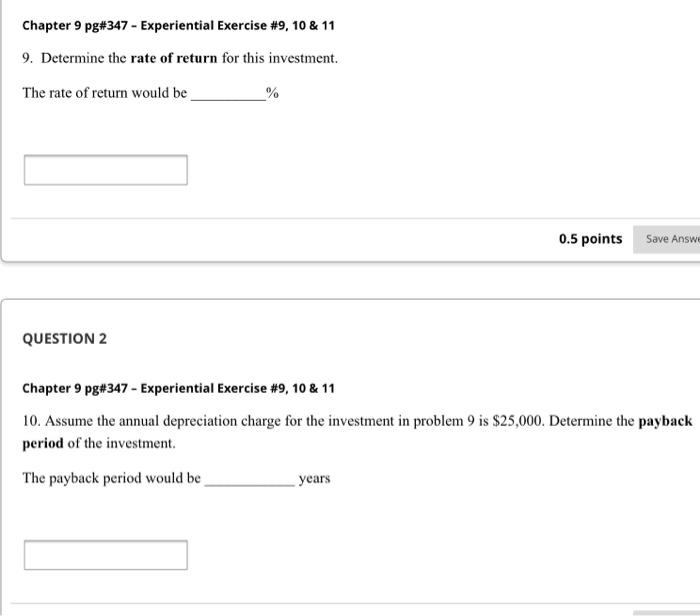

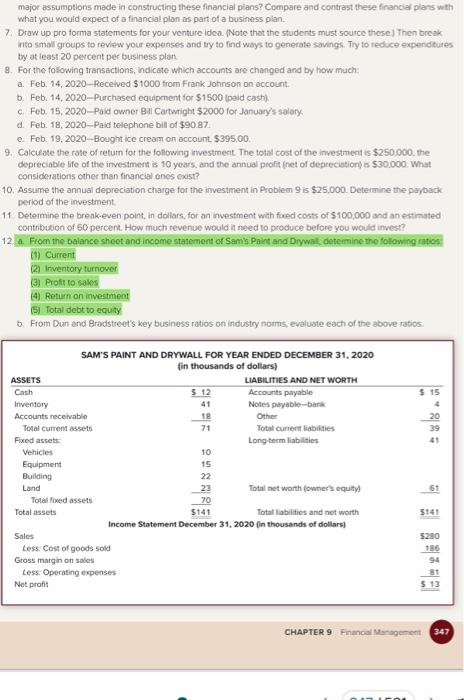

Chapter 9 pg#347 - Experiential Exercise #9, 10 & 11 9. Determine the rate of return for this investment. The rate of return would be % 0.5 points Save Answe QUESTION 2 Chapter 9 pg#347 - Experiential Exercise #9, 10 & 11 10. Assume the annual depreciation charge for the investment in problem 9 is $25,000. Determine the payback period of the investment The payback period would be years major assumptions made in constructing these financial plans? Compare and contrast these financial plans with what you would expect of a financial plan as part of a business plan. 7 Draw up pro forma statements for your venture idea (Note that the students must source these) Then break into small groups to review your expenses and try to find ways to generate savings. Try to reduce expenditures by at least 20 percent per business plan 8. For the following transactions, indicate which accounts are changed and by how much: a. Feb. 14, 2020-Received $1000 from Frank Johnson on account b. Feb. 14, 2020-Purchased equipment for $1500 (paid casti c. Feb. 15, 2020-Paid owner Bal Cartwright $2000 for January's salary d. Feb. 18, 2020-Paid telephone bill of $90.87 e Feb. 19,2020-Bought ice cream on account $395,00 9. Calculate the rate of return for the following investment. The total cost of the investment is $250.000. the depreciable life of the investment is 10 years, and the annual profit (net of depreciation $30.000. What considerations other than financial ones exist? 10. Assume the annual depreciation charge for the investment in Problem 9 is $25.000. Determine the payback period of the investment 11 Determine the break-even point, in dollars, for an investment with fand costs of $100,000 and an estimated contribution of 60 percent. How much revenue would it need to produce before you would invest? 12 . From the balance sheet and income statement of Sam's Paint and Drywatdetermine the following is (1) Current (2) Inventory turnover (3) Profit to sales (4) Return on investment 151 Total debt to equity b. From Dun and Bradstreet's key business ratios on industry noms evaluate each of the above ratios. *** $15 4 20 39 41 SAM'S PAINT AND DRYWALL FOR YEAR ENDED DECEMBER 31, 2020 fin thousands of dollars) ASSETS LIABILITIES AND NET WORTH Cash $ 12 Accounts payable Inventory 41 Notes payable-bank Accounts receivable 18 Other Total current assets 71 Total current liabilities Fixed assets Long term liabilities Vehicles 10 Equipment 15 Building 22 Land 23 Total net worth owner's equity Total foxed assets 70 Total assets $141 Total Tibilities and net worth Income Statement December 31, 2020 (in thousands of dollars) Sales Less Cost of goods sold Gross margin on sales Less Operating expenses Net profit 51 $141 5280 185 94 81 $ 13 CHAPTER 9 Financial Management 347 ira