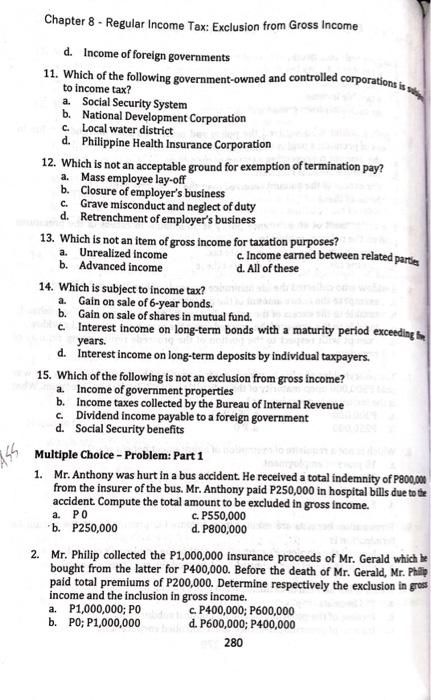

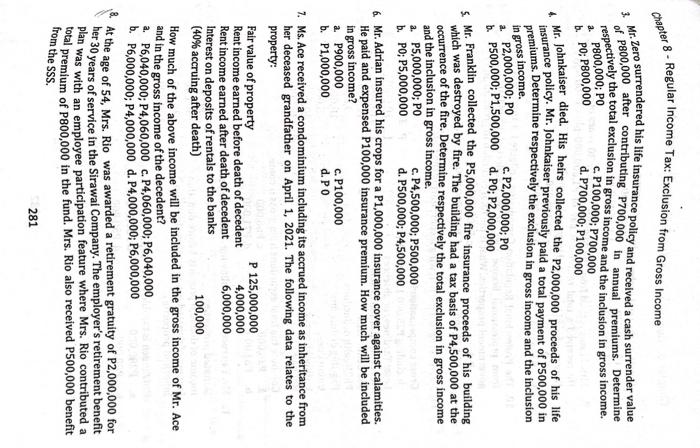

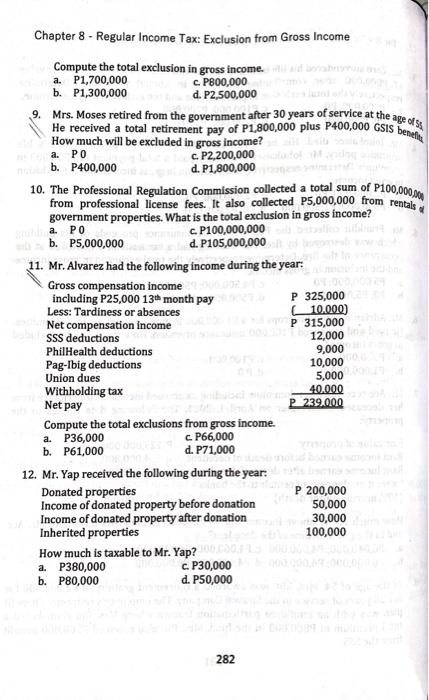

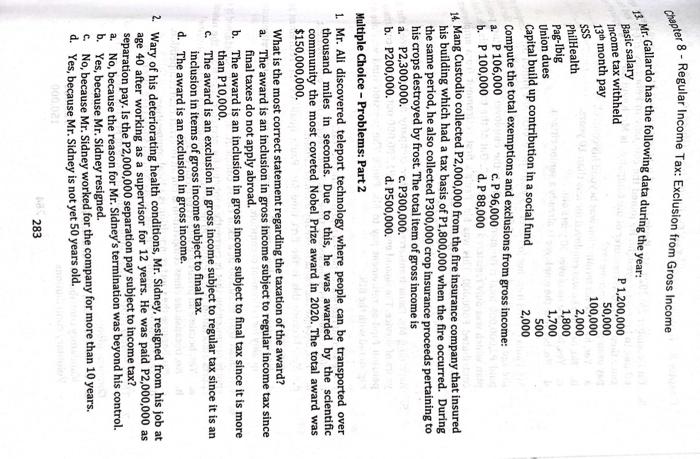

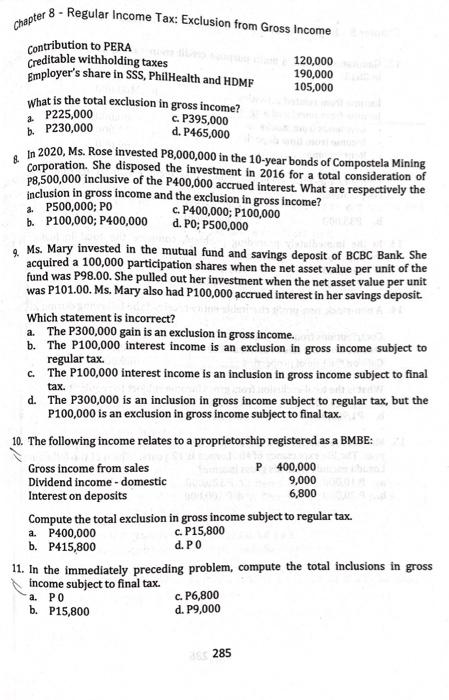

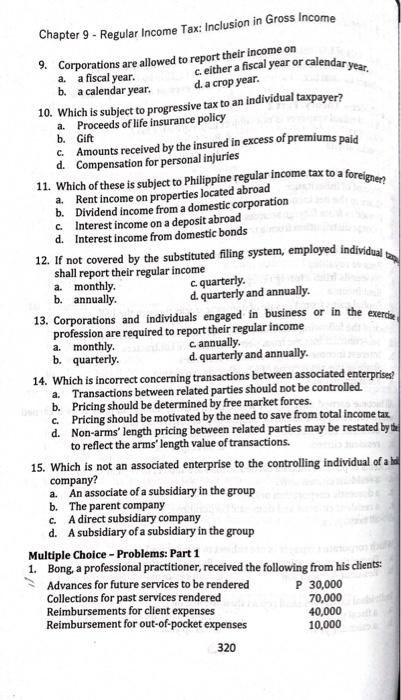

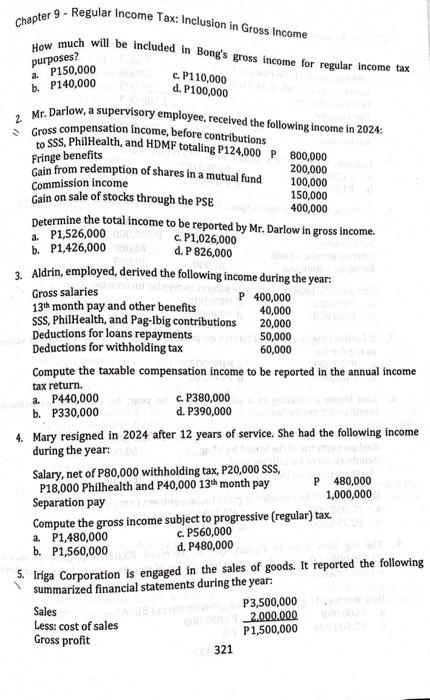

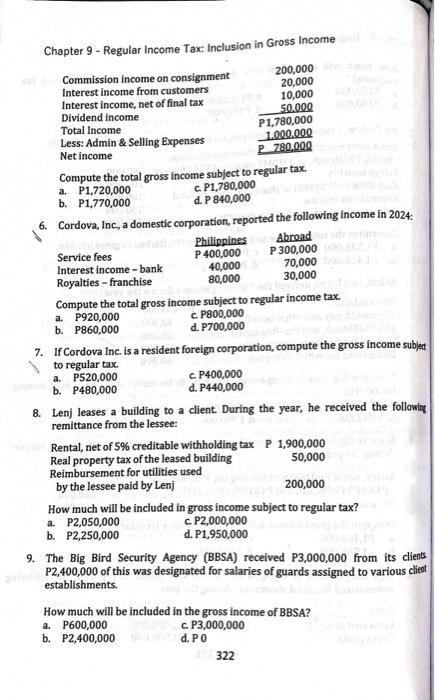

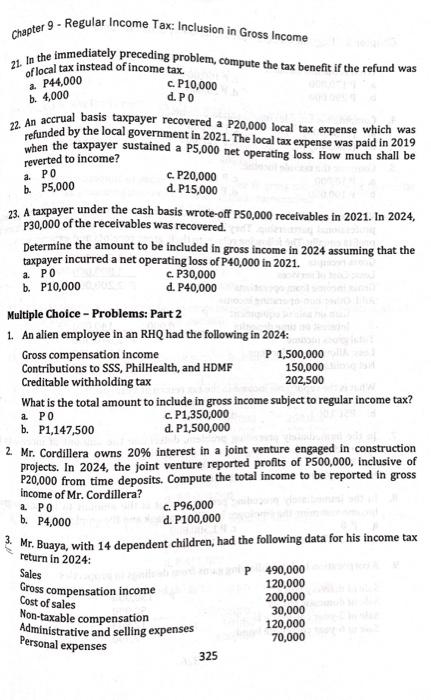

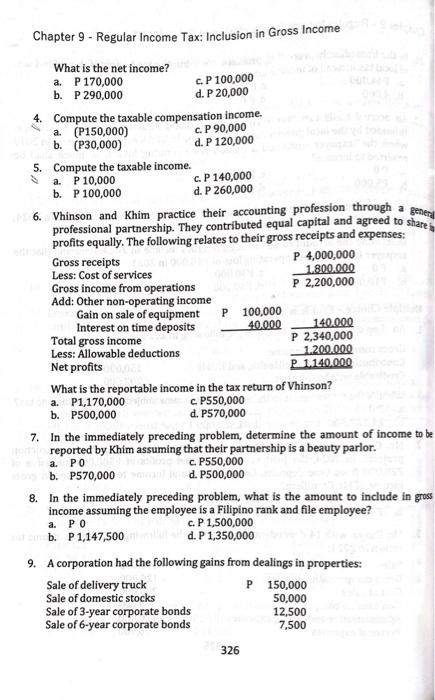

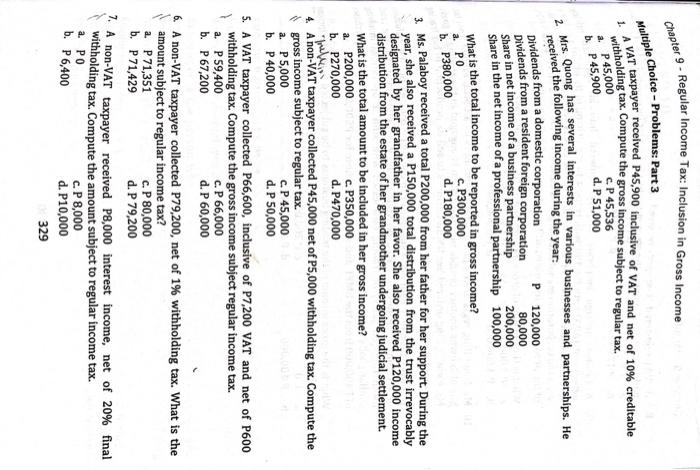

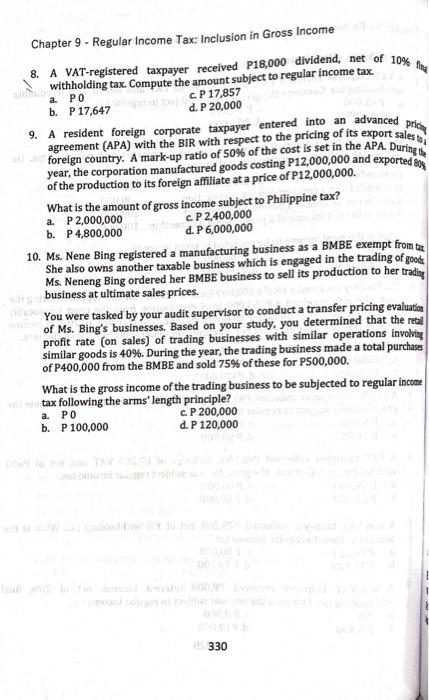

Chapter 8 - Regular Income Tax: Exclusion from Gross Income d. Income of foreign governments 11. Which of the following government-owned and controlled corporations is to income tax? a. Social Security System b. National Development Corporation c. Local water district d. Philippine Health Insurance Corporation 12. Which is not an acceptable ground for exemption of termination pay? a. Mass employee lay-off b. Closure of employer's business c. Grave misconduct and neglect of duty d. Retrenchment of employer's business 13. Which is not an item of gross income for taxation purposes? a. Unrealized income b. Advanced income c. Income earned between related partles d. All of these 14. Which is subject to income tax? a. Gain on sale of 6-year bonds. b. Gain on sale of shares in mutual fund. c. Interest income on long-term bonds with a maturity period exceeding in years. d. Interest income on long-term deposits by individual taxpayers. 15. Which of the following is not an exclusion from gross income? a. Income of government properties b. Income taxes collected by the Bureau of Internal Revenue c. Dividend income payable to a foreign government d. Social Security benefits Multiple Choice - Problem: Part 1 1. Mr. Anthony was hurt in a bus accident. He received a total indemnity of P800,00 from the insurer of the bus. Mr. Anthony paid P250,000 in hospital bills due to the accident. Compute the total amount to be excluded in gross income. a. PO c. P550,000 b. P250,000 d. P800,000 2. Mr. Philip collected the P1,000,000 insurance proceeds of Mr. Gerald which k bought from the latter for P400,000. Before the death of Mr. Gerald, Mr. Phlip paid total premiums of P200,000. Determine respectively the exclusion in gross income and the inclusion in gross income. a. P1,000,000;PO c. P400,000;P600,000 b. PO;P1,000,000 d. P600,000;P400,000 280 chapter 8 - Regular Income Tax: Exclusion from Gross Income 3. Mr. Zero surrendered his life insurance policy and received a cash surrender value of P800,000 after contributing