Answered step by step

Verified Expert Solution

Question

1 Approved Answer

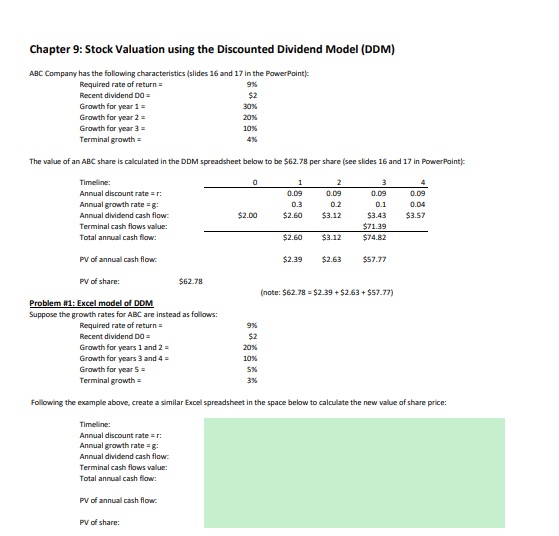

Chapter 9: Stock Valuation using the Discounted Dividend Model (DDM) ABC Company has the following characteristics (slides 16 and 17 in the PowerPoint): The value

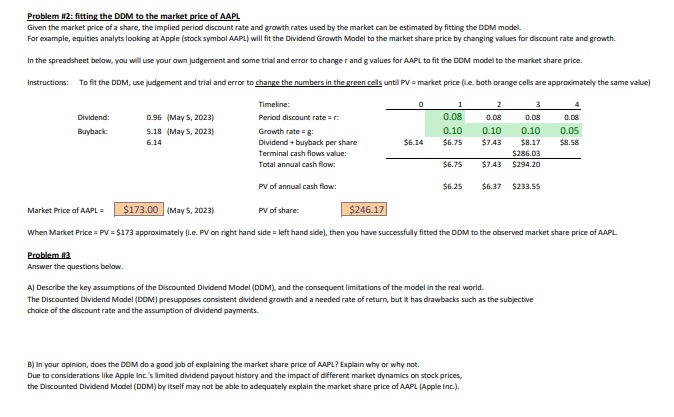

Chapter 9: Stock Valuation using the Discounted Dividend Model (DDM) ABC Company has the following characteristics (slides 16 and 17 in the PowerPoint): The value of an ABC share is calculated in the DDM spreadsheet below to be $62.78 per share (see slides 16 and 17 in PowerPoint Problem 111: Excel model of DDM (note: $62.78=$2.39+$2.63+$57.77 ) Suppose the growth rates for ABC are instead as follows: \begin{tabular}{lr} Required rate of return = & 3% \\ Recent dividend DO = & $2 \\ Growth for years 1 and 2= & 20% \\ Growth for years 3 and 4= & 10% \\ Growth for year 5= & 5% \\ Terminal growth = & 3% \end{tabular} Following the example above, create a similar Excel spreadsheet in the space below to calculate the new value of share price: Problem 12: fitting the DDM to the market price of AAPL Given the market price of a share, the implied period discount rate and growth rates used by the market can be estimated by fitting the DDM model. For example, equities analyts looking at Apple (stock symbol AAPL) will fit the Dividend Growth Model to the market share price by changing values for discount rate and growth. In the spreadsheet below, you will use your own judgement and some trial and error to change r and g values for AAPL to fit the DOM model to the market share price. Instructions: To fit the DDM, use judgement and trial and error to change the numbers in the green cels until PV = market price (Le. both orange cels are approvimately the same value) Mal When Market Price = PV =$173 approximately (i.e. PV on right hand side = left hand side), then you have successfuly fitted the DDM to the observed market share price of AAPL. Problem in Answer the questions below. A) Describe the key assumptions of the Discounted Dividend Model (DDM), and the consequent limitations of the model in the real world. The Discounted Dividend Model (DOM) presupposes consistent dividend growth and a needed rate of return, but it has drawbacks such as the subjective choice of the discount rate and the assumption of dividend payments. B) In your opinion, does the DOM do a good job of explaining the market share price of AAPL? Explain why or why not. Due to considerations like Apple inc.'s limited diwidend payout history and the impact of different market dynamics on stock prices, the Discounted Dividend Model (DDM) by itself may not be able to adequately explain the market share price of AAPL (Apple Inc.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started