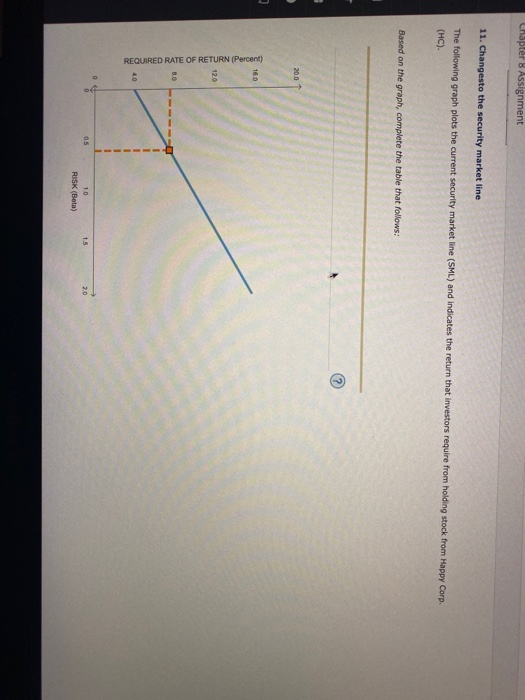

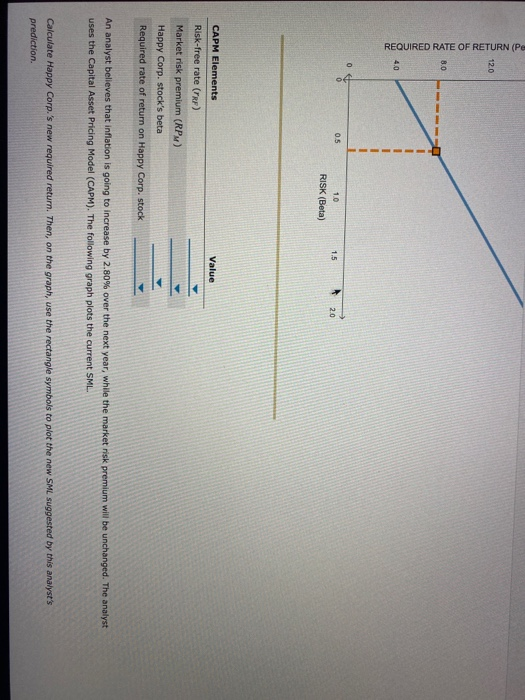

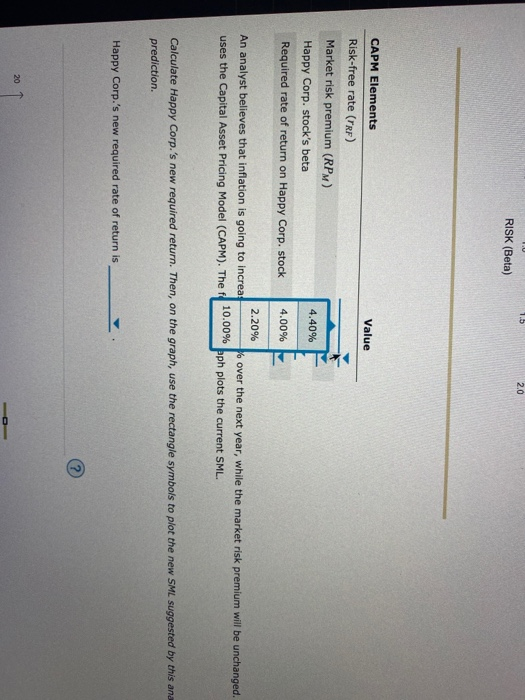

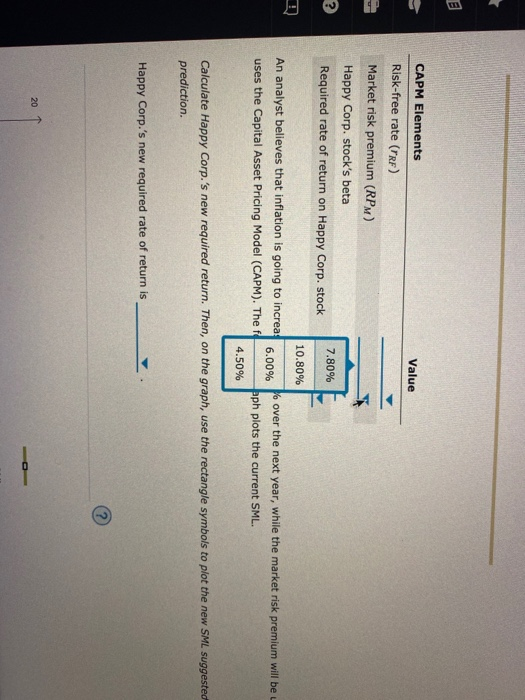

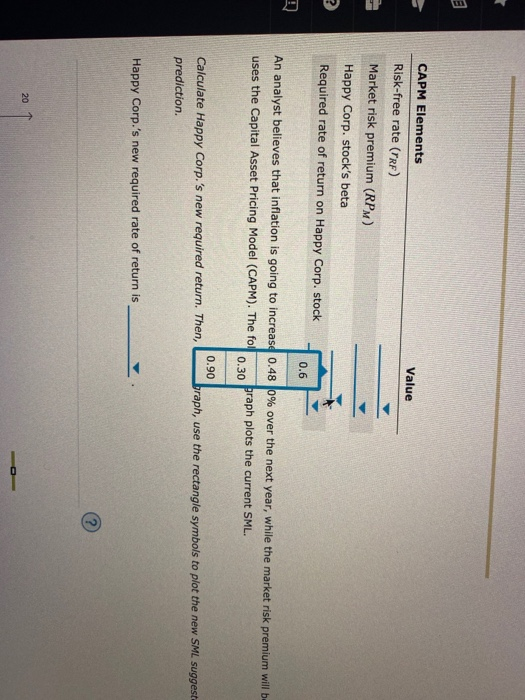

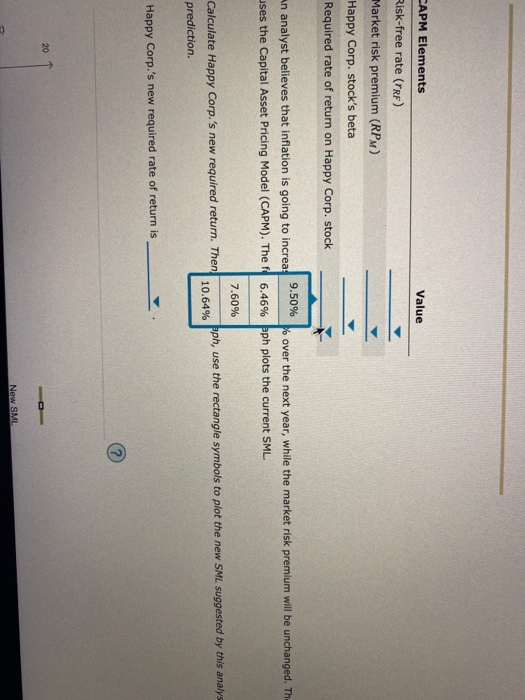

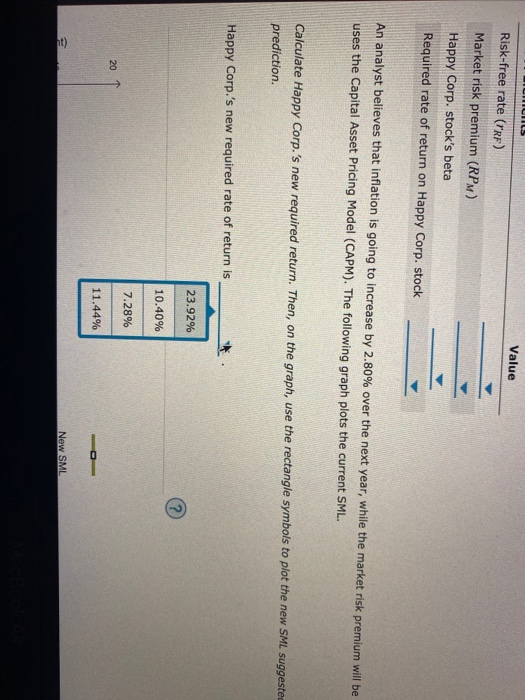

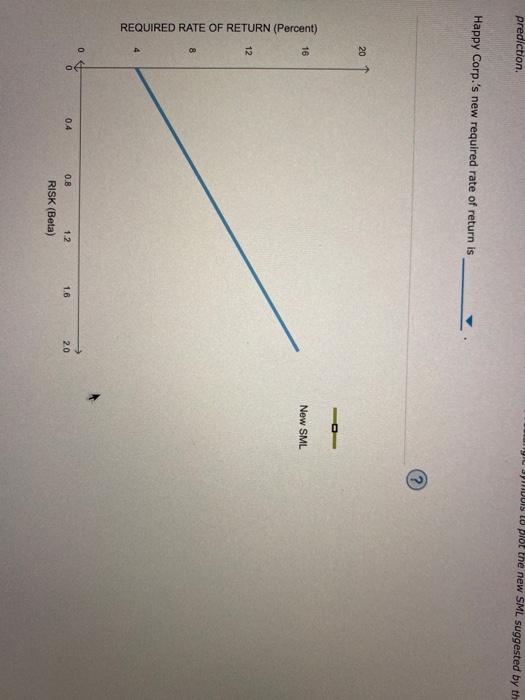

Chapter 8 Assignment 11. Changesto the security market line The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC). Based on the graph, complete the table that follows: 200 16.0 12.0 REQUIRED RATE OF RETURN (Percent) 8.0 1 1 1 0.5 1.5 20 10 RISK (Beta) 12.0 REQUIRED RATE OF RETURN (Pe 8.0 4.0 0.5 10 1.5 2.0 RISK (Beta) Value CAPM Elements Risk-free rate (TRF) Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on Happy Corp. stock An analyst believes that inflation is going to increase by 2.80% over the next year, while the market risk premium will be unchanged. The analyst uses the Capital Asset Pricing Model (CAPM). The following graph plots the current SML. Calculate Happy Corp.'s new required return. Then, on the graph, use the rectangle symbols to plot the new SML suggested by this analyst's prediction. 