P700,000 in annual premiums. Determine respectively the total exclusion in gross income and the inclusion in gross income. a. P800,000; PO c. P100,000; P700,000 b. P0;P800,000 d. P700,000; P100,000 4. Mr. Johnkaiser died. His heirs collected the P2,000,000 proceeds of his life insurance policy. Mr. Johnkaiser previously paid a total payment of P500,000 in premiums. Determine respectively the exclusion in gross income and the inclusion in gross income. a. P2,000,000; PO c. P2,000,000;P0 b. P500,000; P1,500,000 d. P0;P2,000,000 5. Mr. Franklin collected the P5,000,000 fire insurance proceeds of his building which was destroyed by fire. The building had a tax basis of P4,500,000 at the occurrence of the fire. Determine respectively the total exclusion in gross income and the inclusion in gross income. a. P5,000,000; P0 c. P4,500,000;P500,000 b. P0; P5,000,000 d. P500,000;P4,500,000 6. Mr. Adrian insured his crops for a P1,000,000 insurance cover against calamities. He paid and expensed P100,000 insurance premium. How much will be included in gross income? a. P900,000 c. P100,000 b. P1,000,000 d. P0 7. Ms. Ace received a condominium including its accrued income as inheritance from her deceased grandfather on April 1, 2021. The following data relates to the property: How much of the above income will be included in the gross income of Mr. Ace and in the gross income of the decedent? a. P6,040,000;P4,060,000 c. P4,060,000;P6,040,000 b. P6,000,000;P4,000,000 d. P4,000,000;P6,000,000 8. At the age of 54 , Mrs. Rio was awarded a retirement gratuity of P2,000,000 for her 30 years of service in the Sirawai Company. The employer's retirement benefit plan was with an employee participation feature where Mrs. Rio contributed a total premium of P800,000 in the fund. Mrs. Rio also received P500,000 benefit from the SSS. Chapter 8 - Regular Income Tax: Exclusion from Gross Income Compute the total exclusion in gross income. a. P1,700,000 c. P800,000 b. P1,300,000 d. P2,500,000 9. Mrs. Moses retired from the government after 30 years of service at the age of SSgg He received a total retirement pay of P1,800,000 plus P400,000 GSIS beneffit How much will be excluded in gross income? a. PO c. P2,200,000 b. P400,000 d. P1,800,000 10. The Professional Regulation Commission collected a total sum of P100,000,Na from professional license fees. It also collected P5,000,000 from rentals of government properties. What is the total exclusion in gross income? a. P0 c. P100,000,000 b. P5,000,000 d. P105,000,000 