Question

Chapter_8_Applying_Excel_Student_Form.xls Please give the formulas Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell B26

Chapter_8_Applying_Excel_Student_Form.xls

Please give the formulas

Download the Applying Excel form and enter formulas in all cells that contain question marks.

For example, in cell B26 enter the formula "= B5".

Required:

1. Check your worksheet by changing the budgeted unit sales in Quarter 2 of Year 2 in cell C5 to 75,000 units. The total expected cash collections for the year should now be $2,085,000. The required production for the year should be 274,000 units. The cost of raw materials to be purchased for the year should be $1,106,800, whereas the total cash disbursements for the year should be $1,095,980. If you do not get this answer, find the errors in your worksheet and correct them.

Save your completed Applying Excel form to your computer and then upload it here by clicking Browse. Next, click Save. You will use this worksheet to answer the questions in Part 2.

Please give the formulas

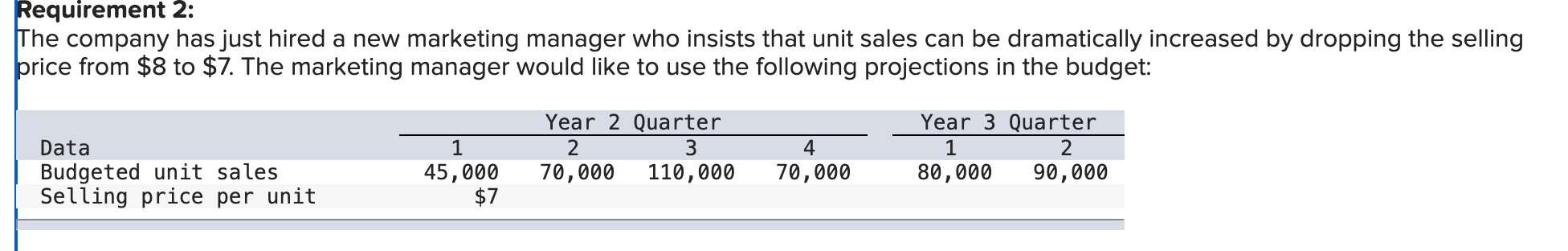

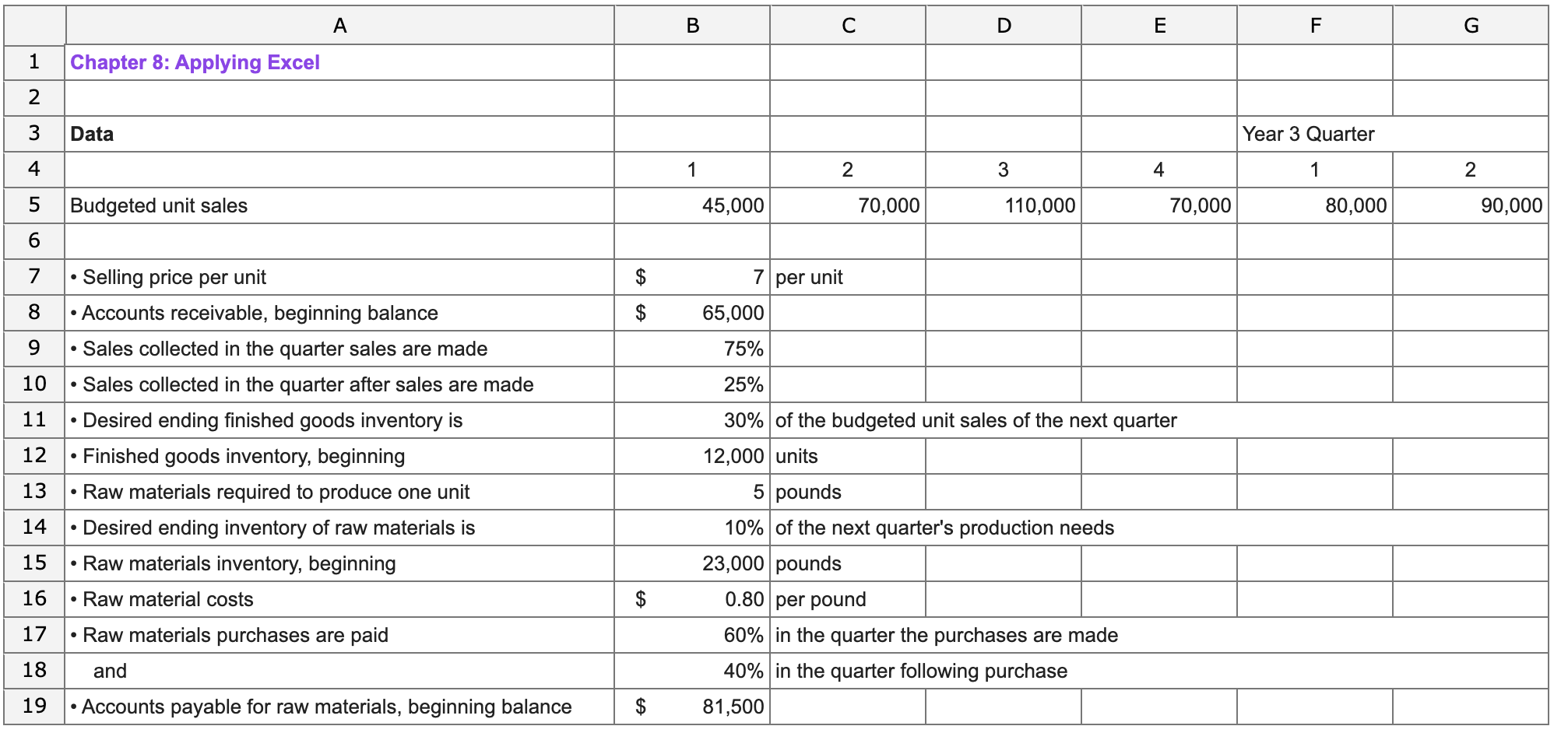

The company has just hired a new marketing manager who insists that unit sales can be dramatically increased by dropping the selling price from $8 to $7. The marketing manager would like to use the following projections in the budget: \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & A & & B & C & D & E & F & G \\ \hline 1 & Chapter 8: Applying Excel & & & & & & & \\ \hline \multicolumn{9}{|l|}{2} \\ \hline 3 & Data & & & & & & \multicolumn{2}{|l|}{ Year 3 Quarter } \\ \hline 4 & & & 1 & 2 & 3 & 4 & 1 & 2 \\ \hline 5 & Budgeted unit sales & & 45,000 & 70,000 & 110,000 & 70,000 & 80,000 & 90,000 \\ \hline 6 & & & & & & & & \\ \hline 7 & - Selling price per unit & $ & 7 & per unit & & & & \\ \hline 8 & - Accounts receivable, beginning balance & $ & 65,000 & & & & & \\ \hline 9 & - Sales collected in the quarter sales are made & & 75% & & & & & \\ \hline 10 & - Sales collected in the quarter after sales are made & & 25% & & & & & \\ \hline 11 & - Desired ending finished goods inventory is & & 30% & \multicolumn{5}{|c|}{ of the budgeted unit sales of the next quarter } \\ \hline 12 & - Finished goods inventory, beginning & & 12,000 & units & & & & \\ \hline 13 & - Raw materials required to produce one unit & & 5 & pounds & & & & \\ \hline 14 & - Desired ending inventory of raw materials is & & 10% & \multicolumn{5}{|c|}{ of the next quarter's production needs } \\ \hline 15 & - Raw materials inventory, beginning & & 23,000 & pounds & & & & \\ \hline 16 & - Raw material costs & $ & 0.80 & per pound & & & & \\ \hline 17 & - Raw materials purchases are paid & & 60% & \multicolumn{5}{|c|}{ in the quarter the purchases are made } \\ \hline 18 & and & & 40% & \multicolumn{5}{|c|}{ in the quarter following purchase } \\ \hline 19 & - Accounts payable for raw materials, beginning balance & $ & 81,500 & & & & & \\ \hline \end{tabular} What are the total expected cash collections for the year under this revised budget? What is the total required production for the year under this revised budget? What is the total cost of raw materials to be purchased for the year under this revised budget? The company has just hired a new marketing manager who insists that unit sales can be dramatically increased by dropping the selling price from $8 to $7. The marketing manager would like to use the following projections in the budget: \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & A & & B & C & D & E & F & G \\ \hline 1 & Chapter 8: Applying Excel & & & & & & & \\ \hline \multicolumn{9}{|l|}{2} \\ \hline 3 & Data & & & & & & \multicolumn{2}{|l|}{ Year 3 Quarter } \\ \hline 4 & & & 1 & 2 & 3 & 4 & 1 & 2 \\ \hline 5 & Budgeted unit sales & & 45,000 & 70,000 & 110,000 & 70,000 & 80,000 & 90,000 \\ \hline 6 & & & & & & & & \\ \hline 7 & - Selling price per unit & $ & 7 & per unit & & & & \\ \hline 8 & - Accounts receivable, beginning balance & $ & 65,000 & & & & & \\ \hline 9 & - Sales collected in the quarter sales are made & & 75% & & & & & \\ \hline 10 & - Sales collected in the quarter after sales are made & & 25% & & & & & \\ \hline 11 & - Desired ending finished goods inventory is & & 30% & \multicolumn{5}{|c|}{ of the budgeted unit sales of the next quarter } \\ \hline 12 & - Finished goods inventory, beginning & & 12,000 & units & & & & \\ \hline 13 & - Raw materials required to produce one unit & & 5 & pounds & & & & \\ \hline 14 & - Desired ending inventory of raw materials is & & 10% & \multicolumn{5}{|c|}{ of the next quarter's production needs } \\ \hline 15 & - Raw materials inventory, beginning & & 23,000 & pounds & & & & \\ \hline 16 & - Raw material costs & $ & 0.80 & per pound & & & & \\ \hline 17 & - Raw materials purchases are paid & & 60% & \multicolumn{5}{|c|}{ in the quarter the purchases are made } \\ \hline 18 & and & & 40% & \multicolumn{5}{|c|}{ in the quarter following purchase } \\ \hline 19 & - Accounts payable for raw materials, beginning balance & $ & 81,500 & & & & & \\ \hline \end{tabular} What are the total expected cash collections for the year under this revised budget? What is the total required production for the year under this revised budget? What is the total cost of raw materials to be purchased for the year under this revised budget

