Answered step by step

Verified Expert Solution

Question

1 Approved Answer

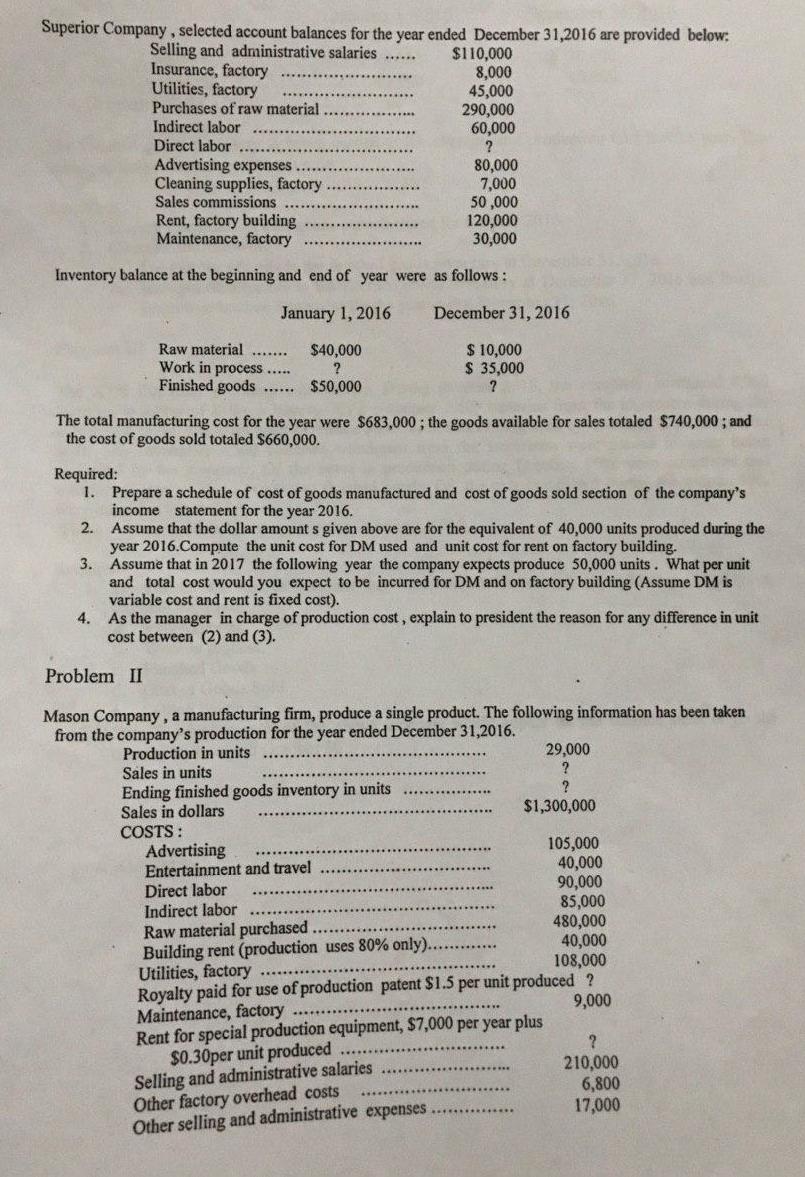

Superior Company, selected account balances for the year ended December 31,2016 are provided below: Selling and administrative salaries Insurance, factory Utilities, factory Purchases of

