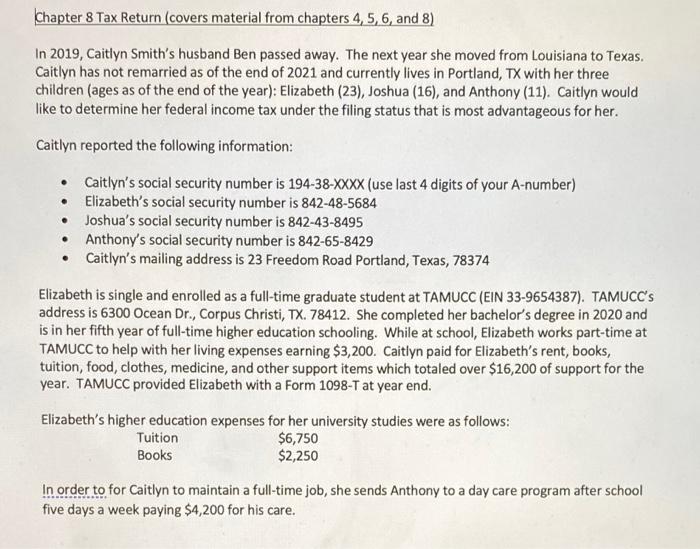

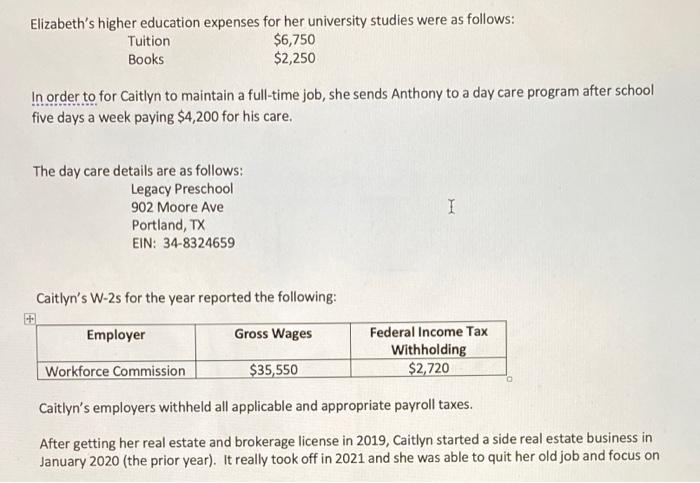

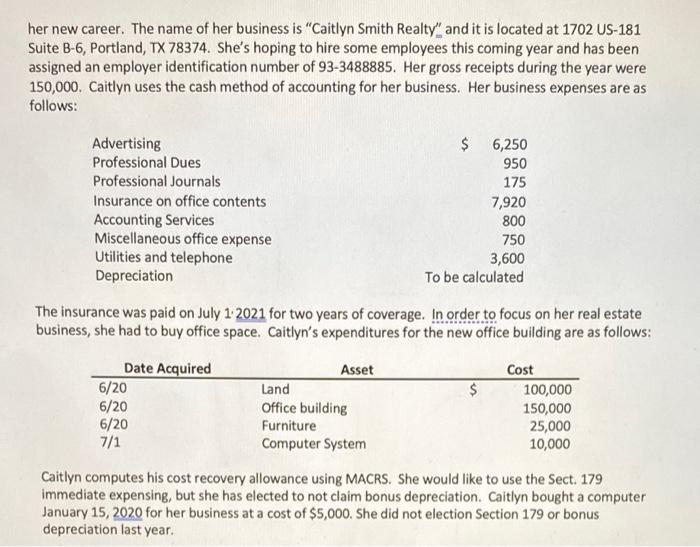

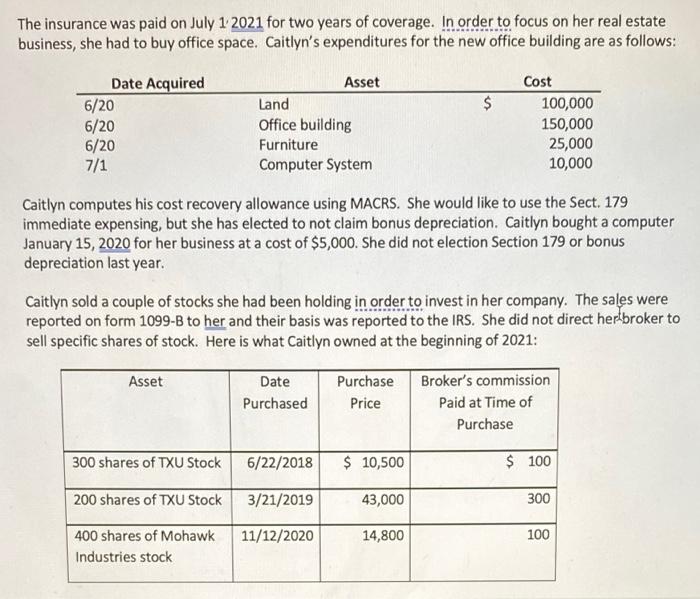

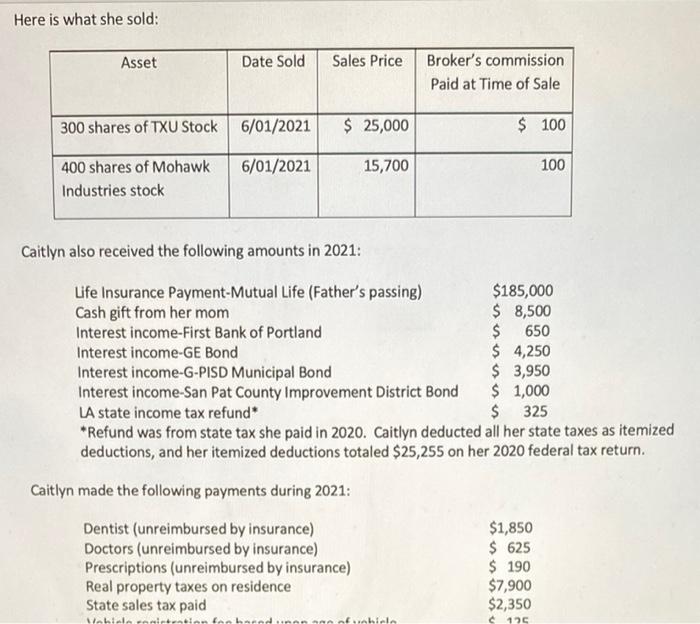

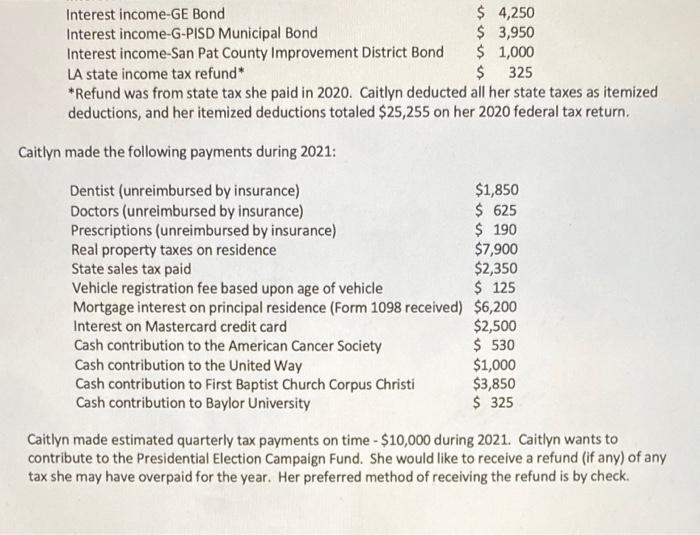

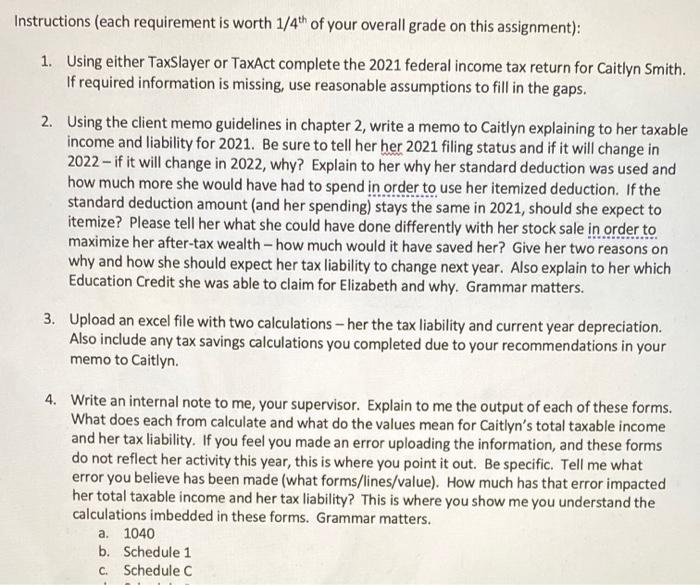

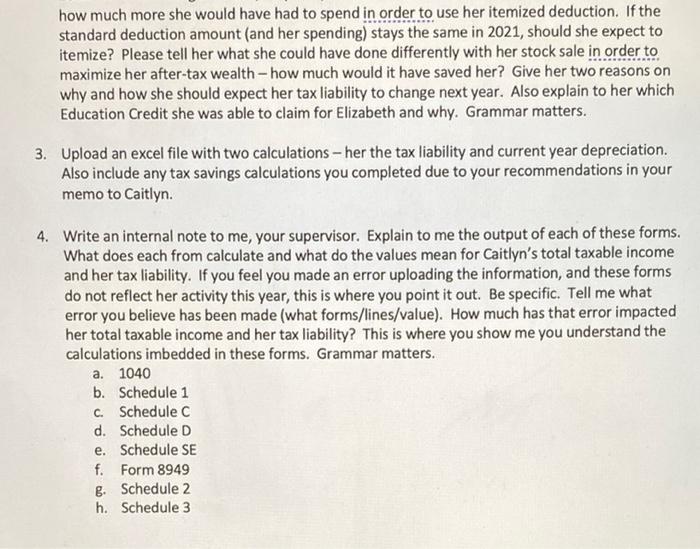

Chapter 8 Tax Return (covers material from chapters 4, 5, 6, and 8) In 2019, Caitlyn Smith's husband Ben passed away. The next year she moved from Louisiana to Texas. Caitlyn has not remarried as of the end of 2021 and currently lives in Portland, TX with her three children (ages as of the end of the year): Elizabeth (23), Joshua (16), and Anthony (11). Caitlyn would like to determine her federal income tax under the filing status that is most advantageous for her. Caitlyn reported the following information: Caitlyn's social security number is 194-38-XXXX (use last 4 digits of your A-number) Elizabeth's social security number is 842-48-5684 Joshua's social security number is 842-43-8495 Anthony's social security number is 842-65-8429 Caitlyn's mailing address is 23 Freedom Road Portland, Texas, 78374 Elizabeth is single and enrolled as a full-time graduate student at TAMUCC (EIN 33-9654387). TAMUCC's address is 6300 Ocean Dr., Corpus Christi, TX. 78412. She completed her bachelor's degree in 2020 and is in her fifth year of full-time higher education schooling. While at school, Elizabeth works part-time at TAMUCC to help with her living expenses earning $3,200. Caitlyn paid for Elizabeth's rent, books, tuition, food, clothes, medicine, and other support items which totaled over $16,200 of support for the year. TAMUCC provided Elizabeth with a Form 1098-T at year end. Elizabeth's higher education expenses for her university studies were as follows: Tuition $6,750 Books $2,250 In order to for Caitlyn to maintain a full-time job, she sends Anthony to a day care program after school five days a week paying $4,200 for his care. Elizabeth's higher education expenses for her university studies were as follows: Tuition $6,750 Books $2,250 In order to for Caitlyn to maintain a full-time job, she sends Anthony to a day care program after school five days a week paying $4,200 for his care, The day care details are as follows: Legacy Preschool 902 Moore Ave Portland, TX EIN: 34-8324659 I Caitlyn's W-2s for the year reported the following: Employer Gross Wages Federal Income Tax Withholding $2,720 Workforce Commission $35,550 Caitlyn's employers withheld all applicable and appropriate payroll taxes. After getting her real estate and brokerage license in 2019, Caitlyn started a side real estate business in January 2020 (the prior year). It really took off in 2021 and she was able to quit her old job and focus on her new career. The name of her business is "Caitlyn Smith Realty and it is located at 1702 US-181 Suite B-6, Portland, TX 78374. She's hoping to hire some employees this coming year and has been assigned an employer identification number of 93-3488885. Her gross receipts during the year were 150,000. Caitlyn