11. Mr. Alvarez had the following income during the year: (hapter 8 - Regular Income Tax: Exclusion from Gross Income 1. Mr. Gallardo has the following data durine the unn.. 14. Mang Custodio collected P2,000,000 from the fire insurance company that insured his building which had a tax basis of P1,800,000 when the fire occurred. During the same period, he also collected P300,000 crop insurance proceeds pertaining to his crops destroyed by frost. The total item of gross income is a. P2,300,000. c. P300,000. b. P200,000. d. P500,000. Multiple Choice - Problems: Part 2 1. Mr. Ali discovered teleport technology where people can be transported over thousand miles in seconds. Due to this, he was awarded by the scientific community the most coveted Nobel Prize award in 2020. The total award was $150,000,000. What is the most correct statement regarding the taxation of the award? a. The award is an inclusion in gross income subject to regular income tax since final taxes do not apply abroad. b. The award is an inclusion in gross income subject to final tax since it is more than P10,000. c. The award is an exclusion in gross income subject to regular tax since it is an inclusion in items of gross income subject to final tax. d. The award is an exclusion in gross income. 2. Wary of his deteriorating health conditions, Mr. Sidney, resigned from his job at age 40 after working as a supervisor for 12 years. He was paid P2,000,000 as separation pay. Is the P2,000,000 separation pay subject to income tax? a. No, because the reason for Mr. Sidney's termination was beyond his control. b. Yes, because Mr. Sidney resigned. c. No, because Mr. Sidney worked for the company for more than 10 years. d. Yes, because Mr. Sidney is not yet 50 years old. chapter 8 - Regular Income Tax: Exclusion from Gross Income What is the total exclusion in gross income? a. P225,000 c. P395,000 b. P230,000 d. P465,000 8. In 2020, Ms. Rose invested P8,000,000 in the 10 -year bonds of Compostela Mining corporation. She disposed the investment in 2016 for a total consideration of P8,500,000 inclusive of the P400,000 accrued interest. What are respectively the inclusion in gross income and the exclusion in gross income? a. P500,000; P0 c. P400,000; P100,000 b. P100,000; P400,000 d. P0;P500,000 9. Ms. Mary invested in the mutual fund and savings deposit of BCBC Bank. She acquired a 100,000 participation shares when the net asset value per unit of the fund was P98.00. She pulled out her investment when the net asset value per unit was