1.5 2.0 RISK (Beta) CAPM Elements Value 17 Risk-free rate (TRF) Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on Happy Corp. stock 4.40% 4.00% 2.20% An analyst believes that inflation is going to increa uses the Capital Asset Pricing Model (CAPM). The 10.00% y over the next year, while the market risk premium will be unchanged. ph plots the current SML. Calculate Happy Corp.'s new required return. Then, on the graph, use the rectangle symbols to plot the new SML suggested by this ana prediction. Happy Corp.'s new required rate of return is 20 CAPM Elements Value Risk-free rate (TRF) Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on Happy Corp. stock 7.80% 10.80% An analyst believes that inflation is going to increa: uses the Capital Asset Pricing Model (CAPM). The 6.00% Vo over the next year, while the market risk premium will be pph plots the current SML. 4.50% Calculate Happy Corp.'s new required return. Then, on the graph, use the rectangle symbols to plot the new SML suggested prediction. Happy Corp.'s new required rate of return is 20 CAPM Elements Value Risk-free rate (TRF) Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on Happy Corp. stock 0.6 An analyst believes that inflation is going to increasd 0.48 0% over the next year, while the market risk premium will b- uses the Capital Asset Pricing Model (CAPM). The fol 0.30 praph plots the current SML. Calculate Happy Corp.'s new required return. Then, prediction. 