uses the cash method of accounting for her business. Her business expenses are as follows: Advertising Professional Dues Professional Journals Insurance on office contents Accounting Services Miscellaneous office expense Utilities and telephone Depreciation $ 6,250 950 175 7,920 800 750 3,600 To be calculated The insurance was paid on July 1 2021 for two years of coverage. In order to focus on her real estate business, she had to buy office space. Caitlyn's expenditures for the new office building are as follows: Date Acquired Asset Cost 6/20 Land $ 100,000 6/20 Office building 150,000 6/20 Furniture 25,000 7/1 Computer System 10,000 Caitlyn computes his cost recovery allowance using MACRS. She would like to use the Sect. 179 immediate expensing, but she has elected to not claim bonus depreciation. Caitlyn bought a computer January 15, 2020 for her business at a cost of $5,000. She did not election Section 179 or bonus depreciation last year. The insurance was paid on July 1 2021 for two years of coverage. In order to focus on her real estate business, she had to buy office space. Caitlyn's expenditures for the new office building are as follows: $ Date Acquired 6/20 6/20 6/20 7/1 Asset Land Office building Furniture Computer System Cost 100,000 150,000 25,000 10,000 Caitlyn computes his cost recovery allowance using MACRS. She would like to use the Sect. 179 immediate expensing, but she has elected to not claim bonus depreciation. Caitlyn bought a computer January 15, 2020 for her business at a cost of $5,000. She did not election Section 179 or bonus depreciation last year Caitlyn sold a couple of stocks she had been holding in order to invest in her company. The sales were reported on form 1099-B to her and their basis was reported to the IRS. She did not direct her broker to sell specific shares of stock. Here is what Caitlyn owned at the beginning of 2021: Asset Date Purchased Purchase Price Broker's commission Paid at Time of Purchase 300 shares of TXU Stock 6/22/2018 $ 10,500 $ 100 200 shares of TXU Stock 3/21/2019 43,000 300 11/12/2020 14,800 100 400 shares of Mohawk Industries stock Here is what she sold: Asset Date Sold Sales Price Broker's commission Paid at Time of Sale 300 shares of TXU Stock 6/01/2021 $ 25,000 $ 100 6/01/2021 15,700 100 400 shares of Mohawk Industries stock Caitlyn also received the following amounts in 2021: Life Insurance Payment-Mutual Life (Father's passing) $185,000 Cash gift from her mom $ 8,500 Interest income-First Bank of Portland $ 650 Interest income-GE Bond $ 4,250 Interest income-G-PISD Municipal Bond $ 3,950 Interest income-San Pat County Improvement District Bond $ 1,000 LA state income tax refund $ 325 *Refund was from state tax she paid in 2020. Caitlyn deducted all her state taxes as itemized deductions, and her itemized deductions totaled $25,255 on her 2020 federal tax return. Caitlyn made the following payments during 2021: Dentist (unreimbursed by insurance) Doctors (unreimbursed by insurance) Prescriptions (unreimbursed by insurance) Real property taxes on residence State