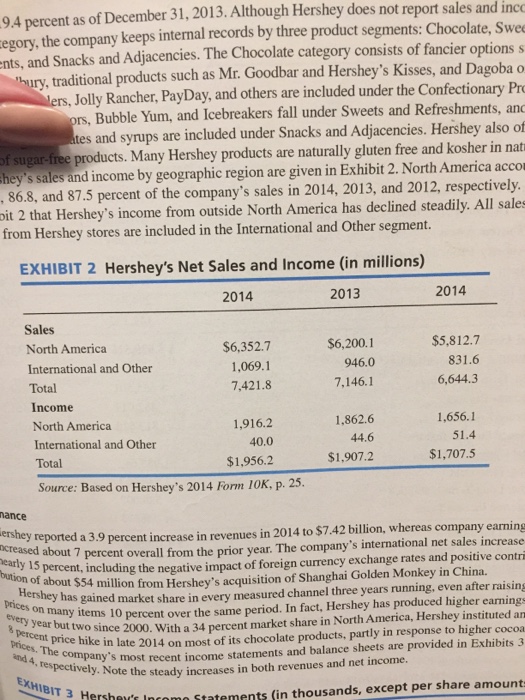

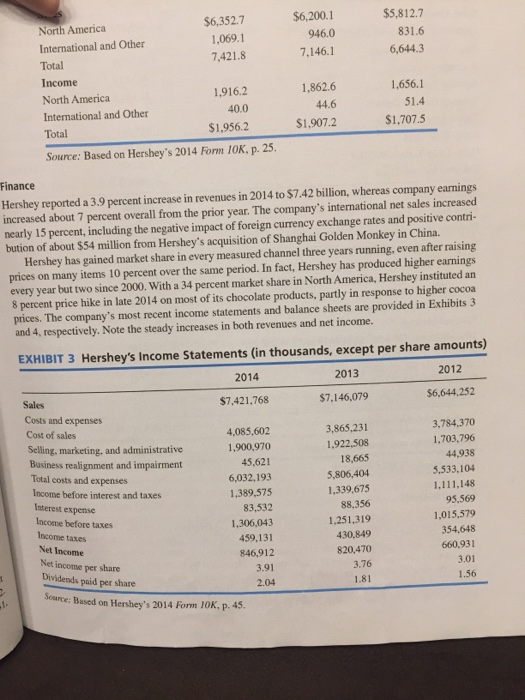

CHAPTER 8 IMPLEMENTING STRATEGIES: MARKETING, FINANCE/ACCOUN uctions Amount Hershey needs: S1 billion to build four new manufacturing plants outside the United States nterest rate: 3% Tax rate: 430/1,251 34% Stock price: $106 as of January 1, 2015 Number of shares outstanding: 220 million Prepare an EPS/EBIT analysis for Hershey. Determine whether Hershey should use all debt,all k, or a 50-50 combination of debt and stock to finance this market-development strategy op an EPS/EBIT chart after completing the EPS/EBIT table. ve a 3-sentence recommendation for Hershey's CFO, Mr. David Tacka. EXERCISE 8D Prepare Projected Financial Statements for Hershey Company urpose This exercise is designed to give you experience preparing projected financial statements. This analy- is is a strategic finance/accounting issue because it allows managers to anticipate and evaluate the expected results of various strategy-implementation approaches. Instructions Step 1 Work with a classmate. Develop a projected 2016 income statement and balance sheet for Hershey. Assume that Hershey plans to raise $900 million to increase its market share, and plans to obtain 50 percent financing from a bank and 50 percent financing from a stock issu- ance. Make other assumptions as needed, and state them clearly in written form. Compute Hershey's projected current ratio, debt-to-equity ratio, and return-on-investment ratio. How do your projected ratios compare to prior year ratios? Why is it important to make this comparison? To begin your analysis, start with the Hershey's 2015 actual financial statements given at http:/finance.yahoo.com or the company website. Step 2 Step 3 Bring your projected statements to class and discuss any problems or questions you Ste4 Compare your projected statements to the statements of other students. What major differ- encountered ences exist between your analysis and the work of other students? Determine the Cash Value of Hershey Company EXERCISE 8E Thisimply good business to continually know the cash value (corporate valuation) of your company. Purposeod CHAPTER 8 IMPLEMENTING STRATEGIES: MARKETING, FINANCE/ACCOUN uctions Amount Hershey needs: S1 billion to build four new manufacturing plants outside the United States nterest rate: 3% Tax rate: 430/1,251 34% Stock price: $106 as of January 1, 2015 Number of shares outstanding: 220 million Prepare an EPS/EBIT analysis for Hershey. Determine whether Hershey should use all debt,all k, or a 50-50 combination of debt and stock to finance this market-development strategy op an EPS/EBIT chart after completing the EPS/EBIT table. ve a 3-sentence recommendation for Hershey's CFO, Mr. David Tacka. EXERCISE 8D Prepare Projected Financial Statements for Hershey Company urpose This exercise is designed to give you experience preparing projected financial statements. This analy- is is a strategic finance/accounting issue because it allows managers to anticipate and evaluate the expected results of various strategy-implementation approaches. Instructions Step 1 Work with a classmate. Develop a projected 2016 income statement and balance sheet for Hershey. Assume that Hershey plans to raise $900 million to increase its market share, and plans to obtain 50 percent financing from a bank and 50 percent financing from a stock issu- ance. Make other assumptions as needed, and state them clearly in written form. Compute Hershey's projected current ratio, debt-to-equity ratio, and return-on-investment ratio. How do your projected ratios compare to prior year ratios? Why is it important to make this comparison? To begin your analysis, start with the Hershey's 2015 actual financial statements given at http:/finance.yahoo.com or the company website. Step 2 Step 3 Bring your projected statements to class and discuss any problems or questions you Ste4 Compare your projected statements to the statements of other students. What major differ- encountered ences exist between your analysis and the work of other students? Determine the Cash Value of Hershey Company EXERCISE 8E Thisimply good business to continually know the cash value (corporate valuation) of your company. Purposeod