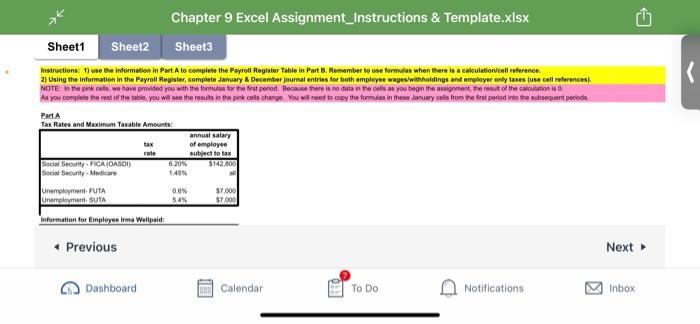

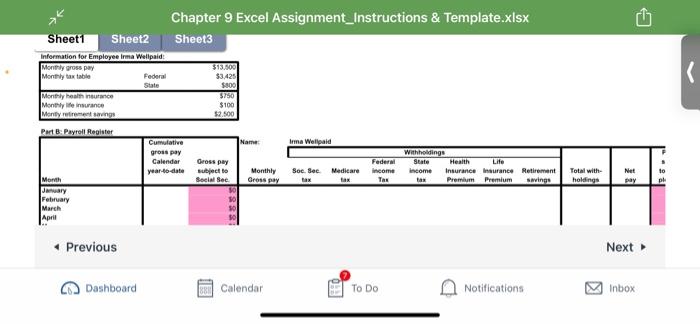

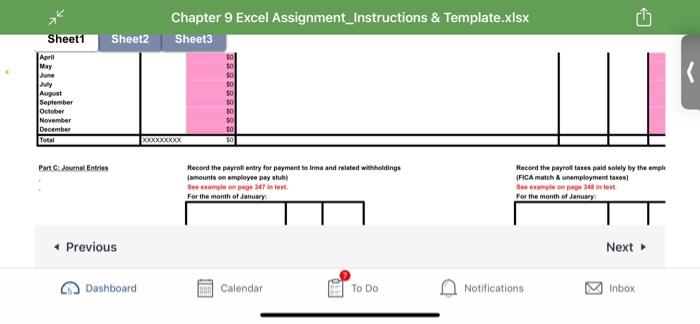

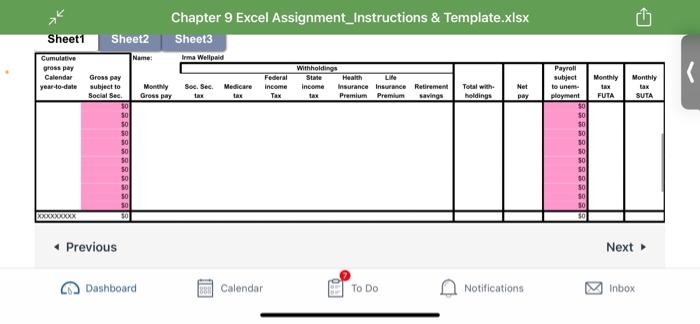

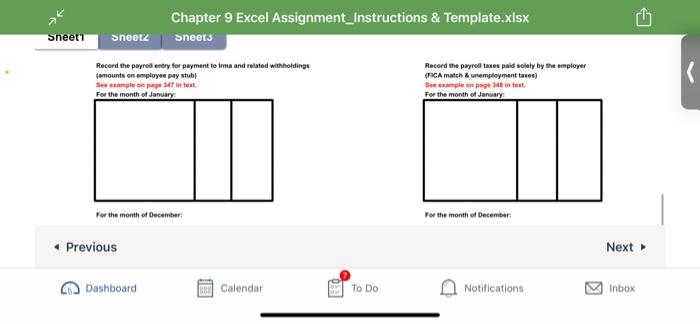

Chapter 9 Excel Assignment_Instructions & Template.xlsx Sheet2 Sheet3 Sheet1 K Instructions: 1) use the information in Part A to complete the Payroll Register Table in Part B. Remember to use formulas when there is a calculation cell reference 2) Using the information in the Payroll Register, complete January & December joumal entries for both employee wages withholdings and employer only taxes (use cell references) NOTE in the places, we have provided you with the formules for the first period. Because there is no data in the ele as you begin the assignment, the result of the calculation in As you complete the rest of the table, you will be the results in the pink onls change. You will need to copy the formules in the Januarycula from the first period into the subsequent periode PA Tax Rates and Maximum Taxable Amounts: annual salary tax of employee rate subject to tax Social Security FICA (OASON 6:20 $142.800 Social Security Medicare 145% Unemployment.FUTA DEN Uratroloyment suTA $1.000 information for Employee Imma Wallpad $1.500 Previous Next Dashboard BH Calendar To Do Notifications Inbox G Chapter 9 Excel Assignment_Instructions & Template.xlsx Sheet3 Sheet1 Sheet2 Information for Employee Irma Weltpaid Monthlygross pay $15.500 Monthly tax table Federal $3,425 State $800 Monyenture $750 Monthly life insurance $100 Mantly refrement sans $2.500 Part B: Payroll Register Cumulative Name: Imma Wetpaid gross pay Calendar Gross pay Federal Year-to-date subject to Monthly Soe. See Medicare income Month Social See Gross pay tax Tax January February March April Withholdinge State Health Life income Insurance Insurance Retirement tax Premium Premium Savings Total with holdinge Net pay to ph Previous Next Dashboard Calendar To Do Notifications Inbox Chapter 9 Excel Assignment_Instructions & Template.xlsx Sheet2 Sheet3 Sheet1 April May ung August September October November December Total XOXOXXXXXXX Par cumal Entries Record the payroll entry for payment to Inna and related withholdings amounts on employee pay stub Sesample ng sinust For the month of January Record the payroll taxes paid solely by the emple (FICA match & unemployment taxes See on page 18 infot For the month of January Previous Next Dashboard SRE Calendar To Do Notifications Inbox Chapter 9 Excel Assignment_Instructions & Template.xlsx Sheet3 Sheet2 Irma Welipaid Sheet1 Cumulative Name: gross pay Calendar Gross pay yeardo-date subject to Monthly Social Sec. Gross Bay K Withholdings Federal State Health LI Income income insurance Insurance Retirement Tax Premium Premium savings Soc. Sec. Medicare tax Payroll subject tounen ployment Total with holdings tax Net pay Monthly Monthly FUTA BUTA 50 30 50 50 50 50 50 KXXXXXXX Previous Next Dashboard Calendar To Do Notifications Inbox Chapter 9 Excel Assignment_Instructions & Template.xlsx Sneets Sheet Sneetz Record the payroll entry for payment to me and related withholdings famounts on employee pay stub Semple en page intent For the month of January Record the payroll taxes paid solely by the employer (FICA match & unemployment taxes) See example on page in text For the month of January K For the