sales tax paid $1,850 $ 625 $ 190 $7,900 $2,350 Mobiele dinle 125 Interest income-GE Bond $ 4,250 Interest income-G-PISD Municipal Bond $ 3,950 Interest income-San Pat County Improvement District Bond $ 1,000 LA state income tax refund $ 325 * Refund was from state tax she paid in 2020. Caitlyn deducted all her state taxes as itemized deductions, and her itemized deductions totaled $25,255 on her 2020 federal tax return. Caitlyn made the following payments during 2021: Dentist (unreimbursed by insurance) $1,850 Doctors (unreimbursed by insurance) $ 625 Prescriptions (unreimbursed by insurance) $ 190 Real property taxes on residence $7,900 State sales tax paid $2,350 Vehicle registration fee based upon age of vehicle $ 125 Mortgage interest on principal residence (Form 1098 received) $6,200 Interest on Mastercard credit card $2,500 Cash contribution to the American Cancer Society $ 530 Cash contribution to the United Way $1,000 Cash contribution to First Baptist Church Corpus Christi $3,850 Cash contribution to Baylor University $ 325 Caitlyn made estimated quarterly tax payments on time - $10,000 during 2021. Caitlyn wants to contribute to the Presidential Election Campaign Fund. She would like to receive a refund (if any) of any tax she may have overpaid for the year. Her preferred method of receiving the refund is by check. Instructions (each requirement is worth 1/4th of your overall grade on this assignment): 1. Using either TaxSlayer or TaxAct complete the 2021 federal income tax return for Caitlyn Smith. If required information is missing, use reasonable assumptions to fill in the gaps. 2. Using the client memo guidelines in chapter 2, write a memo to Caitlyn explaining to her taxable income and liability for 2021. Be sure to tell her her 2021 filing status and if it will change in 2022-if it will change in 2022, why? Explain to her why her standard deduction was used and how much more she would have had to spend in order to use her itemized deduction. If the standard deduction amount (and her spending) stays the same in 2021, should she expect to itemize? Please tell her what she could have done differently with her stock sale in order to maximize her after-tax wealth - how much would it have saved her? Give her two reasons on why and how she should expect her tax liability to change next year. Also explain to her which Education Credit she was able to claim for Elizabeth and why. Grammar matters. 3. Upload an excel file with two calculations - her the tax liability and current year depreciation. Also include any tax savings calculations you completed due to your recommendations in your memo to Caitlyn. 