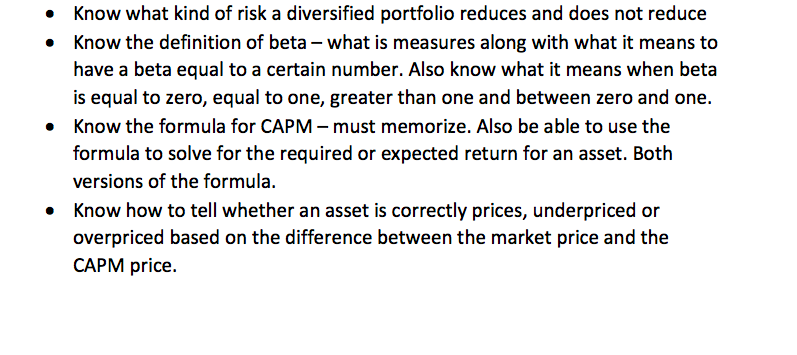

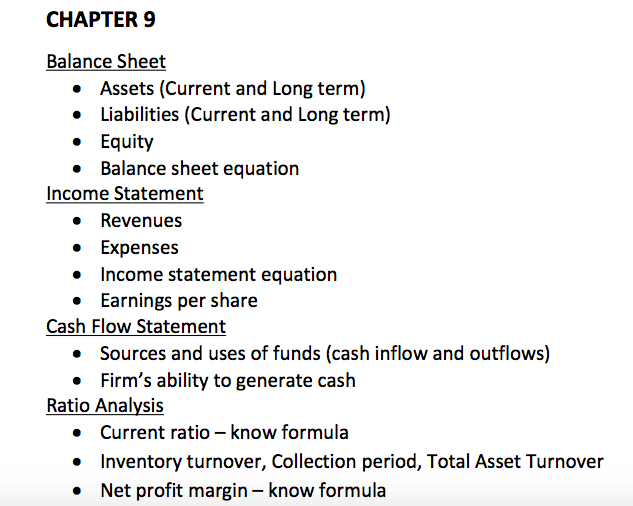

CHAPTER 7 Know how to calculate and solve for N, I, PV, PMT & FV with different compounding periods (annual, semi-annual, quarterly, monthly) for lump sum Know how to calculate and solve for N, T, PV, PMT & FV with different compounding for annuity due and ordinary annuity If maturity increases/decreases, interest rates rise/fall what does that do to the future and present value of a lump sum and annuity Following Calculator conventions which will be given on exam o o o o PV & FV must have different signs if you are solving for N orl PMT& (FV or PV) should be same sign if solving for PV or FV PMT & (FV or PV) should be different sign if solving for N or l PMT & PV should be negative, FV positive if solving for N or l CHAPTER 8 Definitions: diversifiable and non-diversifiable risk, beta, purchasing power risk, interest rate risk, standard deviation Know what kind of risk a diversified portfolio reduces and does not reduce . Know the definition of beta what is measures along with what it means to have a beta equal to a certain number. Also know what it means when beta is equal to zero, equal to one, greater than one and between zero and one. Know the formula for CAPM - must memorize. Also be able to use the formula to solve for the required or expected return for an asset. Both versions of the formula. Know how to tell whether an asset is correctly prices, underpriced or overpriced based on the difference between the market price and the CAPM price. . CHAPTER 9 Balance Sheet Assets (Current and Long term) Liabilities (Current and Long term) . Equity Balance sheet equation Income Statement e Revenues Expenses Income statement equation . Earnings per share Cash Flow Statement Sources and uses of funds (cash inflow and outflows) Firm's ability to generate cash Ratio Analysis Current ratio-know formula Inventory turnover, Collection period, Total Asset Turnover Net profit margin- know formula o ROA, ROE-know formulas Debt/Equity-know formula Ratio comparisons and difficulties CHAPTER 7 Know how to calculate and solve for N, I, PV, PMT & FV with different compounding periods (annual, semi-annual, quarterly, monthly) for lump sum Know how to calculate and solve for N, T, PV, PMT & FV with different compounding for annuity due and ordinary annuity If maturity increases/decreases, interest rates rise/fall what does that do to the future and present value of a lump sum and annuity Following Calculator conventions which will be given on exam o o o o PV & FV must have different signs if you are solving for N orl PMT& (FV or PV) should be same sign if solving for PV or FV PMT & (FV or PV) should be different sign if solving for N or l PMT & PV should be negative, FV positive if solving for N or l CHAPTER 8 Definitions: diversifiable and non-diversifiable risk, beta, purchasing power risk, interest rate risk, standard deviation Know what kind of risk a diversified portfolio reduces and does not reduce . Know the definition of beta what is measures along with what it means to have a beta equal to a certain number. Also know what it means when beta is equal to zero, equal to one, greater than one and between zero and one. Know the formula for CAPM - must memorize. Also be able to use the formula to solve for the required or expected return for an asset. Both versions of the formula. Know how to tell whether an asset is correctly prices, underpriced or overpriced based on the difference between the market price and the CAPM price. . CHAPTER 9 Balance Sheet Assets (Current and Long term) Liabilities (Current and Long term) . Equity Balance sheet equation Income Statement e Revenues Expenses Income statement equation . Earnings per share Cash Flow Statement Sources and uses of funds (cash inflow and outflows) Firm's ability to generate cash Ratio Analysis Current ratio-know formula Inventory turnover, Collection period, Total Asset Turnover Net profit margin- know formula o ROA, ROE-know formulas Debt/Equity-know formula Ratio comparisons and difficulties