Answered step by step

Verified Expert Solution

Question

1 Approved Answer

chapter 9 accouting worksheet 3. Assume Jacoby, Inc. acquired a manufacturing faclity from Gardner Enterprises for $2,000,000. Assume that the facility consisted of land, building,

chapter 9 accouting worksheet

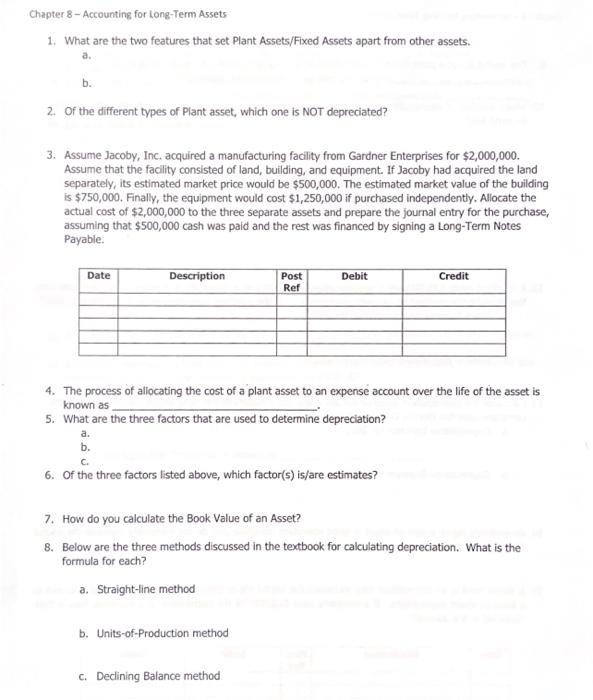

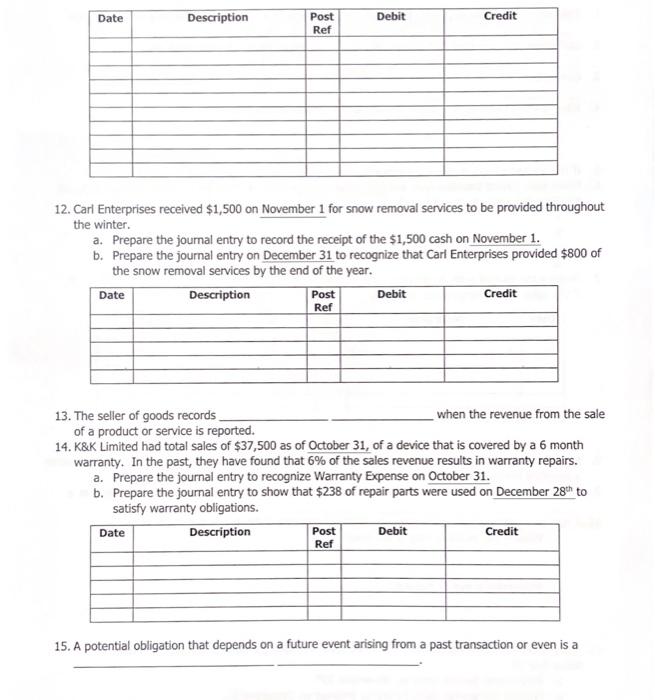

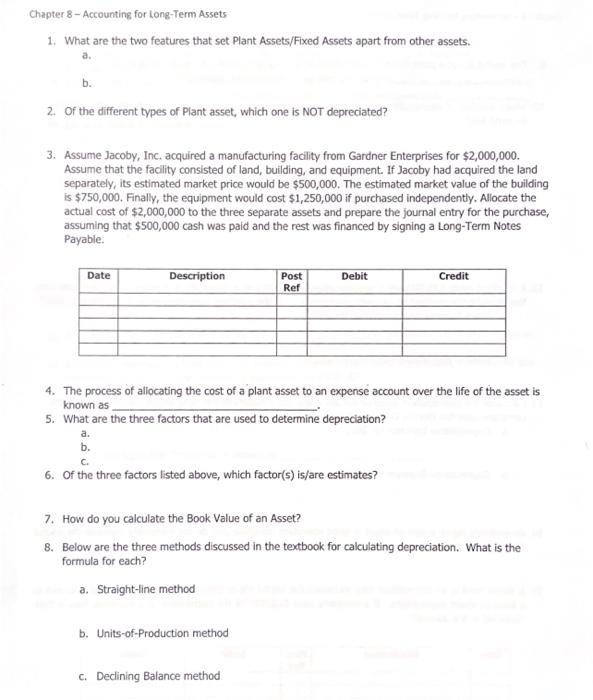

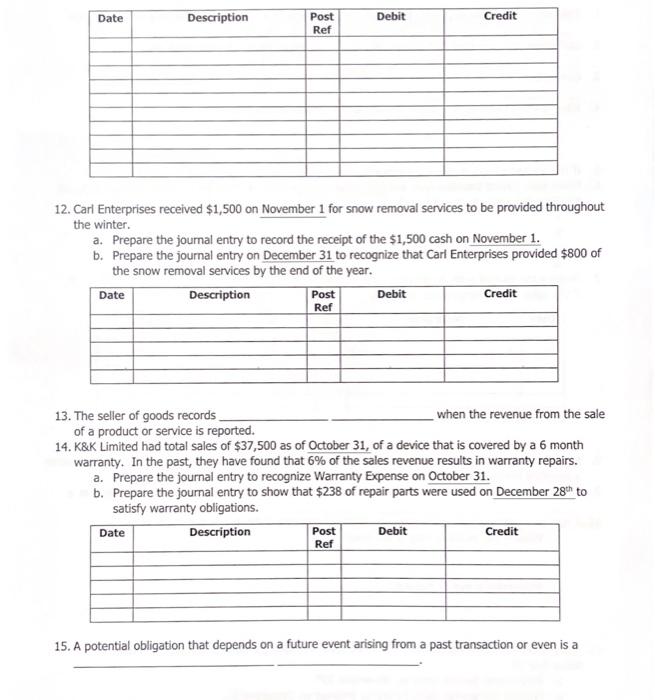

3. Assume Jacoby, Inc. acquired a manufacturing faclity from Gardner Enterprises for $2,000,000. Assume that the facility consisted of land, building, and equipment. If Jacoby had acquired the land separately, its estimated market price would be $500,000. The estimated market value of the building is $750,000. Finally, the equipment would cost $1,250,000 if purchased independently. Allocate the actual cost of $2,000,000 to the three separate assets and prepare the journal entry for the purchase, assuming that $500,000 cash was paid and the rest was financed by signing a Long-Term Notes Payable. 4. The process of allocating the cost of a plant asset to an expense account over the life of the asset is known as 5. What are the three factors that are used to determine depreciation? a. b. c. 6. Of the three factors listed above, which factor(s) is/are estimates? 7. How do you calculate the Book Value of an Asset? 8. Below are the three methods discussed in the textbook for calculating depreciation. What is the formula for each? a. Straight-line method b. Units-of-Production method c. Dedining Balance method 12. Carl Enterprises received $1,500 on November 1 for snow removal services to be provided throughout the winter. a. Prepare the journal entry to record the receipt of the $1,500 cash on November 1. b. Prepare the journal entry on December 31 to recognize that Carl Enterprises provided $800 of the snow removal services by the end of the year. 13. The seller of goods records when the revenue from the sale of a product or service is reported. 14. K\&K Limited had total sales of $37,500 as of October 31 , of a device that is covered by a 6 month warranty. In the past, they have found that 6% of the sales revenue results in warranty repairs. a. Prepare the journal entry to recognize Warranty Expense on October 31. b. Prepare the journal entry to show that $238 of repair parts were used on December 28th to satisfy warranty obligations. 