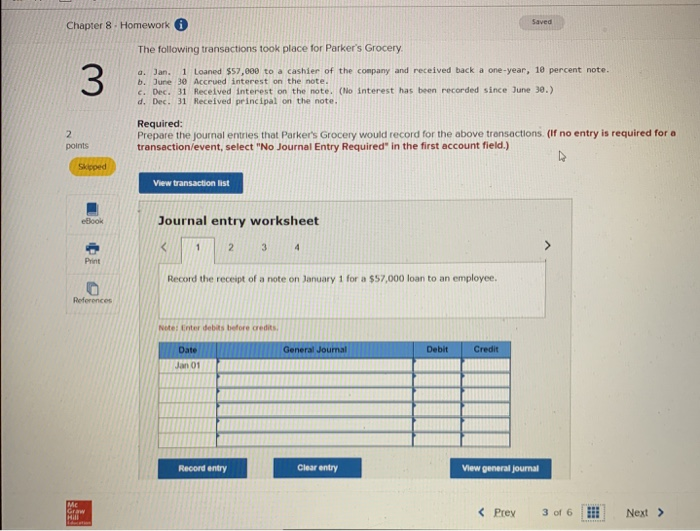

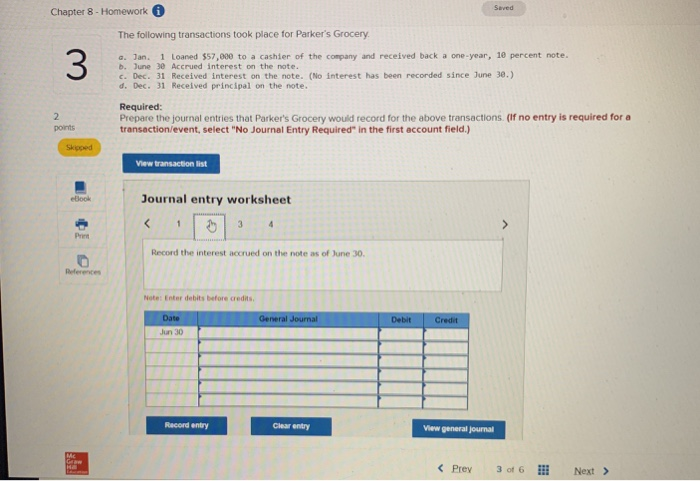

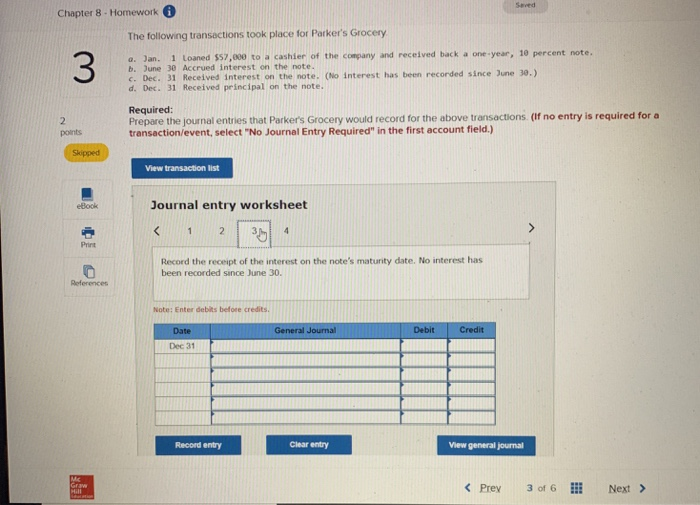

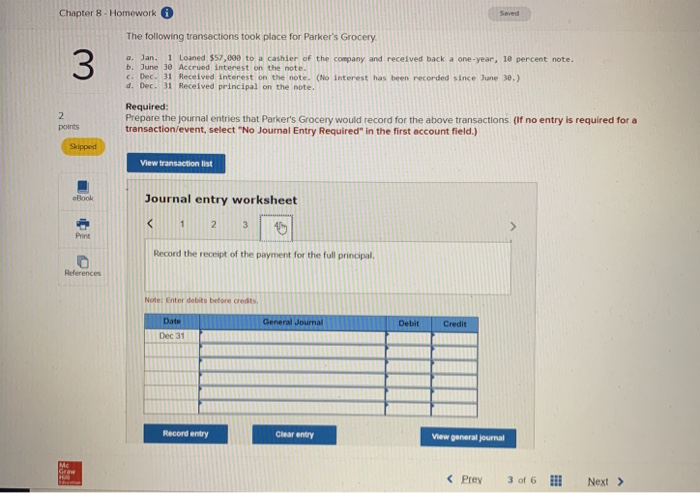

Chapter 8 Homework Saved The following transactions took place for Parker's Grocery a. Jan. 1 Loaned $57,000 to a cashier of the company and received back a one-year, 10 percent note. b. June 30 Accrued interest on the note. c. Dec. 31 Received interest on the note. (No interest has been recorded since June 30.) d. Dec. 31 Received principal on the note. Required Prepare the journal entries that Parkers Grocery would record for the above trensactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) points View transaction list eBlook Journal entry worksheet Print Record the receipt of a note on January 1 for a $57,000 loan to an employee. References Note: Enter debits before credits Debit Credit Date Jan 01 General Journal Reoord entry Clear entry View general journal Chapter 8- Homework The following transactions took place for Parker's Grocery a. Jan. 1 Loaned $57,000 to a cashier of the company and received back a one-year, 10 percent note. b. June 3e Accrued interest on the note. c. Dec. 31 Received interest on the note. (No interest has been recorded since June 30.) d. Dec. 31 Received principal on the note. Required: Prepare the journal entries that Parker's Grocery would record for the above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) points View transaction list Journal entry worksheet eBook Prien Record the interest aocrued on the note as of June 30 References Note: Enter debits before credits General Journal Jun 30 Racord entry Clear entry iew general journal Seved Chapter 8 - Homework The following transactions took place for Parker's Grocery a. Jan. 1 Loaned $57,000 to a cashier of the conpany and received back a one-year, 10 percent note b. June 30 Accrued interest on the note. c. Dec. 31 Received interest on the note. (No interest has been recorded since June 30.) d. Dec. 31 Received principal on the note. Required Prepare the journal entries that Parkers Grocery would record for the above transactions (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) points View transaction list eBook Journal entry worksheet Print Record the receipt of the interest on the note's maturity date. No interest has been recorded since June 30. References Note: Enter debits before credits General Journal DebitCredit Dec 31 Record entry Clear entry View general journal KPrev 3 of 6 Next> Chapter 8 -Homework Seved The following transections took place for Parker's Grocery o. Jan.1 Loaned $57,800 to a cashier of the company and received back a one-year, 10 percent note. b. June 30 Accrued interest on the note c. Dec. 31 Received interest on the note. (No interest has been recorded since une 30.) d. Dec. 31 Received principal on the note. Required Prepare the journal entries that Parkers Grocery would record for the above transactions (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) points View transaction list eBook Journal entry worksheet Print Record the receipt of the payment for the full principal, References General Journal Debit Credit Dec 31 Record entry clear entry iew general journal