The company has just hired a new marketing manager who insists that unit sales can be dramatically increased by dropping the selling price from $8 to $7. The marketing manager would like to use the following projections in the budget: \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & A & & B & C & D & E & F & G \\ \hline 1 & Chapter 8: Applying Excel & & & & & & & \\ \hline \multicolumn{9}{|l|}{2} \\ \hline 3 & Data & & & & & & \multicolumn{2}{|l|}{ Year 3 Quarter } \\ \hline 4 & & & 1 & 2 & 3 & 4 & 1 & 2 \\ \hline 5 & Budgeted unit sales & & 45,000 & 70,000 & 110,000 & 70,000 & 80,000 & 90,000 \\ \hline 6 & & & & & & & & \\ \hline 7 & - Selling price per unit & $ & 7 & per unit & & & & \\ \hline 8 & - Accounts receivable, beginning balance & $ & 65,000 & & & & & \\ \hline 9 & - Sales collected in the quarter sales are made & & 75% & & & & & \\ \hline 10 & - Sales collected in the quarter after sales are made & & 25% & & & & & \\ \hline 11 & - Desired ending finished goods inventory is & & 30% & \multicolumn{5}{|c|}{ of the budgeted unit sales of the next quarter } \\ \hline 12 & - Finished goods inventory, beginning & & 12,000 & units & & & & \\ \hline 13 & - Raw materials required to produce one unit & & 5 & pounds & & & & \\ \hline 14 & - Desired ending inventory of raw materials is & & 10% & \multicolumn{5}{|c|}{ of the next quarter's production needs } \\ \hline 15 & - Raw materials inventory, beginning & & 23,000 & pounds & & & & \\ \hline 16 & - Raw material costs & $ & 0.80 & per pound & & & & \\ \hline 17 & - Raw materials purchases are paid & & 60% & \multicolumn{5}{|c|}{ in the quarter the purchases are made } \\ \hline 18 & and & & 40% & \multicolumn{5}{|c|}{ in the quarter following purchase } \\ \hline 19 & - Accounts payable for raw materials, beginning balance & $ & 81,500 & & & & & \\ \hline \end{tabular} What are the total expected cash collections for the year under this revised budget? What is the total required production for the year under this revised budget? What is the total cost of raw materials to be purchased for the year under this revised budget? The company has just hired a new marketing manager who insists that unit sales can be dramatically increased by dropping the selling price from $8 to $7. The marketing manager would like to use the following projections in the budget: \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & A & & B & C & D & E & F & G \\ \hline 1 & Chapter 8: Applying Excel & & & & & & & \\ \hline \multicolumn{9}{|l|}{2} \\ \hline 3 & Data & & & & & & \multicolumn{2}{|l|}{ Year 3 Quarter } \\ \hline 4 & & & 1 & 2 & 3 & 4 & 1 & 2 \\ \hline 5 & Budgeted unit sales & & 45,000 & 70,000 & 110,000 & 70,000 & 80,000 & 90,000 \\ \hline 6 & & & & & & & & \\ \hline 7 & - Selling price per unit & $ & 7 & per unit & & & & \\ \hline 8 & - Accounts receivable, beginning balance & $ & 65,000 & & & & & \\ \hline 9 & - Sales collected in the quarter sales are made & & 75% & & & & & \\ \hline 10 & - Sales collected in the quarter after sales are made & & 25% & & & & & \\ \hline 11 & - Desired ending finished goods inventory is & & 30% & \multicolumn{5}{|c|}{ of the budgeted unit sales of the next quarter } \\ \hline 12 & - Finished goods inventory, beginning & & 12,000 & units & & & & \\ \hline 13 & - Raw materials required to produce one unit & & 5 & pounds & & & & \\ \hline 14 & - Desired ending inventory of raw materials is & & 10% & \multicolumn{5}{|c|}{ of the next quarter's production needs } \\ \hline 15 & - Raw materials inventory, beginning & & 23,000 & pounds & & & & \\ \hline 16 & - Raw material costs & $ & 0.80 & per pound & & & & \\ \hline 17 & - Raw materials purchases are paid & & 60% & \multicolumn{5}{|c|}{ in the quarter the purchases are made } \\ \hline 18 & and & & 40% & \multicolumn{5}{|c|}{ in the quarter following purchase } \\ \hline 19 & - Accounts payable for raw materials, beginning balance & $ & 81,500 & & & & & \\ \hline \end{tabular} What are the total expected cash collections for the year under this revised budget? What is the total required production for the year under this revised budget? What is the total cost of raw materials to be purchased for the year under this revised budget Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started