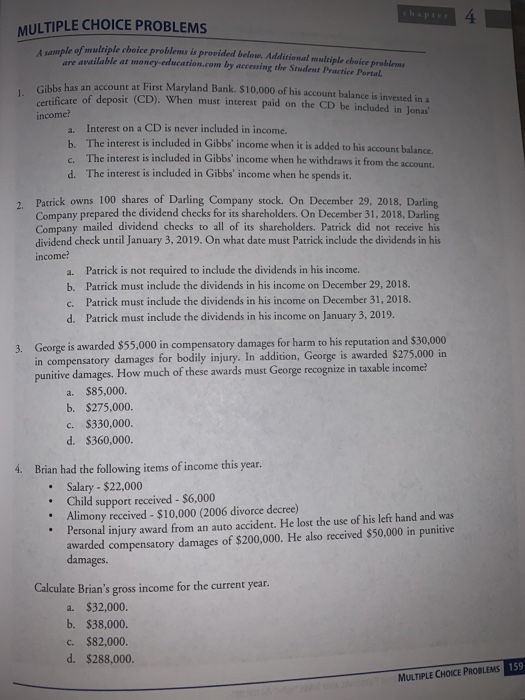

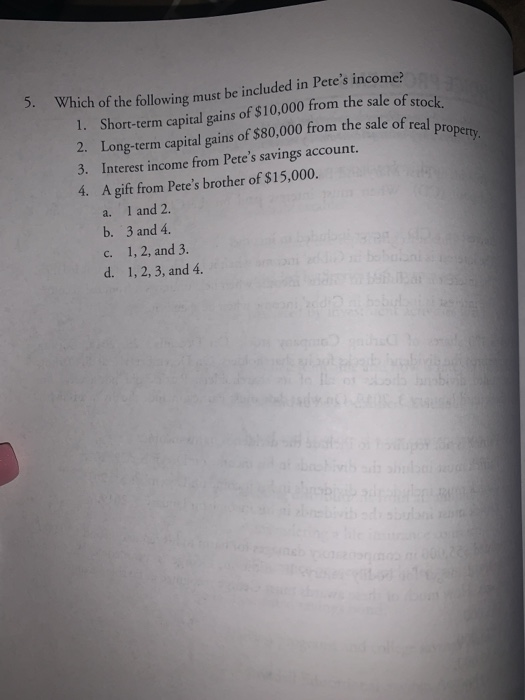

chapter. MULTIPLE CHOICE PROBLEMS A sample of multiple choice problems is provided below. Additional multiple choice problems E available at money-education.com by accessing the Student Practice Pertal Gibbs has an account at First Maryland Bank. $10,000 of his account balance is invested in a 1. artificate of deposit (CD). When must interest paid on the CD be included in lona income? Interest on a CD is never included in income. The interest is included in Gibbs' income when it is added to his account balance. The interest is included in Gibbs' income when he withdraws it from the account al h c. The interest is included in Gibbs' income when he spends it. d. Patrick owns 100 shares of Darling Company stock. On December 29, 2018, Darling Company prepared the dividend checks for its shareholders. On December 31, 2018, Darling Company mailed dividend checks to all of its shareholders. Patrick did not receive his dividend check until January 3, 2019. On what date must Patrick include the dividends in his income? required to include the dividends in his income. b. Patrick must include the dividends in his income on December 29, 2018. Patrick must include the dividends in his income on December 31, 2018. Patrick is not a. January 3, 2019. d. Patrick must include the dividends in his income on George is awarded $55,000 in compensatory damages for harm to his reputation and $30,000 in compensatory damages for bodily injury. In addition, George is awarded $275,0000 in punitive damages. How much of these awards must George recognize in taxable income? 3. $85,000 b. $275,000 a. c. $330,000. d. $360,000. 4. Brian had the following items of income this year. Salary - $22,000 Child support received $6,000 Alimony received - $10,000 (2006 divorce decree) Personal injurv award from an auto accident, He lost the use of his left hand and was awarded compensatory damages of $200,000. He also received $50,000 in punitive damages. Calculate Brian's gross income for the current year. $32,000. a. b. $38,000. c. $82,000. d. $288,000. MULTIPLE CHOICE PROBLEMS 159 ei must be included in Pete's income? 1. Short-term capital gains of $10,000 from the sale of stock 2. Long-term capital gains of $80,000 from the sale of real property. 5. Which of the following Interest income from Pete's savings A gift from Pete's brother of $15,000. account. 3. 4. 1 and 2 b. and 4. . 1,2, and 3. c. 1,2, 3, and 4 d