4. Write an internal note to me, your supervisor. Explain to me the output of each of these forms. What does each from calculate and what do the values mean for Caitlyn's total taxable income and her tax liability. If you feel you made an error uploading the information, and these forms do not reflect her activity this year, this is where you point it out. Be specific. Tell me what error you believe has been made (what forms/lines/value). How much has that error impacted her total taxable income and her tax liability? This is where you show me you understand the calculations imbedded in these forms. Grammar matters. a. 1040 b. Schedule 1 C. Schedule C how much more she would have had to spend in order to use her itemized deduction. If the standard deduction amount (and her spending) stays the same in 2021, should she expect to itemize? Please tell her what she could have done differently with her stock sale in order to maximize her after-tax wealth - how much would it have saved her? Give her two reasons on why and how she should expect her tax liability to change next year. Also explain to her which Education Credit she was able to claim for Elizabeth and why. Grammar matters. 3. Upload an excel file with two calculations - her the tax liability and current year depreciation. Also include any tax savings calculations you completed due to your recommendations in your memo to Caitlyn. 4. Write an internal note to me, your supervisor. Explain to me the output of each of these forms. What does each from calculate and what do the values mean for Caitlyn's total taxable income and her tax liability. If you feel you made an error uploading the information, and these forms do not reflect her activity this year, this is where you point it out. Be specific. Tell me what error you believe has been made (what forms/lines/value). How much has that error impacted her total taxable income and her tax liability? This is where you show me you understand the calculations imbedded in these forms. Grammar matters. a. 1040 b. Schedule 1 C. Schedule C d. Schedule D e. Schedule SE f. Form 8949 g. Schedule 2 h. Schedule 3 Chapter 8 Tax Return (covers material from chapters 4, 5, 6, and 8) In 2019, Caitlyn Smith's husband Ben passed away. The next year she moved from Louisiana to Texas. Caitlyn has not remarried as of the end of 2021 and currently lives in Portland, TX with her three children (ages as of the end of the year): Elizabeth (23), Joshua (16), and Anthony (11). Caitlyn would like to determine her federal income tax under the filing status that is most advantageous for her. Caitlyn reported the following information: Caitlyn's social security number is 194-38-XXXX (use last 4 digits of your A-number) Elizabeth's social security number is 842-48-5684 Joshua's social security number is 842-43-8495 Anthony's social security number is 842-65-8429 Caitlyn's mailing address is 23 Freedom Road Portland, Texas, 78374 Elizabeth is single and enrolled as a full-time graduate student at TAMUCC (EIN 33-9654387). TAMUCC's address is 6300 Ocean Dr., Corpus Christi, TX. 78412. She completed her bachelor's degree in 2020 and is in her fifth year of full-time higher education schooling. While at school, Elizabeth works part-time at TAMUCC to help with her living expenses earning $3,200. Caitlyn paid for Elizabeth's rent, books, tuition, food, clothes, medicine, and other support items which totaled over $16,200 of support for the year. TAMUCC provided Elizabeth with a Form 1098-T