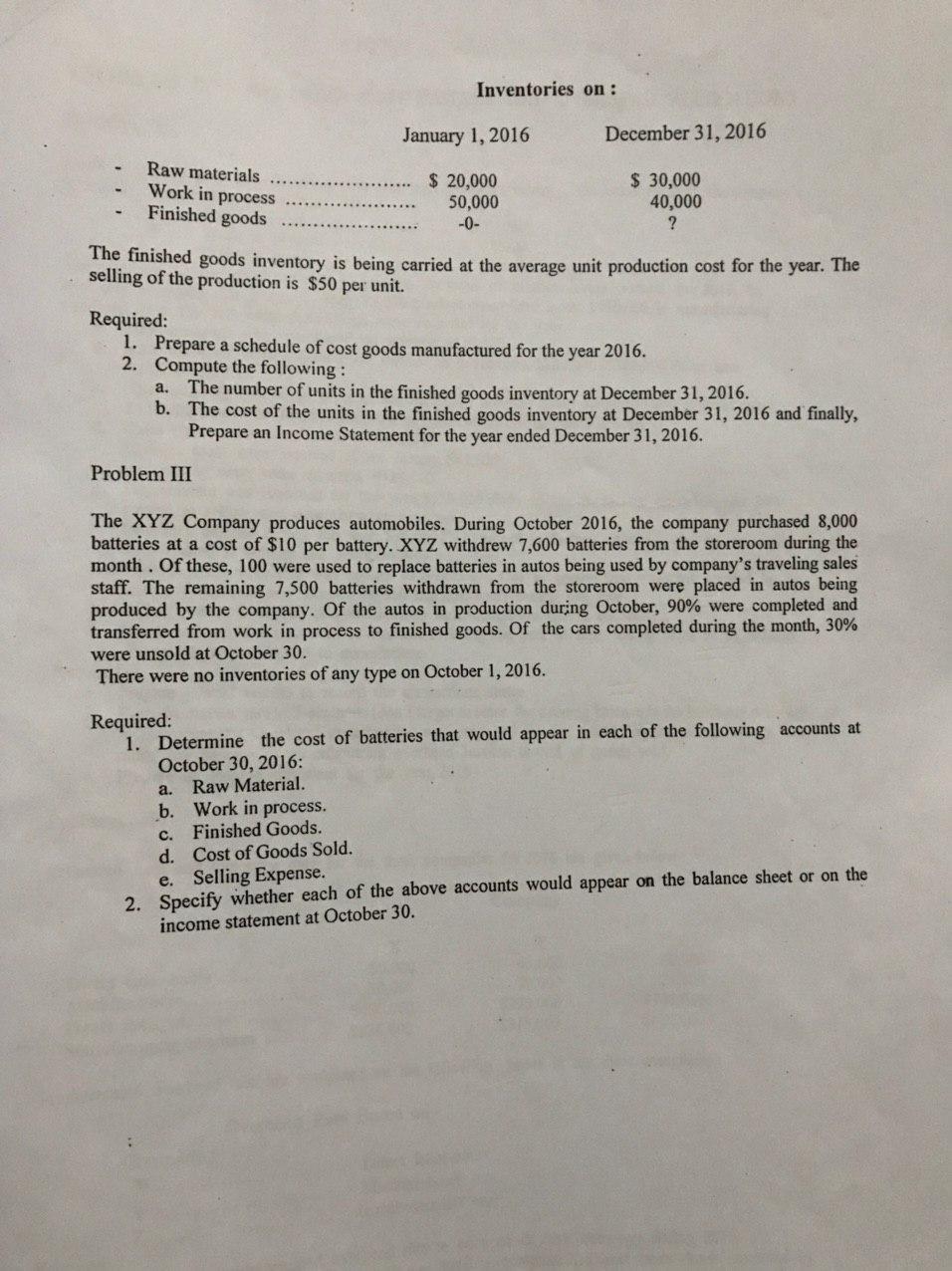

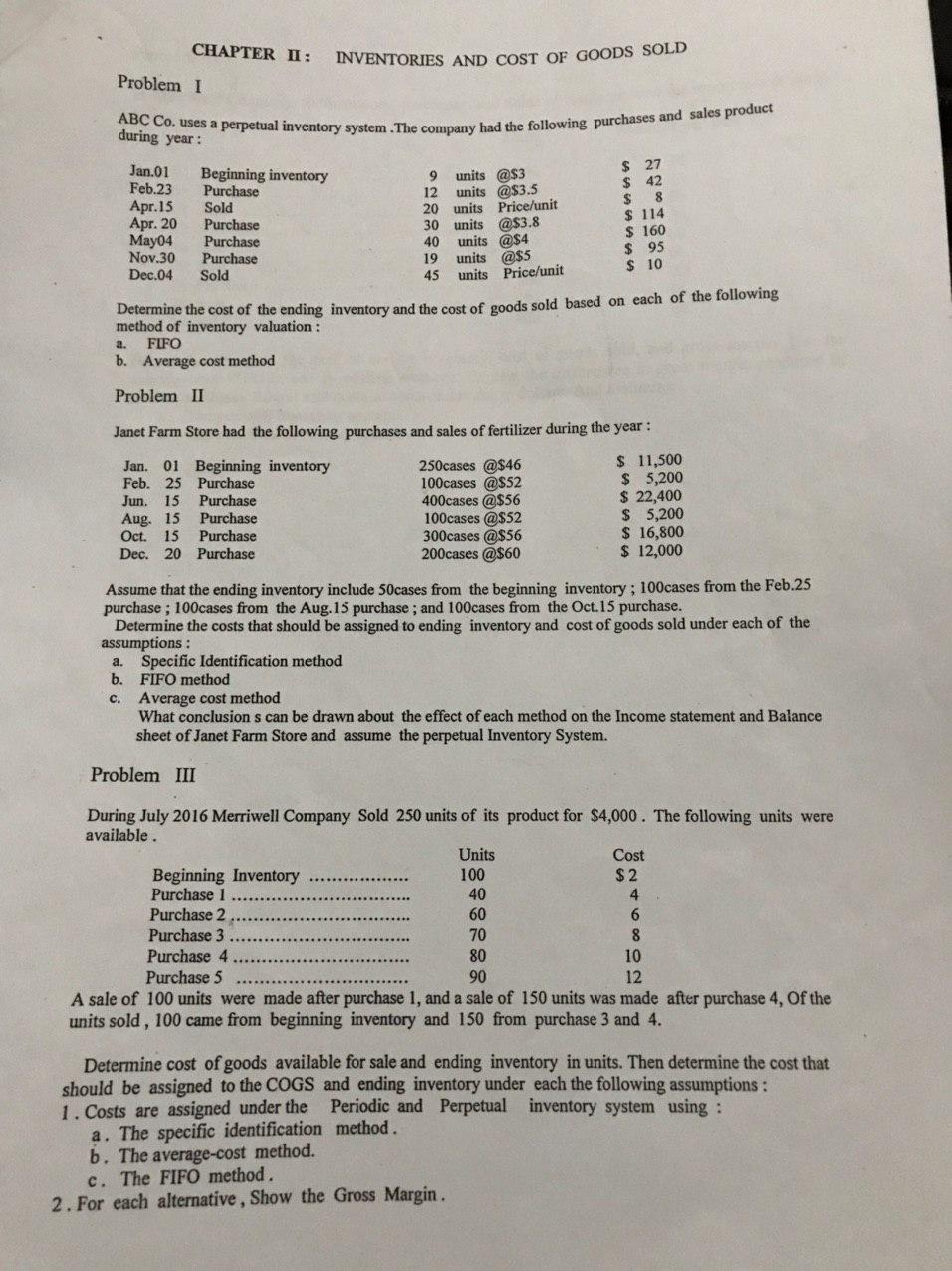

Superior Company, selected account balances for the year ended December 31,2016 are provided below: Selling and administrative salaries Insurance, factory Utilities, factory Purchases of raw material $110,000 8,000 45,000 290,000 60,000 ...... Indirect labor Direct labor Advertising expenses Cleaning supplies, factory Sales commissions 80,000 7,000 50 ,000 120,000 30,000 Rent, factory building Maintenance, factory Inventory balance at the beginning and end of year were as follows: January 1, 2016 December 31, 2016 Raw material Work in process .. Finished goods ..... $ 10,000 $ 35,000 $40,000 ...... $50,000 The total manufacturing cost for the year were $683,000 ; the goods available for sales totaled $740,000 ; and the cost of goods sold totaled $660,000. Required: 1. Prepare a schedule of cost of goods manufactured and cost of goods sold section of the company's income statement for the year 2016. Assume that the dollar amount s given above are for the equivalent of 40,000 units produced during the year 2016.Compute the unit cost for DM used and unit cost for rent on factory building. 3. Assume that in 2017 the following year the company expects produce 50,000 units. What per unit and total cost would you expect to be incurred for DM and on factory building (Assume DM is variable cost and rent is fixed cost). 4. 2. As the manager in charge of production cost , explain to president the reason for any difference in unit cost between (2) and (3). Problem II Mason Company , a manufacturing firm, produce a single product. The following information has been taken from the company's production for the year ended December 31,2016. 29,000 Production in units Sales in units Ending finished goods inventory in units Sales in dollars COSTS : Advertising Entertainment and travel Direct labor Indirect labor Raw material purchased Building rent (production uses 80% only).. Utilities, factory ..... Royalty paid for use of production patent $1.5 per unit produced ? Maintenance, factory Rent for special production equipment, $7,000 per year plus $0.30per unit produced Selling and administrative salaries Other factory overhead costs Other selling and administrative expenses $1,300,000 105,000 40,000 90,000 85,000 480,000 40,000 108,000 9,000 210,000 6,800 17,000 Inventories on : January 1, 2016 December 31, 2016 Raw materials Work in process Finished goods $ 20,000 50,000 -0- $ 30,000 40,000 The finished goods inventory is being carried at the average unit production cost for the year. The selling of the production is $50 per unit. Required: 1. Prepare a schedule of cost goods manufactured for the year 2016. 