P101.00. Ms. Mary also had P100,000 accrued interest in her savings deposit. Which statement is incorrect? a. The P300,000 gain is an exclusion in gross income. b. The P100,000 interest income is an exclusion in gross income subject to regular tax. c. The P100,000 interest income is an inclusion in gross income subject to final tax. d. The P300,000 is an inclusion in gross income subject to regular tax, but the P100,000 is an exclusion in gross income subject to final tax. 10. The following income relates to a proprietorship registered as a BMBE: Compute the total exclusion in gross income subject to regular tax. a. P400,000 c. P15,800 b. P415,800 d. P0 11. In the immediately preceding problem, compute the total inclusions in gross income subject to final tax. a. P0 c. P6,800 b. P15,800 d. P9,000 Chapter 9 - Regular Income Tax: Inclusion in Gross Income 9. Corporations are allowed to report their income on a. a fiscal year. c. either a fiscal year or calendar year. b. a calendar year. d. a crop year. 10. Which is subject to progressive tax to an individual taxpayer? a. Proceeds of life insurance policy b. Gift c. Amounts received by the insured in excess of premiums paid d. Compensation for personal injuries 11. Which of these is subject to Philippine regular income tax to a foreignen? a. Rent income on properties located abroad b. Dividend income from a domestic corporation c. Interest income on a deposit abroad d. Interest income from domestic bonds 12. If not covered by the substituted filing system, employed individual tat shall report their regular income a. monthly. c. quarterly. b. annually. d. quarterly and annually. 13. Corporations and individuals engaged in business or in the exercise profession are required to report their regular income a. monthly. c. annually. b. quarterly. d. quarterly and annually. 14. Which is incorrect concerning transactions between associated enterprise? a. Transactions between related parties should not be controlled. b. Pricing should be determined by free market forces. c. Pricing should be motivated by the need to save from total income tax d. Non-arms' length pricing between related parties may be restated by the to reflect the arms' length value of transactions. 