0.90 braph, use the rectangle symbols to plot the new SML suggest Happy Corp.'s new required rate of return is 20 CAPM Elements Value Risk-free rate (TRF) Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on Happy Corp. stock 9.50% An analyst believes that inflation is going to increa y over the next year, while the market risk premium will be unchanged. Th uses the Capital Asset Pricing Model (CAPM). The f 6.46% pph plots the current SML. 7.60% pph, use the rectangle symbols to plot the new SML suggested by this analys Calculate Happy Corp.'s new required return. Then prediction. 10.64% Happy Corp.'s new required rate of return is 20 Now SML Value Risk-free rate (TRF) Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on Happy Corp. stock An analyst believes that inflation is going to increase by 2.80% over the next year, while the market risk premium will be uses the Capital Asset Pricing Model (CAPM). The following graph plots the current SML. Calculate Happy Corp.'s new required return. Then, on the graph, use the rectangle symbols to plot the new SML suggested prediction. Happy Corp.'s new required rate of return is 23.92% 10.40% 7.28% 20 11.44% nt) New SML prediction IU DUIS 10 plot the new SML suggested by th Happy Corp.'s new required rate of return is 20 O 16 New SML 12 REQUIRED RATE OF RETURN (Percent) 4 0 0.4 1.6 2.0 0.8 12 RISK (Beta)