2. Compute the following: The number of units in the finished goods inventory at December 31, 2016. b. The cost of the units in the finished goods inventory at December 31, 2016 and finally, Prepare an Income Statement for the year ended December 31, 2016. a. Problem III The XYZ Company produces automobiles. During October 2016, the company purchased 8,000 batteries at a cost of $10 per battery. XYZ withdrew 7,600 batteries from the storeroom during the month. Of these, 100 were used to replace batteries in autos being used by company's traveling sales staff. The remaining 7,500 batteries withdrawn from the storeroom were placed in autos being produced by the company. Of the autos in production during October, 90% were completed and transferred from work in process to finished goods. Of the cars completed during the month, 30% were unsold at October 30. There were no inventories of any type on October 1, 2016. Required: 1. Determine the cost of batteries that would appear in each of the following accounts at October 30, 2016: Raw Material. a. b. Work in process. Finished Goods. . d. Cost of Goods Sold. e. Selling Expense. 2. Specify whether each of the above accounts would appear on the balance sheet or on the income statement at October 30. Problem IV In Merriwell Company, the inventory, purchases, and Sales of single product for recent month are as follows : Units Amount per unit June 01 Beginning Inventory $ 30 300 800 400 04 Purchase 08 Sale 12 Purchase 33 60 36 16 Sale 20 Sale 1,000 700 500 60 66 24 Purchase .1,200 600 400 39 66 66 28 Sale 29 Sale Required Compute the cost of ending inventory, cost of goods sold, and gross margin. Use the average-cost, FIFO inventory costing methods. Explain the differences in gross margin produced by the two methods. Round unit costs to cents and totals to dollars. And assuming : a. The periodic inventory system. b. The perpetual inventory system. ABC Co. uses a perpetual inventory system .The company had the following purchases and sales product CHAPTER II: INVENTORIES AND