15. Which is not an associated enterprise to the controlling individual of a bo company? a. An associate of a subsidiary in the group b. The parent company c. A direct subsidiary company d. A subsidiary of a subsidiary in the group Multiple Choice - Problems: Part 1 1. Bong, a professional practitioner, received the following from his clients: Chapter 9 - Regular Income Tax: Inclusion in Gross Income How much will be included in Bong's gross income for regular income tax purposes? a. P150,000 b. P140,000 c. P110,000 d. P100,000 2. Mr. Darlow, a supervisory employee, received the fn.l. in 2024: Determine the total income to be reported by Mr. Darlow in gross income. a. P1,526,000 c. P1,026,000 b. P1,426,000 d. P826,000 3. Aldrin, employed, derived the following income during the year: Compute the taxable compensation income to be reported in the annual income tax return. a. P440,000 c. P380,000 b. P330,000 d. P390,000 4. Mary resigned in 2024 after 12 years of service. She had the following income during the year: Salary, net of P80,000 withholding tax, P20,000 SSS, P18,000 Philhealth and P40,00013th month pay Separation pay P480,0001,000,000 Compute the gross income subject to progressive (regular) tax. a. P1,480,000 c. P560,000 b. P1,560,000 d. P480,000 5. Iriga Corporation is engaged in the sales of goods. It reported the following summarized financial statements during the year: Chapter 9 - Regular Income Tax: Inclusion in Gross Income Compute the total gross income subject to regular tax. a. P1,720,000 c. P1,780,000 b. P1,770,000 d. P840,000 6. Cordova, Inc, a domestic corporation, reported the following income in 2024: Compute the total gross income subject to regular income tax. a. P920,000 c. P800,000 b. P860,000 d. P700,000 7. If Cordova Inc is a resident foreign corporation, compute the gross income subjet to regular tax. a. P520,000 c. P400,000 b. P480,000 d. P440,000 8. Lenj leases a building to a client. During the year, he received the following remittance from the lessee: How much will be included in gross income subject to regular tax? a. P2,050,000 c. P2,000,000 b. P2,250,000 d. P1,950,000 9. The Big Bird Security Agency (BBSA) received P3,000,000 from its clients P2,400,000 of this was designated for salaries of guards assigned to various client establishments. 21. In the immediately preceding problem, compute the tax benefit if the refund was of local tax instead of income tax. a. P44,000 c. P10,000 b. 4,000 d. P0 22. An accrual basis taxpayer recovered a P20,000 local tax expense which was refunded by the local government in 2021. The local tax expense was paid in 2019 when the taxpayer sustained a P5,000 net operating loss. How much shall be reverted to income? a. P0 c. P20,000 b. P5,000 d. P15,000 23. A taxpayer under the cash basis wrote-off