month of December For the month of December Previous Next Dashboard SRE Calendar To Do Notifications Inbox Chapter 9 Excel Assignment_Instructions & Template.xlsx Sheet2 Sheet3 Sheet1 K Instructions: 1) use the information in Part A to complete the Payroll Register Table in Part B. Remember to use formulas when there is a calculation cell reference 2) Using the information in the Payroll Register, complete January & December joumal entries for both employee wages withholdings and employer only taxes (use cell references) NOTE in the places, we have provided you with the formules for the first period. Because there is no data in the ele as you begin the assignment, the result of the calculation in As you complete the rest of the table, you will be the results in the pink onls change. You will need to copy the formules in the Januarycula from the first period into the subsequent periode PA Tax Rates and Maximum Taxable Amounts: annual salary tax of employee rate subject to tax Social Security FICA (OASON 6:20 $142.800 Social Security Medicare 145% Unemployment.FUTA DEN Uratroloyment suTA $1.000 information for Employee Imma Wallpad $1.500 Previous Next Dashboard BH Calendar To Do Notifications Inbox G Chapter 9 Excel Assignment_Instructions & Template.xlsx Sheet3 Sheet1 Sheet2 Information for Employee Irma Weltpaid Monthlygross pay $15.500 Monthly tax table Federal $3,425 State $800 Monyenture $750 Monthly life insurance $100 Mantly refrement sans $2.500 Part B: Payroll Register Cumulative Name: Imma Wetpaid gross pay Calendar Gross pay Federal Year-to-date subject to Monthly Soe. See Medicare income Month Social See Gross pay tax Tax January February March April Withholdinge State Health Life income Insurance Insurance Retirement tax Premium Premium Savings Total with holdinge Net pay to ph Previous Next Dashboard Calendar To Do Notifications Inbox Chapter 9 Excel Assignment_Instructions & Template.xlsx Sheet2 Sheet3 Sheet1 April May ung August September October November December Total XOXOXXXXXXX Par cumal Entries Record the payroll entry for payment to Inna and related withholdings amounts on employee pay stub Sesample ng sinust For the month of January Record the payroll taxes paid solely by the emple (FICA match & unemployment taxes See on page 18 infot For the month of January Previous Next Dashboard SRE Calendar To Do Notifications Inbox Chapter 9 Excel Assignment_Instructions & Template.xlsx Sheet3 Sheet2 Irma Welipaid Sheet1 Cumulative Name: gross pay Calendar Gross pay yeardo-date subject to Monthly Social Sec. Gross Bay K Withholdings Federal State Health LI Income income insurance Insurance Retirement Tax Premium Premium savings Soc. Sec. Medicare tax Payroll subject tounen ployment Total with holdings tax Net pay Monthly Monthly FUTA BUTA 50 30 50 50 50 50 50 KXXXXXXX Previous Next Dashboard Calendar To Do Notifications Inbox Chapter 9 Excel Assignment_Instructions & Template.xlsx Sneets Sheet Sneetz Record the payroll entry for payment to me and related withholdings famounts on employee pay stub Semple en page intent For the month of January Record the payroll taxes paid solely by the employer (FICA match & unemployment taxes) See example on page in text For the month of January K For the month of December For the month of December Previous Next Dashboard SRE Calendar To Do Notifications Inbox