Answered step by step

Verified Expert Solution

Question

1 Approved Answer

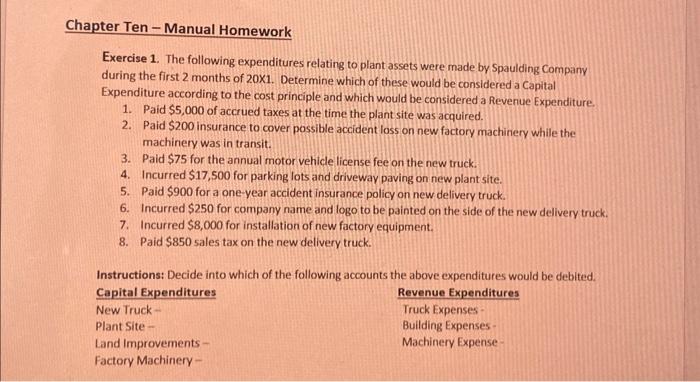

Chapter Ten - Manual Homework Exercise 1. The following expenditures relating to plant assets were made by Spaulding Company during the first 2 months of

Chapter Ten - Manual Homework

Exercise 1. The following expenditures relating to plant assets were made by Spaulding Company during the first 2 months of 20X1. Determine which of these would be considered a Capital Expenditure according to the cost principle and which would be considered a Revenue Expenditure.

1. Paid $5,000 of accrued taxes at the time the plant site was acquired.

2. Paid $200 insurance to cover possible accident loss on new factory machinery while the machinery was in transit.

3. Paid $75 for the annual motor vehicle license fee on the new truck.

4. Incurred $17,500 for parking lots and driveway paving on new plant site.

5. Paid $900 for a one-year accident insurance policy on new delivery truck.

6. Incurred $250 for company name and logo to be painted on the side of the new delivery truck.

7. Incurred $8,000 for installation of new factory equipment.

8. Paid $850 sales tax on the new delivery truck.

Instructions: Decide into which of the following accounts the above expenditures would be debited.

Capital Expenditures:Revenue Expenditures New Truck Truck Expenses

Plant Site Building Expenses

Land Improvements Machinery Expense

Factory Machinery

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started