P50,000 receivables in 2021. In 2024, P30,000 of the receivables was recovered. Determine the amount to be included in gross income in 2024 assuming that the taxpayer incurred a net operating loss of P40,000 in 2021. a. P0 c. P30,000 b. P10,000 d. P40,000 Multiple Choice - Problems: Part 2 1. An alien employee in an RHQ had the following in 2024: What is the total amount to include in gross income subject to regular income tax? a. PO c. P1,350,000 b. P1,147,500 d. P1,500,000 2. Mr. Cordillera owns 20% interest in a joint venture engaged in construction projects. In 2024, the joint venture reported profits of P500,000, inclusive of P20,000 from time deposits. Compute the total income to be reported in gross income of Mr. Cordillera? a. P0 c. P96,000 b. P4,000 d. P100,000 3. Mr. Buaya, with 14 dependent children, had the following data for his income tax return in 3A. Chapter 9 - Regular Income Tax: Inclusion in Gross Income What is the net income? a. P 170,000 c. P100,000 b. P290,000 d. P20,000 4. Compute the taxable compensation income. a. (P150,000) c. P90,000 b. (P30,000) d. P120,000 5. Compute the taxable income. a. P 10,000 c. P140,000 b. P 100,000 d. P260,000 6. Vhinson and Khim practice their accounting profession through a Beneta professional partnership. They contributed equal capital and agreed to share is profits equally. The following relates to their gross receipts and expenses: What is the reportable income in the tax return of Vhinson? a. P1,170,000 c. P550,000 b. P500,000 d. P570,000 7. In the immediately preceding problem, determine the amount of income to be reported by Khim assuming that their partnership is a beauty parior. a. PO c. P550,000 b. P570,000 d. P500,000 8. In the immediately preceding problem, what is the amount to include in gross income assuming the employee is a Filipino rank and file employee? a. P0 c. P1,500,000 b. P1,147,500 d. P1,350,000 9. A corporation had the following gains from dealings in properties: Multiple Choice - Problems: Part 3 1. A VAT taxpayer received P45,900 inclusive of VAT and net of 10% creditable withholding tax. Compute the gross income subject to regular tax. a. P45,000 c. P 45,536 b. P45,900 d. P 51,000 2. Mrs. Quong has several interests in various businesses and partnerships. He received the following income during the year: What is the total income to be reported in gross income? a. P0 c. P300,000 b. P380,000 d. P180,000 3. Ms. Palaboy received a total P200,000 from her father for her support. During the year, she also received