at year end. Elizabeth's higher education expenses for her university studies were as follows: Tuition $6,750 Books $2,250 In order to for Caitlyn to maintain a full-time job, she sends Anthony to a day care program after school five days a week paying $4,200 for his care. Elizabeth's higher education expenses for her university studies were as follows: Tuition $6,750 Books $2,250 In order to for Caitlyn to maintain a full-time job, she sends Anthony to a day care program after school five days a week paying $4,200 for his care, The day care details are as follows: Legacy Preschool 902 Moore Ave Portland, TX EIN: 34-8324659 I Caitlyn's W-2s for the year reported the following: Employer Gross Wages Federal Income Tax Withholding $2,720 Workforce Commission $35,550 Caitlyn's employers withheld all applicable and appropriate payroll taxes. After getting her real estate and brokerage license in 2019, Caitlyn started a side real estate business in January 2020 (the prior year). It really took off in 2021 and she was able to quit her old job and focus on her new career. The name of her business is "Caitlyn Smith Realty and it is located at 1702 US-181 Suite B-6, Portland, TX 78374. She's hoping to hire some employees this coming year and has been assigned an employer identification number of 93-3488885. Her gross receipts during the year were 150,000. Caitlyn uses the cash method of accounting for her business. Her business expenses are as follows: Advertising Professional Dues Professional Journals Insurance on office contents Accounting Services Miscellaneous office expense Utilities and telephone Depreciation $ 6,250 950 175 7,920 800 750 3,600 To be calculated The insurance was paid on July 1 2021 for two years of coverage. In order to focus on her real estate business, she had to buy office space. Caitlyn's expenditures for the new office building are as follows: Date Acquired Asset Cost 6/20 Land $ 100,000 6/20 Office building 150,000 6/20 Furniture 25,000 7/1 Computer System 10,000 Caitlyn computes his cost recovery allowance using MACRS. She would like to use the Sect. 179 immediate expensing, but she has elected to not claim bonus depreciation. Caitlyn bought a computer January 15, 2020 for her business at a cost of $5,000. She did not election Section 179 or bonus depreciation last year. The insurance was paid on July 1 2021 for two years of coverage. In order to focus on her real estate business, she had to buy office space. Caitlyn's expenditures for the new office building are as follows: $ Date Acquired 6/20 6/20 6/20 7/1 Asset Land Office building Furniture Computer System Cost 100,000 150,000 25,000 10,000 Caitlyn computes his cost recovery allowance using MACRS. She would like to use the Sect. 179 immediate expensing, but she has elected to not claim bonus depreciation. Caitlyn bought a computer January 15, 2020 for her business at a cost of $5,000. She did not election Section 179 or bonus depreciation last year Caitlyn sold a couple of stocks she had been holding in order to invest in her company. The sales were