COST OF GOODS SOLD Problem I during year: $ 27 $ 42 8 Jan.01 Feb.23 Apr.15 Apr. 20 May04 Nov.30 Dec.04 Beginning inventory Purchase Sold Purchase Purchase Purchase Sold 9 units @$3 12 units @$3.5 20 units Price/unit units @$3.8 40 2$ $ 114 $ 160 $ 95 $ 10 30 units @$4 19 units @$5 45 units Price/unit Determine the cost of the ending inventory and the cost of goods sold based on each of the following method of inventory valuation : FIFO a. b. Average cost method Problem II Janet Farm Store had the following purchases and sales of fertilizer during the year : 250cases @$46 100cases @S52 400cases @$56 100cases @$52 300cases @$56 200cases @$60 $ 11,500 $ 5,200 $ 22,400 $ 5,200 $ 16,800 $ 12,000 Jan. 01 Beginning inventory Feb. Jun. 25 Purchase Purchase Purchase 15 Purchase 15 Aug. 15 Oc. Dec. 20 Purchase Assume that the ending inventory include 50cases from the beginning inventory ; 100cases from the Feb.25 purchase ; 100cases from the Aug.15 purchase; and 100cases from the Oct.15 purchase. Determine the costs that should be assigned to ending inventory and cost of goods sold under each of the assumptions : Specific Identification method b. FIFO method Average cost method What conclusion s can be drawn about the effect of each method on the Income statement and Balance sheet of Janet Farm Store and assume the perpetual Inventory System. a. . Problem III During July 2016 Merriwell Company Sold 250 units of its product for $4,000. The following units were available . Units Cost $2 Beginning Inventory Purchase 1 100 40 4 Purchase 2 60 6. Purchase 3 Purchase 4 70 80 10 12 Purchase 5 90 A sale of 100 units were made after purchase 1, and a sale of 150 units was made after purchase 4, Of the units sold, 100 came from beginning inventory and 150 from purchase 3 and 4. Determine cost of goods available for sale and ending inventory in units. Then determine the cost that should be assigned to the COGS and ending inventory under each the following assumptions: 1. Costs are assigned under the a. The specific identification method. b. The average-cost method. c. The FIFO method. 2. For each alternative, Show the Gross Margin. Periodic and Perpetual inventory system using:

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

CHAPter 1 PROBIEM 1 2 schedue cast of godds Manutactured and cost f g...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started