Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 9 - Master It ! Please fill table attached with excel In practice, the use of the dividend discount model is refined from the

Chapter Master It Please fill table attached with excel

In practice, the use of the dividend discount model is refined from the method we presented in the textbook. Many analysts will estimate the dividend for the next

years and then estimate a perpetual growth rate at some point in the future, typically years. Rather than have the dividend growth fall dramatically from the fast

growth period to the perpetual growth period, linear interpolation is applied. That is the dividend growth is projected to fall by an equal amount each year. For

example, if the high growth period is percent for the next years and the dividends are expected to fall to a percent perpetual growth rate years later, the

dividend growth rate would decline by percent each year.

The Value Line Investment Survey provides information for investors. Below, you will find information for AbbVie found in the edition of Value Line :

dividend

year dividend growth rate

$

Although Value Line does not provide a perpetual growth rate or required return, we will assume they are:

Perpetual growth rate

Required return

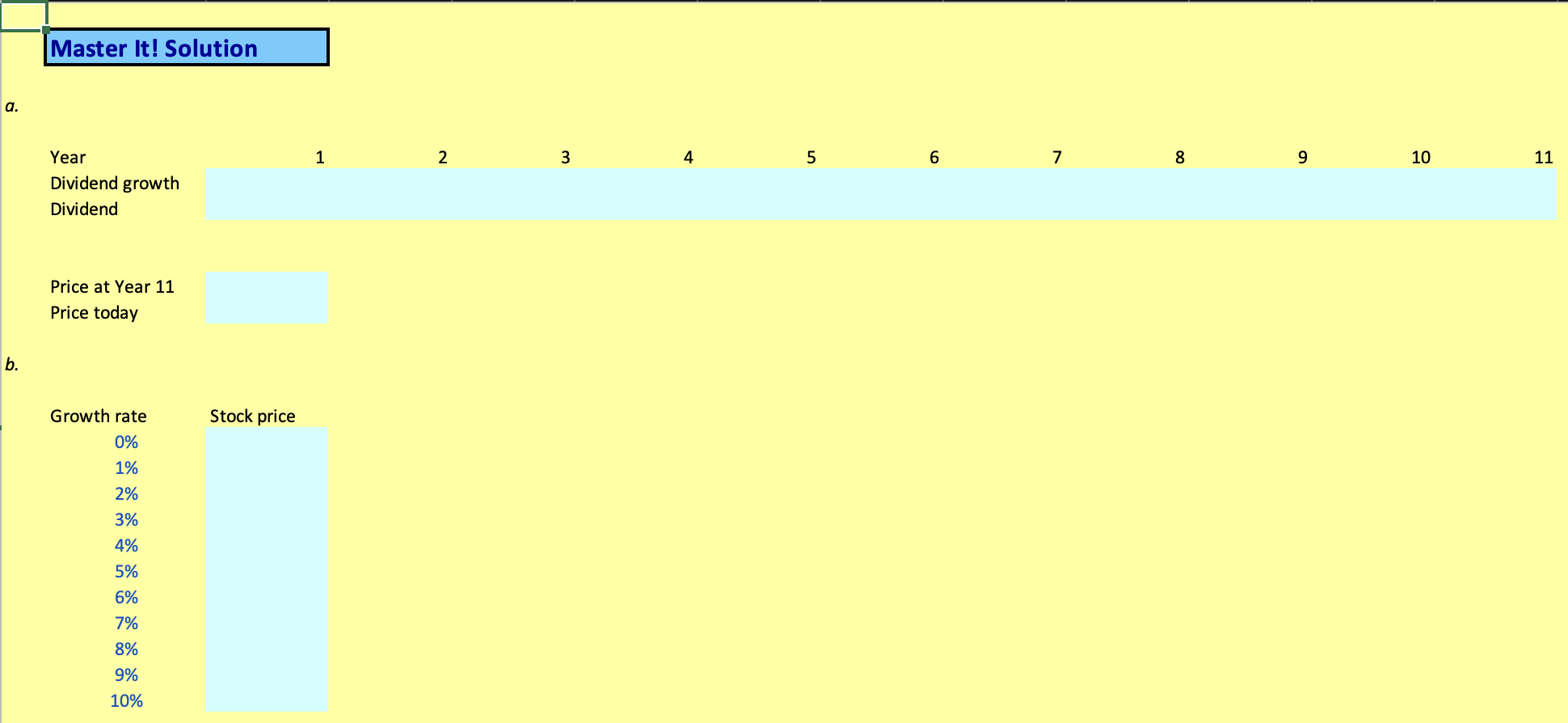

Assume that the perpetual growth rate begins years from now and use linear interpolation between the high growth rate and perpetual growth rate. Construct a

table that shows the dividend growth rate and dividend each year. What is the stock price at Year What is the stock price today?

b

How sensitive is the current stock price to changes in the perpetual growth rate? Graph the current stock price against the perpetual growth rate in years to find out.

Instead of applying the constant dividend growth model to find the stock price in the future, analysts will often combine the dividend discount method with multiple

Payout ratio

PE ratio at constant growth rate

Use the PE ratio to calculate the stock price when AbbVie reaches a perpetual growth rate in dividends. Now find the value of the stock today by finding the present

value of the dividends during the supernormal growth rate and the price you calculated using the PE ratio.

d

How sensitive is the current stock price to changes in PE ratio when the stock reaches the perpetual growth rate? Graph the current stock price against the PE ratio in

years to find out.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started