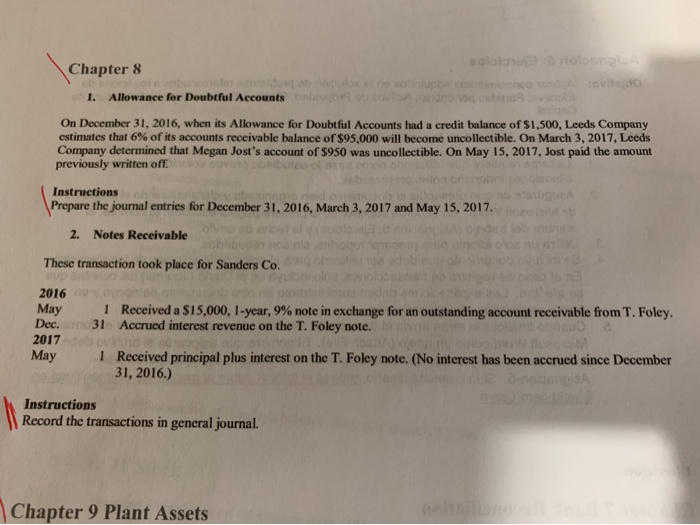

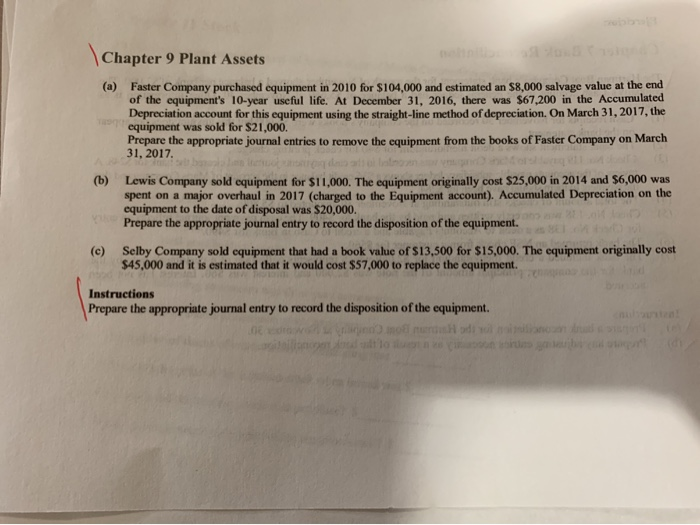

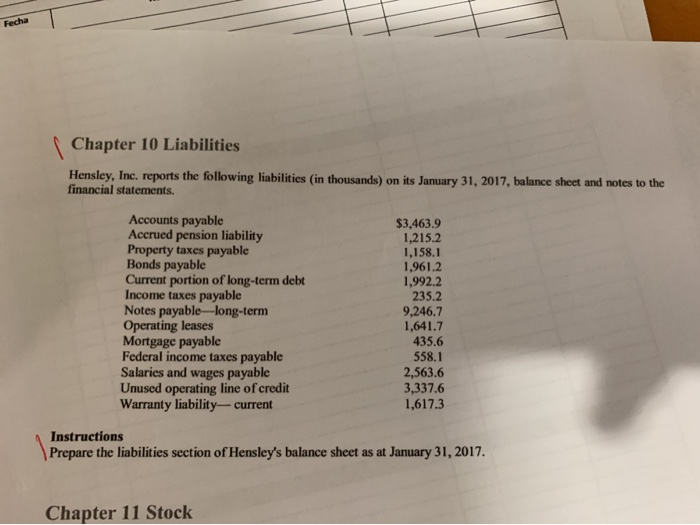

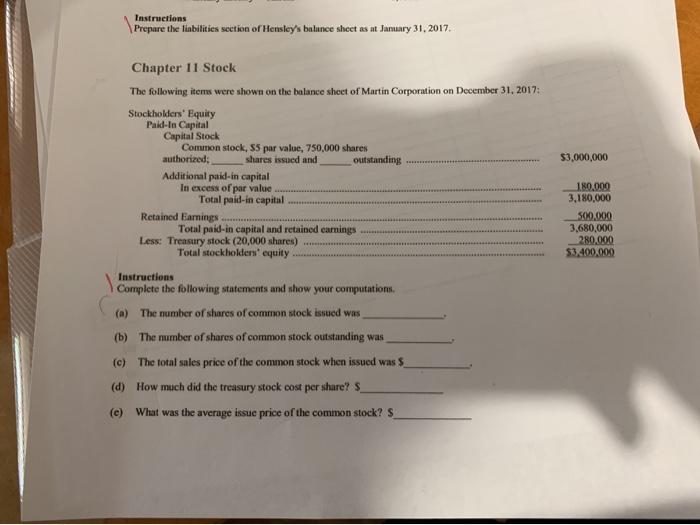

Chapter I. Allowance for Doubtful Accounts On December 31, 2016, when its Allowance for Doubtful Accounts had a credit balance of $1,500, Leeds Company estimates that 6% of its accounts receivable balance of $95,000 will become uncollectible. On March 3, 2017, Leeds Company determined that Megan Jost's account of $950 was uncollectible. On May 15, 2017, Jost paid the amount previously written of Instructions Prepare the journal entries for December 31, 2016, March 3, 2017 and May 15, 2017. 2. Notes Receivable These transaction took place for Sanders Co. 2016 May Dec. 2017 May 1 Received a $15,000, 1 year, 9% note in exchange for an outstanding account receivable from T. Foley. Accrued interest revenue on the T. Foley note. 31 Received principal plus interest on the T. Foley note. (No interest has been accrued since December 31, 2016.) 1 Instructions Record the transactions in general journal. Chapter 9 Plant Assets Chapter 9 Plant Assets Faster Company purchased equipment in 2010 for $104,000 and estimated an $8,000 salvage value at the end of the equipment's 10-year useful life. At December 31, 2016, there was $67,200 in the Accumulated Depreciation account for this equipment using the straight-line method of depreciation. On March 31,2017, the equipment was sold for $21,000. Prepare the appropriate journal entries to remove the equipment from the books of Faster Company on March 31, 2017. (a) (b) Lewis Company sold equipment for $11,000. The equipment originally cost $25,000 in 2014 and $6,000 was spent on a major overhaul in 2017 (charged to the Equipment account). Accumulated Depreciation on the equipment to the date of disposal was $20,000. Prepare the appropriate journal entry to record the disposition of the equipment. Selby