reported on form 1099-B to her and their basis was reported to the IRS. She did not direct her broker to sell specific shares of stock. Here is what Caitlyn owned at the beginning of 2021: Asset Date Purchased Purchase Price Broker's commission Paid at Time of Purchase 300 shares of TXU Stock 6/22/2018 $ 10,500 $ 100 200 shares of TXU Stock 3/21/2019 43,000 300 11/12/2020 14,800 100 400 shares of Mohawk Industries stock Here is what she sold: Asset Date Sold Sales Price Broker's commission Paid at Time of Sale 300 shares of TXU Stock 6/01/2021 $ 25,000 $ 100 6/01/2021 15,700 100 400 shares of Mohawk Industries stock Caitlyn also received the following amounts in 2021: Life Insurance Payment-Mutual Life (Father's passing) $185,000 Cash gift from her mom $ 8,500 Interest income-First Bank of Portland $ 650 Interest income-GE Bond $ 4,250 Interest income-G-PISD Municipal Bond $ 3,950 Interest income-San Pat County Improvement District Bond $ 1,000 LA state income tax refund $ 325 *Refund was from state tax she paid in 2020. Caitlyn deducted all her state taxes as itemized deductions, and her itemized deductions totaled $25,255 on her 2020 federal tax return. Caitlyn made the following payments during 2021: Dentist (unreimbursed by insurance) Doctors (unreimbursed by insurance) Prescriptions (unreimbursed by insurance) Real property taxes on residence State sales tax paid $1,850 $ 625 $ 190 $7,900 $2,350 Mobiele dinle 125 Interest income-GE Bond $ 4,250 Interest income-G-PISD Municipal Bond $ 3,950 Interest income-San Pat County Improvement District Bond $ 1,000 LA state income tax refund $ 325 * Refund was from state tax she paid in 2020. Caitlyn deducted all her state taxes as itemized deductions, and her itemized deductions totaled $25,255 on her 2020 federal tax return. Caitlyn made the following payments during 2021: Dentist (unreimbursed by insurance) $1,850 Doctors (unreimbursed by insurance) $ 625 Prescriptions (unreimbursed by insurance) $ 190 Real property taxes on residence $7,900 State sales tax paid $2,350 Vehicle registration fee based upon age of vehicle $ 125 Mortgage interest on principal residence (Form 1098 received) $6,200 Interest on Mastercard credit card $2,500 Cash contribution to the American Cancer Society $ 530 Cash contribution to the United Way $1,000 Cash contribution to First Baptist Church Corpus Christi $3,850 Cash contribution to Baylor University $ 325 Caitlyn made estimated quarterly tax payments on time - $10,000 during 2021. Caitlyn wants to contribute to the Presidential Election Campaign Fund. She would like to receive a refund (if any) of any tax she may have overpaid for the year. Her preferred method of receiving the refund is by check. Instructions (each requirement is worth 1/4th of your overall grade on this assignment): 1. Using either TaxSlayer or TaxAct complete the 2021 federal income tax return for Caitlyn Smith. If required information is missing, use reasonable assumptions to fill in the gaps. 2. Using the client memo guidelines in chapter 2, write a memo to Caitlyn explaining to