15. A potential obligation that depends on a future event arising from a past transaction or even is a 3. Assume Jacoby, Inc. acquired a manufacturing faclity from Gardner Enterprises for $2,000,000. Assume that the facility consisted of land, building, and equipment. If Jacoby had acquired the land separately, its estimated market price would be $500,000. The estimated market value of the building is $750,000. Finally, the equipment would cost $1,250,000 if purchased independently. Allocate the actual cost of $2,000,000 to the three separate assets and prepare the journal entry for the purchase, assuming that $500,000 cash was paid and the rest was financed by signing a Long-Term Notes Payable. 4. The process of allocating the cost of a plant asset to an expense account over the life of the asset is known as 5. What are the three factors that are used to determine depreciation? a. b. c. 6. Of the three factors listed above, which factor(s) is/are estimates? 7. How do you calculate the Book Value of an Asset? 8. Below are the three methods discussed in the textbook for calculating depreciation. What is the formula for each? a. Straight-line method b. Units-of-Production method c. Dedining Balance method 12. Carl Enterprises received $1,500 on November 1 for snow removal services to be provided throughout the winter. a. Prepare the journal entry to record the receipt of the $1,500 cash on November 1. b. Prepare the journal entry on December 31 to recognize that Carl Enterprises provided $800 of the snow removal services by the end of the year. 13. The seller of goods records when the revenue from the sale of a product or service is reported. 14. K\&K Limited had total sales of $37,500 as of October 31 , of a device that is covered by a 6 month warranty. In the past, they have found that 6% of the sales revenue results in warranty repairs. a. Prepare the journal entry to recognize Warranty Expense on October 31. b. Prepare the journal entry to show that $238 of repair parts were used on December 28th to satisfy warranty obligations. 15. A potential obligation that depends on a future event arising from a past transaction or even is a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started