Company sold equipment that had a book value of S13,500 for $15,000. The equipment originally cost $45,000 and it is estimated that it would cost $57,000 to replace the equipment. (c) Instructions Prepare the appropriate journal entry to record the disposition of the equipment. Fecha Chapter 10 Liabilities Hensley, Inc. reports the following liabilities (in thousands) on its January 31, 2017, balance sheet and notes to the financial statements. Accounts payable Accrued pension liability Property taxes payable Bonds payable Current portion of long-term debt Income taxes payable Notes payable-long-term Operating leases Mortgage payable Federal income taxes payable Salaries and wages payable Unused operating line of credit Warranty liability-current $3,463.9 1,215.2 1,158.1 1,961.2 1,992.2 235.2 9,246.7 1,641.7 435.6 558.1 2,563.6 3,337.6 1,617.3 Instructions Prepare the liabilities section of Hensley's balance sheet as at January 31, 2017. Chapter 11 Stock Instructions Prepare the liabilities section of Hensley's balance sheet as at January 31, 2017. Chapter 11 Stock The following items were shown on the balance sheet of Martin Corporation on December 31,2017: Stockholders' Equity Paid-In Capital Capital Stock Common stock, $5 par value, 750,000 shares $3,000,000 authorized: shares issued and Additional paid-in capital outstanding -180.000 3,180,000 500,000 3,680,000 280,000 In excess of par value Total paid-in capital Retained Earnings Total paid-in capital and retained carnings Less: Treasury stock (20,000 shares)... Total stockholders' equity Instructions Complete the following statements and show your computations. (a) The number of shares of common stock issued was (b) The number of shares of common stock outstanding was (c) The total sales price of the common stock when issued was $ (d) How much did the treasury stock cost per share? S (e) What was the average issue price of the common stock? S