her taxable income and liability for 2021. Be sure to tell her her 2021 filing status and if it will change in 2022-if it will change in 2022, why? Explain to her why her standard deduction was used and how much more she would have had to spend in order to use her itemized deduction. If the standard deduction amount (and her spending) stays the same in 2021, should she expect to itemize? Please tell her what she could have done differently with her stock sale in order to maximize her after-tax wealth - how much would it have saved her? Give her two reasons on why and how she should expect her tax liability to change next year. Also explain to her which Education Credit she was able to claim for Elizabeth and why. Grammar matters. 3. Upload an excel file with two calculations - her the tax liability and current year depreciation. Also include any tax savings calculations you completed due to your recommendations in your memo to Caitlyn. 4. Write an internal note to me, your supervisor. Explain to me the output of each of these forms. What does each from calculate and what do the values mean for Caitlyn's total taxable income and her tax liability. If you feel you made an error uploading the information, and these forms do not reflect her activity this year, this is where you point it out. Be specific. Tell me what error you believe has been made (what forms/lines/value). How much has that error impacted her total taxable income and her tax liability? This is where you show me you understand the calculations imbedded in these forms. Grammar matters. a. 1040 b. Schedule 1 C. Schedule C how much more she would have had to spend in order to use her itemized deduction. If the standard deduction amount (and her spending) stays the same in 2021, should she expect to itemize? Please tell her what she could have done differently with her stock sale in order to maximize her after-tax wealth - how much would it have saved her? Give her two reasons on why and how she should expect her tax liability to change next year. Also explain to her which Education Credit she was able to claim for Elizabeth and why. Grammar matters. 3. Upload an excel file with two calculations - her the tax liability and current year depreciation. Also include any tax savings calculations you completed due to your recommendations in your memo to Caitlyn. 4. Write an internal note to me, your supervisor. Explain to me the output of each of these forms. What does each from calculate and what do the values mean for Caitlyn's total taxable income and her tax liability. If you feel you made an error uploading the information, and these forms do not reflect her activity this year, this is where you point it out. Be specific. Tell me what error you believe has been made (what forms/lines/value). How much has that error impacted her total taxable income and her tax liability? This is where you show me you understand the calculations imbedded in these forms. Grammar matters. a. 1040 b. Schedule 1 C. Schedule C d. Schedule D e. Schedule SE f. Form 8949 g. Schedule 2 h. Schedule 3