a P150,000 total distribution from the trust irrevocably designated by her grandfather in her favor. She also received P120,000 income distribution from the estate of her grandmother undergoing judicial settlement. What is the total amount to be included in her gross income? a. P200,000 c. P350,000 b. P270,000 d. P470,000 4. A non-VAT taxpayer collected P45,000 net of P5,000 withholding tax. Compute the gross income subject to regular tax. a. P 5,000 c. P45,000 b. P 40,000 d. P50,000 5. A VAT taxpayer collected P66,600, inclusive of P7,200 VAT and net of P600 withholding tax. Compute the gross income subject regular income tax. a. P59,400 c. P66,000 b. P67,200 d. P60,000 6. A non-VAT taxpayer collected P79,200, net of 1% withholding tax. What is the amount subject to regular income tax? a. P 71,351 c. P80,000 b. P 71,429 d. P79,200 7. A non-VAT taxpayer received P8,000 interest income, net of 20% final withholding tax. Compute the amount subject to regular income tax. a. P0 b. P6,400 c. P8,000 d. P10,000 329 8. A VAT-registered taxpayer received P18,000 dividend, net of 10% fir withholding tax. Compute the amount subject to regular income tax. a. P0 c. P17,857 b. P 17,647 d. P20,000 9. A resident foreign corporate taxpayer entered into an advanced pricin agreement (APA) with the BIR with respect to the pricing of its export sales 00d foreign country. A mark-up ratio of 50% of the cost is set in the APA. During 1 s year, the corporation manufactured goods costing P12,000,000 and exported 80, of the production to its foreign affiliate at a price of P12,000,000. What is the amount of gross income subject to Philippine tax? a. P2,000,000 c. P2,400,000 b. P4,800,000 d. P6,000,000 10. Ms. Nene Bing registered a manufacturing business as a BMBE exempt from tax She also owns another taxable business which is engaged in the trading of good Ms. Neneng Bing ordered her BMBE business to sell its production to her trading business at ultimate sales prices. You were tasked by your audit supervisor to conduct a transfer pricing evaluation of Ms. Bing's businesses. Based on your study, you determined that the retal profit rate (on sales) of trading businesses with similar operations involing similar goods is 40%. During the year, the trading business made a total purchass of P400,000 from the BMBE and sold 75\% of these for PS00,000. What is the gross income of the trading business to be subjected to regular incent tax following the arms' length principle? a. P0 c. P200,000 b. P 100,000 d. P120,000